Aimless Action In Energy Markets

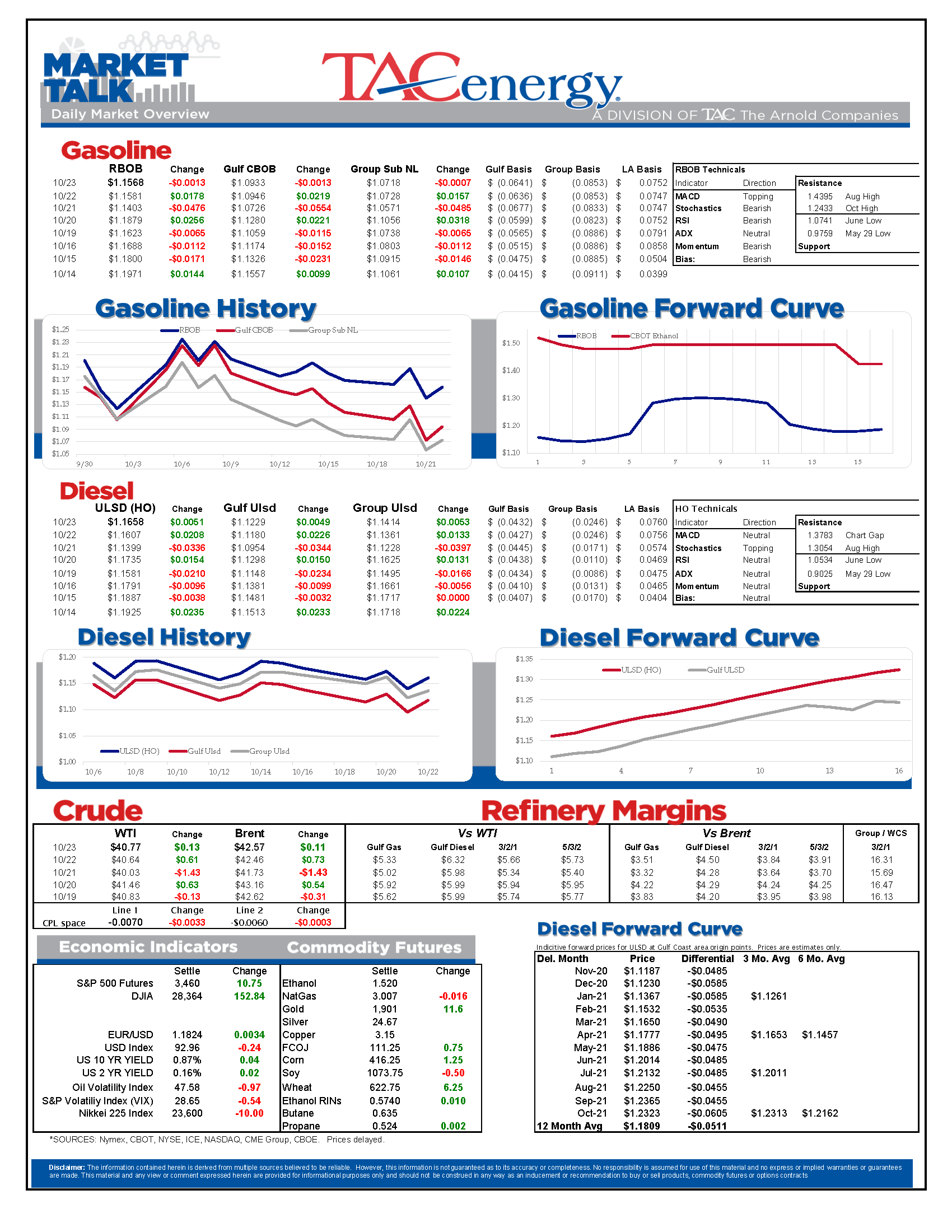

The back and forth and ultimately aimless action in energy markets continues, with another mixed bag for the futures complex to start Friday’s trading. While a Thursday bounce kept the risk of a technical breakdown at bay, if prices settle near current levels today we’ll have another weekly loss with a lower-high and lower-low than the previous week, which suggests that when prices do finally break out of this sideways range, it will be to the downside.

The price action has not helped the industry, as companies large and small still seem to be struggling with a challenging demand environment that looks like it could get worse over the winter.

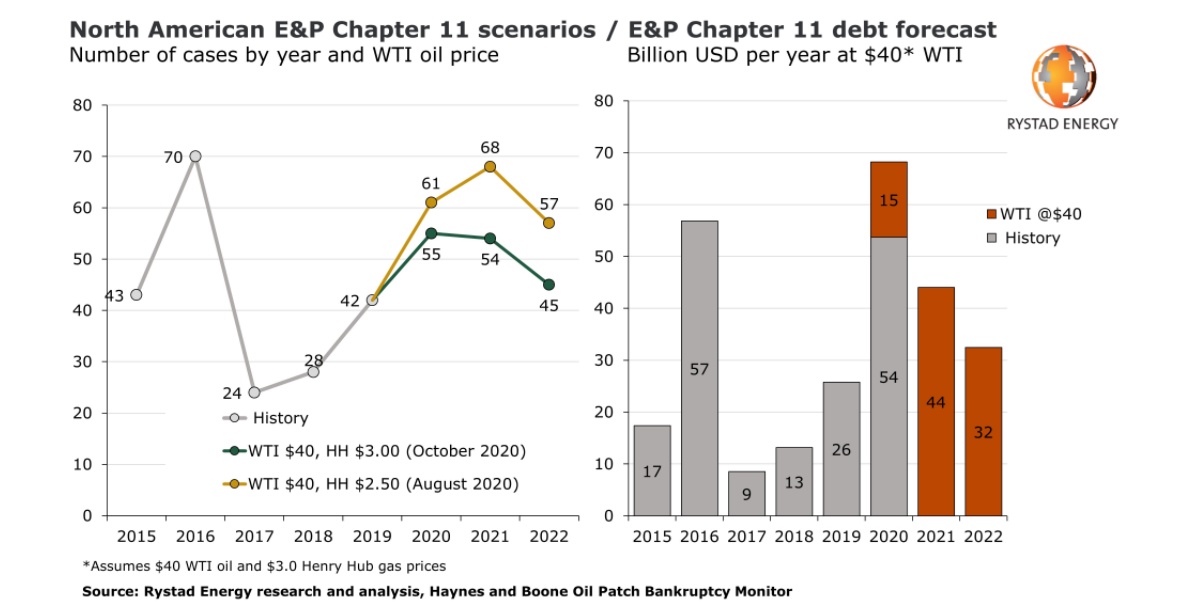

Exxon was reportedly close to making job cuts in the U.S., after going through similar rationalizations around the world. While the large oil companies are all following a similar playbook on cutting expenses to survive the COVID crisis, a Rystad energy report suggests that many more smaller producers will not make it. The report forecasts more than $100 billion in debt that will need to be restructured via bankruptcy this year, and predicts bankruptcy filings will remain high over the next two years.

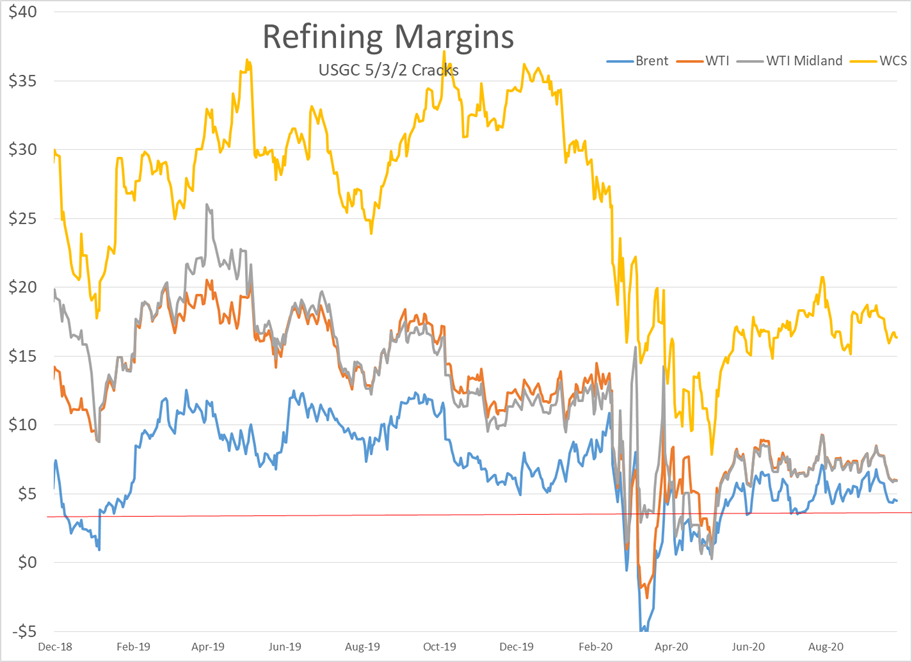

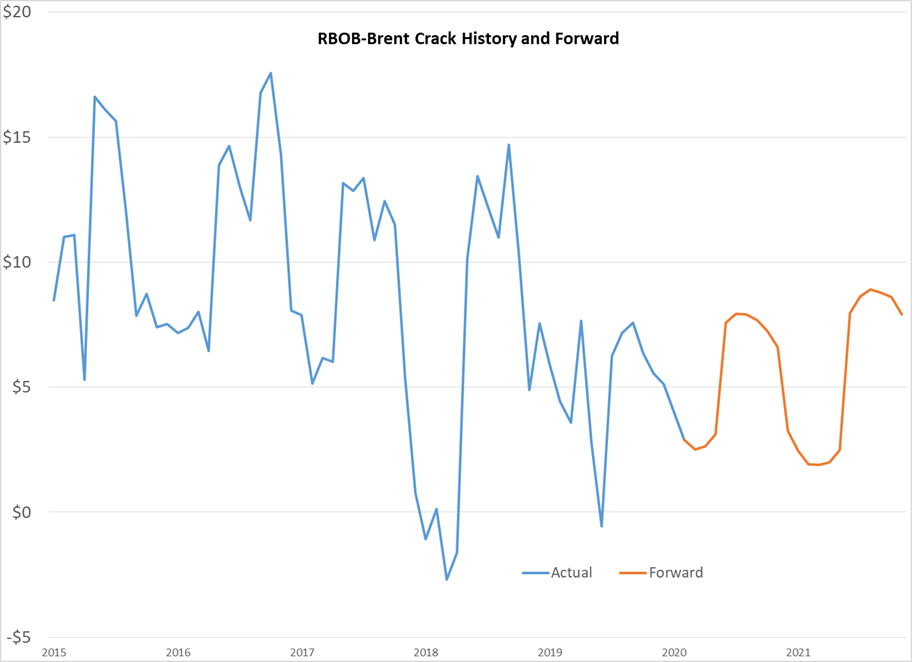

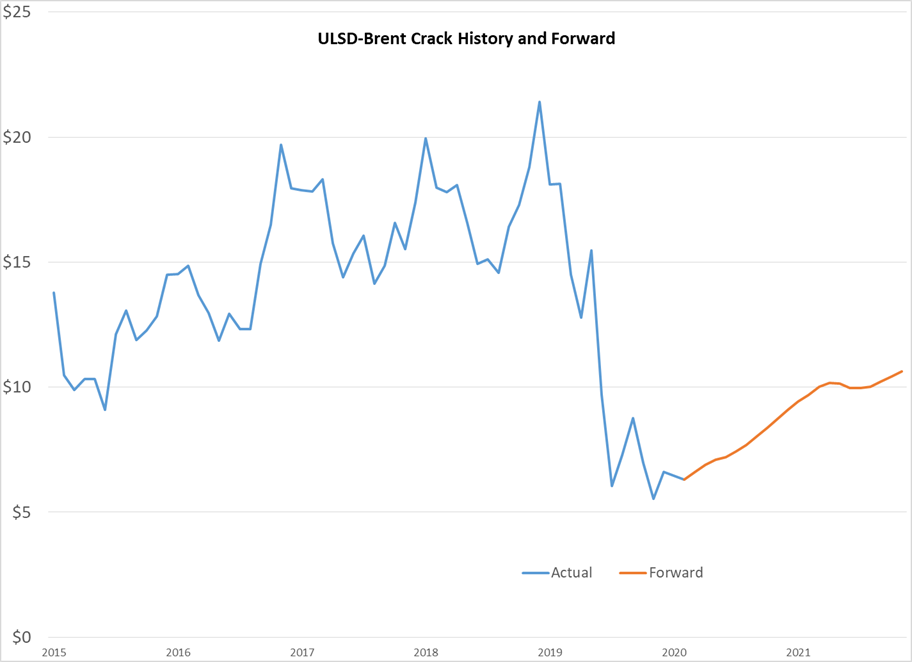

The outlook isn’t much better for refiners. The charts below show current crack spreads are near break-even levels, and the forward curve suggests those margins may not return to healthier levels for more than a year.

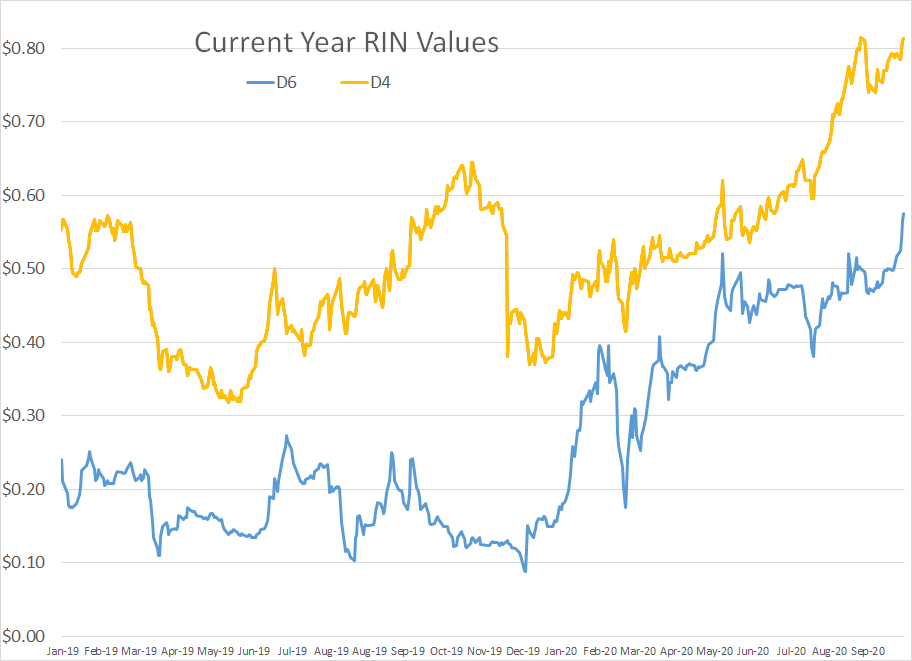

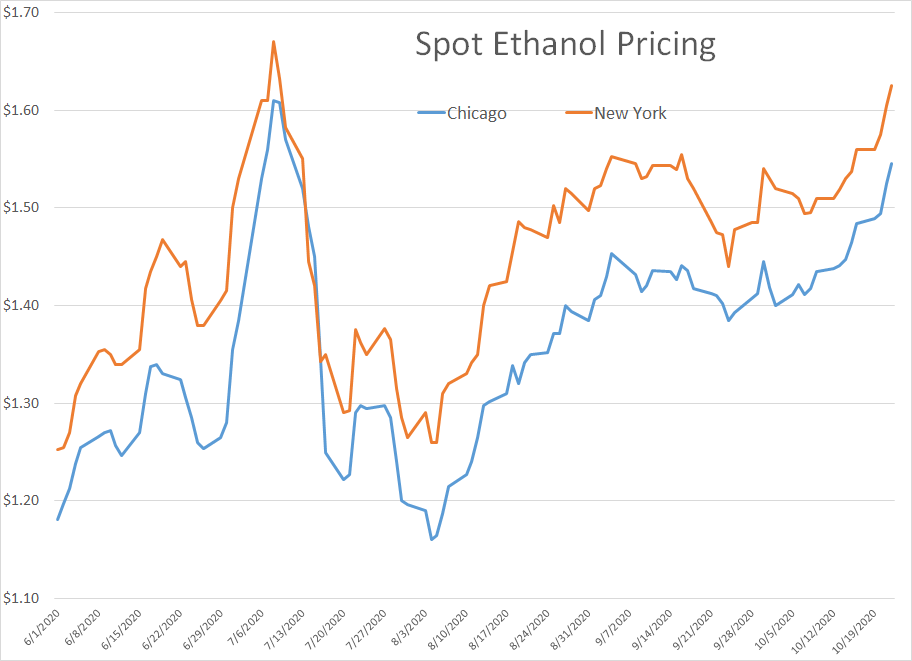

The plea to the EPA by senators in refining states to give those plants a break from unreachable renewable volume obligations didn’t seem to stir traders much Thursday with RIN values holding near multi-year highs, while ethanol prices continued to rally on the heels of surging corn prices.

Signs of a bottom? Trafigura was reported to take a stake in Italian refiner Saras, which (like most refiners) has seen its share price tumble this year. At current prices, that facility could be seen as more of a terminal asset than a production asset for the trading house, and the relatively small (3%) stake suggests they aren’t exactly jumping in with both feet.

Looking (far) ahead? Shell hired a leader for its Global Renewable Solutions department, who won’t start until August of 2021, in what is another sign of the tide change for refiners and perhaps of the cash flow challenges they face.

Libya’s warring factions are expected to sign a truce today, which should allow another 300,000 - 500,000 barrels/day of oil to reach the world market, which will put more pressure on the rest of the OPEC alliance to agree to extend production cuts as demand isn’t strong enough to soak up any incremental supply.

The storm system that’s been churning in the Caribbean for the better part of a week looks like it went from nothing to maybe something overnight. The odds of development jumped to 60%, and instead of heading north and east over Cuba and the southern tip of Florida, it’s now looking like it might move further north into the Gulf of Mexico before making a hard right turn, so we’ll need to keep an eye on it over the weekend. Hurricane Epsilon is still churning through the Atlantic, but beyond some dangerous rip currents, should not impact the U.S. or Canadian coast lines as it is staying out to sea.

If you’re having trouble sleeping, take a look at the study the EIA commissioned on the energy efficiency gap in food processing.

Two conclusions were drawn from the study:

1. If the least efficient processing plants adopt basic upgrades, they’ll consume less energy.

2. We probably did not need the EIA to hire a company to perform a stochastic frontier regression analysis applied to pooled cross sections using plant level data from the quinquennial Census of Manufacturing to figure that out.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

Week 16 - US DOE Inventory Recap

Energy Markets Trading Quietly In The Red As Ethanol Prices Rally To Five-Month High

The Struggle For Renewable Producers Continues As A Rapid Influx Of Supply And Crashing Credit Prices Make Biodiesel

After Years Of Backwardation, Diesel Prices Have Slipped Into Contango Over The Past Week

Social Media

News & Views

View All

Week 16 - US DOE Inventory Recap

Energy Markets Trading Quietly In The Red As Ethanol Prices Rally To Five-Month High

Energy markets are trading quietly in the red to start Wednesday’s session after a healthy bounce Tuesday afternoon suggested the Israel-Iran-linked liquidation had finally run its course.

There are reports of more Ukrainian strikes on Russian energy assets overnight, but the sources are sketchy so far, and the market doesn’t seem to be reacting as if this is legitimate news.

Ethanol prices have rallied to a 5-month high this week as corn and other grain prices have rallied after the latest crop progress update highlighted risks to farmers this year, lower grain export expectations from Ukraine, and the approval of E15 blends this summer despite the fact it pollutes more. The rally in grain and renewables prices has also helped RIN values find a bid after it looked like they were about to test their 4-year lows last week.

The API reported small changes in refined product inventories last week, with gasoline stocks down about 600,000, while distillates were up 724,000. Crude oil inventories increased by 3.2 million barrels according to the industry-group estimates. The DOE’s weekly report is due out at its normal time this morning.

Total reported another upset at its Port Arthur refinery that’s been a frequent flier on the TCEQ alerts since the January deep freeze knocked it offline and damaged multiple operating units. This latest upset seems minor as the un-named unit impacted was returned to normal operations in under an hour. Gulf Coast basis markets have shrugged off most reports of refinery upsets this year as the region remains well supplied, and it’s unlikely we’ll see any impact from this news.

California conversely reacted in a big way to reports of an upset at Chevron’s El Segundo refinery outside of LA, with CARBOB basis values jumping by more than a dime. Energy News Today continued to show its value by reporting the upset before the flaring notice was even reported to area regulators, proving once again it’s ahead of the curve on refinery-related events. Another industry news outlet meanwhile struggled just to remember where the country’s largest diesel seller is located.

Click here to download a PDF of today's TACenergy Market Talk

The Struggle For Renewable Producers Continues As A Rapid Influx Of Supply And Crashing Credit Prices Make Biodiesel

The sigh of relief selloff continues in energy markets Tuesday morning, with gasoline prices now down more than 20 cents in 7 sessions, while diesel prices have dropped 26 cents in the past 12. Crude oil prices are within a few pennies of reaching a 1 month low as a lack of headlines from the world’s hot spots allows some reflection into the state of the world’s spare capacity for both oil and refined products.

Gasoline prices are trading near a 6-week low this morning, but still need to fall about another nickel in order to break the weekly trendline that pushed prices steadily higher since December. If that trend breaks, it will be safer to say that we saw the end of the spring gasoline rally on April 12th for the 2nd year in a row. Last year RBOB futures peaked on April 12 at $2.8943 and bottomed out on May 4th at $2.2500. The high (at this point) for this year was set on April 12th at $2.8516, and the low overnight was $2.6454.

It’s not just energy commodities that are seeing an unwind of the “flight to safety” trade: Gold prices had their biggest selloff in 2 years Monday and continue to point lower today. Just how much money poured into commodities in the weeks leading up to the direct confrontation between Israel and Iran is unclear, but we have seen in year’s past that these unwind-events can create a snowball effect as traders can be forced to sell to cover their margin calls.

Supply > Demand: The EIA this morning highlighted the record setting demand for natural gas in the US last year, which was not nearly enough to offset the glut of supply that forced prices to a record low in February. A shortage of natural gas in Europe was a key driver of the chaotic markets that smashed just about every record in 2022, and an excess of natural gas supply in Europe and the US this year is acting as a buffer, particularly on diesel prices.

The struggle for renewable producers continues as a rapid influx of supply and crashing credit prices make Biodiesel, RD and SAF unprofitable for many. In addition to the plant closures announced in the past 6 months, Vertex Energy reported Monday it’s operating its Renewable Diesel facility in Mobile AL at just 50% of capacity in Q1. The truly scary part for many is that the $1/gallon Blender's tax credit ends this year and is being replaced by the “Clean” Fuel production credit that forces producers to prove their emissions reductions in order to qualify for an increased subsidy. It’s impossible to say at this point how much the net reduction will be for domestic producers, but importers will get nothing, and at current CI values, many biodiesel producers may see their “blend credit” cut by more than half.

Click here to download a PDF of today's TACenergy Market Talk.