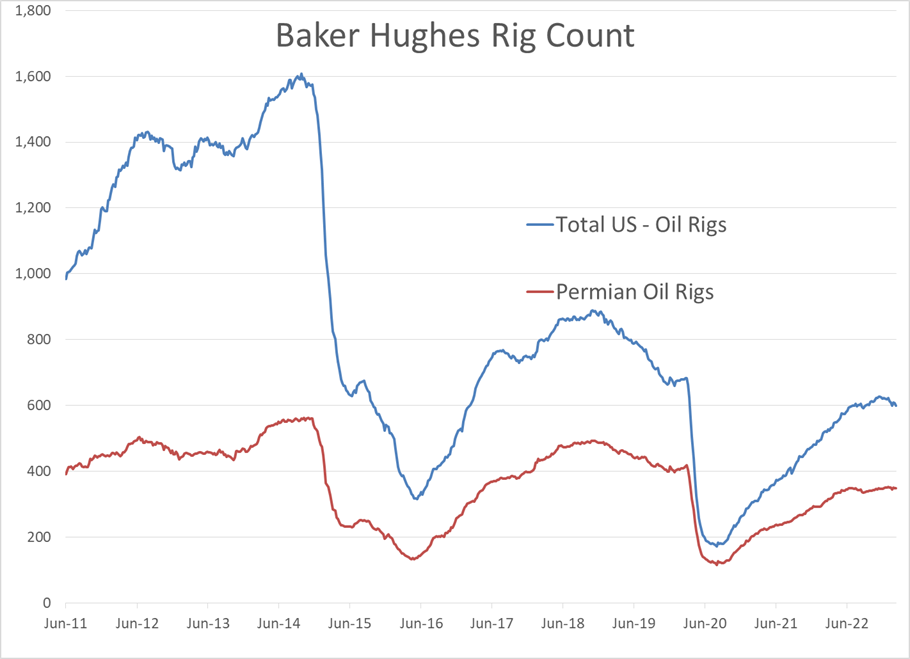

Baker Hughes Reported A Decline Of 7 Oil Rigs Drilling In The US, While The Natural Gas Rig Count Held Steady

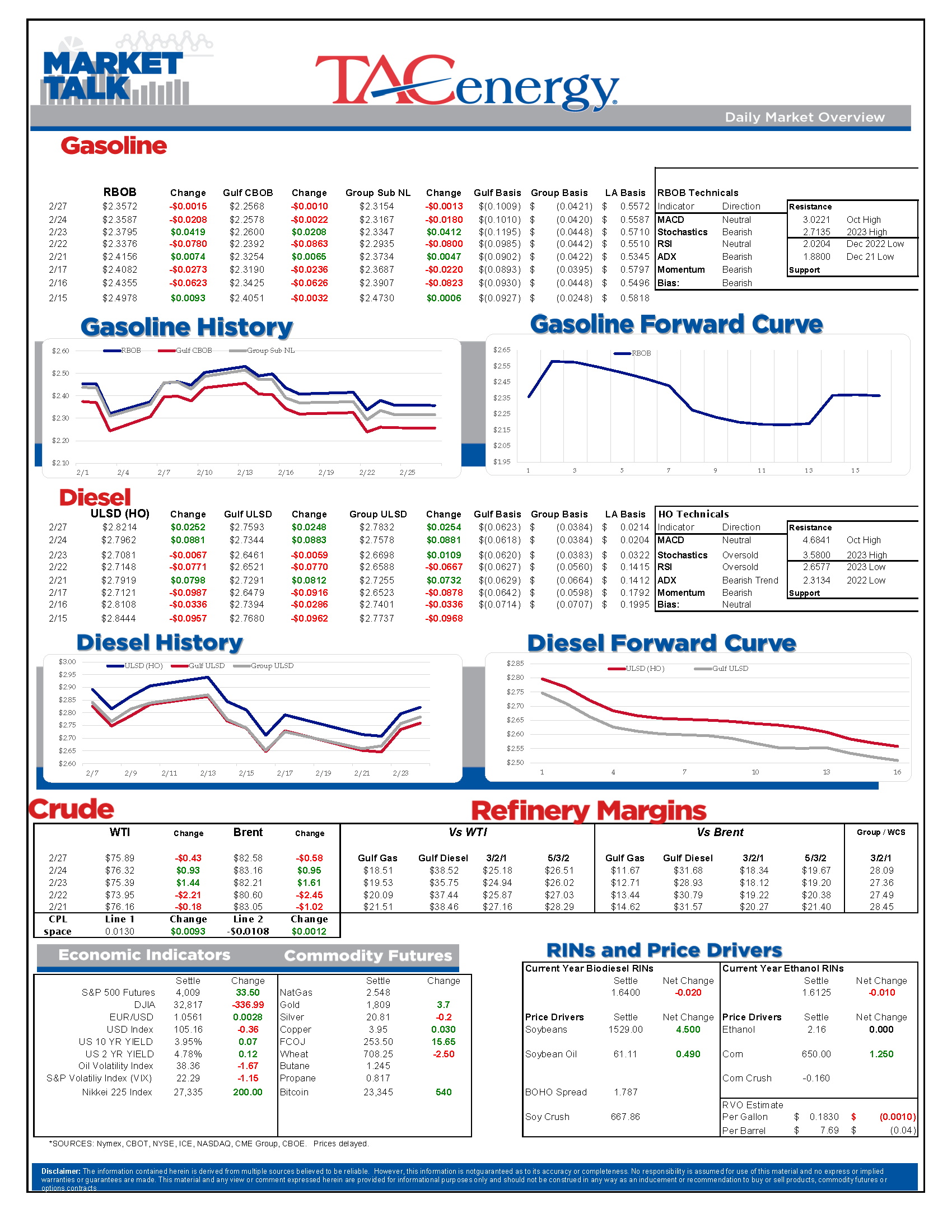

It’s another mixed bag for energy markets to start the week, with ULSD trying to follow through on its strong showing Friday, while RBOB is flat and WTI is trading modestly lower to start the day.

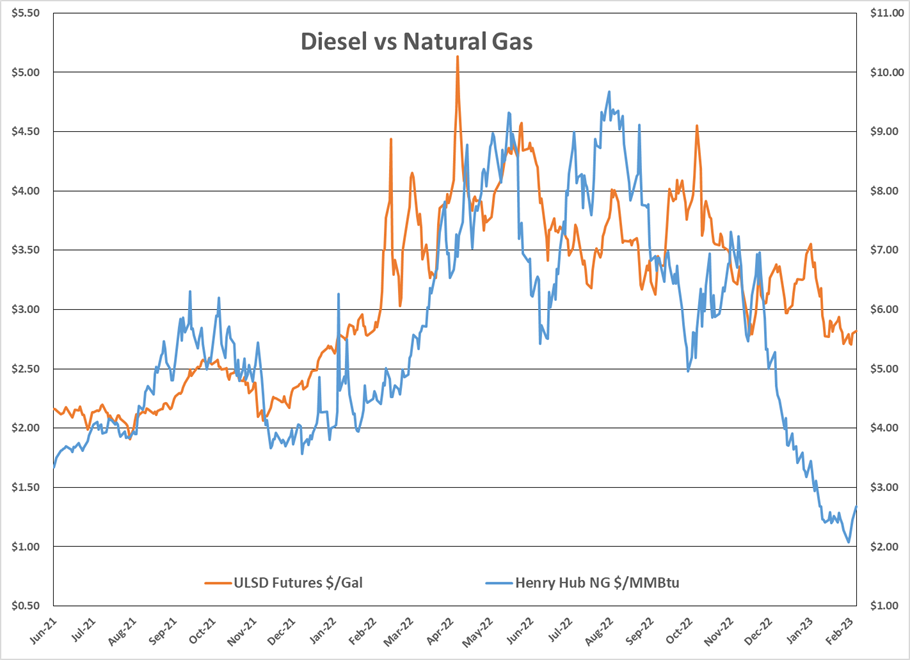

Natural gas prices have rebounded sharply in the past 4 days, reaching $2.69 overnight after trading as low as $1.96 last Wednesday. The restart of the Freeport export facility, and some forecast models calling for below average temps in March after a much warmer than normal winter are both getting credit for that rally, which is no doubt having some positive impact on ULSD prices which have rallied 15 cents since reaching their lowest levels in 13 months last week, just as natural gas prices were bottoming out.

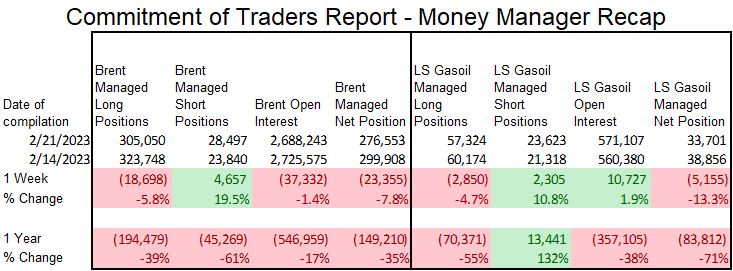

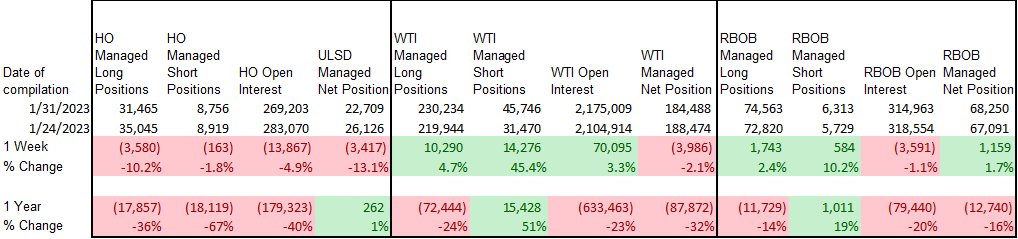

The CFTC issued its first set of commitments of trader's data in nearly a month Friday, releasing data originally scheduled to be published from January 31. The agency hopes to get caught up with its reporting by Mid-March. In case you were wondering, the contracts directly impacted by the cyber-attack, based on the latest update were “IFED MISO IN RT Off-Peak and CME USD Malaysian Crude Palm Oil Calendar Spread contract markets”. Somehow, I think the world could have managed without seeing the COT data on those two contracts.

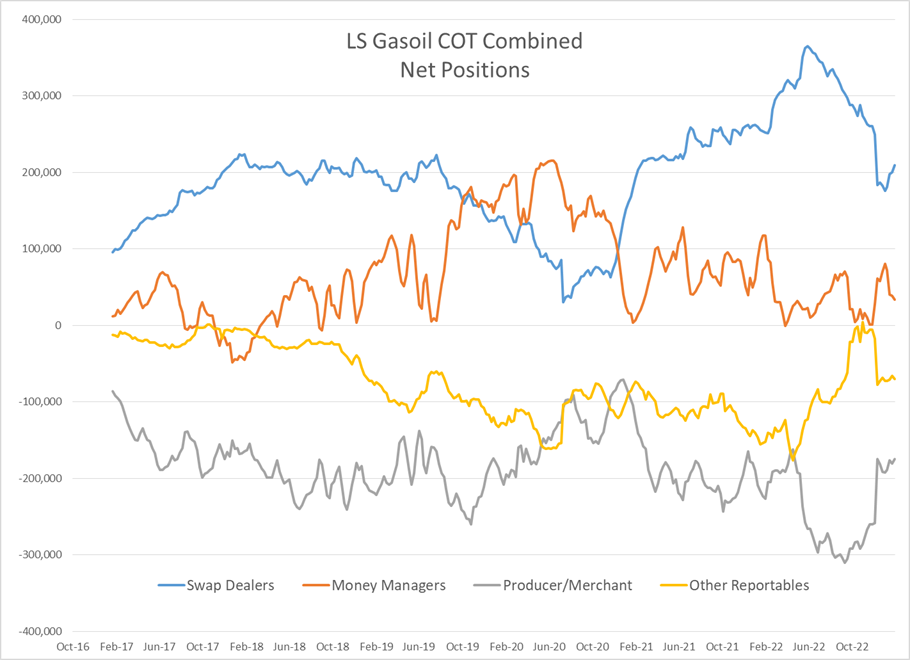

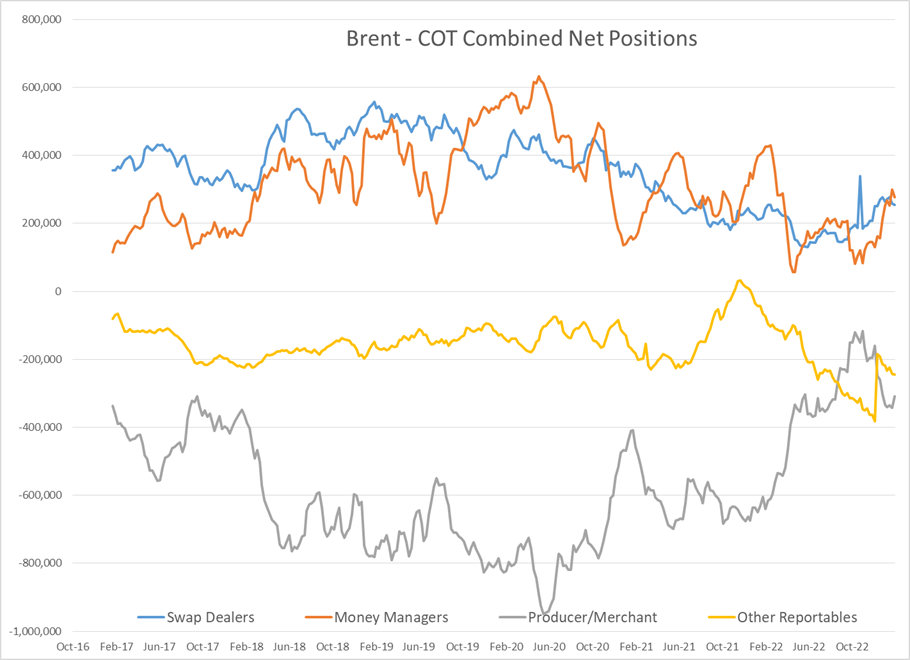

While we’re still a couple of weeks behind for NYMEX contracts, we can see the money flows in ICE Brent and Gasoil contracts, and no surprise there it’s been steady liquidation by hedge funds for diesel contracts so far in February as prices have crumbled.

Baker Hughes reported a decline of 7 oil rigs drilling in the US, while the natural gas rig count held steady. California, New Mexico, Oklahoma and West Virginia all had a decline of 2 or more rigs on the week, while Texas held steady. Canada looks like it has topped out for its winter drilling season, with a reduction of 5 rigs on the week.

Russia’s influence on European energy supplies continues to be a wild card, with changes continuing on a near daily basis. Over the weekend we saw reports that Russia was allowing shipments of crude from Kazakhstan to Germany to begin flowing after delaying them for several weeks only then to find out that Russia had cut off shipments to Poland due to “paperwork issues”. Neither event seemed to have much influence on futures prices but serve as a reminder that despite the relative calm that’s taken over markets so far in 2023, there are still plenty of unknowns in the global supply network this year.

The Deer Park TX refinery was forced to shut its smaller crude unit after a fire on Thursday, which was one of 3 fires to hit owner Pemex’s operations in the US and Mexico that day.

So far there are no reports of major issues at California refineries following the blizzard, although power outages in the region were numerous.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

The Sell-Off Continues In Energy Markets, RBOB Gasoline Futures Are Now Down Nearly 13 Cents In The Past Two Days

Week 15 - US DOE Inventory Recap

Prices To Lease Space On Colonial’s Main Gasoline Line Continue To Rally This Week

Equity Markets Have Been Pulling Back Sharply In Recent Days As Inflation And Trade Concerns Inject A Sense Of Reality Into Stocks

Social Media

News & Views

View All

The Sell-Off Continues In Energy Markets, RBOB Gasoline Futures Are Now Down Nearly 13 Cents In The Past Two Days

The sell-off continues in energy markets. RBOB gasoline futures are now down nearly 13 cents in the past two days, and have fallen 16 cents from a week ago, leading to questions about whether or not we’ve seen the seasonal peak in gasoline prices. ULSD futures are also coming under heavy selling pressure, dropping 15 cents so far this week and are trading at their lowest level since January 3rd.

The drop on the weekly chart certainly takes away the upside momentum for gasoline that still favored a run at the $3 mark just a few days ago, but the longer term up-trend that helped propel a 90-cent increase since mid-December is still intact as long as prices stay above the $2.60 mark for the next week. If diesel prices break below $2.50 there’s a strong possibility that we see another 30 cent price drop in the next couple of weeks.

An unwind of long positions after Iran’s attack on Israel was swatted out of the sky without further escalation (so far anyway) and reports that Russia is resuming refinery runs, both seeming to be contributing factors to the sharp pullback in prices.

Along with the uncertainty about where the next attacks may or may not occur, and if they will have any meaningful impact on supply, come no shortage of rumors about potential SPR releases or how OPEC might respond to the crisis. The only thing that’s certain at this point, is that there’s much more spare capacity for both oil production and refining now than there was 2 years ago, which seems to be helping keep a lid on prices despite so much tension.

In addition, for those that remember the chaos in oil markets 50 years ago sparked by similar events in and around Israel, read this note from the NY Times on why things are different this time around.

The DOE’s weekly status report was largely ignored in the midst of the big sell-off Wednesday, with few noteworthy items in the report.

Diesel demand did see a strong recovery from last week’s throwaway figure that proves the vulnerability of the weekly estimates, particularly the week after a holiday, but that did nothing to slow the sell-off in ULSD futures.

Perhaps the biggest next of the week was that the agency made its seasonal changes to nameplate refining capacity as facilities emerged from their spring maintenance.

PADD 2 saw an increase of 36mb/day, and PADD 3 increased by 72mb/day, both of which set new records for regional capacity. PADD 5 meanwhile continued its slow-motion decline, losing another 30mb/day of capacity as California’s war of attrition against the industry continues. It’s worth noting that given the glacial pace of EIA reporting on the topic, we’re unlikely to see the impact of Rodeo’s conversion in the official numbers until next year.

Speaking of which, if you believe the PADD 5 diesel chart below that suggests the region is running out of the fuel, when in fact there’s an excess in most local markets, you haven’t been paying attention. Gasoline inventories on the West Coast however do appear consistent with reality as less refining output and a lack of resupply options both continue to create headaches for suppliers.

Week 15 - US DOE Inventory Recap

Prices To Lease Space On Colonial’s Main Gasoline Line Continue To Rally This Week

Energy markets are sliding lower again to start Wednesday’s trading as demand concerns and weaker stock markets around the world seem to be outweighing any supply concerns for the time being.

Rumors continue to swirl about an “imminent” response by Israel to Iran’s attacks, but so far, no news seems to be taken as good news in the hopes that further escalation can be avoided, even as tensions near the Red Sea and Strait of Hormuz continue to simmer.

Prices to lease space on Colonial’s main gasoline line continue to rally this week, trading north of 11 cents/gallon as Gulf Coast producers still struggle to find outlets for their production, despite a healthy export market. Gulf Coast CBOB is trading at discounts of around 34 cents to futures, while Gulf Coast RBOB is trading around a 16-cent discount, which gives shippers room to pay up for the linespace and still deliver into the East Coast markets at a profit.

Back to reality, or just the start of more volatility? California CARBOB basis values have dropped back to “only” 40 cent premiums to RBOB futures this week, as multiple flaring events at California refineries don’t appear to have impacted supply. The state has been an island for fuel supplies for many years as its boutique grades prevent imports from neighboring states, and now add the conversion of the P66 Rodeo refinery to renewable diesel production and the pending changes to try and cap refinery profits, and it’s easier to understand why these markets are increasingly vulnerable to supply shocks and price spikes on gasoline.

RIN prices continue to fall this week, touching 44 cents/RIN for D4 and D6 values Tuesday, their lowest level in 6 weeks and just about a nickel above a 4-year low. While the sharp drop in RIN and LCFS values has caused several biodiesel and Renewable Diesel producers to either shut down or limit production, the growth in RIN generation continues thanks to projects like the Rodeo refinery conversion, making the supply in RINs still outpace the demand set by the Renewable Fuel Standard by a wide margin.

The API reported draws in refined products, 2.5 million barrels for gasoline and 427,000 barrels for distillates, while crude oil stocks had an estimated build of more than 4 million barrels. The DOE’s weekly report is due out at its normal time this morning.

Click here to download a PDF of today's TACenergy Market Talk.