Calm Between Storms For Energy Markets

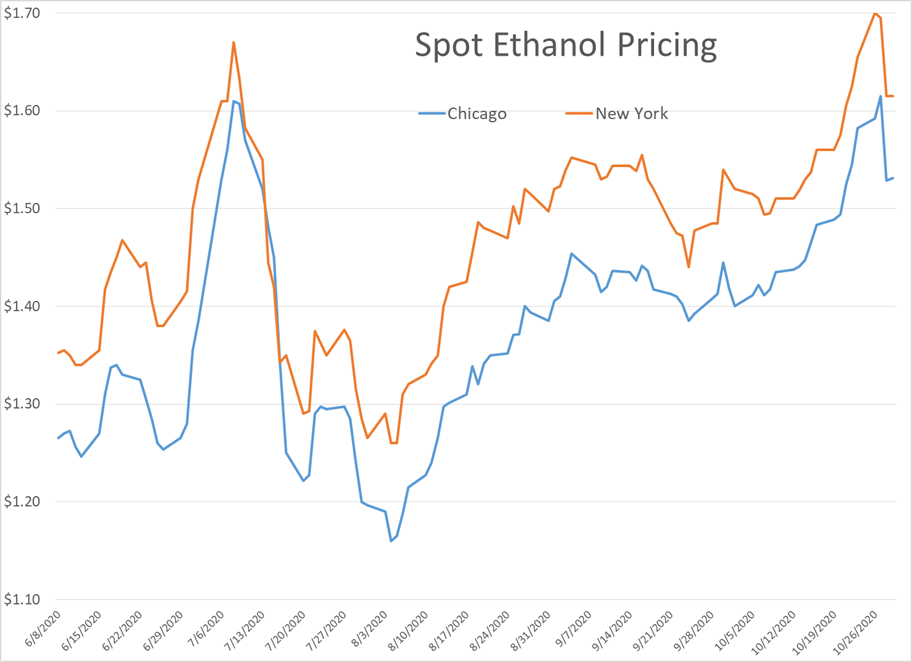

The calm between storms has set in on energy markets to start Friday’s trading with only fractional moves so far, after a week of mostly heavy selling. The dark cloud of rapidly rising COVID counts continues to hang over markets around the globe, while next week’s election is expected to create even more volatility.

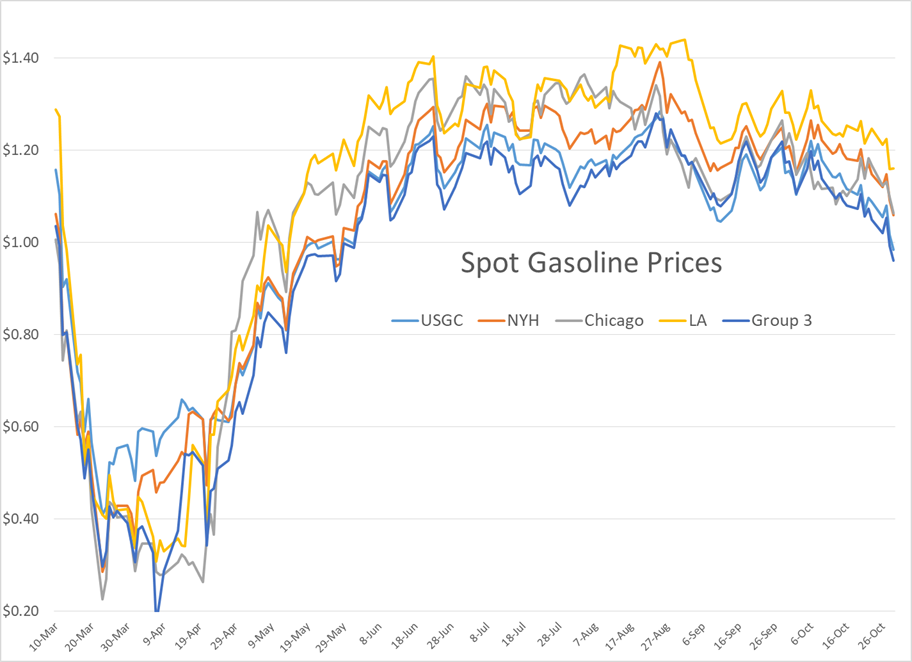

November RBOB and HO contracts expire today, so watch the December contracts (RBZ/HOZ) for price direction today. RBOB futures reached their lowest levels since May during Thursday’s selloff, but held support just above the $1 mark, holding off a technical collapse for now. WTI and ULSD finally found a bid just a few ticks above their June lows meaning the sideways pattern is still hanging on by a thread. If the range finally breaks down, it looks like we’ll see another 10-20 cent drop for products in short order.

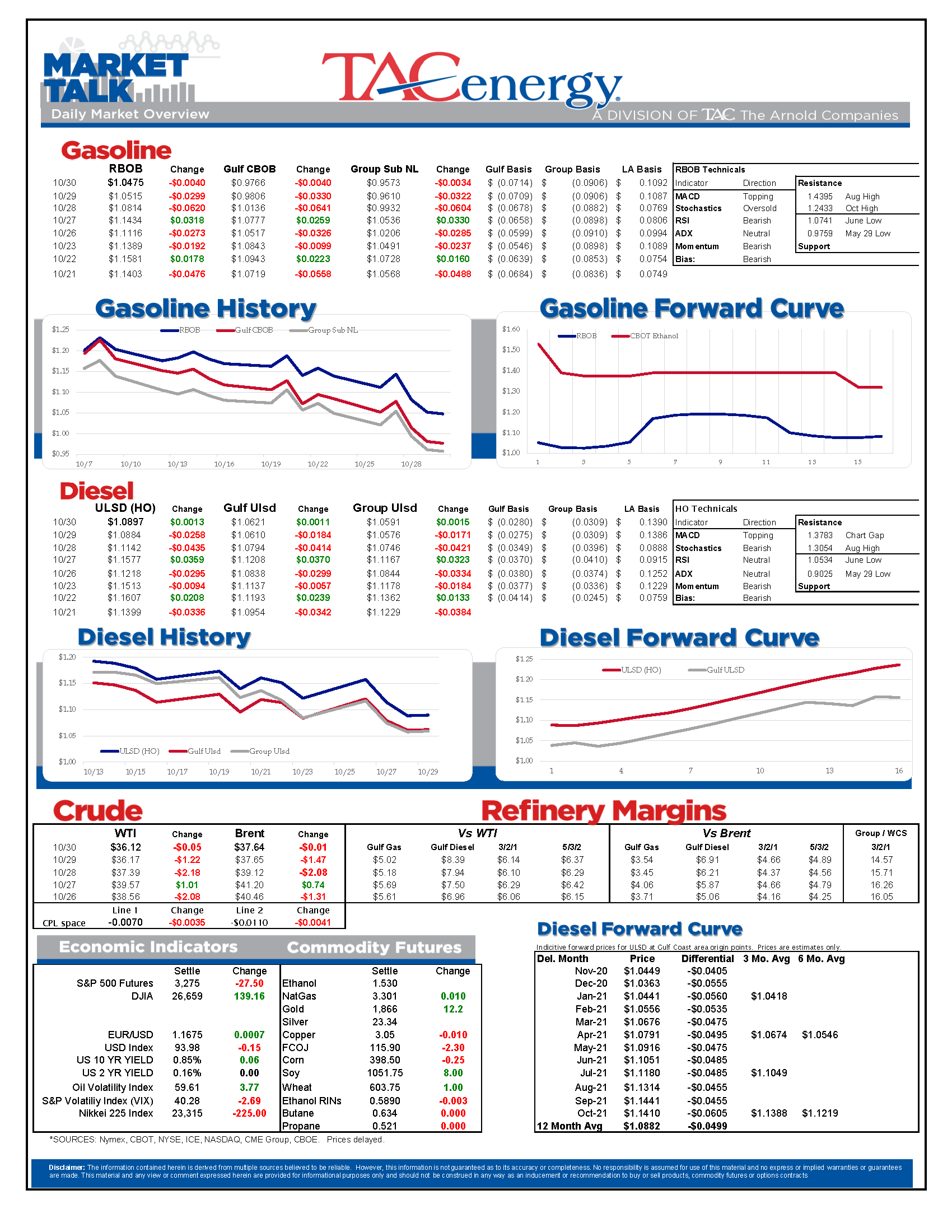

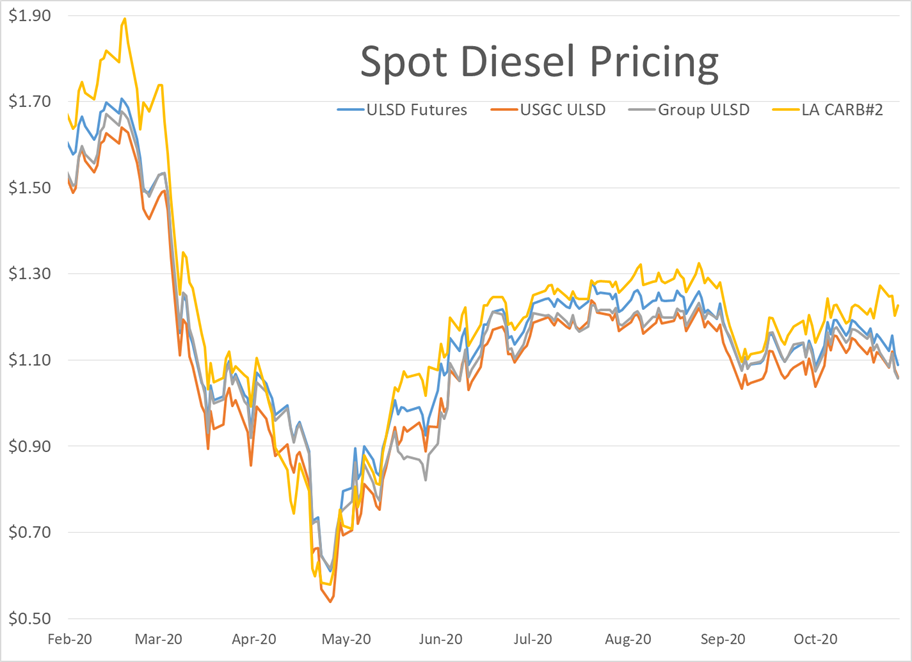

Gulf Coast gasoline prices joined the Group 3 market in the under $1 club Thursday. Chicago and NYH prices are just about a nickel away, while West Coast values still have more than a dime to fall before reaching that level. Ethanol prices saw their bubble burst as both corn and gasoline prices have plummeted this week. The upward momentum in RIN values also appears to have stalled out temporarily, with the weaker commodity values and the announcement that there will be one less obligated refinery requiring RINs next year managing to push both D4 and D6 prices back down from multi-year highs.

Big Oil earnings reports for Q3 being released this week are shedding more light on the challenging environment that’s forcing more job cuts, even with oil prices trading north of $40 for most of the quarter. Q4 is looking even worse with the drop in prices the past couple of weeks, and demand forecasts continuing to decline. While most OPEC members don’t release earnings reports like public corporations due, it’s fairly easy to extrapolate that they’re facing similar challenges, which makes the need to extend production cuts clear, although the will to do so from some members is less so.

The parade of hurricanes in the Gulf Coast isn’t helping oil producers as several noted in their earnings reports the reduced output and additional costs of having to shut in and restart production (not to mention shuttling employees to and from the rigs) have happened at the worst possible time.

As the Atlantic Coast dries out from the remnants of Hurricane Zeta today, the NHC is already giving a high probability of another named storm forming over the weekend. The disturbance has 80% odds of becoming the next named storm as it moves into the Caribbean over the next five days, but so far the NHC isn’t publishing a potential path for after it develops. This is close to where both hurricanes Delta and Zeta formed, so another hit to the Gulf Coast is still possible even as we move into the last few weeks of the season.

Another one bites the dust: BP announced it would shut Australia’s largest refinery, converting it to an import terminal, as operating the plant was no longer “economically viable." At 150mb/day, the plant is not large by U.S. refining standards, and won’t be missed in the current environment, but is the latest in a long string of rationalizations globally that’s expected to continue as long as demand is weak.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

Energy Markets Rally Again Thursday After A Choppy Wednesday Session

Week 16 - US DOE Inventory Recap

Energy Markets Trading Quietly In The Red As Ethanol Prices Rally To Five-Month High

The Struggle For Renewable Producers Continues As A Rapid Influx Of Supply And Crashing Credit Prices Make Biodiesel

Social Media

News & Views

View All

Energy Markets Rally Again Thursday After A Choppy Wednesday Session

Energy markets are trying to rally again Thursday after a choppy Wednesday session. RBOB gasoline futures are leading the push higher, on pace for a 3rd consecutive day of gains after finding a temporary floor Tuesday and have added 12 cents from those lows.

Equity markets are pointing sharply lower after a weak Q1 GDP estimate which seems to have contributed to a pullback in product prices over the past few minutes, but don’t be surprised if the “bad news is good news” low interest rate junkies start jumping in later on.

The DOE’s weekly report showed sluggish demand for gasoline and diesel, but inventory levels in most markets continue to follow their typical seasonal trends. Refinery runs held fairly steady last week with crude inputs down slightly but total gross throughputs up slightly as most facilities are now back online from a busy spring maintenance season and geared up for peak demand this summer.

Propane and propylene exports spiked to a record high north of 2.3 million barrels/day last week, which demonstrates both the US’s growing influence on global product markets, and the steady shift towards “other” products besides traditional gasoline and diesel in the level of importance for refiners.

The EIA acknowledged this morning that its weak diesel consumption estimates reflected the switch to Renewable Diesel on the West Coast, although they did not provide any timeline for when that data will be included in the weekly survey. The agency acknowledged that more than 4% of the total US consumption is now a combination of RD and Biodiesel, and that number is expected to continue to grow this year. This morning’s note also suggested that weak manufacturing activity was to blame for the sluggish diesel demand across the US, while other reports suggest the freight recession continued through Q1 of this year, which is also contributing to the big shift from tight diesel markets to oversupplied in several regions.

Valero kicked off the Q1 earnings releases for refiners with solid net income of $1.2 billion that’s a far cry from the spectacular earnings north of $3 billion in the first quarter of 2023. The refining sector made $1.7 billion, down from $4.1 billion last year. That is a pattern that should be expected from other refiners as well as the industry returns to a more normal market after 2 unbelievable years. You wouldn’t guess it by looking at stock prices for refiners though, as they continue to trade near record highs despite the more modest earnings.

Another pattern we’re likely to see continue with other refiners is that Renewable earnings were down, despite a big increase in production as lower subsidies like RINs and LCFS credit values sting producers that rely on those to compete with traditional products. Valero’s SAF conversion project at its Diamond Green joint venture is progressing ahead of schedule and will give the company optionality to flip between RD and SAF depending on how the economics of those two products shakes out this year. Valero also shows part of why refiners continue to disappear in California, with operating expenses for its West Coast segment nearly 2X that of the other regions it operates in.

Week 16 - US DOE Inventory Recap

Energy Markets Trading Quietly In The Red As Ethanol Prices Rally To Five-Month High

Energy markets are trading quietly in the red to start Wednesday’s session after a healthy bounce Tuesday afternoon suggested the Israel-Iran-linked liquidation had finally run its course.

There are reports of more Ukrainian strikes on Russian energy assets overnight, but the sources are sketchy so far, and the market doesn’t seem to be reacting as if this is legitimate news.

Ethanol prices have rallied to a 5-month high this week as corn and other grain prices have rallied after the latest crop progress update highlighted risks to farmers this year, lower grain export expectations from Ukraine, and the approval of E15 blends this summer despite the fact it pollutes more. The rally in grain and renewables prices has also helped RIN values find a bid after it looked like they were about to test their 4-year lows last week.

The API reported small changes in refined product inventories last week, with gasoline stocks down about 600,000, while distillates were up 724,000. Crude oil inventories increased by 3.2 million barrels according to the industry-group estimates. The DOE’s weekly report is due out at its normal time this morning.

Total reported another upset at its Port Arthur refinery that’s been a frequent flier on the TCEQ alerts since the January deep freeze knocked it offline and damaged multiple operating units. This latest upset seems minor as the un-named unit impacted was returned to normal operations in under an hour. Gulf Coast basis markets have shrugged off most reports of refinery upsets this year as the region remains well supplied, and it’s unlikely we’ll see any impact from this news.

California conversely reacted in a big way to reports of an upset at Chevron’s El Segundo refinery outside of LA, with CARBOB basis values jumping by more than a dime. Energy News Today continued to show its value by reporting the upset before the flaring notice was even reported to area regulators, proving once again it’s ahead of the curve on refinery-related events. Another industry news outlet meanwhile struggled just to remember where the country’s largest diesel seller is located.

Click here to download a PDF of today's TACenergy Market Talk