Energy Futures Had A Big Rally On Friday

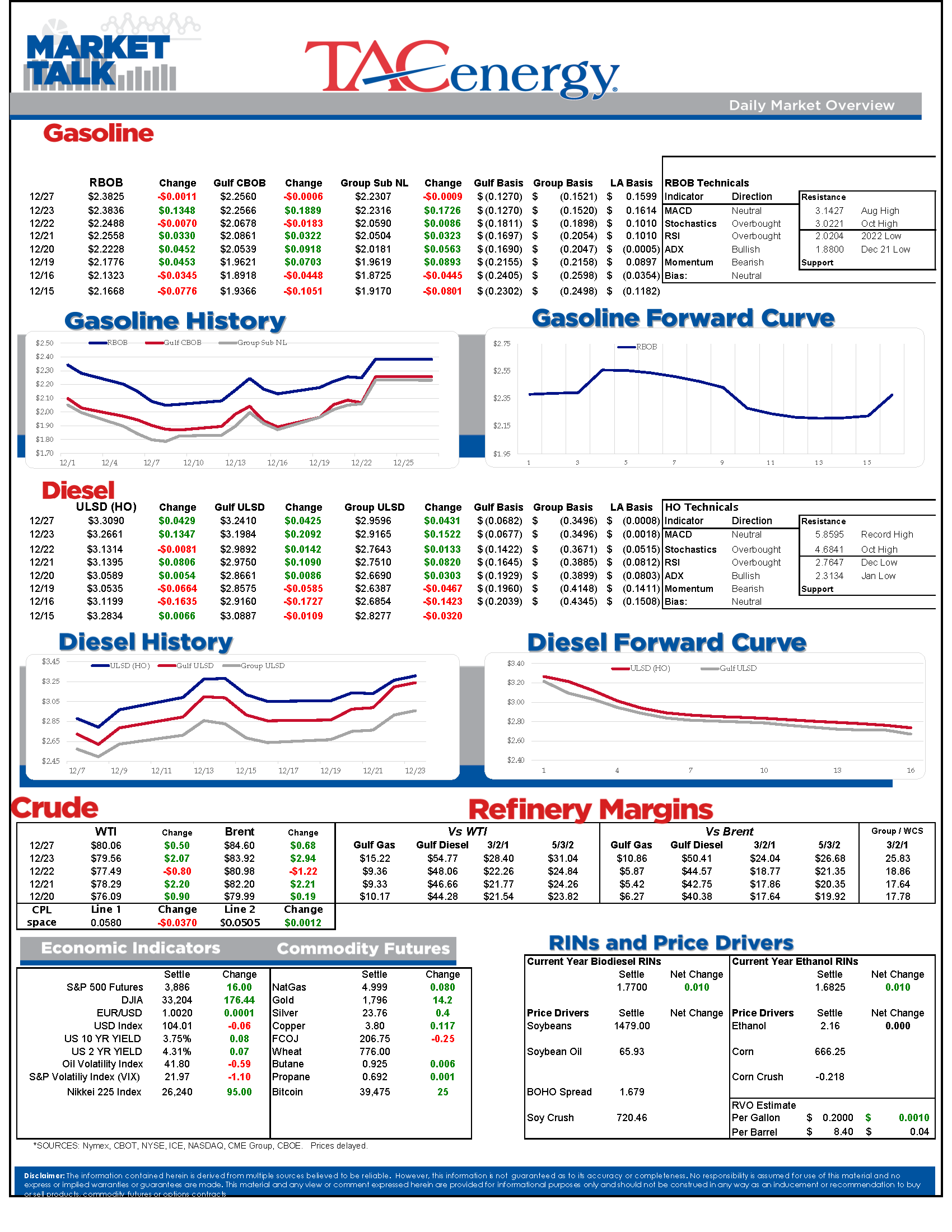

Energy futures had a big rally on Friday, and are following through with higher prices to start the short week as a pair of major supply disruptions, one actual and another potential, grip the market. ULSD continues to lead the move higher and came within striking distance of setting a new high for December overnight, marking a rally of more than 60 cents/gallon since bottoming out 2.5 weeks ago.

Russia threatened to cut its oil output in retaliation for sanctions on Friday, which sounds scary but may actually have to do more with limited options to sell and transport some of the nation’s production than a strategic plan to strike back at nations participating in the embargo.

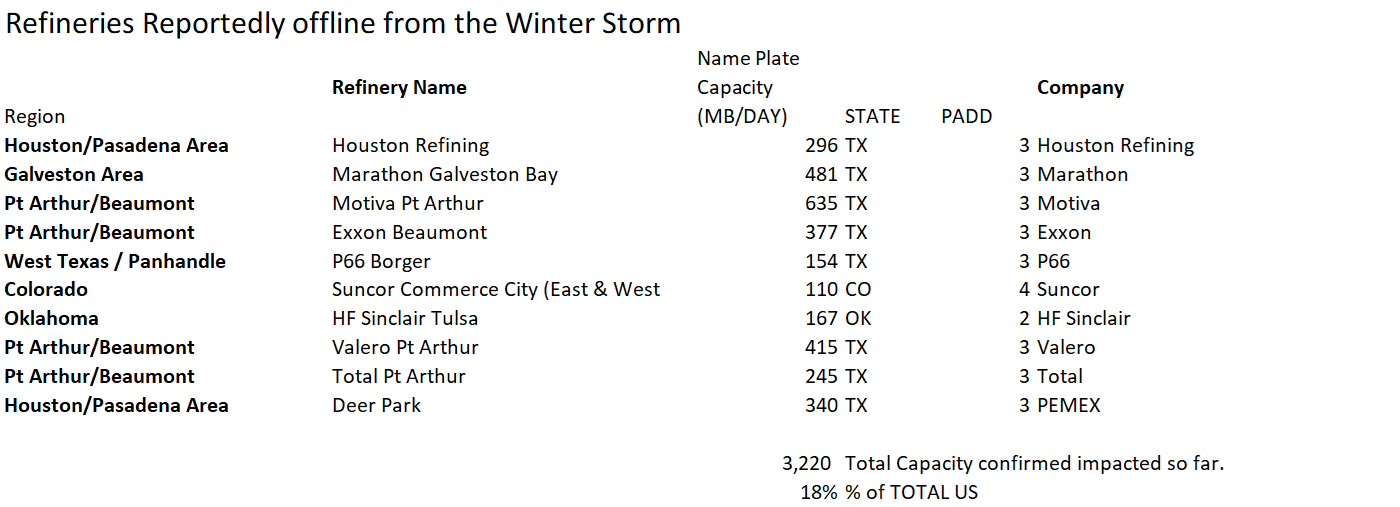

Numerous refineries were knocked offline by the winter storm last week, including several of the largest in the country. Refineries accounting for approximately 18% of total US capacity had units reported offline over the weekend, although the total number of facilities impacted is likely to be much higher, which could place this event in the top 5 all time for disruptions. The steady stream of reports of refineries dropping had basis values for gasoline and distillates rallying in addition to the strong move higher in futures on Friday as the big physical shippers were scrambling to find replacement barrels.

Much warmer temps are sweeping the country allowing damage to be assessed and restarts to begin. While there’s never a good time for a mass refinery disruption, the week between Christmas and New Years typically has the weakest demand of the year, so may limit the impact of these shutdowns on the market. The timing is also likely to encourage some of those facilities to move up maintenance to take advantage of units already being offline and demand being weak. Oil and natural gas output was also hit by the huge storm, but it appears that the electric grids held up well in most cases, unlike what we experienced in early 2021.

The disruptions weren’t limited to production and refining facilities. Numerous terminals and pipelines across the country were reporting various issues, and vessel traffic in and around the NY Harbor was temporarily halted as the storm passed. Here too the impacts may have been much worse if they hadn’t happened just after the pre-holiday rush and just before Christmas day, which marks the slowest day for terminal loadings of the entire year.

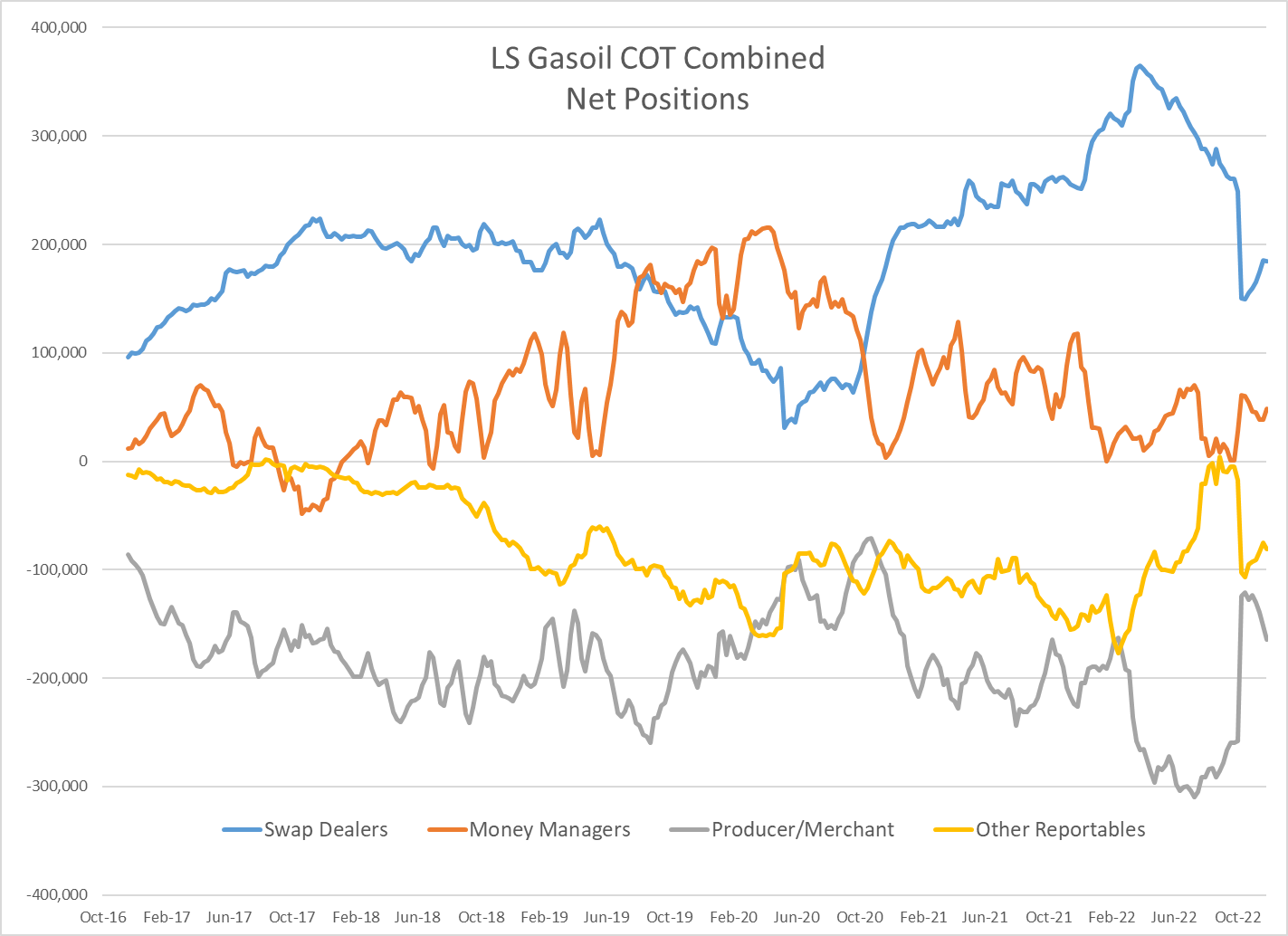

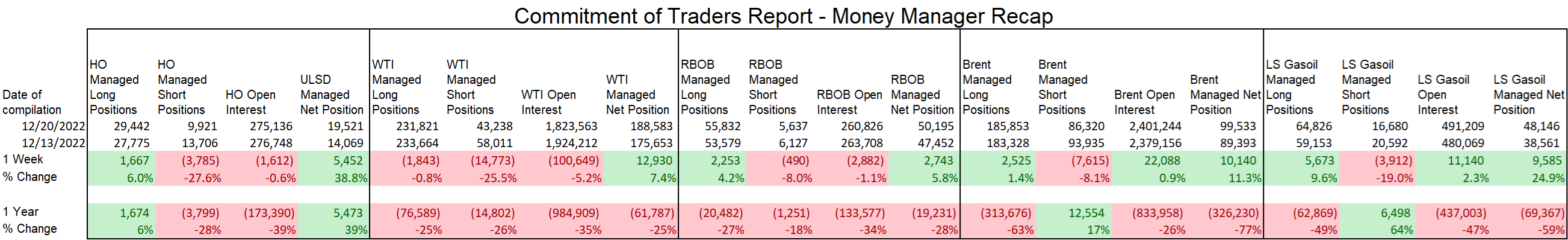

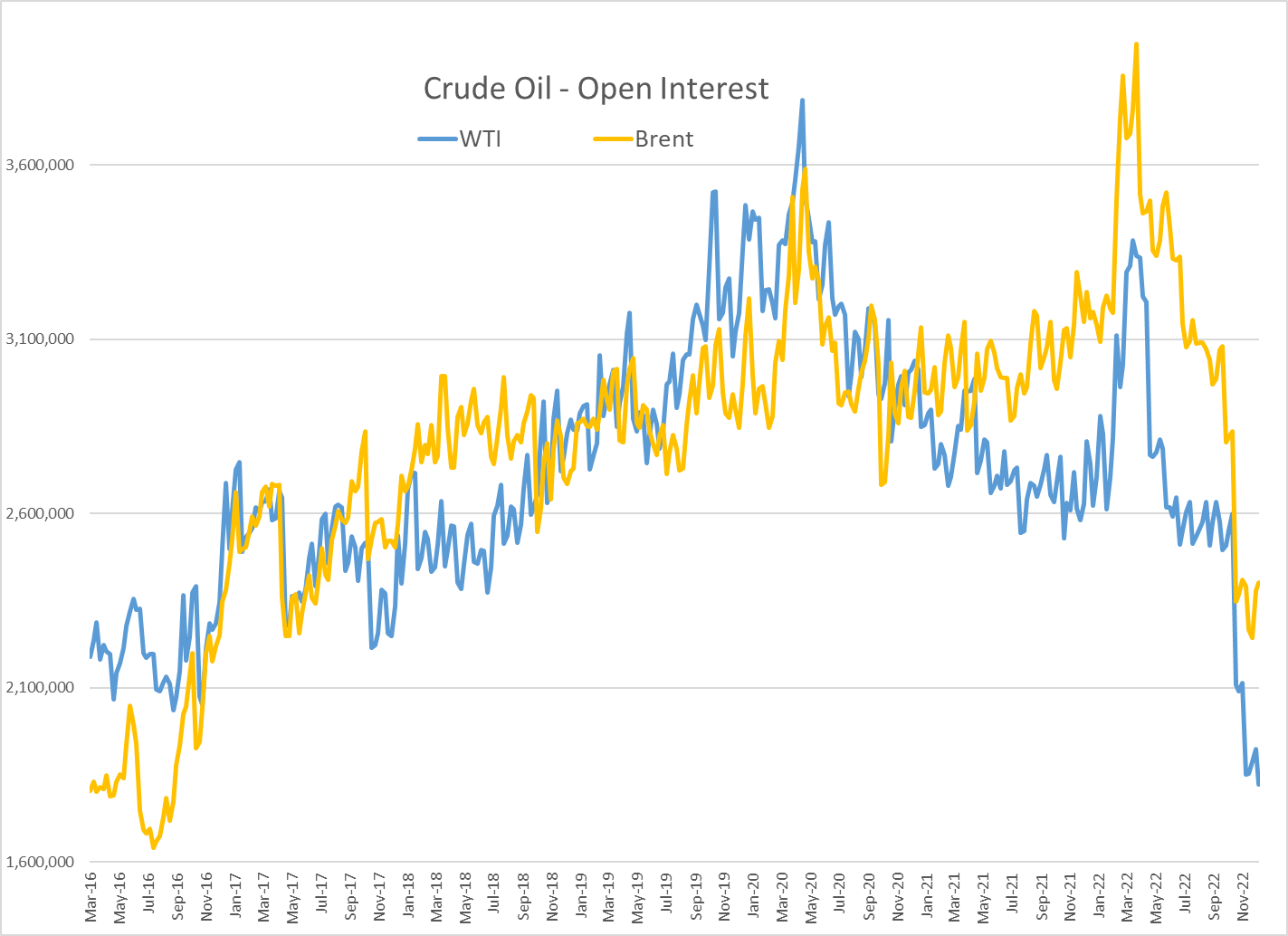

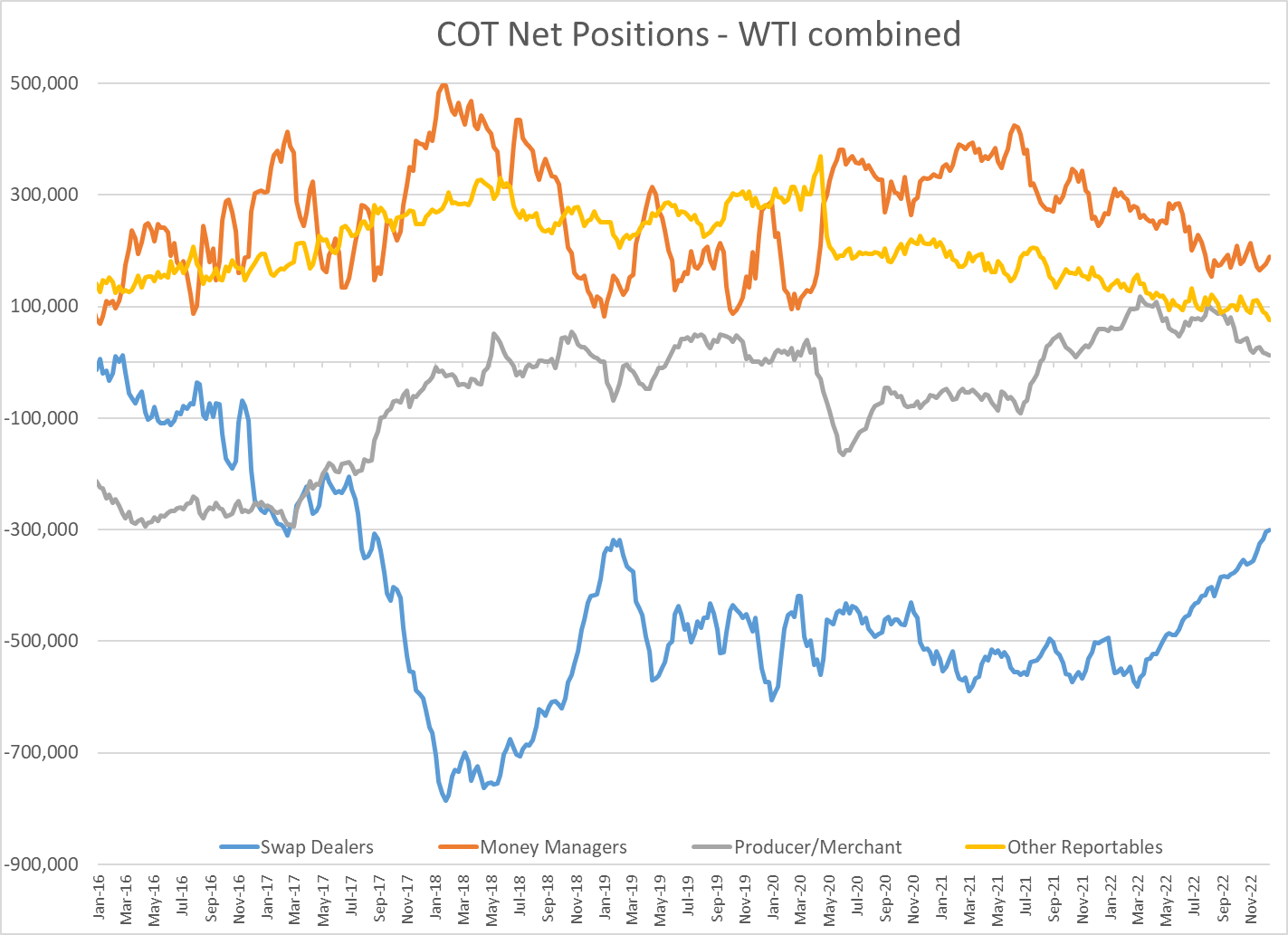

Money managers were jumping back on the energy bandwagon last week with large percentage increases in net length seen across the board. While the percentage increases are large, the starting positions were fairly small, so the actual number of contracts added was less impressive. New length and short covering were consistent for crude and products, while open interest continues to hover near 6 year lows.

Baker Hughes reported 2 more oil rigs and 1 more natural gas rig drilling in the US last week, after both counts had declined in the prior 2 weeks. Drilling activity in the US has stagnated over the past couple of months as lower prices and various supply chain and labor shortages continue to have producers acting conservatively.

Keystone pipeline received approval to restart its shuttered line on Friday, with flows to the Cushing OK hub expected to resume this week.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

Gasoline And Crude Oil Prices Reached Fresh Multi-Month Highs Friday Morning As News Of The Anticipated Attacks Spread

Charts Continue To Favor A Push Towards The $3 Mark For Gasoline, While Diesel Prices May Need To Be Dragged Along For The Ride

Diesel Prices Continue To Be The Weak Link In The Energy Chain

Week 14 - US DOE Inventory Recap

Social Media

News & Views

View All

Gasoline And Crude Oil Prices Reached Fresh Multi-Month Highs Friday Morning As News Of The Anticipated Attacks Spread

Buy the rumor, sell the news seems to be the pattern for energy contracts that are heading lower this morning after Iran’s well-telegraphed attack on Israel over the weekend was thwarted by a coalition of air forces and no further escalation has ensued so far.

Gasoline and crude oil prices reached fresh multi-month highs Friday morning as news of the anticipated attacks spread, and those new highs keep the technical outlook pointing higher on the weekly charts, but we’ll need to see a new high set this week or else the argument for the end of the spring rally may begin.

Marathon reported unplanned flaring at the Wilmington section of its Los Angeles area refining complex early this morning, a week after reported issues at the Carson facility, which combined make up the largest refinery in the state. California’s basis values did pull back sharply after a big rally last week, and now we’ll wait to see if this latest upset sends them higher once again.

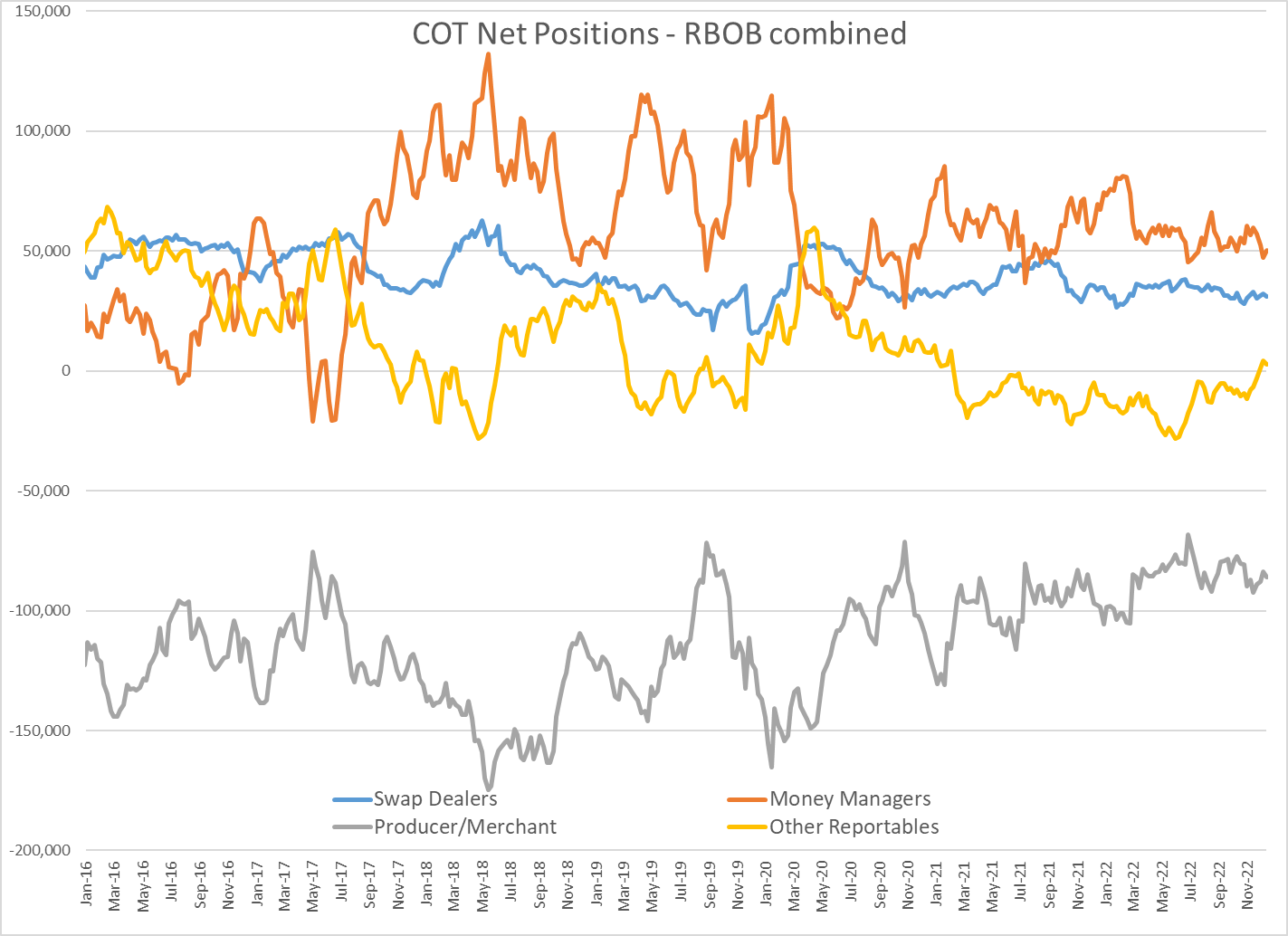

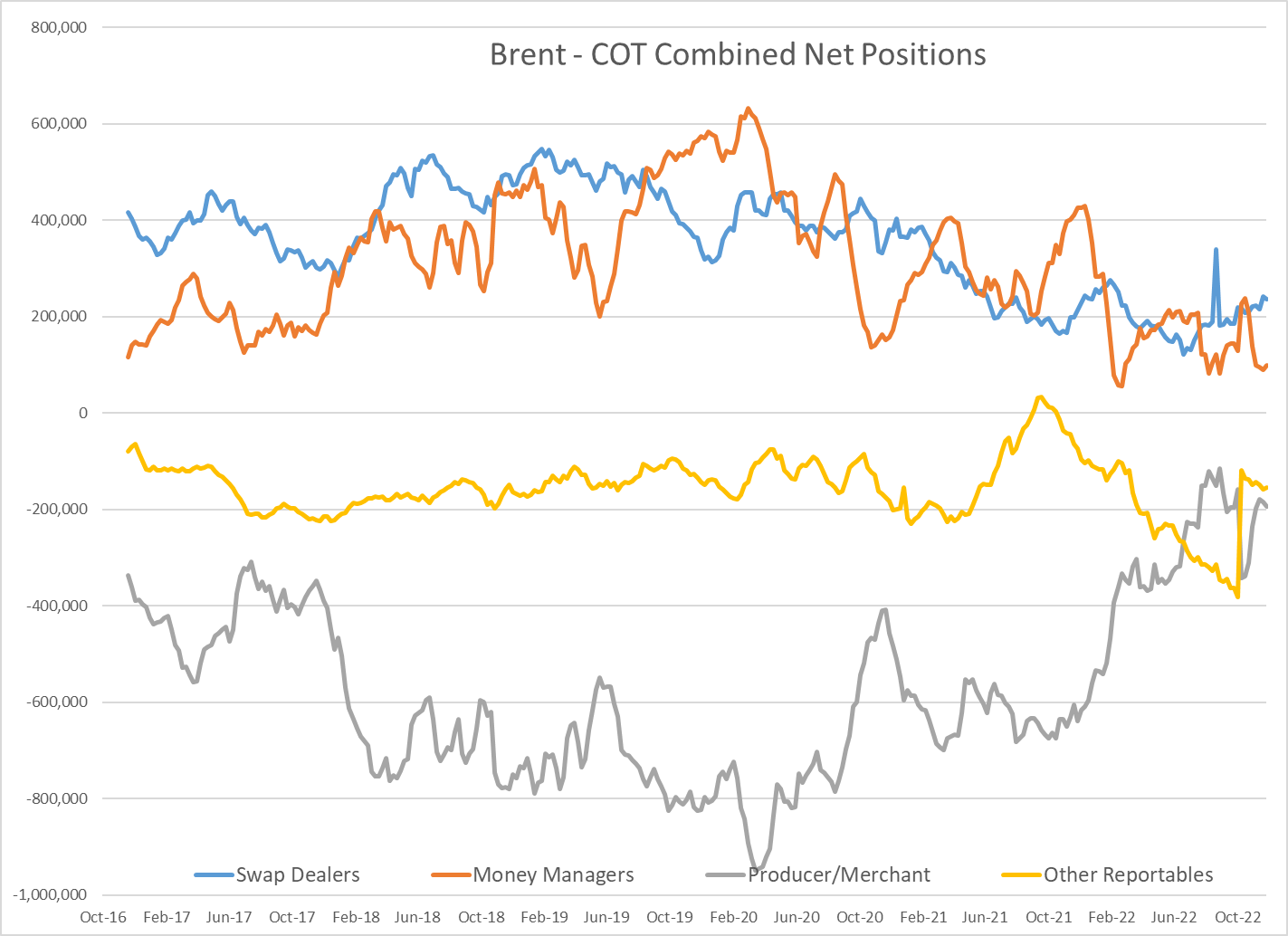

Money managers continue to act moderately bullish on energy contracts, adding net length across the board last week, even as new short positions were added in most of the contracts.

Perhaps most notable in the COT report last week was a surge in open interest with RBOB gasoline reaching its highest level in 3 years, while Brent crude oil contracts reached their highest levels since the full-scale invasion of Ukraine kicked off more than 2 years ago.

It seems likely that the increased violence around the Middle East, and the attacks on Russian refineries are contributing to the increase in bettors in the energy space, particularly now that margin requirements have returned to more tolerable levels after spiking during the chaotic trading of 2022. This same pattern may also be contributing to the surge in energy company stock prices, even though margins are far below the record-setting levels we saw the prior 2 years.

The big increase in short bets on gasoline last week also suggests that some traders are starting to prepare for the spring peak in prices that often happens in late April or May.

A Reuters report suggests that Russia has been able to repair nearly 1/3 of the refining output that was taken offline due to Ukraine’s drone strikes, bringing the offline capacity to 10% down from 14% at the end of March, but that still means more than 650,000 barrels/day of capacity is offline, roughly the size of the largest refinery in the US.

Baker Hughes reported a drop of 2 oil rigs last week, erasing the increase in the rig count we saw the week before. Natural gas rigs continue to decline, falling by 1 last week to a fresh 2 year low at 109 total for the US. Baker Hughes changed the format of their report a couple of weeks ago, which is still challenging some data providers and analysts who continue to report the last numbers that show up on the old report.

A CNN article over the weekend highlighted the challenges still being faced at the PES refinery outside of Philadelphia nearly 5 years after an explosion knocked that plant offline for good. This type of struggle is one major factor in why some refiners are choosing to convert their facilities to renewables production in recent years, which effectively extends their timeline on any remediation needed if the facility was closed for good.

Click here to download a PDF of today's TACenergy Market Talk.

Charts Continue To Favor A Push Towards The $3 Mark For Gasoline, While Diesel Prices May Need To Be Dragged Along For The Ride

Energy prices are rallying once again with the expected Iranian attack on Israel over the weekend appearing to be the catalyst for the move. RBOB gasoline futures are leading the way once again, trading up more than a nickel on the day to reach a fresh 7 month high at $2.8280. Charts continue to favor a push towards the $3 mark for gasoline, while diesel prices may need to be dragged along for the ride.

So far it appears that Motiva Pt. Arthur is the only refinery that experienced a noteworthy upset from the storms that swept across the southern half of the country this week. Those storms also delayed the first round of the Masters, which matters more to most traders this week than the refinery upset.

Chevron’s El Segundo refinery in the LA-area reported an unplanned flaring event Thursday, but the big moves once again came from the San Francisco spot market that saw diesel prices rally sharply to 25 cent premiums to futures. The Bay Area now commands the highest prices for spot gasoline and diesel as the conversion of 1 out of the 4 remaining refineries to renewable output is not-surprisingly creating disruptions in the supply chain.

RIN values dropped back below the 50-cent mark, after the recovery rally ran out of steam last week. The EPA is facing numerous legal challenges on the RFS and other policies, and now half of the US states are challenging the agency’s new rule restricting soot emissions. That lack of clarity on what the law actually is or may be is having widespread impacts on environmental credits around the world and makes enforcement of such policies a bit of a joke. Speaking of which, the EPA did just fine a South Carolina company $2.8 million and require that it buy and retire 9 million RINs for improper reporting from 2013-2019. The cost of those RINs now is about 1/3 of what it was this time last year, so slow playing the process definitely appears to have paid off in this case.

The IEA continues to do its best to downplay global demand for petroleum, once again reducing its economic outlook in its Monthly Report even though the EIA and OPEC continue to show growth, and the IEA’s own data shows “Robust” activity in the first quarter of the year. The IEA has come under fire from US lawmakers for changing its priorities from promoting energy security, to becoming a cheerleader for energy transition at the expense of reality.

Click here to download a PDF of today's TACenergy Market Talk.

Diesel Prices Continue To Be The Weak Link In The Energy Chain

Energy prices are ticking modestly lower this morning, despite warnings from the US that an Iranian attack on Israeli interest is “imminent” and reports of weather induced refinery outages, as demand fears seem to be outweighing supply fears temporarily. Diesel prices continue to be the weak link in the energy chain with both the DOE and OPEC reports giving the diesel bears reason to believe lower prices are coming.

The March PPI report showed a lower inflation reading for producers than the Consumer Price Index report, leading to an immediate bounce in equity futures after the big wave of selling we saw yesterday. To put the CPI impact in perspective, a week ago Fed Fund futures were pricing in an 80% chance of an interest rate cut by the FED’s July 31 meeting, and today those odds have shrunk to 40% according to the CME’s FedWatch tool.

OPEC’s monthly oil market report held a steady outlook for economic growth and oil demand from last month’s report, noting the healthy momentum of economic activity in the US. The cartel’s outlook also highlighted significant product stock increases last month that weighed heavily on refining margins, particularly for diesel. Given the US focus on ULSD futures that are deliverable on the East Coast, which continues to have relatively tight supply for diesel, it’s easy to overlook how quickly Asian markets have gotten long on distillates unless of course you’re struggling through the slog of excess supply in numerous west coast markets these days. The OPEC report noted this in a few different ways, including a 33% decline in Chinese product exports as the region simply no longer needs its excess. The cartel’s oil output held steady during March with only small changes among the countries as they hold to their output cut agreements.

If you believe the DOE’s diesel demand estimates, there’s reason to be concerned about domestic consumption after a 2nd straight week of big declines. The current estimate below 3 million barrels/day is something we typically only see the week after Christmas when many businesses shut their doors. We know the DOE’s figures are missing about 5% of total demand due to Renewable Diesel not being included in the weekly stats, and it’s common to see a drop the week after a holiday, but to lose more than a million barrels/day of consumption in just 2 weeks will keep some refiners on edge.

Most PADDs continue to follow their seasonal trends on gasoline with 1 and 2 still in their normal draw down period, while PADD 3 is rebuilding inventories faster than normal following the transition to summer grade products. That rapid influx of inventory in PADD 3 despite robust export activity helps explain the spike in premiums to ship barrels north on Colonial over the past 2 weeks. Gasoline also saw a sizeable drop in its weekly demand estimate, but given the holiday hangover effect, and the fact that it’s in line with the past 2 years, there’s not as much to be concerned about with that figure. While most of the activity happens in PADDs 1-3, the biggest disconnect is coming in PADDs 4 and 5, with gasoline prices in some Colorado markets being sold 50 cents or more below futures, while prices in some California markets are approaching 90 cents above futures.

Severe weather sweeping across the southern US knocked several units offline at Motiva’s Pt Arthur plant (the country’s largest refinery) Wednesday, and it seems likely that Louisiana refineries will see some disruption from the storm that spawned tornadoes close to the Mississippi River refining hub. So far cash markets haven’t reacted much, but they’ll probably need more time to see what damage may have occurred.