Financial Markets Unimpressed By Debate Performance

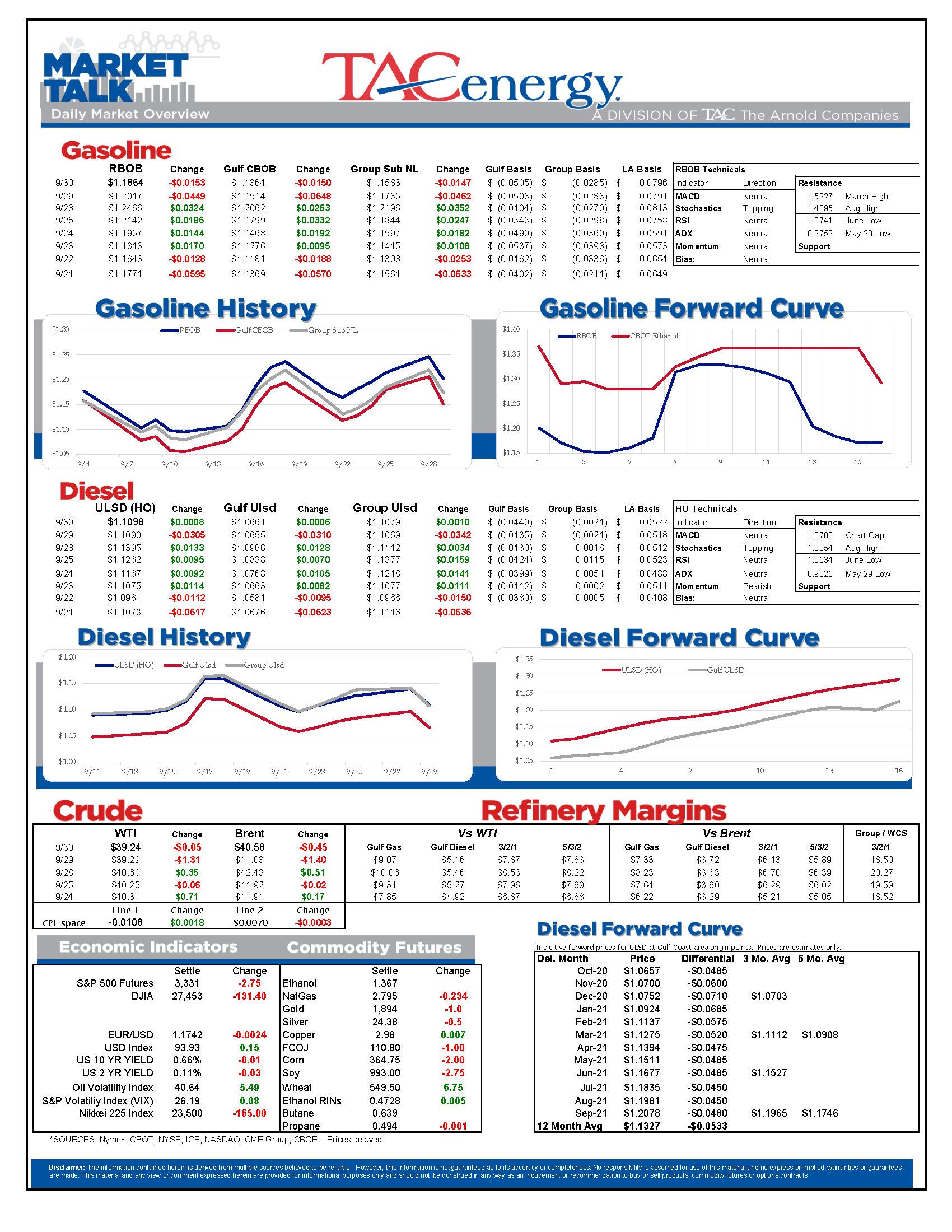

The wheels came off the energy bus Tuesday, as a four day rally was largely wiped out in a single session. Gasoline prices are now leading the complex lower for a second day, after the leading the move higher during the run up.

This is the second cycle of the four-days-up, two-days-down pattern for RBOB futures in the back half of September, with a net result of prices increasing seven cents during that time. Nearly half of those gains will be wiped out when the November contract takes over the prompt position tomorrow, as we slide down the backwardation curve heading into winter. That roll will leave gasoline prices just one decent sell-off away from the lows of the summer trading range, with the seasonal demand drop looming and threatening another move below $1 - should that support finally break.

The API report seems to be driving the direction in the early going, as a build in gasoline stocks has RBOB under pressure while draws in distillate and crude inventories has those contracts holding steady. The DOE’s weekly report is due out at its normal time, 9:30 Central. October RBOB and ULSD contracts are expiring today, so watch the November contracts (RBX & HOX) for direction in the racks.

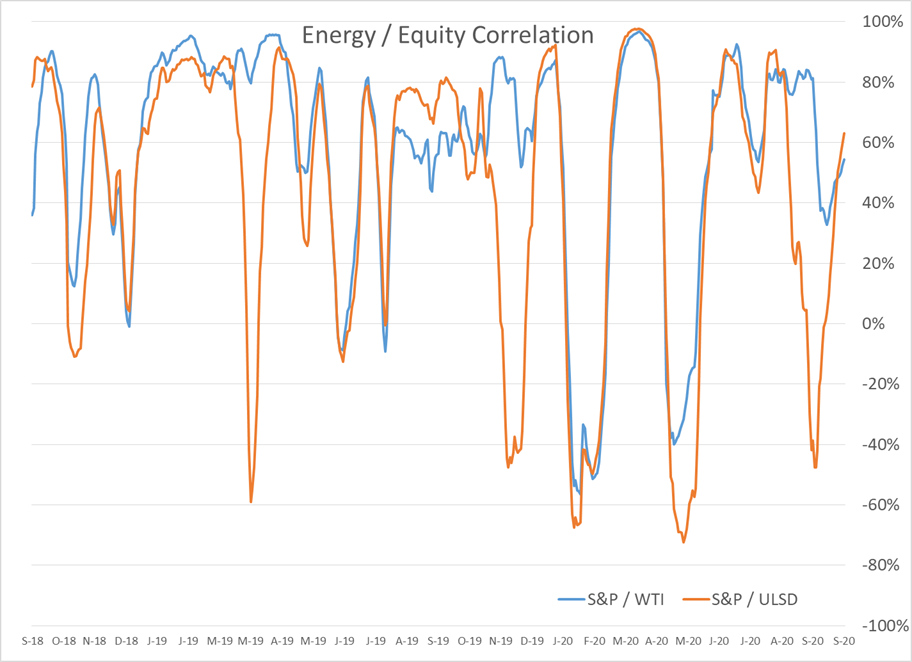

Financial markets were apparently not impressed by the debate performance last night, which foreshadows more volatility over the next month as the election looms and potentially even more price swings should the results be contested. While the correlation between equity and energy prices has been hit or miss this year, any major moves in stocks – particularly to the downside – have the ability to pull the energy complex (which is just a fraction of the size of equity markets in dollar terms) along for the ride.

As the momentum builds towards clean(er) energy options, it should be no surprise that Wall Street is being flooded with Green Energy acquisition companies (aka SPAC’s) seeking to capitalize on investor’s desire for new ideas, whether or not they’re proven. The movement certainly has a dot-com bubble feel about it, as the majority of the companies being purchased have no revenue stream, suggesting the move by PE groups to spin them off into the public markets has less to do with creating sustainable green energy platforms, and more with racing to put more green in their own pockets before the appetite for IPOs of unproven companies market dries up.

JP Morgan has reached a settlement with the CFTC and other agencies, and will pay a $920 million fine for trade spoofing in metal and treasury markets. There’s plenty of evidence that similar forms of manipulation have been happening in energy markets over the years as well, but it remains to be seen if any of those cases will come to light.

Marathon began implementing job cuts nationwide Tuesday, after announcing plans earlier this year to reduce workforce due to demand destruction. Shell is also announcing plans to cut 7,000-9,000 jobs over the next three years, but did not indicate where those cuts would take place.

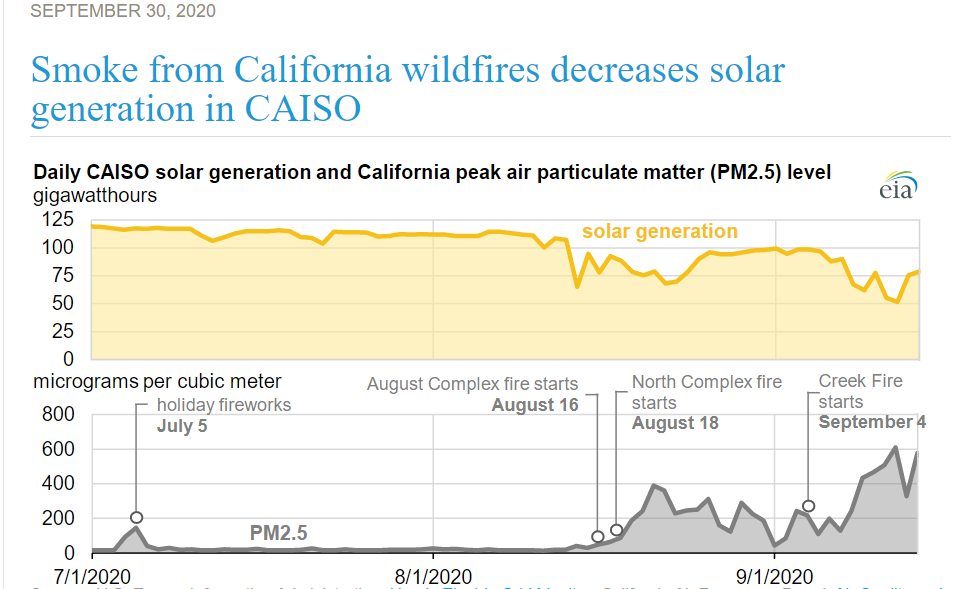

Stop Smoking: The EIA published an interesting report on the negative impact California’s wildfires are having on solar electricity production, highlighting yet another challenge with the reliability of the state’s power grid.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

Equity Markets Have Been Pulling Back Sharply In Recent Days As Inflation And Trade Concerns Inject A Sense Of Reality Into Stocks

Gasoline And Crude Oil Prices Reached Fresh Multi-Month Highs Friday Morning As News Of The Anticipated Attacks Spread

Charts Continue To Favor A Push Towards The $3 Mark For Gasoline, While Diesel Prices May Need To Be Dragged Along For The Ride

Diesel Prices Continue To Be The Weak Link In The Energy Chain

Social Media

News & Views

View All

Equity Markets Have Been Pulling Back Sharply In Recent Days As Inflation And Trade Concerns Inject A Sense Of Reality Into Stocks

It’s a mixed bag for energy markets to start Tuesday’s session with gasoline prices holding small gains, while oil and diesel prices show small losses as the world anxiously debates what comes next in the conflict, we’re still hoping we don’t have to call a war in the Middle East.

An early sell-off picked up steam Monday morning with refined products down more than a nickel for a few minutes, before reports that Israel was vowing to respond to Iran’s attack seemed to encourage buyers step back in an erase most of the losses for the day.

Equity markets have been pulling back sharply in recent days as inflation and trade concerns inject a sense of reality into stocks that had been flying high earlier in the year. The correlation between gasoline and crude oil prices had been fairly strong for the past couple of months but has since weakened as the weakness in stocks hasn’t yet trickled over into the energy arena. Both asset classes are seeing a tick higher in their volatility (aka Fear) indices this week however, and when fear starts driving the trade, we often see these prices move together.

Diesel has been underperforming the rest of the energy complex for most of the year so far, and those hoping for lower diesel prices got more good news when the Dangote refinery in Nigeria began loading diesel for domestic use Monday, in the latest milestone for the giant project that will have a major influence on Atlantic basin supply. Naturally, local lawmakers are already complaining that the refinery’s prices are too high.

The EIA this morning highlighted the record amount of crude oil China imported in 2023 after reopening the country post-COVID and after completing numerous new refinery builds in the past few years. Russia accounted for the largest increase in shipments to China last year, as China is one of the few countries that doesn’t mind ignoring sanctions. Speaking of which, the US House is expected to take up a new vote this week on sanctioning Chinese imports of Iranian crude, which the EIA notes are often hidden by relabeling the crude to make it appear as if it originated in Malaysia, Oman or the UAE.

We’re just 2 weeks away from the startup of Canada’s long-awaited Transmountain pipeline expansion that will bring roughly 600,000 barrels/day of capacity to the Pacific basin. That new outlet is great news for Canadian producers long restricted by takeaway capacity, and bad news for Midcontinent refiners who have grown accustomed to the discounted Canadian grades. A Bloomberg article Monday noted that Iraq’s Basrah Heavy crude is most likely to be displaced by West Coast US refiners who can now buy much closer to home.

Click here to download a PDF of today's TACenergy Market Talk.

Gasoline And Crude Oil Prices Reached Fresh Multi-Month Highs Friday Morning As News Of The Anticipated Attacks Spread

Buy the rumor, sell the news seems to be the pattern for energy contracts that are heading lower this morning after Iran’s well-telegraphed attack on Israel over the weekend was thwarted by a coalition of air forces and no further escalation has ensued so far.

Gasoline and crude oil prices reached fresh multi-month highs Friday morning as news of the anticipated attacks spread, and those new highs keep the technical outlook pointing higher on the weekly charts, but we’ll need to see a new high set this week or else the argument for the end of the spring rally may begin.

Marathon reported unplanned flaring at the Wilmington section of its Los Angeles area refining complex early this morning, a week after reported issues at the Carson facility, which combined make up the largest refinery in the state. California’s basis values did pull back sharply after a big rally last week, and now we’ll wait to see if this latest upset sends them higher once again.

Money managers continue to act moderately bullish on energy contracts, adding net length across the board last week, even as new short positions were added in most of the contracts.

Perhaps most notable in the COT report last week was a surge in open interest with RBOB gasoline reaching its highest level in 3 years, while Brent crude oil contracts reached their highest levels since the full-scale invasion of Ukraine kicked off more than 2 years ago.

It seems likely that the increased violence around the Middle East, and the attacks on Russian refineries are contributing to the increase in bettors in the energy space, particularly now that margin requirements have returned to more tolerable levels after spiking during the chaotic trading of 2022. This same pattern may also be contributing to the surge in energy company stock prices, even though margins are far below the record-setting levels we saw the prior 2 years.

The big increase in short bets on gasoline last week also suggests that some traders are starting to prepare for the spring peak in prices that often happens in late April or May.

A Reuters report suggests that Russia has been able to repair nearly 1/3 of the refining output that was taken offline due to Ukraine’s drone strikes, bringing the offline capacity to 10% down from 14% at the end of March, but that still means more than 650,000 barrels/day of capacity is offline, roughly the size of the largest refinery in the US.

Baker Hughes reported a drop of 2 oil rigs last week, erasing the increase in the rig count we saw the week before. Natural gas rigs continue to decline, falling by 1 last week to a fresh 2 year low at 109 total for the US. Baker Hughes changed the format of their report a couple of weeks ago, which is still challenging some data providers and analysts who continue to report the last numbers that show up on the old report.

A CNN article over the weekend highlighted the challenges still being faced at the PES refinery outside of Philadelphia nearly 5 years after an explosion knocked that plant offline for good. This type of struggle is one major factor in why some refiners are choosing to convert their facilities to renewables production in recent years, which effectively extends their timeline on any remediation needed if the facility was closed for good.

Click here to download a PDF of today's TACenergy Market Talk.

Charts Continue To Favor A Push Towards The $3 Mark For Gasoline, While Diesel Prices May Need To Be Dragged Along For The Ride

Energy prices are rallying once again with the expected Iranian attack on Israel over the weekend appearing to be the catalyst for the move. RBOB gasoline futures are leading the way once again, trading up more than a nickel on the day to reach a fresh 7 month high at $2.8280. Charts continue to favor a push towards the $3 mark for gasoline, while diesel prices may need to be dragged along for the ride.

So far it appears that Motiva Pt. Arthur is the only refinery that experienced a noteworthy upset from the storms that swept across the southern half of the country this week. Those storms also delayed the first round of the Masters, which matters more to most traders this week than the refinery upset.

Chevron’s El Segundo refinery in the LA-area reported an unplanned flaring event Thursday, but the big moves once again came from the San Francisco spot market that saw diesel prices rally sharply to 25 cent premiums to futures. The Bay Area now commands the highest prices for spot gasoline and diesel as the conversion of 1 out of the 4 remaining refineries to renewable output is not-surprisingly creating disruptions in the supply chain.

RIN values dropped back below the 50-cent mark, after the recovery rally ran out of steam last week. The EPA is facing numerous legal challenges on the RFS and other policies, and now half of the US states are challenging the agency’s new rule restricting soot emissions. That lack of clarity on what the law actually is or may be is having widespread impacts on environmental credits around the world and makes enforcement of such policies a bit of a joke. Speaking of which, the EPA did just fine a South Carolina company $2.8 million and require that it buy and retire 9 million RINs for improper reporting from 2013-2019. The cost of those RINs now is about 1/3 of what it was this time last year, so slow playing the process definitely appears to have paid off in this case.

The IEA continues to do its best to downplay global demand for petroleum, once again reducing its economic outlook in its Monthly Report even though the EIA and OPEC continue to show growth, and the IEA’s own data shows “Robust” activity in the first quarter of the year. The IEA has come under fire from US lawmakers for changing its priorities from promoting energy security, to becoming a cheerleader for energy transition at the expense of reality.

Click here to download a PDF of today's TACenergy Market Talk.