Oil Prices See Largest Daily Selloff

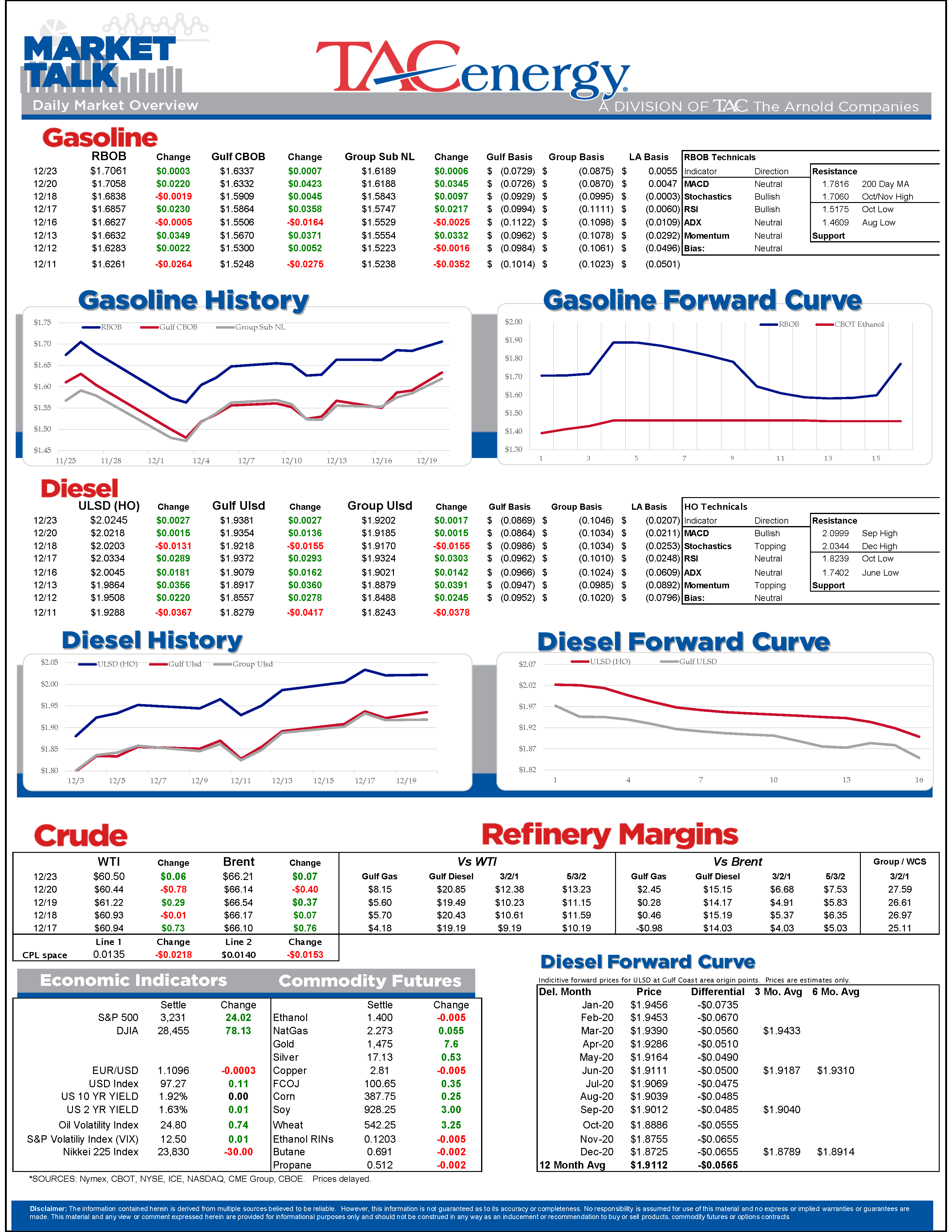

A large increase in drilling activity, and perhaps a bit of profit taking, led to the largest daily selloff for oil prices since the Black Friday melt-down to end last week. That said, losses barely surpassed 1% on the day, and didn’t threaten the upward trend lines that have taken hold in December, and refined products still managed gains, leaving the chance of another breakout to the upside for prices near term.

It’s Christmas week so companies that are open are operating with skeleton crews and trading volumes are very light. This can mean more price volatility as trading algorithms were built to react in more liquid environments, but so far, there is very little action in futures to speak of and cash trade has been non-existent.

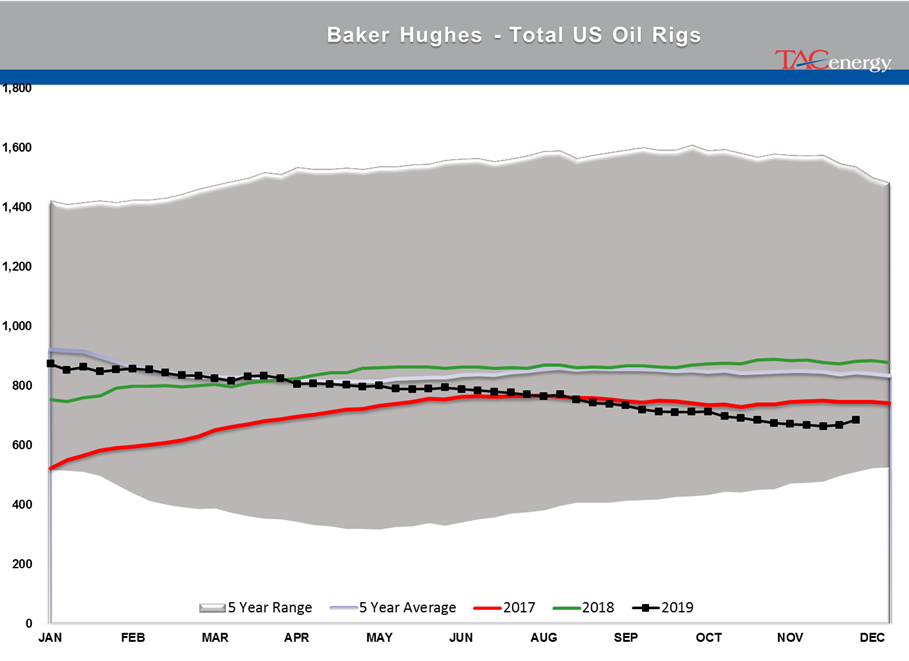

Baker Hughes reported 18 more oil rigs put to work in the U.S. last week, the largest weekly increase of the year. All of the gains came in the Eagle Ford and Permian basins of TX, while the other basins reported more declines. The suddenly large increase this close to year end – following steady declines all year – suggest there may be some operators choosing to activate projects to avoid lease expirations, or perhaps someone in charge of the weekly data just learned a new way of counting.

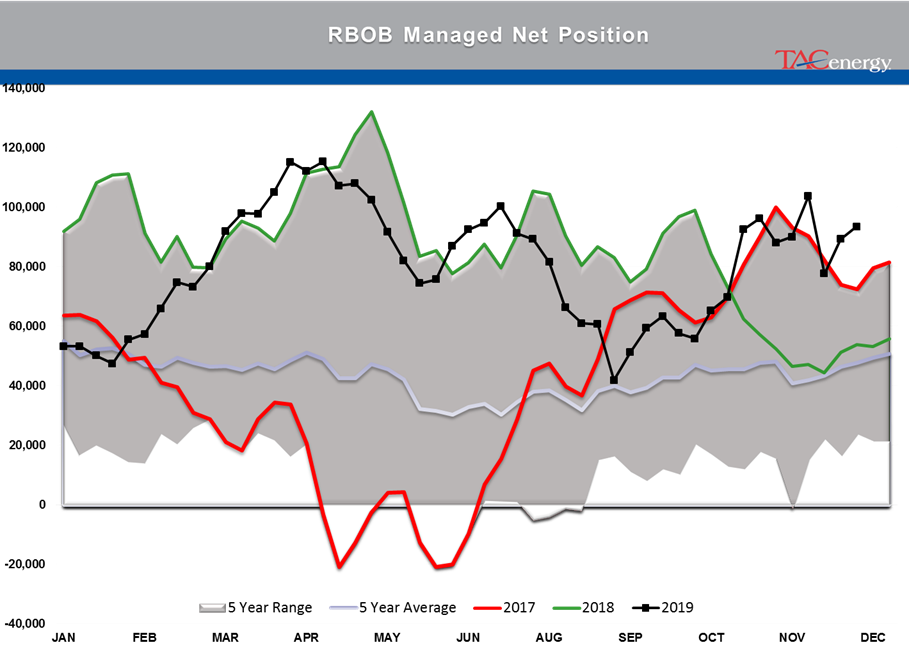

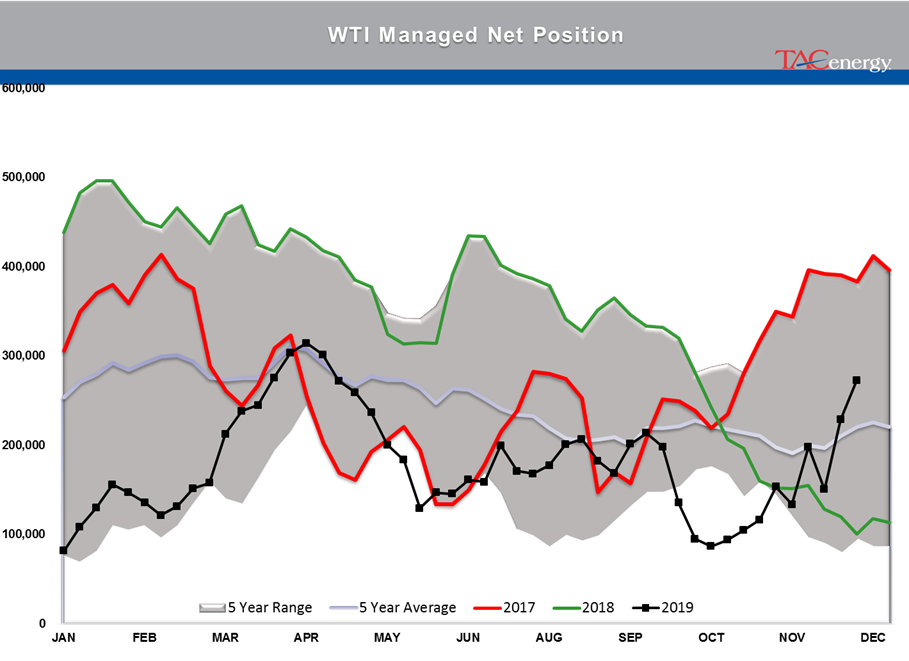

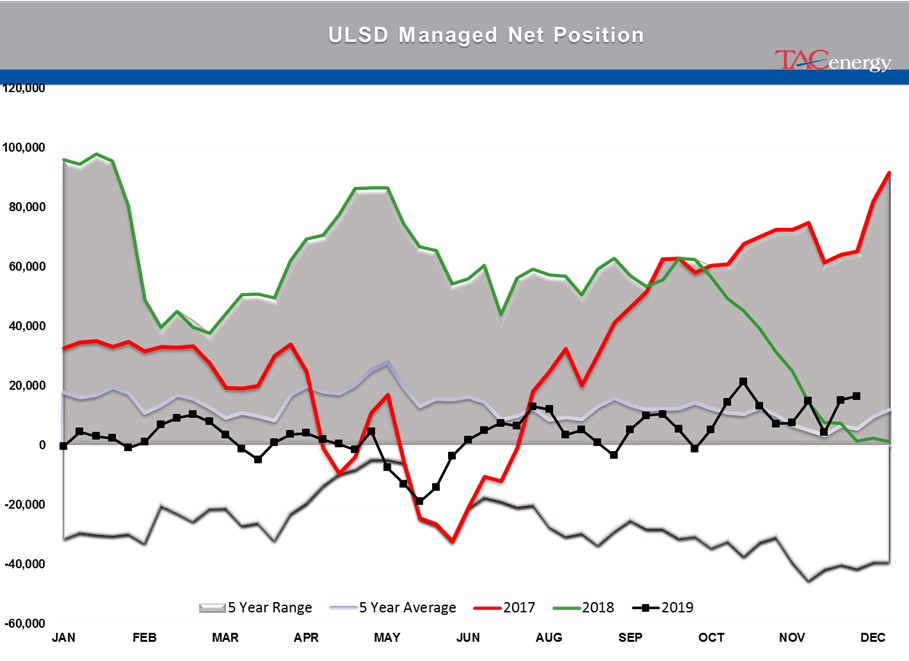

Money managers continued to add to their speculative bets on higher petroleum prices, adding net length across the board for a 2nd straight week. As we’ve seen with prices recently, RBOB is showing counter-seasonal strength, with more speculative bets on higher gasoline prices than we’ve ever seen this time of year. Brent and WTI are seeing managed length approach the highest levels of 2019, but remain well below the seasonal peaks set in previous years.

The congressional bill was signed by the President Friday night, so we’ll see a return of both the biodiesel blender’s credit, and the federal oil spill fee in the coming weeks. The oil spill fee will not be retroactive and will take effect on January 1, which is good news for the industry that’s proceeded without it for all of 2019.

Christmas Holiday Trading schedule: Tuesday, 12/24 will see early settlements and closing for NYMEX futures contracts and spot market assessments will follow suit. Christmas day will have no futures or spot market activity until futures resume in the normal overnight session for Thursday. Thursday and Friday will be regular days for futures and spots, except that fewer people will be around to participate. Rack prices published Tuesday afternoon will carry through Thursday.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

The Struggle For Renewable Producers Continues As A Rapid Influx Of Supply And Crashing Credit Prices Make Biodiesel

After Years Of Backwardation, Diesel Prices Have Slipped Into Contango Over The Past Week

Gasoline Futures Are Leading The Way Lower This Morning

The Sell-Off Continues In Energy Markets, RBOB Gasoline Futures Are Now Down Nearly 13 Cents In The Past Two Days

Social Media

News & Views

View All

The Struggle For Renewable Producers Continues As A Rapid Influx Of Supply And Crashing Credit Prices Make Biodiesel

The sigh of relief selloff continues in energy markets Tuesday morning, with gasoline prices now down more than 20 cents in 7 sessions, while diesel prices have dropped 26 cents in the past 12. Crude oil prices are within a few pennies of reaching a 1 month low as a lack of headlines from the world’s hot spots allows some reflection into the state of the world’s spare capacity for both oil and refined products.

Gasoline prices are trading near a 6-week low this morning, but still need to fall about another nickel in order to break the weekly trendline that pushed prices steadily higher since December. If that trend breaks, it will be safer to say that we saw the end of the spring gasoline rally on April 12th for the 2nd year in a row. Last year RBOB futures peaked on April 12 at $2.8943 and bottomed out on May 4th at $2.2500. The high (at this point) for this year was set on April 12th at $2.8516, and the low overnight was $2.6454.

It’s not just energy commodities that are seeing an unwind of the “flight to safety” trade: Gold prices had their biggest selloff in 2 years Monday and continue to point lower today. Just how much money poured into commodities in the weeks leading up to the direct confrontation between Israel and Iran is unclear, but we have seen in year’s past that these unwind-events can create a snowball effect as traders can be forced to sell to cover their margin calls.

Supply > Demand: The EIA this morning highlighted the record setting demand for natural gas in the US last year, which was not nearly enough to offset the glut of supply that forced prices to a record low in February. A shortage of natural gas in Europe was a key driver of the chaotic markets that smashed just about every record in 2022, and an excess of natural gas supply in Europe and the US this year is acting as a buffer, particularly on diesel prices.

The struggle for renewable producers continues as a rapid influx of supply and crashing credit prices make Biodiesel, RD and SAF unprofitable for many. In addition to the plant closures announced in the past 6 months, Vertex Energy reported Monday it’s operating its Renewable Diesel facility in Mobile AL at just 50% of capacity in Q1. The truly scary part for many is that the $1/gallon Blender's tax credit ends this year and is being replaced by the “Clean” Fuel production credit that forces producers to prove their emissions reductions in order to qualify for an increased subsidy. It’s impossible to say at this point how much the net reduction will be for domestic producers, but importers will get nothing, and at current CI values, many biodiesel producers may see their “blend credit” cut by more than half.

Click here to download a PDF of today's TACenergy Market Talk.

After Years Of Backwardation, Diesel Prices Have Slipped Into Contango Over The Past Week

The pullback continues for energy prices as violence in the Middle East looks like it won’t rapidly expand, and financial markets continue to struggle with a higher-for-longer interest rate reality.

After years of backwardation, diesel prices have slipped into contango over the past week, despite multiple canal disruption concerns of reduced exports coming out of Russia. A Reuters article highlights how sluggish demand in Europe, and a glut of Asian supply [thanks to the rapid influx of new refining capacity over the past 2 years] is contributing to the changing market structure. This sudden weakness in diesel is also leading many refiners to reconsider their max-diesel output stance that had been key to their record setting margins in 2022 and 2023.

Money managers were reducing their bets on higher energy prices last week, in what appears to be an unwind of the positions added the prior week when it seemed like we might have an all-out war between Israel and Iran. The exception to the reduction in speculative length was the Brent crude oil contract which saw its money manager positions increase for a 4th week to reach a 3-year high. Open interest in crude oil contracts is also increasing to multi-year highs as new money flows into the energy space as a hedge of both inflation and geopolitical concerns, which could contribute to a tick higher in volatility if the sell-off continues this week as the bandwagon jumpers may soon be looking for a new ride.

Baker Hughes reported a net increase of 5 oil rigs drilling in the US last week, while natural gas rigs dropped by 2 on the week to a fresh 2 year low. The Permian basin has quietly added 8 more rigs in the past 4 weeks as producers in that region try to find a way around the shipping bottlenecks to get their otherwise profitable production to market. An RBN note last week highlighted how the lack of natural gas pipeline capacity will limit crude oil production capacity in the basin, and Kinder Morgan highlighted the need for another pipe in its latest earnings call.

Valero reported an upset at its Corpus Christi West refinery Saturday, although it appears that the brief flaring didn’t reduce operational levels.

Click here to download a PDF of today's TACenergy Market Talk.

Gasoline Futures Are Leading The Way Lower This Morning

It was a volatile night for markets around the world as Israel reportedly launched a direct strike against Iran. Many global markets, from equities to currencies to commodities saw big swings as traders initially braced for the worst, then reversed course rapidly once Iran indicated that it was not planning to retaliate. Refined products spiked following the initial reports, with ULSD futures up 11 cents and RBOB up 7 at their highest, only to reverse to losses this morning. Equities saw similar moves in reverse overnight as a flight to safety trade soon gave way to a sigh of relief recovery.

Gasoline futures are leading the way lower this morning, adding to the argument that we may have seen the spring peak in prices a week ago, unless some actual disruption pops up in the coming weeks. The longer term up-trend is still intact and sets a near-term target to the downside roughly 9 cents below current values. ULSD meanwhile is just a nickel away from setting new lows for the year, which would open up a technical trap door for prices to slide another 30 cents as we move towards summer.

A Reuters report this morning suggests that the EPA is ready to announce another temporary waiver of smog-prevention rules that will allow E15 sales this summer as political winds continue to prove stronger than any legitimate environmental agenda. RIN prices had stabilized around 45 cents/RIN for D4 and D6 credits this week and are already trading a penny lower following this report.

Delek’s Big Spring refinery reported maintenance on an FCC unit that would require 3 days of work. That facility, along with several others across TX, have had numerous issues ever since the deep freeze events in 2021 and 2024 did widespread damage. Meanwhile, overnight storms across the Midwest caused at least one terminal to be knocked offline in the St. Louis area, but so far no refinery upsets have been reported.

Meanwhile, in Russia: Refiners are apparently installing anti-drone nets to protect their facilities since apparently their sling shots stopped working.

Click here to download a PDF of today's TACenergy Market Talk.