Refined Products Are Teetering On The Edge Of A Technical Breakdown To Wrap Up Trading For The First Half Of The Year

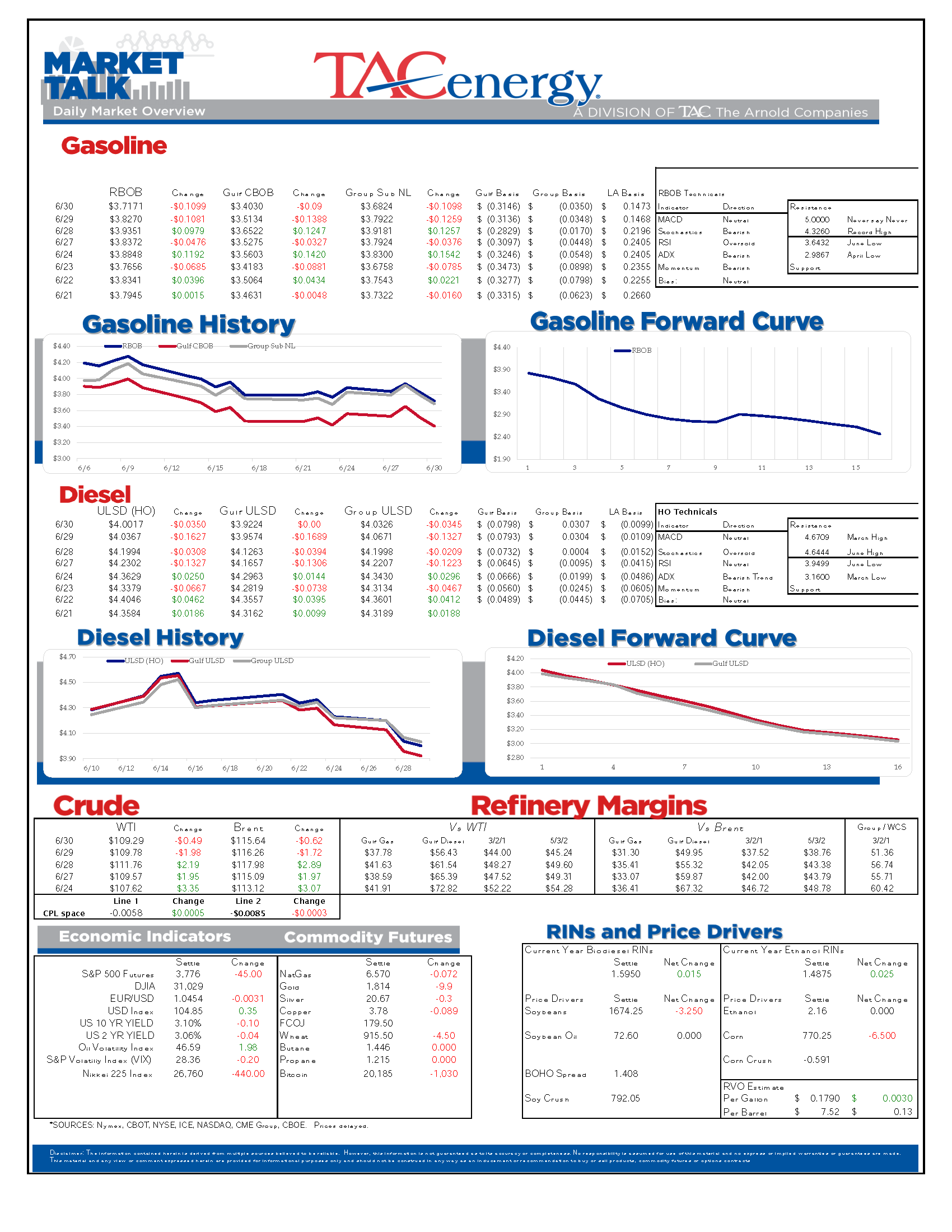

Refined products are teetering on the edge of a technical breakdown to wrap up trading for the first half of the year. While two days of heavy selling has the energy complex in a defensive stance, support on the charts has not yet completely given way, meaning it’s still too soon to call a top in prices even though we’ve had a major pullback in the past two weeks.

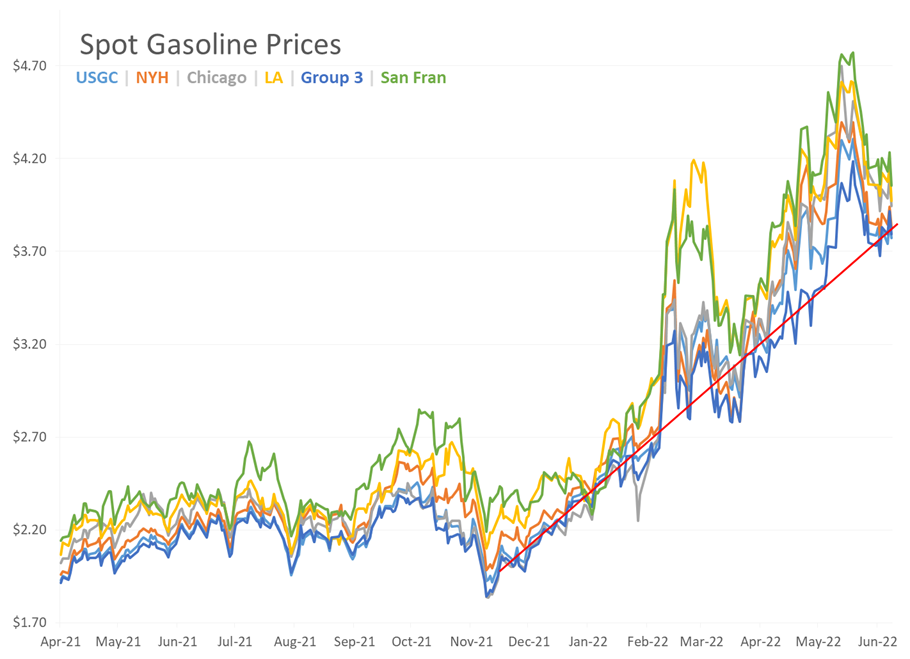

RBOB prices are trading 62 cents below their June highs this morning, but still need to break and hold below $3.64 before the technical breakdown can be confirmed. Keep in mind that today’s expiration of the July RBOB contract will knock about 10 cents off of prompt values, which adds to the bearish outlook on the charts. IF the trend support and June lows break today, don’t be surprised to see prices make a run at $3 later this summer.

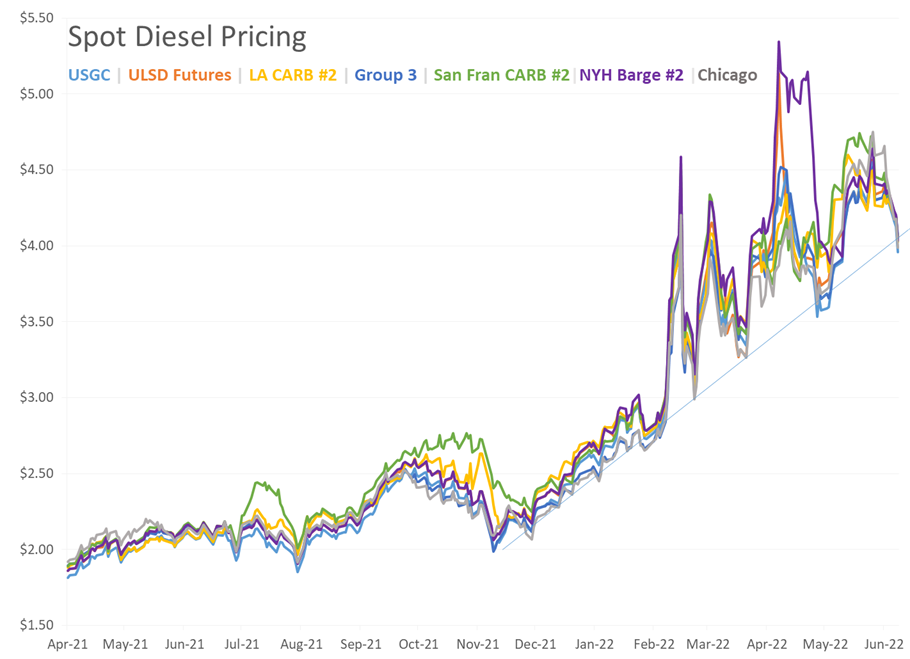

ULSD prices are in a similar spot, trading 64 cents below where they were less than 2 weeks ago, but they’ve rallied more than 6 cents from their overnight low at $3.95, giving the bulls a chance to hang on to the trend that’s pushed prices up from $2 in December. If prices drop and hold below $4, that trend will be officially broken which opens the door to a run at $3.50 in the next few weeks despite the well-documented fundamental issues with distillates.

Yesterday’s long-awaited DOE report, which provided a rare 2 weeks’ worth of data due to system issues seemed to be a catalyst for some of the selling in products, as inventory levels for both gasoline and diesel saw healthy increases in both of the past 2 weeks, while demand estimates slumped well below average levels for this time of year. Those data points also coincide with the latest slide in equity markets as some traders seem to be convinced that high prices may have already started to cure themselves, and the solution to the imbalance in fuel markets will come from a big drop in consumption.

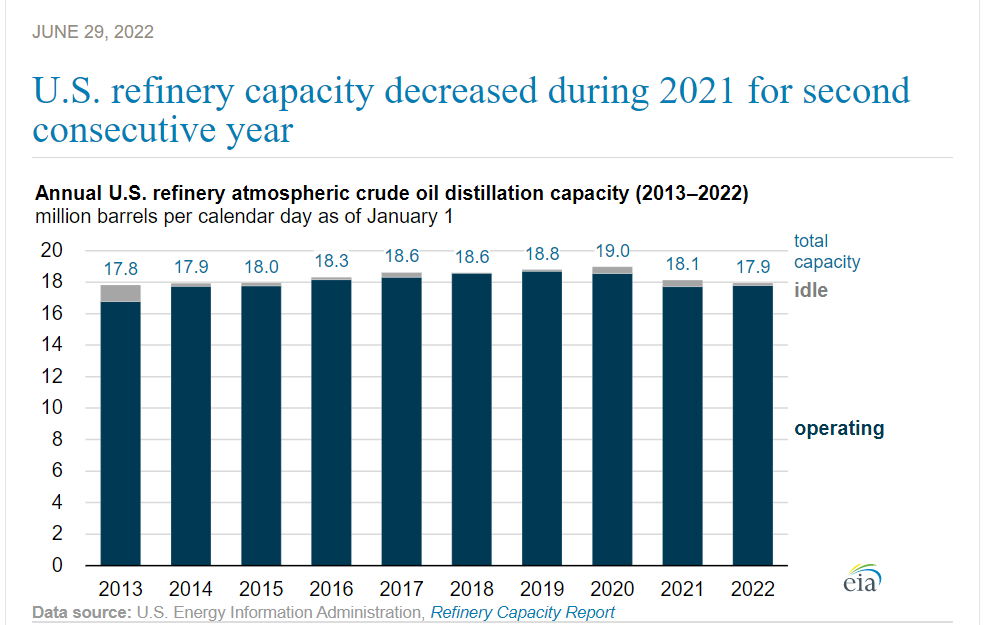

US refiners are running at 95% capacity, but an EIA note suggests that in reality they’re effectively maxed out due to the normal operational constraints on those facilities that are much more complicated to operate than many believe. That report also highlights that US capacity is expected to decline for a third straight year in 2022 with 2 more plants scheduled to be shut down or converted, unless the record high margin environment convinces someone with a few billion dollars to reopen those plants.

Reminder: Today is the last day for July RBN and HON futures contracts, so for those in the NYH and Group 3 markets that haven’t already transitioned to an August price reference will need to watch the RBQ and HOQ contracts for direction today. The backwardation in products is not nearly as extreme as we’ve seen over the past few months, but there will still be a noticeable drop when August futures take the prompt position that will confuse some tomorrow when cash markets don’t follow.

Latest Posts

Week 15 - US DOE Inventory Recap

Prices To Lease Space On Colonial’s Main Gasoline Line Continue To Rally This Week

Equity Markets Have Been Pulling Back Sharply In Recent Days As Inflation And Trade Concerns Inject A Sense Of Reality Into Stocks

Gasoline And Crude Oil Prices Reached Fresh Multi-Month Highs Friday Morning As News Of The Anticipated Attacks Spread

Social Media

News & Views

View All

Week 15 - US DOE Inventory Recap

Prices To Lease Space On Colonial’s Main Gasoline Line Continue To Rally This Week

Energy markets are sliding lower again to start Wednesday’s trading as demand concerns and weaker stock markets around the world seem to be outweighing any supply concerns for the time being.

Rumors continue to swirl about an “imminent” response by Israel to Iran’s attacks, but so far, no news seems to be taken as good news in the hopes that further escalation can be avoided, even as tensions near the Red Sea and Strait of Hormuz continue to simmer.

Prices to lease space on Colonial’s main gasoline line continue to rally this week, trading north of 11 cents/gallon as Gulf Coast producers still struggle to find outlets for their production, despite a healthy export market. Gulf Coast CBOB is trading at discounts of around 34 cents to futures, while Gulf Coast RBOB is trading around a 16-cent discount, which gives shippers room to pay up for the linespace and still deliver into the East Coast markets at a profit.

Back to reality, or just the start of more volatility? California CARBOB basis values have dropped back to “only” 40 cent premiums to RBOB futures this week, as multiple flaring events at California refineries don’t appear to have impacted supply. The state has been an island for fuel supplies for many years as its boutique grades prevent imports from neighboring states, and now add the conversion of the P66 Rodeo refinery to renewable diesel production and the pending changes to try and cap refinery profits, and it’s easier to understand why these markets are increasingly vulnerable to supply shocks and price spikes on gasoline.

RIN prices continue to fall this week, touching 44 cents/RIN for D4 and D6 values Tuesday, their lowest level in 6 weeks and just about a nickel above a 4-year low. While the sharp drop in RIN and LCFS values has caused several biodiesel and Renewable Diesel producers to either shut down or limit production, the growth in RIN generation continues thanks to projects like the Rodeo refinery conversion, making the supply in RINs still outpace the demand set by the Renewable Fuel Standard by a wide margin.

The API reported draws in refined products, 2.5 million barrels for gasoline and 427,000 barrels for distillates, while crude oil stocks had an estimated build of more than 4 million barrels. The DOE’s weekly report is due out at its normal time this morning.

Click here to download a PDF of today's TACenergy Market Talk.

Equity Markets Have Been Pulling Back Sharply In Recent Days As Inflation And Trade Concerns Inject A Sense Of Reality Into Stocks

It’s a mixed bag for energy markets to start Tuesday’s session with gasoline prices holding small gains, while oil and diesel prices show small losses as the world anxiously debates what comes next in the conflict, we’re still hoping we don’t have to call a war in the Middle East.

An early sell-off picked up steam Monday morning with refined products down more than a nickel for a few minutes, before reports that Israel was vowing to respond to Iran’s attack seemed to encourage buyers step back in an erase most of the losses for the day.

Equity markets have been pulling back sharply in recent days as inflation and trade concerns inject a sense of reality into stocks that had been flying high earlier in the year. The correlation between gasoline and crude oil prices had been fairly strong for the past couple of months but has since weakened as the weakness in stocks hasn’t yet trickled over into the energy arena. Both asset classes are seeing a tick higher in their volatility (aka Fear) indices this week however, and when fear starts driving the trade, we often see these prices move together.

Diesel has been underperforming the rest of the energy complex for most of the year so far, and those hoping for lower diesel prices got more good news when the Dangote refinery in Nigeria began loading diesel for domestic use Monday, in the latest milestone for the giant project that will have a major influence on Atlantic basin supply. Naturally, local lawmakers are already complaining that the refinery’s prices are too high.

The EIA this morning highlighted the record amount of crude oil China imported in 2023 after reopening the country post-COVID and after completing numerous new refinery builds in the past few years. Russia accounted for the largest increase in shipments to China last year, as China is one of the few countries that doesn’t mind ignoring sanctions. Speaking of which, the US House is expected to take up a new vote this week on sanctioning Chinese imports of Iranian crude, which the EIA notes are often hidden by relabeling the crude to make it appear as if it originated in Malaysia, Oman or the UAE.

We’re just 2 weeks away from the startup of Canada’s long-awaited Transmountain pipeline expansion that will bring roughly 600,000 barrels/day of capacity to the Pacific basin. That new outlet is great news for Canadian producers long restricted by takeaway capacity, and bad news for Midcontinent refiners who have grown accustomed to the discounted Canadian grades. A Bloomberg article Monday noted that Iraq’s Basrah Heavy crude is most likely to be displaced by West Coast US refiners who can now buy much closer to home.

Click here to download a PDF of today's TACenergy Market Talk.