A Wild January Comes To A Close

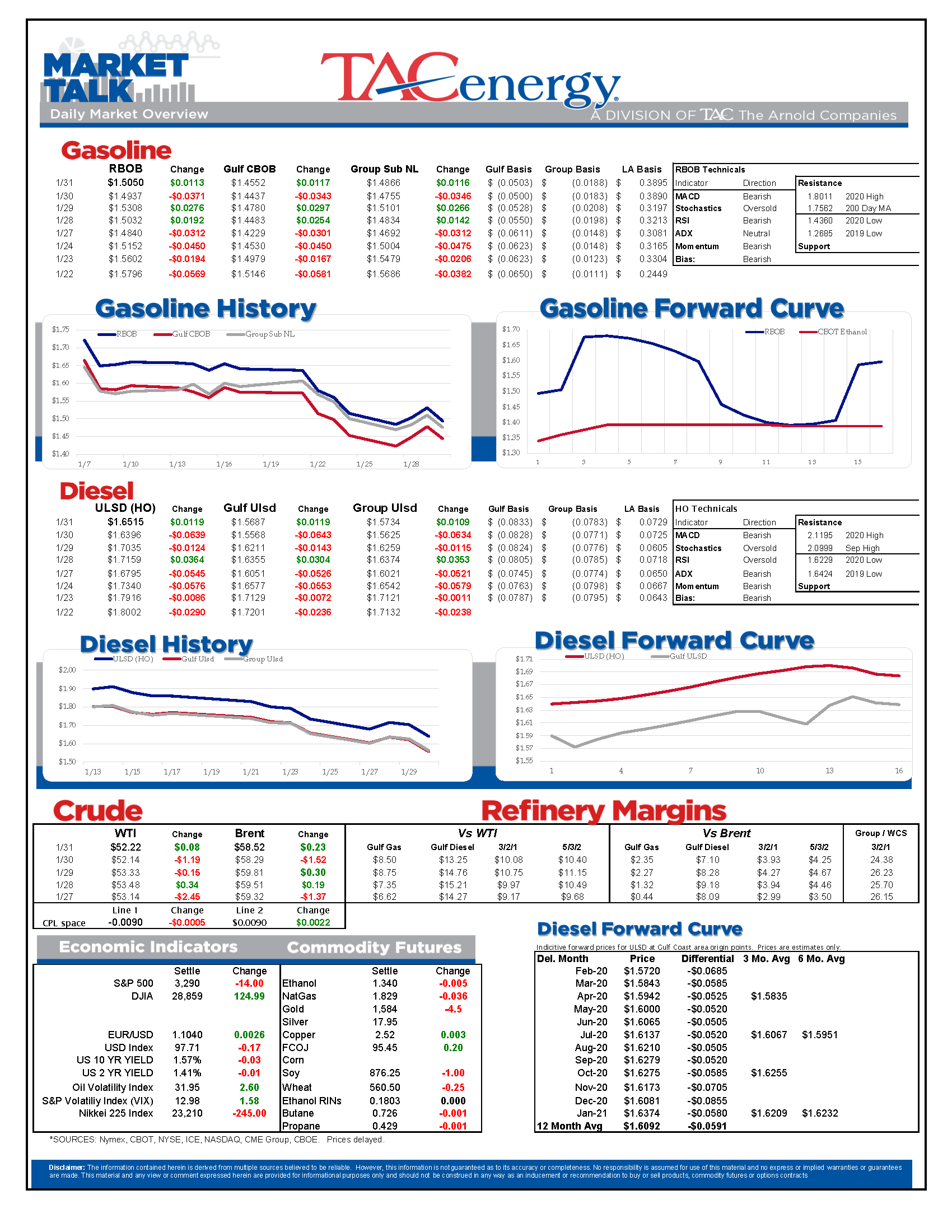

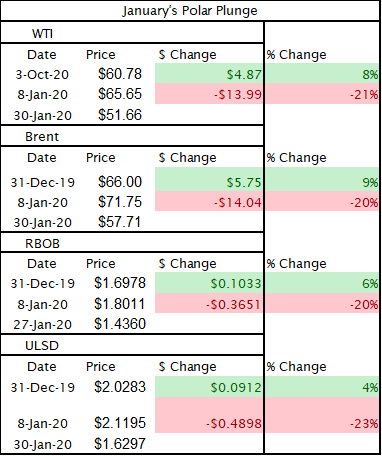

A wild January is coming to a close with energy prices clinging to small gains, and trying to avoid another wave of selling that has brought diesel prices to 17 month lows.

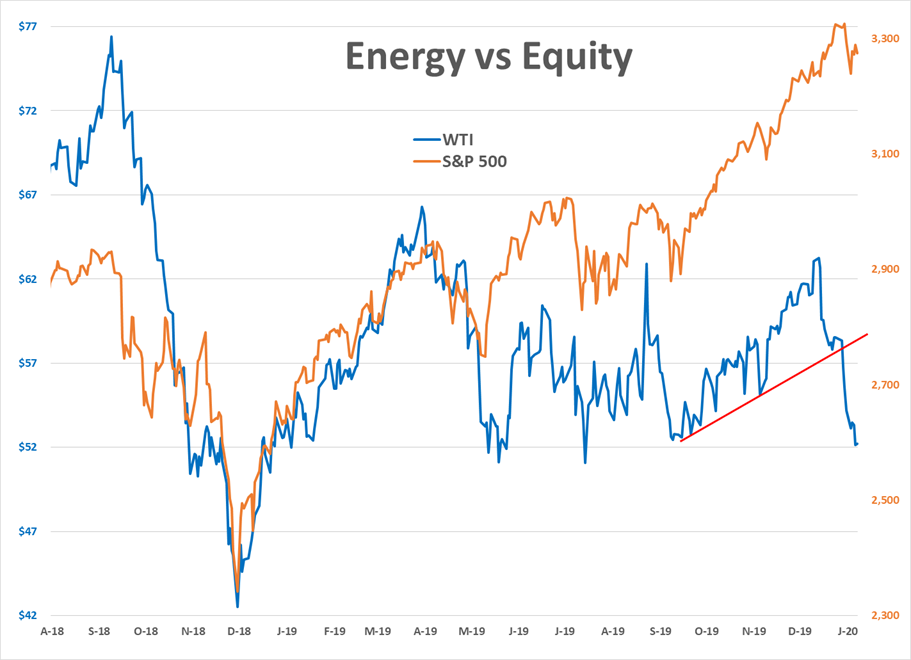

While equity futures are pointing lower again as the outbreak continues to grow, energy futures are clinging to small gains after new reports of violence across the MENA region remind us that there still are supply fears that could send prices higher, in addition to the demand fears that have taken over the headlines.

Fighting has resumed in Libya after cease-fire talks broke down. Roughly 750,000 barrels/day of oil exports have been taken offline as a result of this most recent flare up.

Saudi Arabia: Another attack on Aramco’s facilities was reportedly stopped last week. No impact on supplies was reported due to this latest attack.

Persian Gulf: An oil tanker caught fire west of the Strait of Hormuz. Still unclear if this was another attack like we saw last summer, or just a creative effort by the crew – who have been stuck on board for a year due to an ownership dispute – to get off the boat.

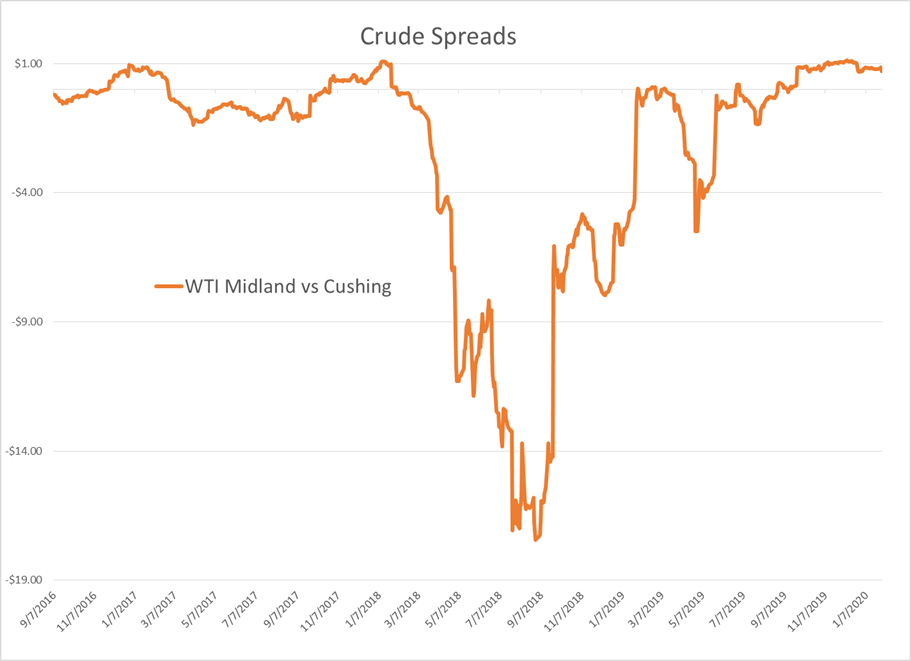

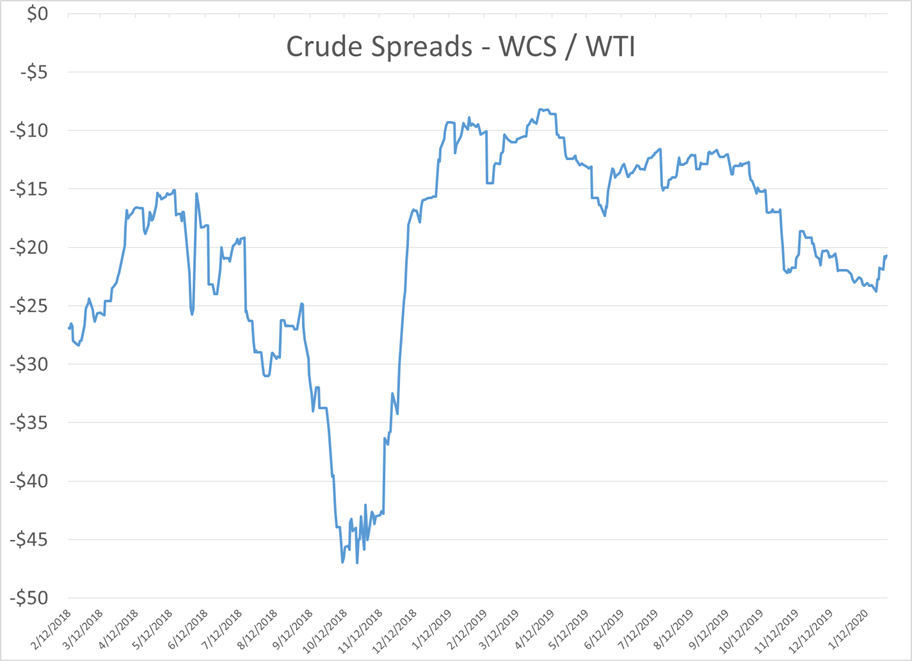

Earnings releases this week from several major oil producers and refiners shows a tough operating environment, with many reporting year on year declines in earnings, and several announcing plans to divest more assets as a result. Refiners are noting narrower crude differentials this year as a reason for lower profits, as new pipelines have eliminated the transportation bottleneck in W. Texas. For those plants that have access to Western Canadian crude, the picture is a bit brighter as those spreads have been widening again, although they’re still only half as wide as they were in 2018.

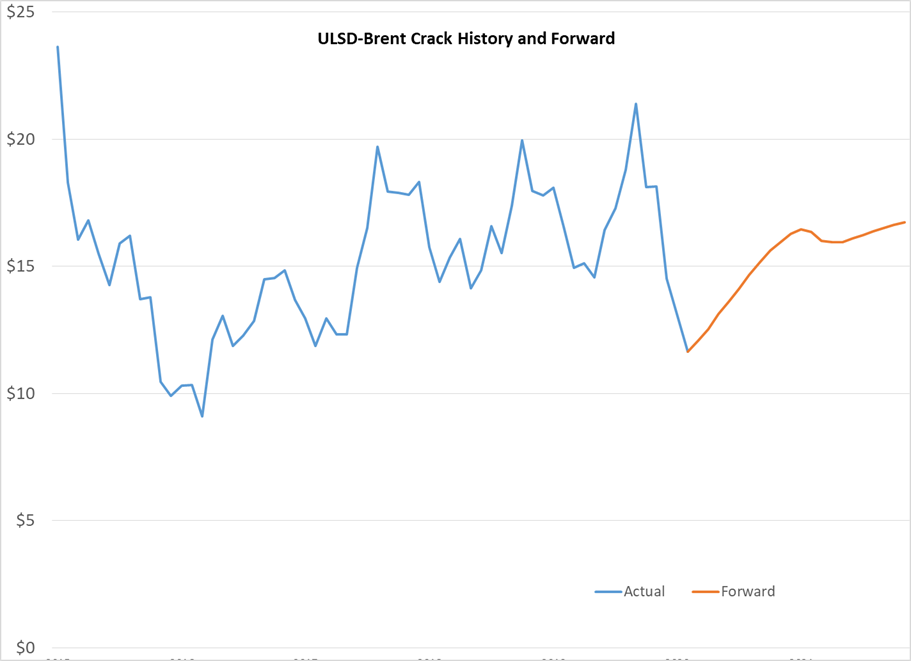

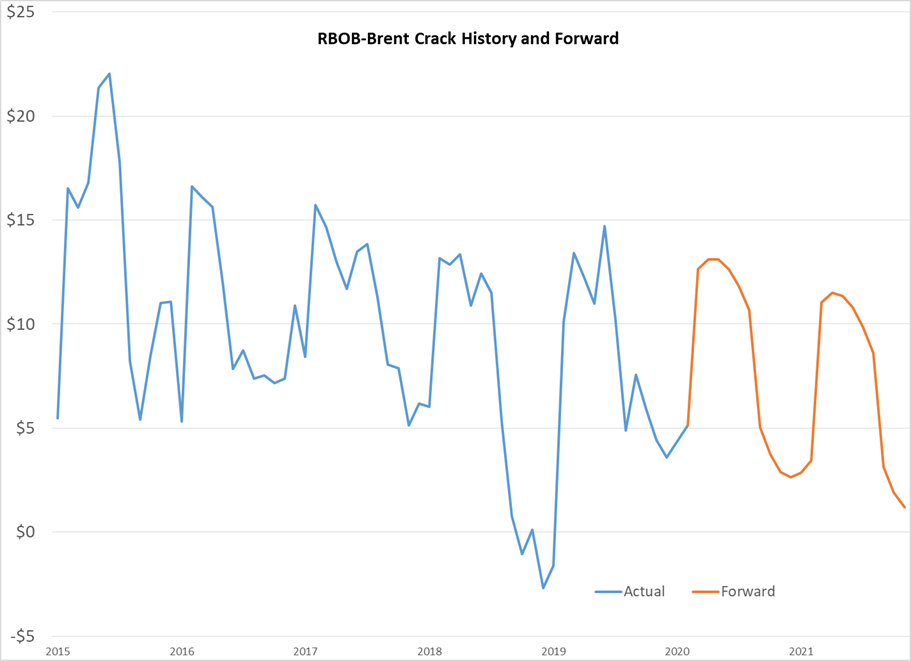

With product spreads crumbling in January, and most crude spreads not offering a bail out, it’s no wonder that we’re seeing more and more reports of elective run cuts at refiners this week.

Today’s captain obvious award: The EIA’s report that risk of oil supply disruptions can have an immediate effect on oil prices. Thanks for that.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

Crude Oil, Gasoline, And Diesel Benchmarks Are All Trading >1% Lower To Start The Day

Energy prices are sinking again this morning, albeit with a little more conviction than yesterday’s lackadaisical wilting. Crude oil, gasoline, and diesel benchmarks are all trading >1% lower to start the day with headlines pointing to an across-the-board build in national inventories as the source for this morning’s bearish sentiment. The Department of Energy’s official report is due out at its regular time this morning (9:30am CDT).

WTI has broken below its 100-day moving average this morning as it fleshed out the downward trend that began early last month. While crossing this technical threshold may not be significant in and of itself (it happened multiple times back in February), the fact that it coincides with the weekly and monthly charts also breaking below a handful of their respective moving averages paints a pretty bearish picture in the short term. The door is open for prices to drop down to $75 per barrel in the next couple weeks.

Shortly after the EIA’s weekly data showed U.S. commercial crude inventories surpassing 2023 levels for the first time this year, their monthly short-term energy outlook is forecasting a fall back to the bottom end of the 5-year range by August due to increasing refinery runs over the period. However, afterward the administration expects a rise in inventories into 2025, citing continued production increases and loosening global markets hindering the incentive to send those excess barrels overseas. The agency also cut back their average gas and diesel price forecasts for the first time since February with the biggest reductions in the second and third quarter of this year.

The STEO also featured their famed price prediction for WTI, stating with 95% confidence that the price for crude oil will be between $40 and $140 through 2026.

Need a general indication of the global crude oil supply? Most headlines seem to be covering a shortage of a different type of oil, one that we haven’t turned into fuel (yet).

Click here to download a PDF of today's TACenergy Market Talk.

The Perceived Cooling Of Regional Tensions In The Middle East Area Attributing To The Quiet Start To Today’s Trading Session

The energy complex is drifting lower this morning with RBOB futures outpacing its counterparts, trading -.9% lower so far to start the day. The oils (WTI, Brent, heating) are down only .2%-.3% so far this morning.

The perceived cooling of regional tensions in the Middle East area attributing to the quiet start to today’s trading session, despite Israel’s seizure of an important border crossing. A ceasefire/hostage-release agreement was proposed Monday, and accepted by Hamas, but rejected by Israel as they seemingly pushed ahead with their Rafah offensive.

U.S. oil and natural gas production both hit record highs in 2023 and continue to rise in 2024, with oil output currently standing at 13.12 million barrels per day and January 2024 natural gas production slightly exceeding the previous year. With WTI currently changing hands at higher than year-ago levels, this increased production trend is expected to continue despite a decrease in rigs drilling for these resources.

Less than a week after the Senate Budget Committee’s hearing centered on the credibility of big oil’s climate preservation efforts, a major oil company was reported to have sold millions of carbon capture credits, without capturing any carbon. Fraud surrounding government subsidies to push climate-conscious fuel initiatives is nothing new, on a small scale, but it will be interesting to see how much (if any) of the book is thrown at a major refiner.

Today’s interesting read: sourcing hydrogen for refining.

Click here to download a PDF of today's TACenergy Market Talk.

Energy Contracts Are Trying To Find A Floor After Taking Their Largest Weekly Losses Of The Year So Far Last Week

Energy contracts are trying to find a floor after taking their largest weekly losses of the year so far last week.

There’s not much in the way of news yet this morning, so the modest buying is largely being blamed on reports that Saudi Arabia raised its prices for Asian and Mediterranean buyers in June, signaling that demand is strong enough in those markets to shoulder the increase.

RBOB gasoline futures have already dropped 28 cents from the high set April 12th, leading the argument that prices have peaked for the season. The 200-day moving average comes in just under $2.50/gallon this week, some 6.5 cents below current values, and helps set a pivotal chart support layer. If prices break there, there’s a strong case that we’ll see another 20-30 cents of downside, similar to what we saw this time last year.

Money managers continued to reduce their net length in NYMEX contracts last week, as WTI, RBOB and ULSD saw a net decrease of more than 17,000 contracts of speculative length. The hedge fund liquidation seems to have run its course for this latest news cycle however, as new short positions accounted for the majority of the decrease, and WTI and Brent both saw new length added by the big speculators. Money managers are now net-short on ULSD, which could be another reason to think the bottom is near if you subscribe to the theory that the bandwagon-jumping hedge funds usually are wrong.

Baker Hughes reported a decline of 7 oil rigs and 3 natural gas rigs last week, bringing the combined total rig count to its lowest level in more than 2 years. Perhaps most noteworthy in this week’s report was that Alaska saw 5 of its 14 active rigs taken offline in just 1 week. It’s not yet clear if this may have anything to do with the startup of the transmountain pipeline which will have Western Canadian crude now competing more directly with Alaskan grades.

Click here to download a PDF of today's TACenergy Market Talk.