Another Wave Of Selling Hit The Energy Complex After A Pair Of Potentially Bearish Headlines Hit The Wires Overnight

Another wave of selling hit the energy complex after a pair of potentially bearish headlines hit the wires overnight, but already those losses have been cut in half, suggesting another choppy day of trading ahead. On the supply side, the market seems to be breathing a sigh of relief after Russia announced it would honor its supply commitments to Europe and restart the Nord Stream natural gas pipeline Thursday, along with the customary threats against more sanctions. On the demand side of the equation, rising COVID rates in Asia seem to be contributing to a bearish outlook for fuel consumption over the coming months.

The drop so far does not change the neutral technical outlook, and we’ll need to see another 15-20 cents taken off of refined product prices before the lower end of the July range comes under threat, and based on the back and forth action we’ve seen so far this week it wouldn’t be surprising to see these early losses wiped out in the afternoon. Longer term, IF we do see the July lows taken out, there’s a good chance we could see sub $3 prices later this year, but if the sideways pattern can hold on for another few weeks, there’s a good chance we see another rally heading into the fall.

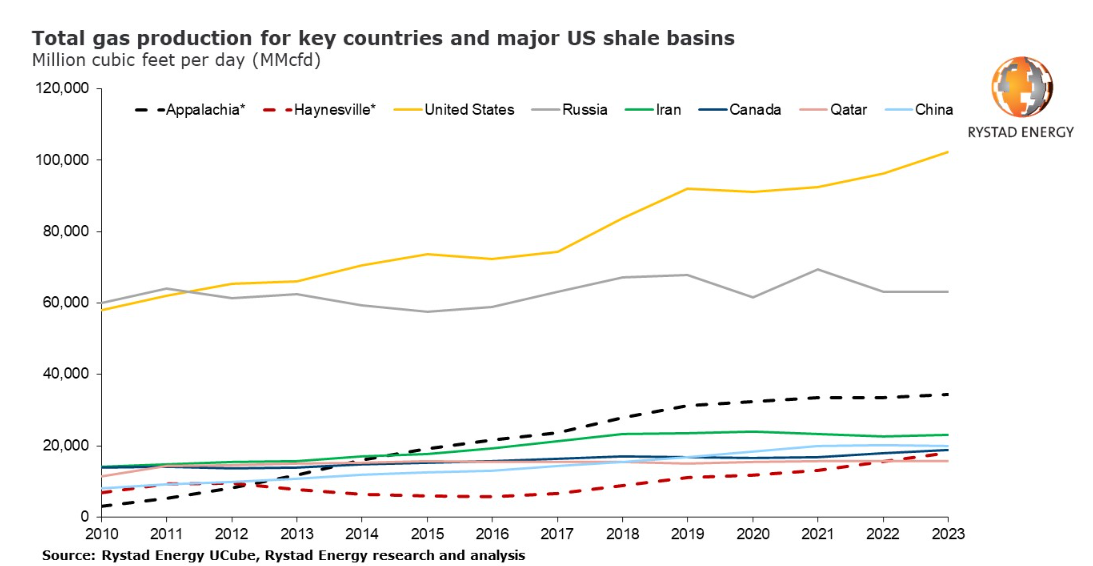

Natural gas continues to have an outsized impact on the rest of the petroleum complex, particularly ULSD, as distillates are one of the few short term options to supplement electricity generation when gas-burning facilities can’t keep up. A Rystad Energy report this week estimates that the US will surpass previous estimates and shatter production records this year and next as producers are finally able to utilize much of the supply they’ve been sitting on impatiently for the past decade.

The explosion and fire at the Freeport export facility is certainly complicating the movement of that new supply as that plant accounted for roughly 20% of US exports and 10% of European imports, keeping the spread between US and natural gas prices in other parts of the world at elevated levels. A political showdown between environmental and low-price energy advocates may be looming, following reports that the PHMSA could delay restart at the facility due to “safety concerns”.

The API was scheduled to release their weekly inventory statistical bulletin as normal Tuesday afternoon, but as of this writing that data has not been reported. That could mean the API is cracking down on news services publishing it’s subscription only data, or perhaps they’re struggling with IT issues like the EIA did for several weeks, delaying their reports. The EIA is scheduled to release its weekly status report at 9:30 central.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

Crude Oil Inventories Climbed Above Year-Ago Levels For The First Time In 2024

Week 17 - US DOE Inventory Recap

The Energy Complex Is Trading Modestly Lower So Far This Morning With WTI Crude Oil Futures Leading The Way

Energy Futures Are Drifting Quietly Higher This Morning

Social Media

News & Views

View All

Crude Oil Inventories Climbed Above Year-Ago Levels For The First Time In 2024

Sell by May then go away.

The old trading adage looked good for energy markets in 2024 as the new month started off with the biggest daily sell-off of the year so far. WTI and ULSD contracts are now in “rally or else” mode on the charts with sharply lower prices a strong possibility now that technical support layers have broken down. RBOB doesn’t look quite as bearish on the charts, but seasonal factors will now act as a headwind as we’re well into the spring peaking window for gasoline prices, and we’ve already seen a 27 cent drop from the highs. If RBOB can hold above $2.50 there’s a chance to avoid a larger selloff, but if not, a run towards $2.20 for both gasoline and diesel looks likely in the months ahead.

The selling picked up steam following the DOE’s weekly report Wednesday, even though the inventory changes were fairly small. Crude oil inventories continue their steady build and climbed above year-ago levels for the first time in 2024. Demand for refined products remains sluggish, even after accounting for the RD consumption that’s still not in the weekly reports, and most PADDs are following a typical seasonal inventory trend. The Gulf Coast saw a healthy build in diesel inventories last week as the export market slowed for a 3rd straight week. Refinery runs dipped modestly last week following a handful of upsets across the country, but overall rates remain near normal levels for this time of year.

The Transmountain pipeline expansion began operations yesterday, completing a 12-year saga that has the potential to materially change refining economics for plants in the US that relied heavily on discounted Canadian crude to turn profits over the past decade.

The P66 Borger refinery reported another operational upset Monday that lasted a full 24 hours impacting a sulfur recovery unit. Last week the company highlighted how the plant’s fire department helped the surrounding area when the largest wildfire in state history came within feet of the facility.

The EPA approved a new model to determine life cycle carbon intensity scores this week, which cracks open the door for things like ethanol to SAF, which were previously deemed to not reduce emissions enough to qualify for government subsidies. The new model would require improved farming techniques like no-till, cover crop planting and using higher efficiency nitrogen fertilizer to limit the damage done by farms that no longer rotate crops due to the ethanol mandates. Whether or not the theoretical ability to produce SAF comes to fruition in the coming years thanks to the increased tax credit potential will be a key pivot point for some markets that find themselves with too much RD today, but could see those supplies transition to aviation demand.

The FED continues to throw cold water on anyone hoping for a near term cut in interest rates. The FOMC held rates steady as expected Wednesday, but also highlighted the struggles with stubbornly high inflation. The CME’s Fedwatch tool gave 58% odds of at least one rate cut by September before the announcement, and those odds have slipped modestly to 54% this morning.

Week 17 - US DOE Inventory Recap

The Energy Complex Is Trading Modestly Lower So Far This Morning With WTI Crude Oil Futures Leading The Way

The energy complex is trading modestly lower so far this morning with WTI crude oil futures leading the way, exchanging hands $1.50 per barrel lower (-1.9%) than Tuesday’s settlement price. Gasoline and diesel futures are following suit, dropping .0390 and .0280 per gallon, respectively.

A surprise crude oil build (one that doesn’t include any changes to the SPR) as reported by the American Petroleum Institute late Tuesday is taking credit for the bearish trading seen this morning. The Institute estimated an increase in crude inventories of ~5 million barrels and drop in both refined product stocks of 1.5-2.2 million barrels for the week ending April 26. The Department of Energy’s official report is due out at it’s regular time (9:30 CDT) this morning.

The Senate Budget Committee is scheduled to hold a hearing at 9:00 AM EST this morning regarding a years-long probe into climate change messaging from big oil companies. Following a 3-year investigation, Senate and House Democrats released their final report yesterday alleging major oil companies have internally recognized the impacts of fossil fuels on the climate since as far back as the 1960s, while privately lobbying against climate legislation and publicly presenting a narrative that undermines a connection between the two. Whether this will have a tangible effect on policy or is just the latest announcement in an election-yeardeluge is yet to be seen.

Speaking of deluge, another drone attack was launched against Russian infrastructure earlier this morning, causing an explosion and subsequent fire at Rosneft’s Ryazan refinery. While likely a response to the five killed from Russian missile strikes in Odesa and Kharkiv, Kyiv has yet to officially claim responsibility for the attack that successfully struck state infrastructure just 130 miles from Moscow.

The crude oil bears are on a tear this past week, blowing past WTI’s 5 and 10 day moving averages on Monday and opening below it’s 50-day MA this morning. The $80 level is likely a key resistance level, below which the path is open for the American oil benchmark to drop to the $75 level in short order.

Click here to download a PDF of today's TACenergy Market Talk.