California Regulators Requiring Refineries To Improve Their NOx Emissions

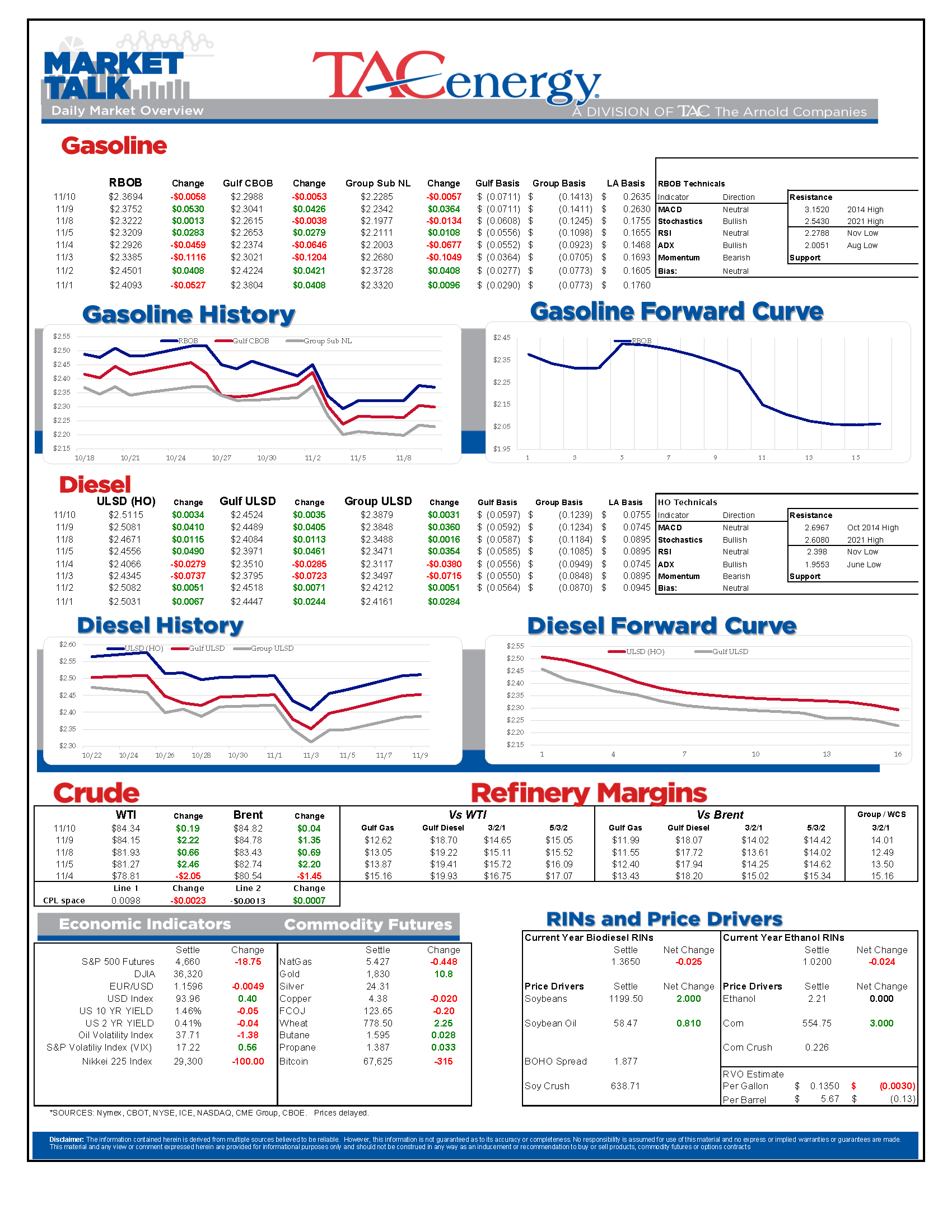

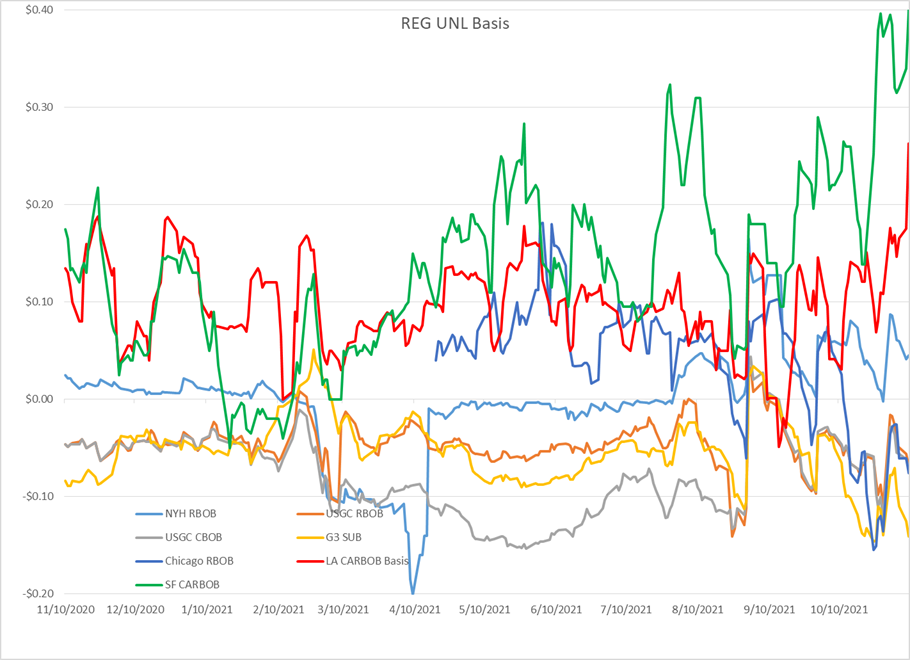

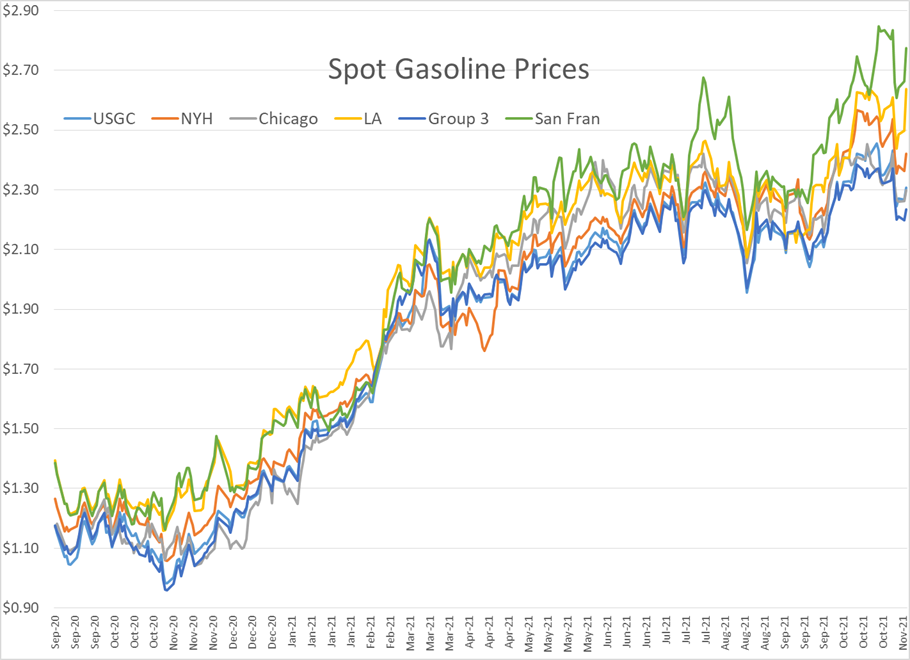

West Coast gasoline values outpaced the rally across the rest of the country with CARBOB gaining more than a dime in both the LA and San Francisco spot markets. The big jump in CARBOB basis values to 8 month highs didn’t coincide with any new refinery disruptions, but it did come just 2 days following a ruling by California regulators requiring refineries improve their NOx emissions, which will cost billions to implement, and could force another plant or two to shut their doors.

The EIA raised its price outlook for crude oil in the latest Short Term Energy Outlook, and noted that fuel switching from natural gas to petroleum for electricity generation should continue pushing demand higher in the coming quarter. That said, the agency also increased its production estimates for next year as drillers race to take advantage of higher prices, which they predict will push prices lower in 2022. The report also highlighted the extreme backwardation in the price curve, noting that this type of price structure typically only happens following a severe supply disruption, whereas this time it’s been the fast recovery in global recovery that’s driven the tight supply.

The API reported a draw in crude oil inventories of nearly 2.5 million barrels last week, snapping a 6 week streak of increases, while gasoline stocks dropped roughly ½ million barrels and diesel increased by about the same. That report gave prices a brief bounce in the afternoon, but failed to sustain the upward momentum overnight. The DOE’s report will be out at 9:30 central.

Ethanol looks like it may have made the turn lower after an insane rally of $1/gallon to start November pushed prices to all-time highs in some markets, although reports of logistical bottlenecks caused by rail and trucking delays are likely to continue to cause headaches until the winter demand slowdown takes hold.

News & Views

View All

Energy Futures Are Caught Up In Headline Tug-O-War This Morning

Energy futures are caught up in headline tug-o-war this morning with Canadian oil production concerns and a positive US GDP report trying to push prices higher while sinking Chinese demand worries and Gaza ceasefire hopes are applying downward pressure. The latter two seem to be favored more so far this morning with WTI and Brent crude oil futures down ~45 cents per barrel, while gasoline and diesel prices are down about half a cent and two cents, respectively.

No news is good news? Chicago gasoline prices dropped nearly 30 cents yesterday, despite there not being any update on Exxon’s Joliet refinery after further damage was discovered Wednesday. Its tough to say if traders have realized the supply situation isn’t as bad as originally thought or if this historically volatile market is just being itself (aka ‘Chicago being Chicago’).

The rain isn’t letting up along the Texas Gulf Coast today and is forecasted to carry on through the weekend. While much of the greater Houston area is under flood watch, only two refineries are within the (more serious) flood warning area: Marathon’s Galveston Bay and Valero’s Texas City refineries. However, notification that more work is needed at Phillip’s 66 Borger refinery (up in the panhandle) is the only filing we’ve seen come through the TECQ, so far.

Premiums over the tariff on Colonial’s Line 1 (aka linespace value) returned to zero yesterday, and actually traded in the negatives, after its extended run of positive values atypical of this time of year. Line 1’s counterpart, Line 2, which carries distillates from Houston to Greensboro NC, has traded at a discount so far this year, due to the healthy, if not over-, supply of diesel along the eastern seaboard.

Click here to download a PDF of today's TACenergy Market Talk.

WTI And Brent Crude Oil Futures Are Trading ~$1.50 Per Barrel Lower In Pre-Market Trading

The across-the-board drawdown in national energy stockpiles, as reported by the Department of Energy yesterday, stoked bullish sentiment Wednesday and prompt month gasoline, diesel, and crude oil futures published gains on the day. Those gains are being given back this morning.

The surprise rate cut by the People’s Bank of China is being blamed for the selling we are seeing in energy markets this morning. While the interest rate drop in both short- and medium-term loans won’t likely affect energy prices outright, the concern lies in the overall economic health of the world’s second largest economy and crude oil consumer. Prompt month WTI and Brent crude oil futures are trading ~$1.50 per barrel lower in pre-market trading, gasoline and diesel are following suit, shaving off .0400-.0450 per gallon.

Chicagoland RBOB has maintained its 60-cent premium over New York prices through this morning and shows no sign of coming down any time soon. Quite the opposite in fact: the storm damage, which knocked Exxon Mobil’s Joliet refinery offline on 7/15, seems to be more extensive than initially thought, potentially extending the repair time and pushing back the expected return date.

There are three main refineries that feed the Chicago market, the impact from one of them shutting down abruptly can be seen in the charts derived from aforementioned data published by the DOE. Refinery throughput in PADD 2 dropped 183,000 barrels per day, driving gasoline stockpiles in the area down to a new 5-year seasonal low.

While it seems all is quiet on the Atlantic front (for now), America’s Refineryland is forecasted to receive non-stop rain and thunderstorms for the next four days. While it may not be as dramatic as a hurricane, flooding and power outages can shut down refineries, and cities for that matter, all the same, as we learned from Beryl.