Cold Water Thrown On Petroleum Price Rally

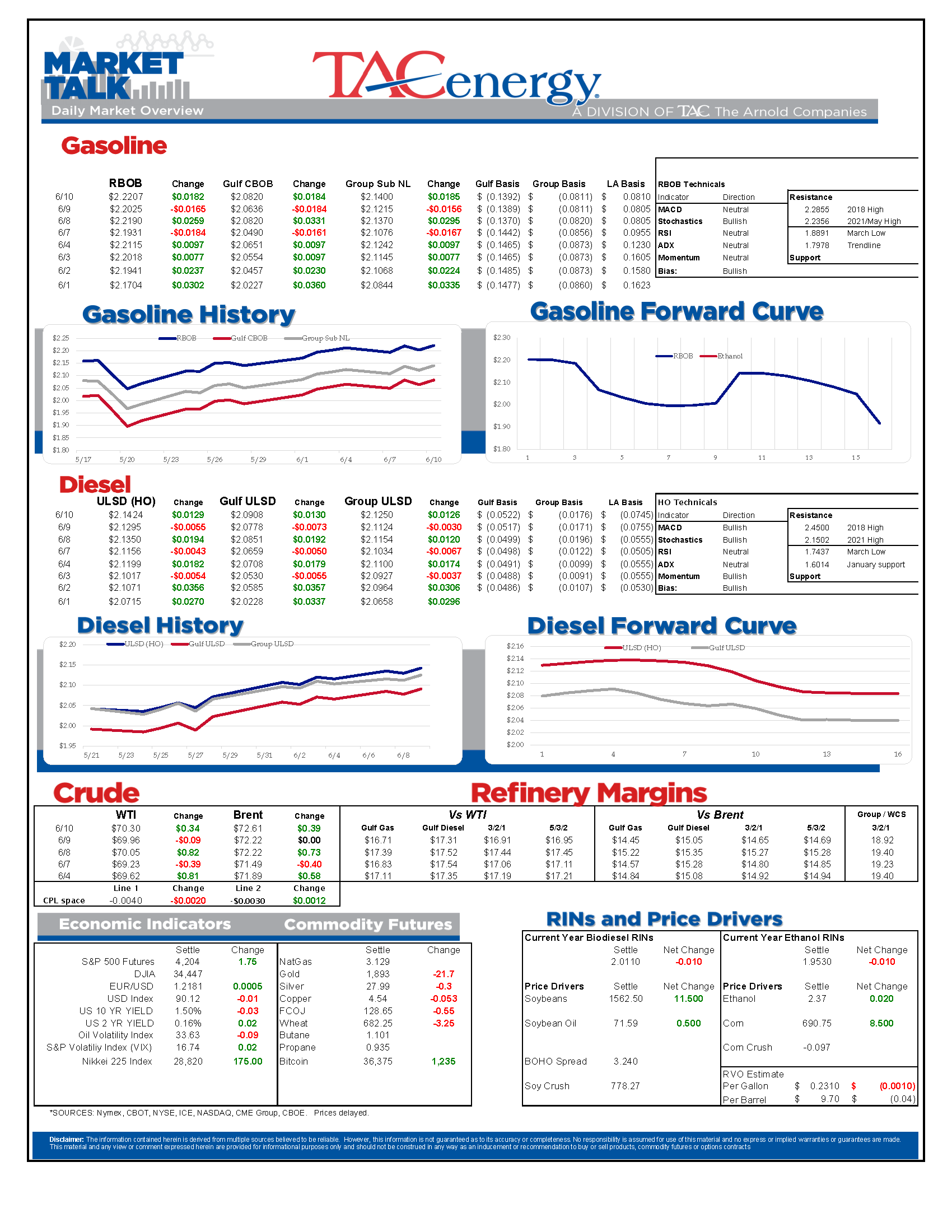

The DOE’s weekly inventory report threw cold water on the petroleum price rally Wednesday, knocking prices backward after they’d reached multi-year highs earlier that morning. Huge drops in demand estimates created large builds in refined product inventories, and suggested that the reopening rally may be outkicking its coverage. Then again, despite the pullback, the upward sloping trend lines have not yet been threatened, and prices have resumed their push higher already this morning, so it’s too soon to say the bulls have lost control.

Gasoline demand estimates dropped sharply last week, falling almost to the same level we saw a year ago when the country was just beginning to talk about reopening. The bulls can easily write off this drop as a temporary holiday hangover as drivers filled up ahead of Memorial Day (or may still be using up that gasoline in their Rubbermaid containers after the Colonial shutdown) and there are signs on the ground that retail demand has been healthy to start June. Diesel saw a second straight week of large demand declines, in what is typically one of its weakest times of the year.

U.S. refinery runs jumped to 15.9 million barrels/day last week, the highest level since COVID started shutting down the country in March of last year. That is still more than one million barrels/day less than we would normally see this time of year when refiners typically start approaching maximum run rates to meet the peak summer demand. On a percentage basis, refineries are operating at 91% of capacity, compared to normal levels around 94% this time of year. Then again, we saw nearly 5% of the country’s capacity taken permanently offline in the past year, so there’s nearly 40 million gallons/day of production that isn’t coming back, making that % comparison less meaningful, and leaving the system more vulnerable to disruption.

Speaking of which, the DOE this morning took a look at the surge in refined product imports this March, following the rash of refinery shutdowns in the U.S. caused by February’s polar plunge.

News & Views

View All

The Perceived Cooling Of Regional Tensions In The Middle East Area Attributing To The Quiet Start To Today’s Trading Session

The energy complex is drifting lower this morning with RBOB futures outpacing its counterparts, trading -.9% lower so far to start the day. The oils (WTI, Brent, heating) are down only .2%-.3% so far this morning.

The perceived cooling of regional tensions in the Middle East area attributing to the quiet start to today’s trading session, despite Israel’s seizure of an important border crossing. A ceasefire/hostage-release agreement was proposed Monday, and accepted by Hamas, but rejected by Israel as they seemingly pushed ahead with their Rafah offensive.

U.S. oil and natural gas production both hit record highs in 2023 and continue to rise in 2024, with oil output currently standing at 13.12 million barrels per day and January 2024 natural gas production slightly exceeding the previous year. With WTI currently changing hands at higher than year-ago levels, this increased production trend is expected to continue despite a decrease in rigs drilling for these resources.

Less than a week after the Senate Budget Committee’s hearing centered on the credibility of big oil’s climate preservation efforts, a major oil company was reported to have sold millions of carbon capture credits, without capturing any carbon. Fraud surrounding government subsidies to push climate-conscious fuel initiatives is nothing new, on a small scale, but it will be interesting to see how much (if any) of the book is thrown at a major refiner.

Today’s interesting read: sourcing hydrogen for refining.

Click here to download a PDF of today's TACenergy Market Talk.

Energy Contracts Are Trying To Find A Floor After Taking Their Largest Weekly Losses Of The Year So Far Last Week

Energy contracts are trying to find a floor after taking their largest weekly losses of the year so far last week.

There’s not much in the way of news yet this morning, so the modest buying is largely being blamed on reports that Saudi Arabia raised its prices for Asian and Mediterranean buyers in June, signaling that demand is strong enough in those markets to shoulder the increase.

RBOB gasoline futures have already dropped 28 cents from the high set April 12th, leading the argument that prices have peaked for the season. The 200-day moving average comes in just under $2.50/gallon this week, some 6.5 cents below current values, and helps set a pivotal chart support layer. If prices break there, there’s a strong case that we’ll see another 20-30 cents of downside, similar to what we saw this time last year.

Money managers continued to reduce their net length in NYMEX contracts last week, as WTI, RBOB and ULSD saw a net decrease of more than 17,000 contracts of speculative length. The hedge fund liquidation seems to have run its course for this latest news cycle however, as new short positions accounted for the majority of the decrease, and WTI and Brent both saw new length added by the big speculators. Money managers are now net-short on ULSD, which could be another reason to think the bottom is near if you subscribe to the theory that the bandwagon-jumping hedge funds usually are wrong.

Baker Hughes reported a decline of 7 oil rigs and 3 natural gas rigs last week, bringing the combined total rig count to its lowest level in more than 2 years. Perhaps most noteworthy in this week’s report was that Alaska saw 5 of its 14 active rigs taken offline in just 1 week. It’s not yet clear if this may have anything to do with the startup of the transmountain pipeline which will have Western Canadian crude now competing more directly with Alaskan grades.

Click here to download a PDF of today's TACenergy Market Talk.

Energy Markets Are Pointing Modestly Higher To Start Friday’s Session

Energy markets are pointing modestly higher to start Friday’s session, in a meager attempt at a recovery rally at the end of what would be the worst week in over two months if prices settle near current values. The liquidation of speculative bets placed on higher energy prices ahead of the direct conflict between Israel and Iran continues to appear to be the driver of the weakness, and we’ll have to wait and see if this modest bounce is a sign that the liquidation is over, or just a pause before it picks up again. Most contracts remain in a precarious technical position with the potential for a slide towards $70 for WTI and $2.20 for both refined products if the buyers don’t get serious soon.

Stocks are pointing sharply higher after a slowdown in job growth reported in the April Non-Farm payroll report. The BLS reported an increase of 175,000 jobs for the month, down sharply from the 315,000 jobs added in March, and the February & March estimates were revised down a combined 22,000. Both the “official” (U-3) and “real” (U-6) unemployment rates ticked up by .1% to 3.9% and 7.4% respectively. The immediate positive reaction to negative news suggest that the bad news is good news low-interest-rate junkies believe this may help the FED’s dilemma of the US economy being too strong to cut rates. The big jump in equities has not seemed to spill over into energy contracts yet, as crude and refined product contracts changed very little following the report.

San Francisco diesel basis spiked 15 cents Thursday to reach the highest level of any market in the country so far this year at 35 cents over prompt futures. While there aren’t yet any refinery upsets reported to blame the spike on, PBF is undergoing planned maintenance at its Martinez facility, and of course P66 just finished converting its Rodeo plant to RD after Marathon converted its Martinez facility in the past couple of years, meaning there are at most only 2 out of the previous 5 refineries in the region operating near capacity these days. The question now is how quickly barrels can shift north from Southern California which continues to show signs of a supply glut with weak basis values and spot to rack spreads.

PBF continued the trend of Q1 refinery earnings that were sharply lower, but still healthy by longer-term historical standards. The company noted that its Saint Bernard (the parish, not the dog) Renewables facility co-processing at its Chalmette refinery had received provisional approval from CARB to lower its CI scores and help improve the amount of LCFS subsidies it can receive. That facility is operating at 18mb/day which is roughly 86% of its capacity.

Cenovus highlighted the restart of its Toledo and Superior refineries in improved refinery run rates in Q1 2024 vs Q1 2023 and noted that it had ramped up production at units that were slowed down for economic reasons in December and January (you may remember this as the time when midcontinent basis values were trading 50 cents/gallon below futures). The company did note that the January deep freeze slowed operations at Superior, but did not mention any change in operating rates despite numerous upsets at its 50% owned Borger refinery.

Dress rehearsal for a busy hurricane season? So far there are no reports of refinery issues caused by the flooding in the Houston area this week. At this point, most of the flooding appears to be far to the north of the refining hubs on the Gulf Coast but with more storms in the forecast and 88 counties already declaring disaster status, this will be something to watch for the next few days.

Click here to download a PDF of today's TACenergy Market Talk.