Energy Futures Are Moving Sharply Lower To Start The Last Trading Day In The Most Volatile Month On Record

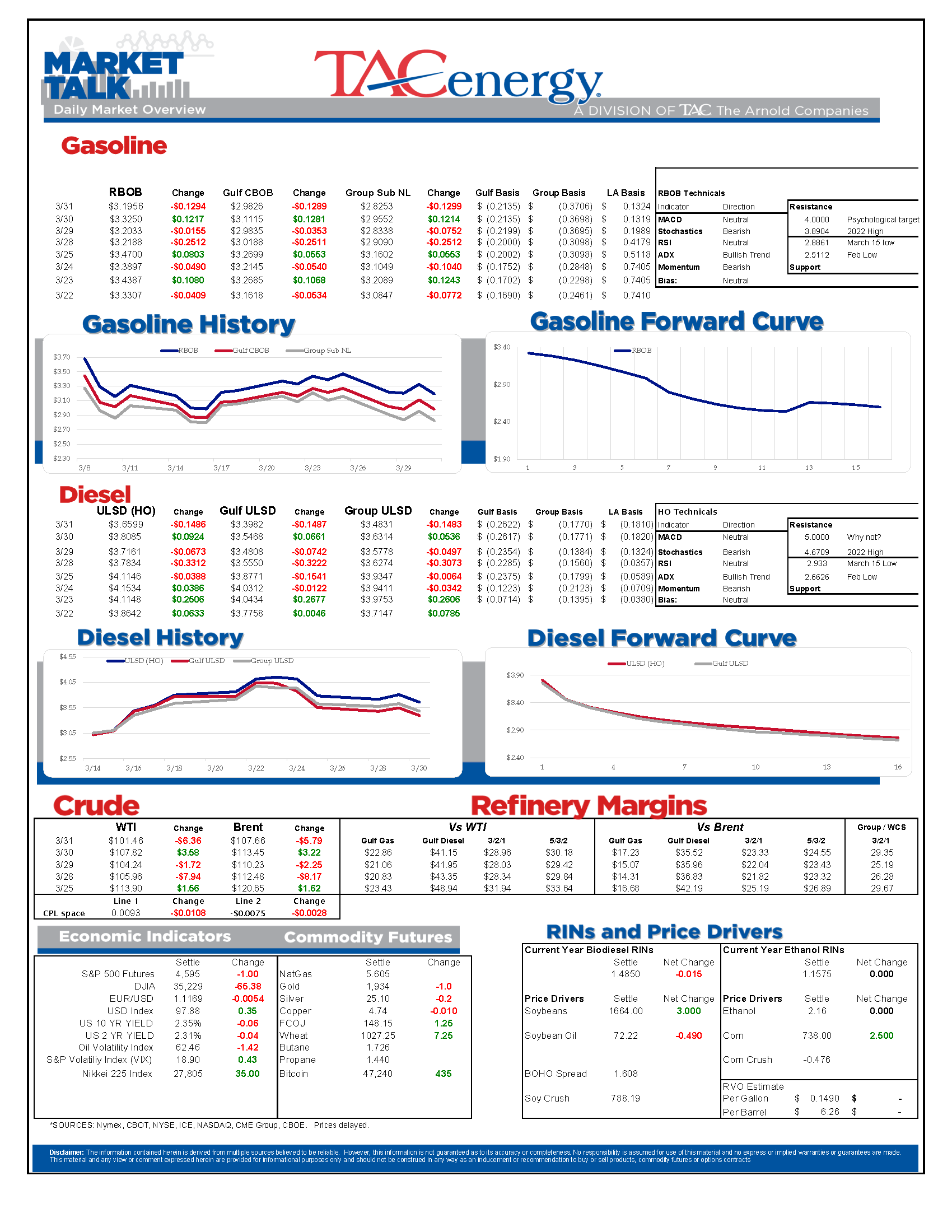

After another strong rally Wednesday, energy futures are moving sharply lower to start the last trading day in the most volatile month on record. Reports that the White House would be announcing a major release of oil from the SPR is getting most of the credit for the early selloff, while the inverted yield curve and COVID lockdowns are also easy targets any time prices pull back.

It’s the last day for April RB and HO contracts, so watch the May futures (RBK/HOK) for price direction today if your region hasn’t already made the move to the new month. So far, despite a 15 cent drop, the April HO contract has not done anything too wild today, but given all the records that contract has already set in March, don’t be surprised to see some fireworks before today’s settlement.

If the rumored/reported SPR release of up to 1 million barrels/day for 6 months happens, it would be by far the largest drawdown in history, making previous releases such as during Gulf War 1, barely show up on the chart in comparison (see chart below). This move – IF all 180 million barrels of it happens – would also draw down SPR inventories to a 40 year low by the end of the year.

US refiners are running hard, increasing output past 92% of nameplate capacity last week, which is at the top end of the seasonal range. While these refiners are seeing the best margins in nearly a decade, after many barely survived the COVID/ESG combo the past two years, there is also a bit of a warning here that plants are reaching the top end of their sustainable output levels, while domestic demand may still be far from peaking this year unless there’s an economic slowdown.

Domestic oil output did tick higher for the first time in two months, but the DOE’s estimate was only up 100mb/day on the week, putting it on par with where the year started, and proving once again that restarting shuttered operations, and overcoming natural well decline, takes a lot longer than many would like. Still, with oilfield hiring and spending reaching new records in some markets, the supply increase does seem to be coming later in the year, and the big questions are just how long will it take to add back the 1.4 million barrels/day that were taken out of service during the COVID lockdowns, and will those barrels come back online just in time for the world not to need them, especially if the SPR release happens, and lead to the next bust in prices?

We don’t often talk about jet fuel prices in this note, but it’s worth mentioning that NY Harbor saw a new record for Jet A prices Wednesday with basis values getting close to $1/gallon over April futures, and more than $1.25/gallon over its Midwestern counterparts. Inventory charts at the end of the DOE chart list below show that PADD 1 inventories are well below their 5 year range, while PADD 2 stocks are above average, in another sign of how coastal markets are being influenced by the cargo chaos in response to the war in Ukraine, while inland markets are insulated.

News & Views

View All

Crude Oil, Gasoline, And Diesel Benchmarks Are All Trading >1% Lower To Start The Day

Energy prices are sinking again this morning, albeit with a little more conviction than yesterday’s lackadaisical wilting. Crude oil, gasoline, and diesel benchmarks are all trading >1% lower to start the day with headlines pointing to an across-the-board build in national inventories as the source for this morning’s bearish sentiment. The Department of Energy’s official report is due out at its regular time this morning (9:30am CDT).

WTI has broken below its 100-day moving average this morning as it fleshed out the downward trend that began early last month. While crossing this technical threshold may not be significant in and of itself (it happened multiple times back in February), the fact that it coincides with the weekly and monthly charts also breaking below a handful of their respective moving averages paints a pretty bearish picture in the short term. The door is open for prices to drop down to $75 per barrel in the next couple weeks.

Shortly after the EIA’s weekly data showed U.S. commercial crude inventories surpassing 2023 levels for the first time this year, their monthly short-term energy outlook is forecasting a fall back to the bottom end of the 5-year range by August due to increasing refinery runs over the period. However, afterward the administration expects a rise in inventories into 2025, citing continued production increases and loosening global markets hindering the incentive to send those excess barrels overseas. The agency also cut back their average gas and diesel price forecasts for the first time since February with the biggest reductions in the second and third quarter of this year.

The STEO also featured their famed price prediction for WTI, stating with 95% confidence that the price for crude oil will be between $40 and $140 through 2026.

Need a general indication of the global crude oil supply? Most headlines seem to be covering a shortage of a different type of oil, one that we haven’t turned into fuel (yet).

Click here to download a PDF of today's TACenergy Market Talk.

The Perceived Cooling Of Regional Tensions In The Middle East Area Attributing To The Quiet Start To Today’s Trading Session

The energy complex is drifting lower this morning with RBOB futures outpacing its counterparts, trading -.9% lower so far to start the day. The oils (WTI, Brent, heating) are down only .2%-.3% so far this morning.

The perceived cooling of regional tensions in the Middle East area attributing to the quiet start to today’s trading session, despite Israel’s seizure of an important border crossing. A ceasefire/hostage-release agreement was proposed Monday, and accepted by Hamas, but rejected by Israel as they seemingly pushed ahead with their Rafah offensive.

U.S. oil and natural gas production both hit record highs in 2023 and continue to rise in 2024, with oil output currently standing at 13.12 million barrels per day and January 2024 natural gas production slightly exceeding the previous year. With WTI currently changing hands at higher than year-ago levels, this increased production trend is expected to continue despite a decrease in rigs drilling for these resources.

Less than a week after the Senate Budget Committee’s hearing centered on the credibility of big oil’s climate preservation efforts, a major oil company was reported to have sold millions of carbon capture credits, without capturing any carbon. Fraud surrounding government subsidies to push climate-conscious fuel initiatives is nothing new, on a small scale, but it will be interesting to see how much (if any) of the book is thrown at a major refiner.

Today’s interesting read: sourcing hydrogen for refining.

Click here to download a PDF of today's TACenergy Market Talk.

Energy Contracts Are Trying To Find A Floor After Taking Their Largest Weekly Losses Of The Year So Far Last Week

Energy contracts are trying to find a floor after taking their largest weekly losses of the year so far last week.

There’s not much in the way of news yet this morning, so the modest buying is largely being blamed on reports that Saudi Arabia raised its prices for Asian and Mediterranean buyers in June, signaling that demand is strong enough in those markets to shoulder the increase.

RBOB gasoline futures have already dropped 28 cents from the high set April 12th, leading the argument that prices have peaked for the season. The 200-day moving average comes in just under $2.50/gallon this week, some 6.5 cents below current values, and helps set a pivotal chart support layer. If prices break there, there’s a strong case that we’ll see another 20-30 cents of downside, similar to what we saw this time last year.

Money managers continued to reduce their net length in NYMEX contracts last week, as WTI, RBOB and ULSD saw a net decrease of more than 17,000 contracts of speculative length. The hedge fund liquidation seems to have run its course for this latest news cycle however, as new short positions accounted for the majority of the decrease, and WTI and Brent both saw new length added by the big speculators. Money managers are now net-short on ULSD, which could be another reason to think the bottom is near if you subscribe to the theory that the bandwagon-jumping hedge funds usually are wrong.

Baker Hughes reported a decline of 7 oil rigs and 3 natural gas rigs last week, bringing the combined total rig count to its lowest level in more than 2 years. Perhaps most noteworthy in this week’s report was that Alaska saw 5 of its 14 active rigs taken offline in just 1 week. It’s not yet clear if this may have anything to do with the startup of the transmountain pipeline which will have Western Canadian crude now competing more directly with Alaskan grades.

Click here to download a PDF of today's TACenergy Market Talk.