Energy Futures Continue As Markets Await Decisions From Two Major Powers In Global Oil Prices

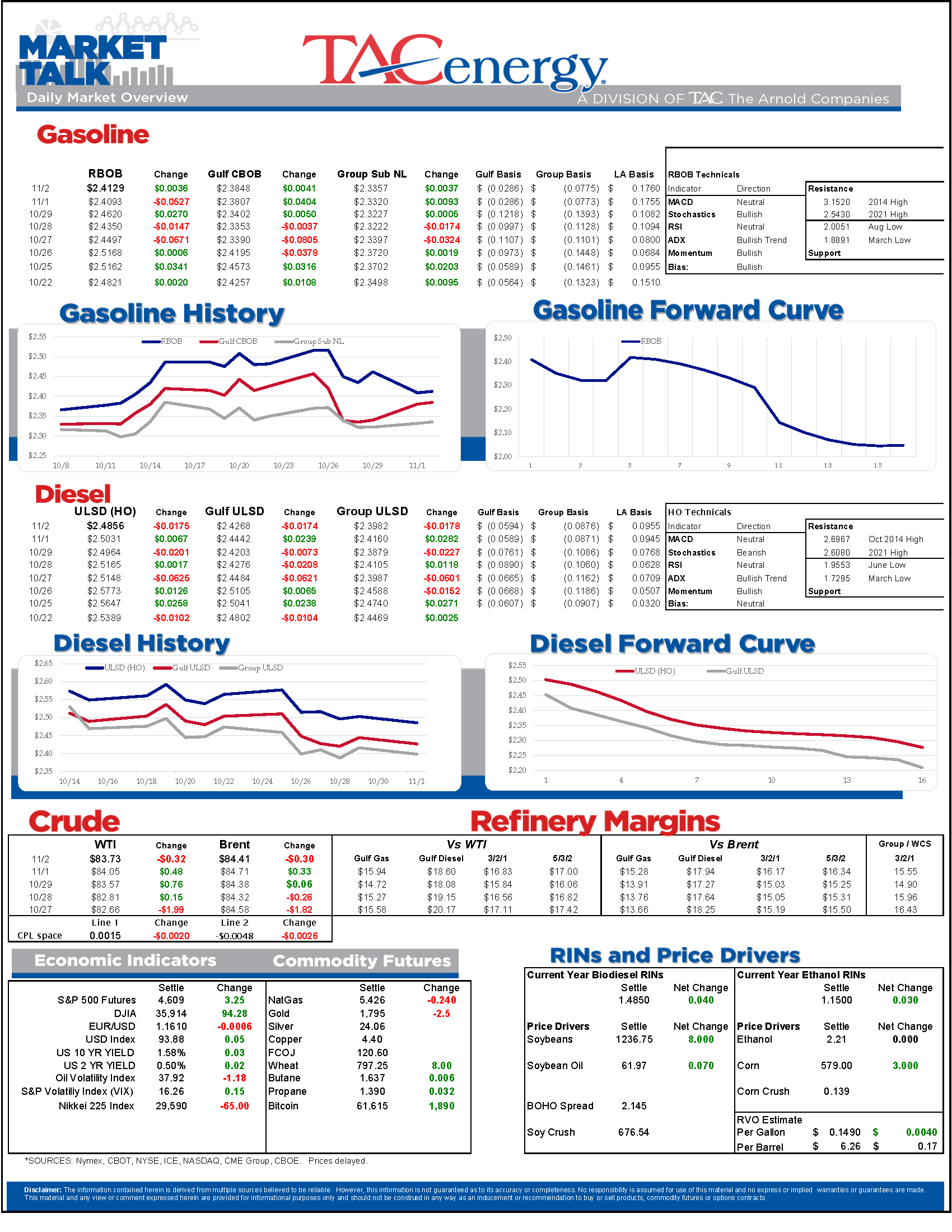

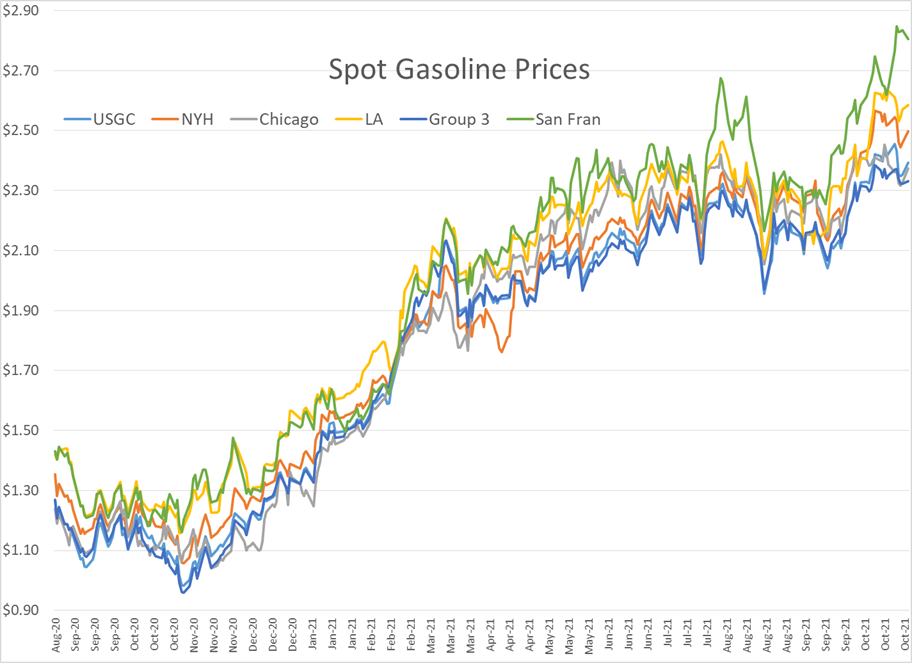

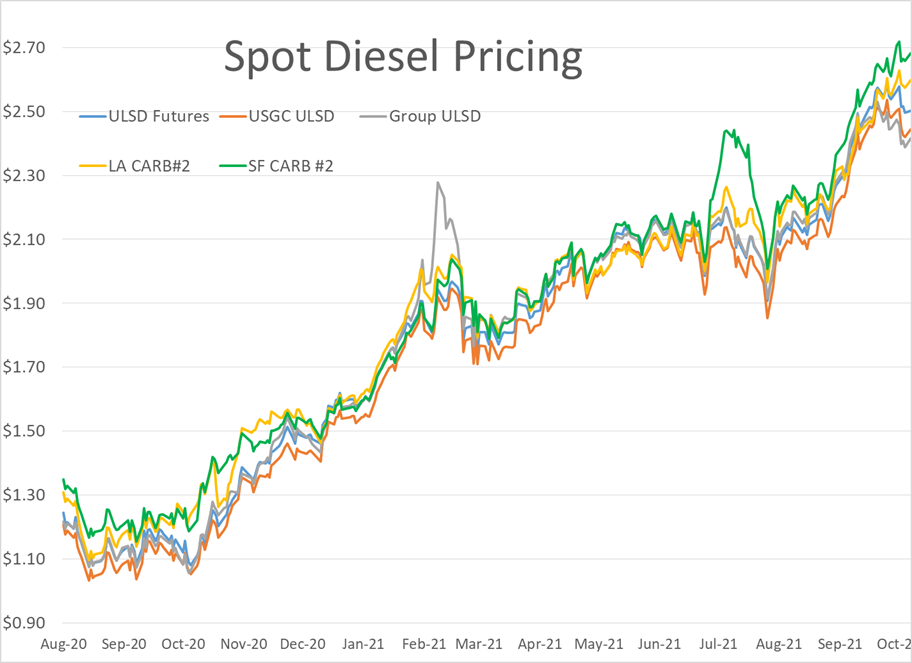

The choppy action in energy futures continues as markets await decisions from the two major powers in global oil prices, OPEC and the US Federal reserve. A rally Monday to start November’s trading pushed prices further away from the brink of a technical breakdown, but most contracts are slipping back into the red this morning.

More OPEC members are signaling support of Saudi Arabia’s pledge to stick with the output agreement that will add 400,000 barrels/day of production each month until mid 2022, which they argue will balance the global supply/demand equation.

The November FOMC meeting starts today, and will conclude with an announcement on the FED’s changes to monetary policy tomorrow. While expectations for interest rate hikes remain non-existent until the middle of 2022, this meeting is expected to start the process of reducing the FED’s extraordinary bond purchases which started during the depths of the pandemic to stabilize markets. There is concern of a “taper tantrum” if equity markets respond poorly to the removal of the free money that’s fueled a record move in stock prices, and other forms of inflation, that could spill over into commodity prices as well.

Lots of pledges coming from the COP26 meetings this week: The US President announced new proposed rule to limit methane emissions in the US, which many believe to be the low hanging fruit in the climate battle. The regulations, if passed, would give federal oversight to more US gathering systems (something likely to face a legal battle in Texas) and cut even further back on natural gas flaring. Perhaps the biggest change in this proposal from prior rulings is that they would apply not just to new facilities, but to existing ones as well.

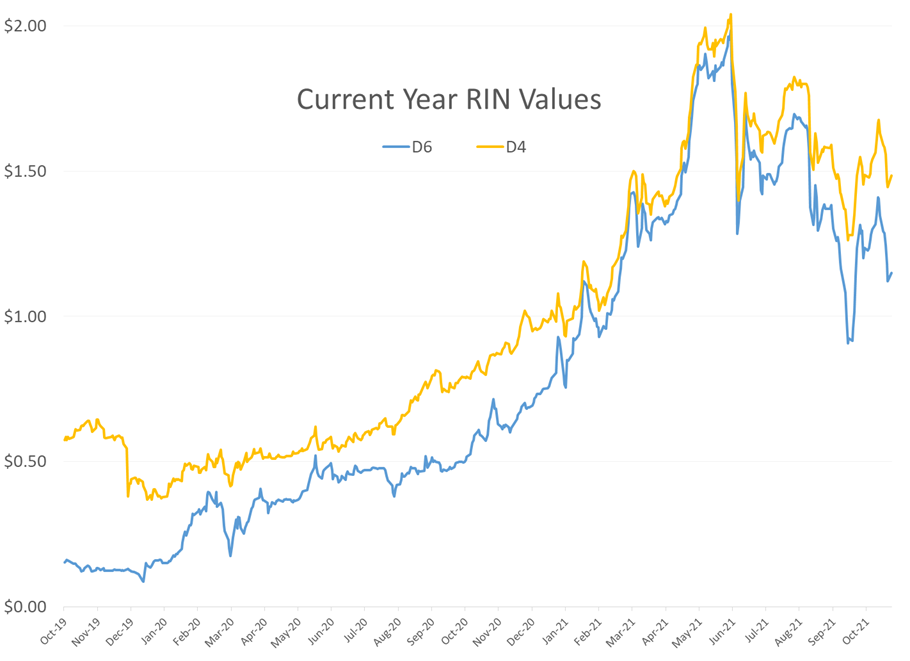

Along with the rally in refined products Monday, RINs had their first move higher in nearly 2 weeks, after D6 values had dropped 30 cents from their October highs and D4s fell by 25 cents. Still no updates on the RVOs for 2021 from the EPA, which may mean those numbers are being held as a bargaining chip in the congressional tax, spending and climate bills that continue to go nowhere, or that the agency is more focused on the new rules on methane and doesn’t have the resources to comply with the RFS timing mandates.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

Week 18 - US DOE Inventory Recap

Crude Oil, Gasoline, And Diesel Benchmarks Are All Trading >1% Lower To Start The Day

Energy prices are sinking again this morning, albeit with a little more conviction than yesterday’s lackadaisical wilting. Crude oil, gasoline, and diesel benchmarks are all trading >1% lower to start the day with headlines pointing to an across-the-board build in national inventories as the source for this morning’s bearish sentiment. The Department of Energy’s official report is due out at its regular time this morning (9:30am CDT).

WTI has broken below its 100-day moving average this morning as it fleshed out the downward trend that began early last month. While crossing this technical threshold may not be significant in and of itself (it happened multiple times back in February), the fact that it coincides with the weekly and monthly charts also breaking below a handful of their respective moving averages paints a pretty bearish picture in the short term. The door is open for prices to drop down to $75 per barrel in the next couple weeks.

Shortly after the EIA’s weekly data showed U.S. commercial crude inventories surpassing 2023 levels for the first time this year, their monthly short-term energy outlook is forecasting a fall back to the bottom end of the 5-year range by August due to increasing refinery runs over the period. However, afterward the administration expects a rise in inventories into 2025, citing continued production increases and loosening global markets hindering the incentive to send those excess barrels overseas. The agency also cut back their average gas and diesel price forecasts for the first time since February with the biggest reductions in the second and third quarter of this year.

The STEO also featured their famed price prediction for WTI, stating with 95% confidence that the price for crude oil will be between $40 and $140 through 2026.

Need a general indication of the global crude oil supply? Most headlines seem to be covering a shortage of a different type of oil, one that we haven’t turned into fuel (yet).

Click here to download a PDF of today's TACenergy Market Talk.

The Perceived Cooling Of Regional Tensions In The Middle East Area Attributing To The Quiet Start To Today’s Trading Session

The energy complex is drifting lower this morning with RBOB futures outpacing its counterparts, trading -.9% lower so far to start the day. The oils (WTI, Brent, heating) are down only .2%-.3% so far this morning.

The perceived cooling of regional tensions in the Middle East area attributing to the quiet start to today’s trading session, despite Israel’s seizure of an important border crossing. A ceasefire/hostage-release agreement was proposed Monday, and accepted by Hamas, but rejected by Israel as they seemingly pushed ahead with their Rafah offensive.

U.S. oil and natural gas production both hit record highs in 2023 and continue to rise in 2024, with oil output currently standing at 13.12 million barrels per day and January 2024 natural gas production slightly exceeding the previous year. With WTI currently changing hands at higher than year-ago levels, this increased production trend is expected to continue despite a decrease in rigs drilling for these resources.

Less than a week after the Senate Budget Committee’s hearing centered on the credibility of big oil’s climate preservation efforts, a major oil company was reported to have sold millions of carbon capture credits, without capturing any carbon. Fraud surrounding government subsidies to push climate-conscious fuel initiatives is nothing new, on a small scale, but it will be interesting to see how much (if any) of the book is thrown at a major refiner.

Today’s interesting read: sourcing hydrogen for refining.

Click here to download a PDF of today's TACenergy Market Talk.