Energy Futures Trading Higher

After another soft day of trading Tuesday, Rumors that OPEC may be discussing a production cut ahead of their meeting this weekend has energy futures trading higher this morning, erasing overnight losses that were sparked by a large build in US crude oil inventories.

The OPEC discussions have already been called nothing more than an attempt at “verbal intervention” to stall the price collapse. Given the challenges the cartel has faced in reaching an agreement over the past few years, may be nothing more than a good excuse to see some profit taking after prices reached multi-month lows.

The API was said to show US oil inventories increased more than 7.8 million barrels last week, which sent most prices lower overnight, while refined products saw draws of 3.6 million barrels for diesel and 1.2 million barrels for gasoline.

The EIA released its monthly Short Term Energy Outlook Tuesday, and reduced its price forecast for petroleum products for the first time in several months as global supplies look to be building more than they expected in previous reports. The agency’s weekly status report is due out at its regular time of 9:30 central today.

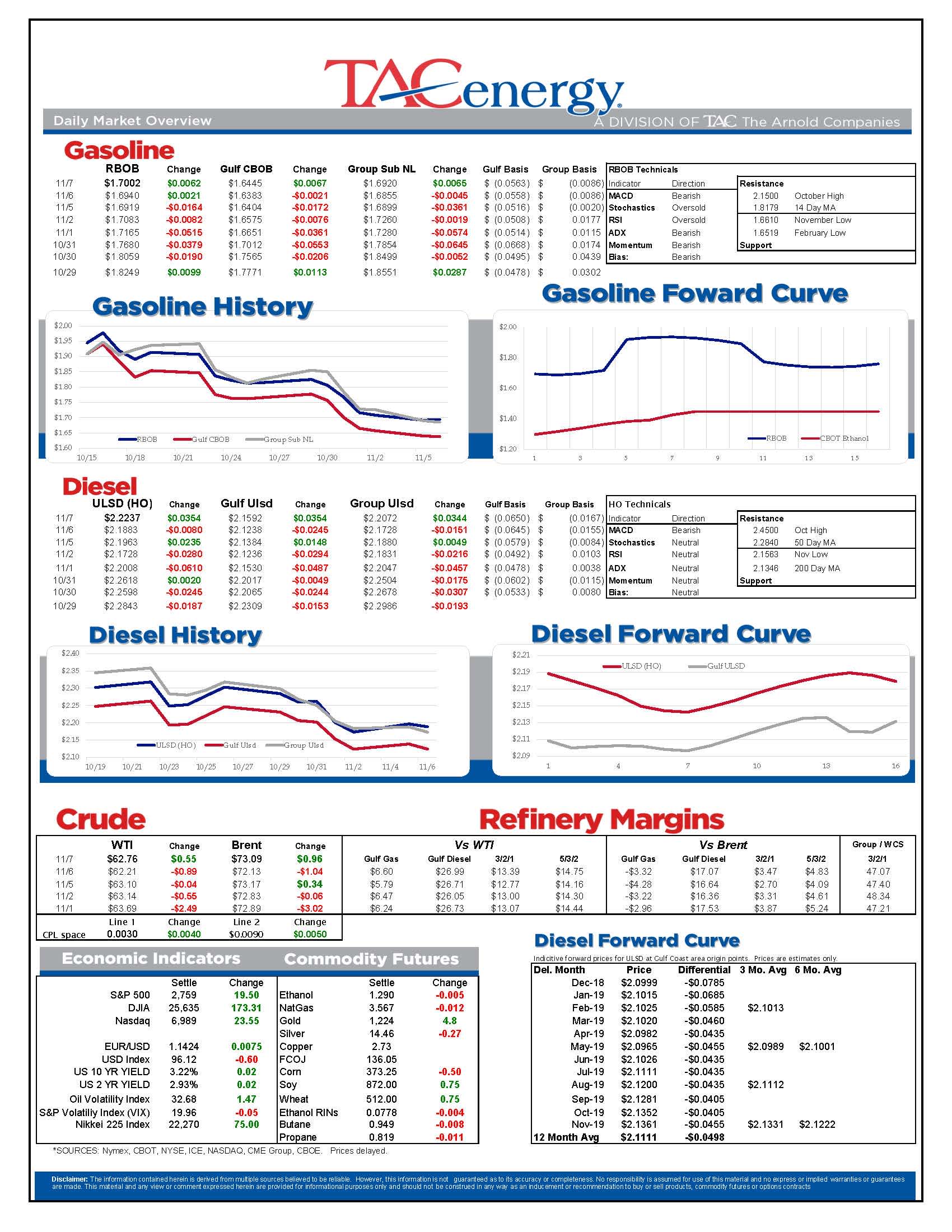

A look at the forward curves: WTI and Brent show the sell-off of the past month has focused on the front end of the curve, as the global supply outlook shifted from shortage to excess, and the first few months moved from backwardation to contango as a result.

RBOB gasoline’s forward curve was fairly steady with ample supplies and soft demand a theme throughout, which also helps to explain why gasoline prices are 52 cents cheaper than Diesel. ULSD meanwhile is seeing a bit of a guessing game as traders try to determine when the IMO bunker fuel spec change due 2020 may create a shortage next year.

Colorado voters rejected a proposed law that would have sharply reduced oil and natural gas drilling in the state.

News & Views

View All

Energy Futures Are Caught Up In Headline Tug-O-War This Morning

Energy futures are caught up in headline tug-o-war this morning with Canadian oil production concerns and a positive US GDP report trying to push prices higher while sinking Chinese demand worries and Gaza ceasefire hopes are applying downward pressure. The latter two seem to be favored more so far this morning with WTI and Brent crude oil futures down ~45 cents per barrel, while gasoline and diesel prices are down about half a cent and two cents, respectively.

No news is good news? Chicago gasoline prices dropped nearly 30 cents yesterday, despite there not being any update on Exxon’s Joliet refinery after further damage was discovered Wednesday. Its tough to say if traders have realized the supply situation isn’t as bad as originally thought or if this historically volatile market is just being itself (aka ‘Chicago being Chicago’).

The rain isn’t letting up along the Texas Gulf Coast today and is forecasted to carry on through the weekend. While much of the greater Houston area is under flood watch, only two refineries are within the (more serious) flood warning area: Marathon’s Galveston Bay and Valero’s Texas City refineries. However, notification that more work is needed at Phillip’s 66 Borger refinery (up in the panhandle) is the only filing we’ve seen come through the TECQ, so far.

Premiums over the tariff on Colonial’s Line 1 (aka linespace value) returned to zero yesterday, and actually traded in the negatives, after its extended run of positive values atypical of this time of year. Line 1’s counterpart, Line 2, which carries distillates from Houston to Greensboro NC, has traded at a discount so far this year, due to the healthy, if not over-, supply of diesel along the eastern seaboard.

Click here to download a PDF of today's TACenergy Market Talk.

WTI And Brent Crude Oil Futures Are Trading ~$1.50 Per Barrel Lower In Pre-Market Trading

The across-the-board drawdown in national energy stockpiles, as reported by the Department of Energy yesterday, stoked bullish sentiment Wednesday and prompt month gasoline, diesel, and crude oil futures published gains on the day. Those gains are being given back this morning.

The surprise rate cut by the People’s Bank of China is being blamed for the selling we are seeing in energy markets this morning. While the interest rate drop in both short- and medium-term loans won’t likely affect energy prices outright, the concern lies in the overall economic health of the world’s second largest economy and crude oil consumer. Prompt month WTI and Brent crude oil futures are trading ~$1.50 per barrel lower in pre-market trading, gasoline and diesel are following suit, shaving off .0400-.0450 per gallon.

Chicagoland RBOB has maintained its 60-cent premium over New York prices through this morning and shows no sign of coming down any time soon. Quite the opposite in fact: the storm damage, which knocked Exxon Mobil’s Joliet refinery offline on 7/15, seems to be more extensive than initially thought, potentially extending the repair time and pushing back the expected return date.

There are three main refineries that feed the Chicago market, the impact from one of them shutting down abruptly can be seen in the charts derived from aforementioned data published by the DOE. Refinery throughput in PADD 2 dropped 183,000 barrels per day, driving gasoline stockpiles in the area down to a new 5-year seasonal low.

While it seems all is quiet on the Atlantic front (for now), America’s Refineryland is forecasted to receive non-stop rain and thunderstorms for the next four days. While it may not be as dramatic as a hurricane, flooding and power outages can shut down refineries, and cities for that matter, all the same, as we learned from Beryl.