Energy Markets Are Off To Another Quiet Start Thursday

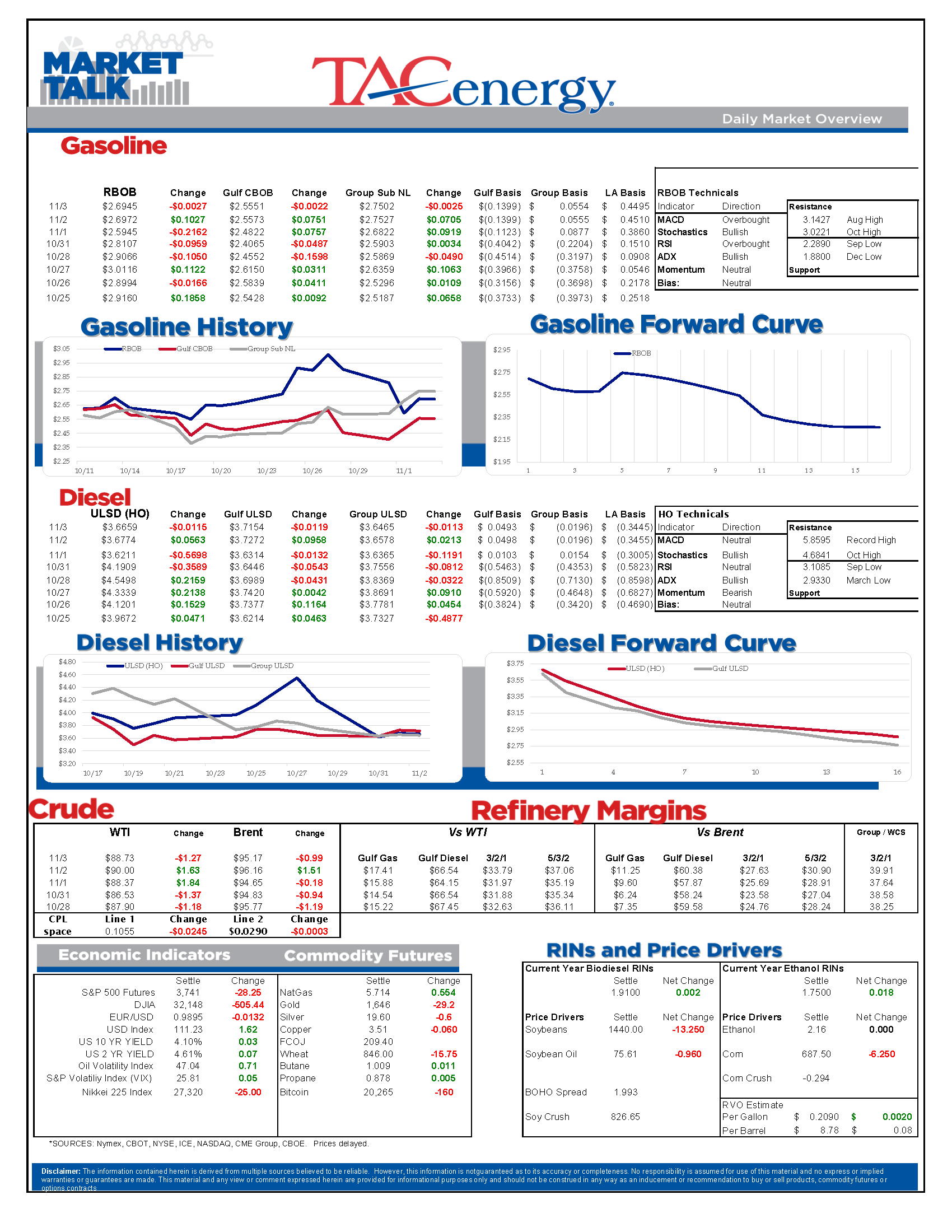

Energy markets are off to another quiet start Thursday with modest losses in the early going after some bullish data points from the DOE helped push prices higher on Wednesday.

Stock markets have reacted negatively to the FOMC chair’s press conference Wednesday in which he made it clear that a pivot is not coming and that rates will go higher than previously expected to stomp out inflation. The correlation between daily moves in equity and energy prices has ticked higher in the past couple of weeks so some of that negative outlook seems to be spilling over into the energy arena as well.

Coastal Extremes: While the East Coast has received plenty of attention for tight diesel supplies (and a particular panicked supplier’s color coding) over the past few weeks, and ULSD basis values in NYH are north of 80 cents over December futures, the West Coast is seeing the opposite phenomenon as diesel basis values plummeted to a 50 cent discount Wednesday. Less than a month ago we saw LA spots at a 50 cent premium to November futures, that set cash prices above $4.55/gallon vs values around $3.20 this morning. Will we see a similar drop in East Coast values over the next month?

PADD 1 (East Coast) refining rates actually surpassed 100% of nameplate capacity last week, reaching the highest run rates since the PES refinery exploded and shut down in 2019. You may be wondering how refineries can physically run above 100% of capacity, and the simple answer is it’s just like football players giving 110% on every play. Actually, the reason is that when PBF shut units at its Paulsboro refinery at the end of 2020 to try and survive the brutal demand environment that knocked several refineries out of business, 70mb/day of refining capacity was taken off the DOE’s ledger, but hasn’t yet been added back now that those units have restarted. Given the tight state of supplies in PADD 1, that incremental production could not come at a better time, and helps explain how that particular refiner went from knocking on the door of insolvency 2 years ago, to making more than $1 billion last quarter.

Demand is bad, supply is worse: US gasoline stocks dropped to an 8 year low last week, and soft demand that remains near levels we saw in 2020 may be the only thing preventing widespread outages as a result.

Total US gasoline imports dropped to their lowest levels of the year, led by a big decline in PADD 1 imports caused by a combination of a temporarily closed arb window from Europe during the French refinery strikes, refinery maintenance at a Canadian refinery that’s a major supplier to the region, and various vessel delays. That drop in imports was a key driver in the various short term outages plaguing terminals across the region in the past few weeks, and if we don’t see a recovery in those imports soon, expect those shortages to continue. Then again, the next few months are typically the slowest period for imports as US driving demand slows, and gasoline supply increases thanks to the butane blending that’s becoming more prevalent across the country, so we may not see as big of a snap back as we would if this drop had happened 2 months ago.

The diesel import/export flow also continues to have an outsized influence on prices. We did see diesel exports decline last week, and PADD 1 imports start to tick higher in what could be the early wave reacting to the $1/gallon premiums for diesel in the region, both of which helped inventories increase modestly, although days of supply still ticked lower thanks to a healthy increase in the DOE’s demand estimate. Note the drop in PADD 5 diesel imports below as the market reacts just as strongly to the drop in West Coast basis values as it did to the spike in September. The billion dollar question for the months ahead is whether or not the Atlantic basin is capable of that type of a reaction to the high prices in New York.

Hurricane Lisa made Landfall over Belize Wednesday, and most models now have the storm emerging in the Gulf of Mexico tomorrow after crossing the Yucatan peninsula. Those models don’t currently have the storm redeveloping into a hurricane as it approaches refinery row, but it will need to be watched for another few days. Meanwhile Martin has also reached Hurricane status as it churns through the North Atlantic, far from being a threat to land, and the NHC is tracking two more potential systems off the SE US that are given low odds of being named.

News & Views

View All

Energy Futures Are Caught Up In Headline Tug-O-War This Morning

Energy futures are caught up in headline tug-o-war this morning with Canadian oil production concerns and a positive US GDP report trying to push prices higher while sinking Chinese demand worries and Gaza ceasefire hopes are applying downward pressure. The latter two seem to be favored more so far this morning with WTI and Brent crude oil futures down ~45 cents per barrel, while gasoline and diesel prices are down about half a cent and two cents, respectively.

No news is good news? Chicago gasoline prices dropped nearly 30 cents yesterday, despite there not being any update on Exxon’s Joliet refinery after further damage was discovered Wednesday. Its tough to say if traders have realized the supply situation isn’t as bad as originally thought or if this historically volatile market is just being itself (aka ‘Chicago being Chicago’).

The rain isn’t letting up along the Texas Gulf Coast today and is forecasted to carry on through the weekend. While much of the greater Houston area is under flood watch, only two refineries are within the (more serious) flood warning area: Marathon’s Galveston Bay and Valero’s Texas City refineries. However, notification that more work is needed at Phillip’s 66 Borger refinery (up in the panhandle) is the only filing we’ve seen come through the TECQ, so far.

Premiums over the tariff on Colonial’s Line 1 (aka linespace value) returned to zero yesterday, and actually traded in the negatives, after its extended run of positive values atypical of this time of year. Line 1’s counterpart, Line 2, which carries distillates from Houston to Greensboro NC, has traded at a discount so far this year, due to the healthy, if not over-, supply of diesel along the eastern seaboard.

Click here to download a PDF of today's TACenergy Market Talk.

WTI And Brent Crude Oil Futures Are Trading ~$1.50 Per Barrel Lower In Pre-Market Trading

The across-the-board drawdown in national energy stockpiles, as reported by the Department of Energy yesterday, stoked bullish sentiment Wednesday and prompt month gasoline, diesel, and crude oil futures published gains on the day. Those gains are being given back this morning.

The surprise rate cut by the People’s Bank of China is being blamed for the selling we are seeing in energy markets this morning. While the interest rate drop in both short- and medium-term loans won’t likely affect energy prices outright, the concern lies in the overall economic health of the world’s second largest economy and crude oil consumer. Prompt month WTI and Brent crude oil futures are trading ~$1.50 per barrel lower in pre-market trading, gasoline and diesel are following suit, shaving off .0400-.0450 per gallon.

Chicagoland RBOB has maintained its 60-cent premium over New York prices through this morning and shows no sign of coming down any time soon. Quite the opposite in fact: the storm damage, which knocked Exxon Mobil’s Joliet refinery offline on 7/15, seems to be more extensive than initially thought, potentially extending the repair time and pushing back the expected return date.

There are three main refineries that feed the Chicago market, the impact from one of them shutting down abruptly can be seen in the charts derived from aforementioned data published by the DOE. Refinery throughput in PADD 2 dropped 183,000 barrels per day, driving gasoline stockpiles in the area down to a new 5-year seasonal low.

While it seems all is quiet on the Atlantic front (for now), America’s Refineryland is forecasted to receive non-stop rain and thunderstorms for the next four days. While it may not be as dramatic as a hurricane, flooding and power outages can shut down refineries, and cities for that matter, all the same, as we learned from Beryl.