Energy Prices Are Moving Lower In The Early Going Friday After A Strong Week

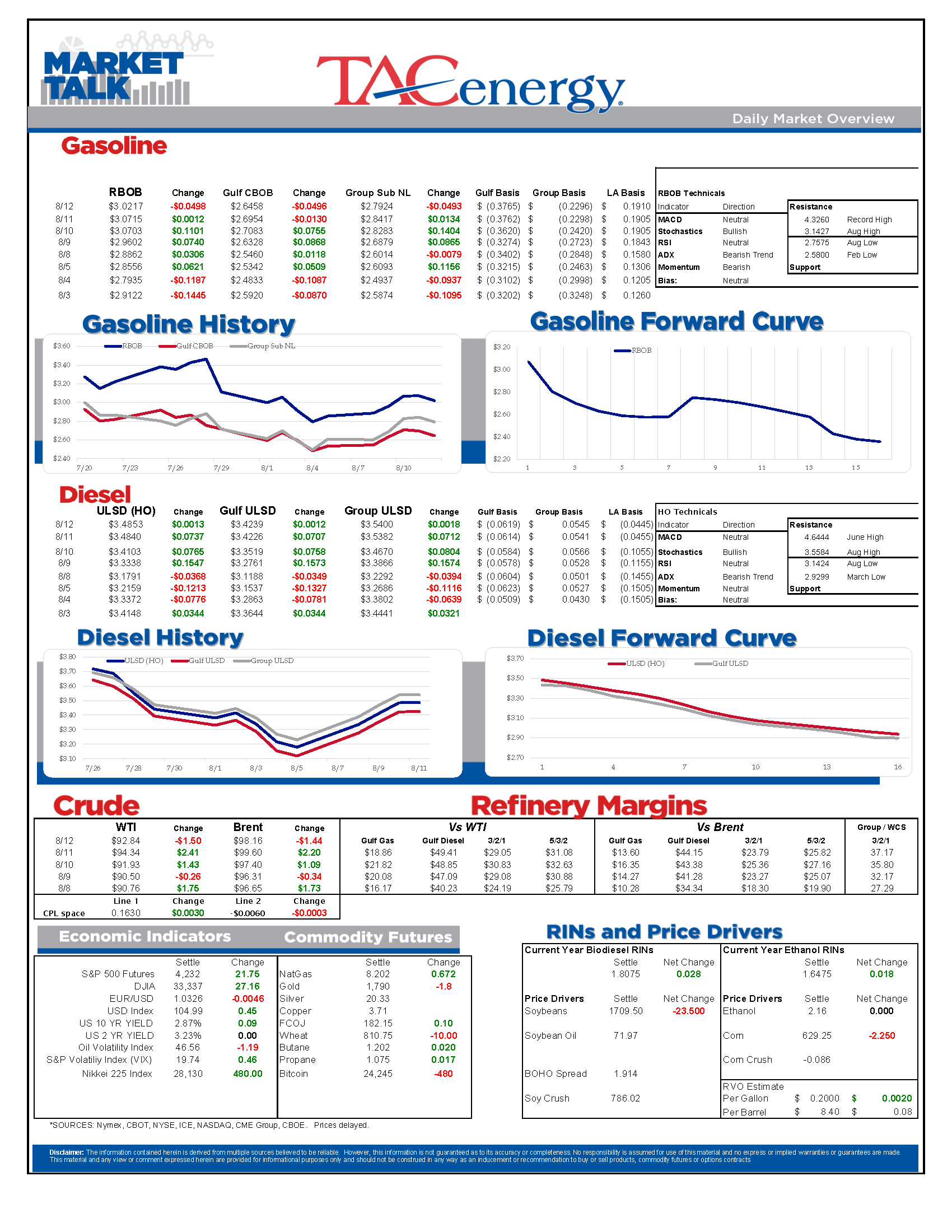

Energy prices are moving lower in the early going Friday after a strong week in which fear of inflation and slowing demand both eased, while fears of supply disruptions returned. From a chart perspective, gasoline and diesel prices have returned into more neutral territory after failing to break near term resistance and are set up for another period of back and forth action – just like we saw yesterday with ULSD experiencing multiple 10 cent moves on the day.

The IEA disagreed with OPEC’s estimates for declining global fuel demand Wednesday, raising its oil consumption estimates, with consumers switching to oil-based products to supplement the electricity grid during the summer heat wave (and tight natural gas supplies) driving the increase and masking the “…relative weakness in other sectors…”. Of course, it’s typically not crude oil that’s being used to supplement electricity supplies, it’s some form of diesel whether it be known as Gasoil, fuel oil etc. which explains why we’ve seen ULSD prices react to movements in natural gas prices, while gasoline prices tend to go their own way.

The IEA increased its forecast for Russian oil output as buyers in some parts of the world are getting awfully creative to find ways around sanctions. Read here for an interesting story on a big gamble on old ships to carry out dangerous ship to ship transfers of Russian crude. Never doubt the ingenuity of an oil trader.

The IEA’s monthly report ended with a word of caution: “…with supply increasingly at risk to disruptions, another price rally cannot be excluded.” Read this Reuters note for more specifics on why European distillates are particularly vulnerable.

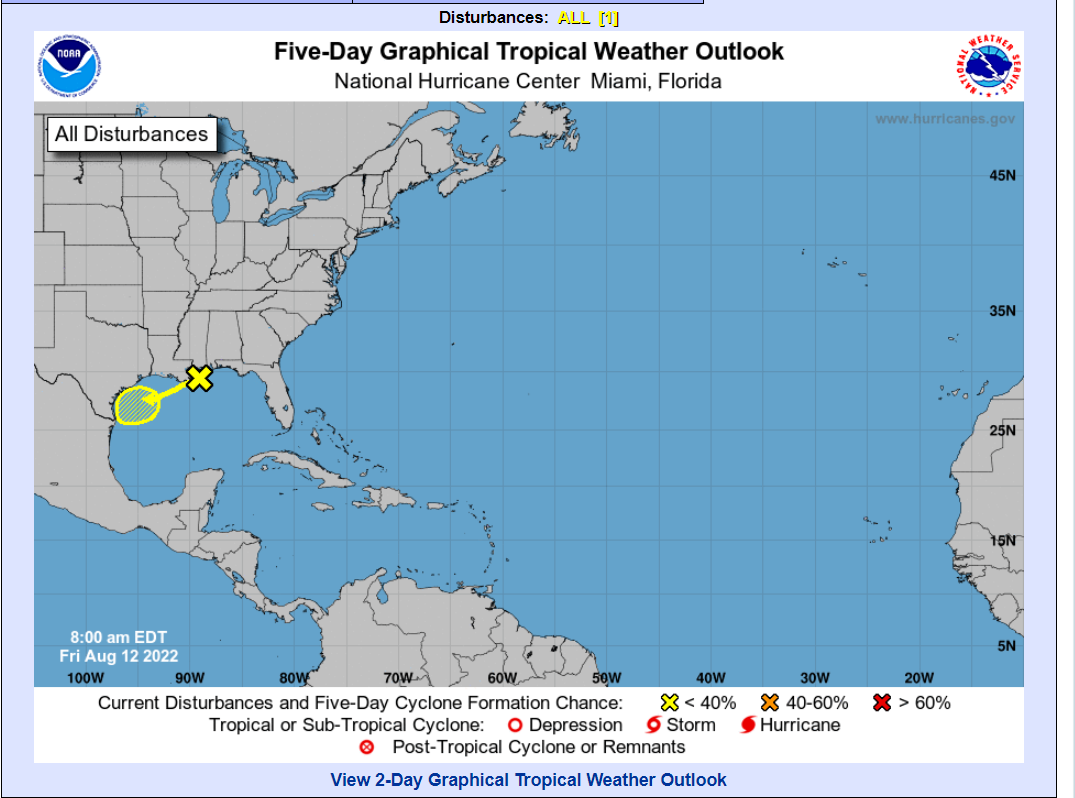

Speaking of disruptions, the storm system moving across the Atlantic didn’t turn into anything this week and the only other system on the NHC’s watch list is given just 10% odds of developing off the coast of Texas and Louisiana, although it is expected to bring heavy rains to the region over the weekend. We’re getting to the time of year where we can expect waves to move off the African coast every few days, and each of those waves has the chance to become a hurricane. Where those storms head will likely determine if this season is a nuisance or a disaster for energy supplies, with early forecasts suggesting Florida may be the storm magnet this year, which would be bade news for retirees, but good news for suppliers compared to the past 2 years of Louisiana landfalls that pummeled refinery row.

There are all sorts of new energy-related incentives in the new bill moving through congress. While electric vehicle incentives are capturing much of the attention, a lack of domestic battery production may limit the impact of those plans. Meanwhile, residential heat pumps may become the hot new item and lower carbon cement could end up making a larger impact on emissions than the slow moving changes in the transportation sector.

Massachusetts is jumping on the congressional climate bandwagon, passing a new bill this week that would join the California dream of banning sales of new gasoline and diesel powered vehicles in 2035, and designate some cities as fossil fuel free and ban natural gas in new construction. This comes just a few months after the state backed out of the proposed Transportation and Climate initiative that would have enforced a cap and trade style program on fuel suppliers.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

Week 18 - US DOE Inventory Recap

Crude Oil, Gasoline, And Diesel Benchmarks Are All Trading >1% Lower To Start The Day

Energy prices are sinking again this morning, albeit with a little more conviction than yesterday’s lackadaisical wilting. Crude oil, gasoline, and diesel benchmarks are all trading >1% lower to start the day with headlines pointing to an across-the-board build in national inventories as the source for this morning’s bearish sentiment. The Department of Energy’s official report is due out at its regular time this morning (9:30am CDT).

WTI has broken below its 100-day moving average this morning as it fleshed out the downward trend that began early last month. While crossing this technical threshold may not be significant in and of itself (it happened multiple times back in February), the fact that it coincides with the weekly and monthly charts also breaking below a handful of their respective moving averages paints a pretty bearish picture in the short term. The door is open for prices to drop down to $75 per barrel in the next couple weeks.

Shortly after the EIA’s weekly data showed U.S. commercial crude inventories surpassing 2023 levels for the first time this year, their monthly short-term energy outlook is forecasting a fall back to the bottom end of the 5-year range by August due to increasing refinery runs over the period. However, afterward the administration expects a rise in inventories into 2025, citing continued production increases and loosening global markets hindering the incentive to send those excess barrels overseas. The agency also cut back their average gas and diesel price forecasts for the first time since February with the biggest reductions in the second and third quarter of this year.

The STEO also featured their famed price prediction for WTI, stating with 95% confidence that the price for crude oil will be between $40 and $140 through 2026.

Need a general indication of the global crude oil supply? Most headlines seem to be covering a shortage of a different type of oil, one that we haven’t turned into fuel (yet).

Click here to download a PDF of today's TACenergy Market Talk.

The Perceived Cooling Of Regional Tensions In The Middle East Area Attributing To The Quiet Start To Today’s Trading Session

The energy complex is drifting lower this morning with RBOB futures outpacing its counterparts, trading -.9% lower so far to start the day. The oils (WTI, Brent, heating) are down only .2%-.3% so far this morning.

The perceived cooling of regional tensions in the Middle East area attributing to the quiet start to today’s trading session, despite Israel’s seizure of an important border crossing. A ceasefire/hostage-release agreement was proposed Monday, and accepted by Hamas, but rejected by Israel as they seemingly pushed ahead with their Rafah offensive.

U.S. oil and natural gas production both hit record highs in 2023 and continue to rise in 2024, with oil output currently standing at 13.12 million barrels per day and January 2024 natural gas production slightly exceeding the previous year. With WTI currently changing hands at higher than year-ago levels, this increased production trend is expected to continue despite a decrease in rigs drilling for these resources.

Less than a week after the Senate Budget Committee’s hearing centered on the credibility of big oil’s climate preservation efforts, a major oil company was reported to have sold millions of carbon capture credits, without capturing any carbon. Fraud surrounding government subsidies to push climate-conscious fuel initiatives is nothing new, on a small scale, but it will be interesting to see how much (if any) of the book is thrown at a major refiner.

Today’s interesting read: sourcing hydrogen for refining.

Click here to download a PDF of today's TACenergy Market Talk.