Energy Prices Continue Choppy Trading Action

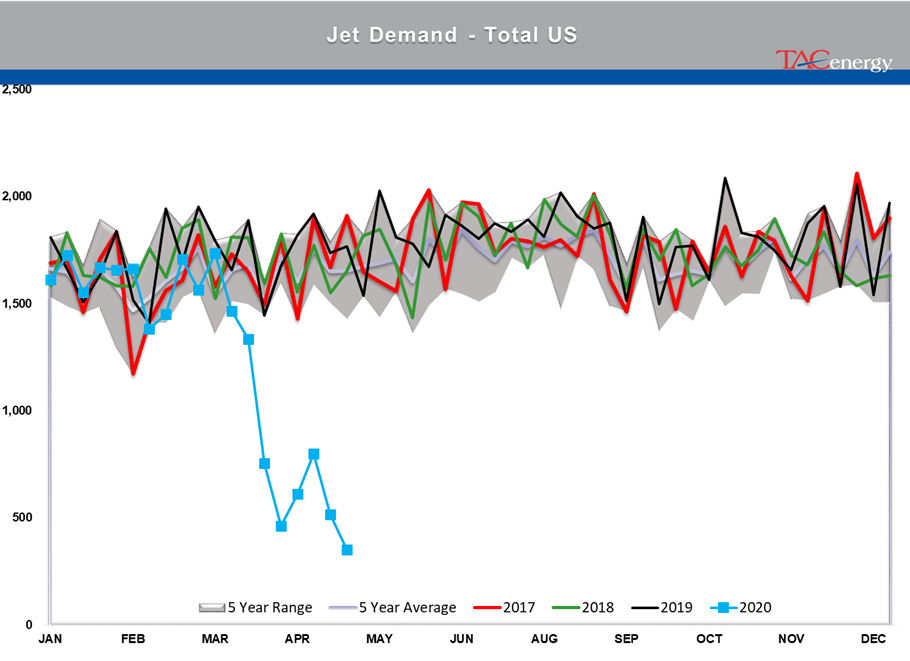

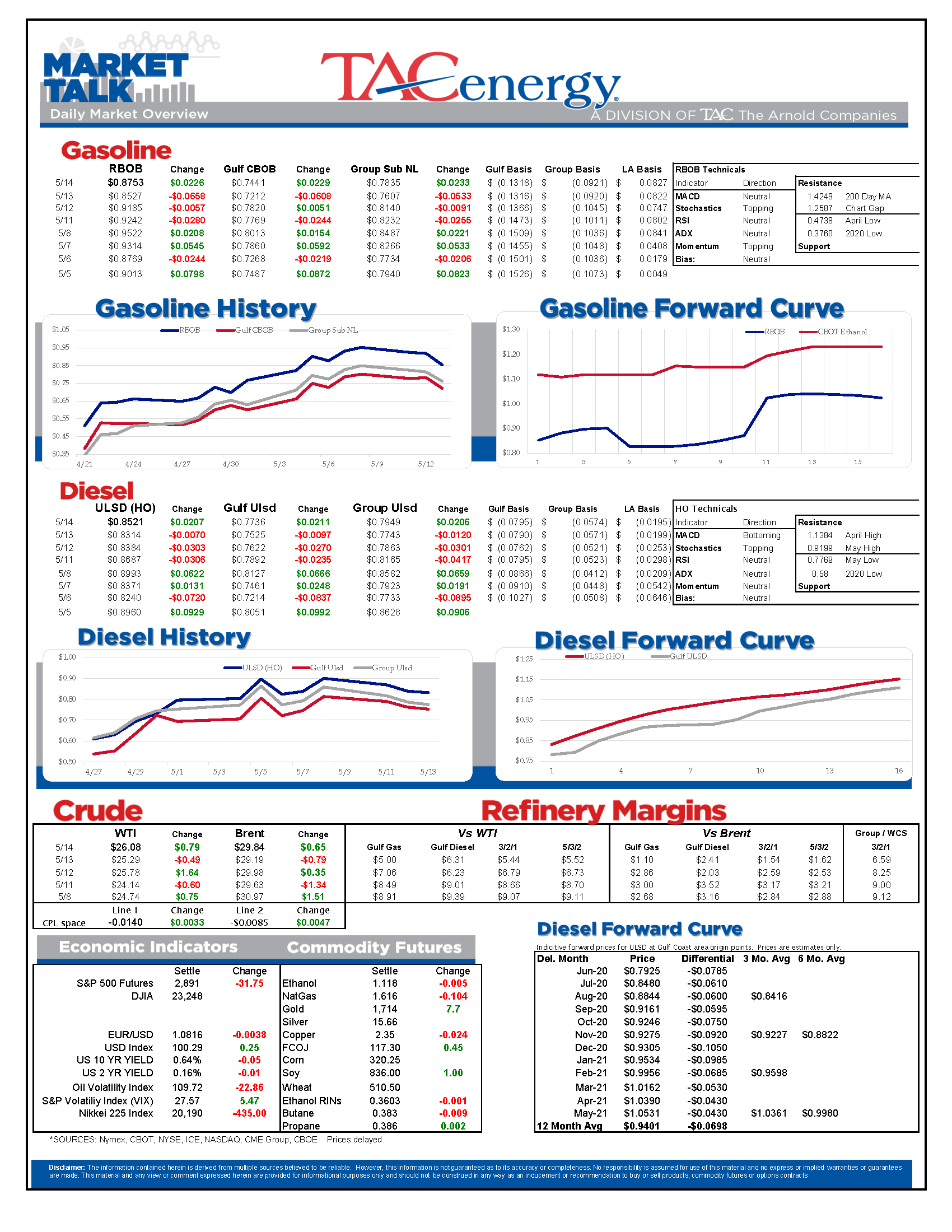

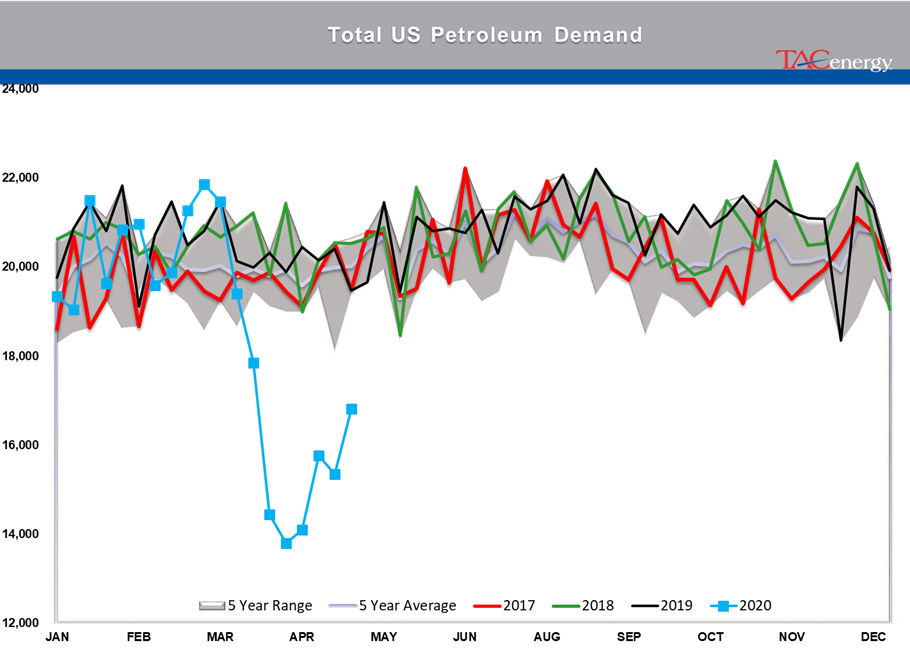

Energy prices continue their choppy trading action, starting Thursday’s action with modest gains, after another selloff Wednesday. The IEA’s monthly oil market report seems to be contributing to the optimism this morning, with a global demand forecast that’s less bad than previous estimates.

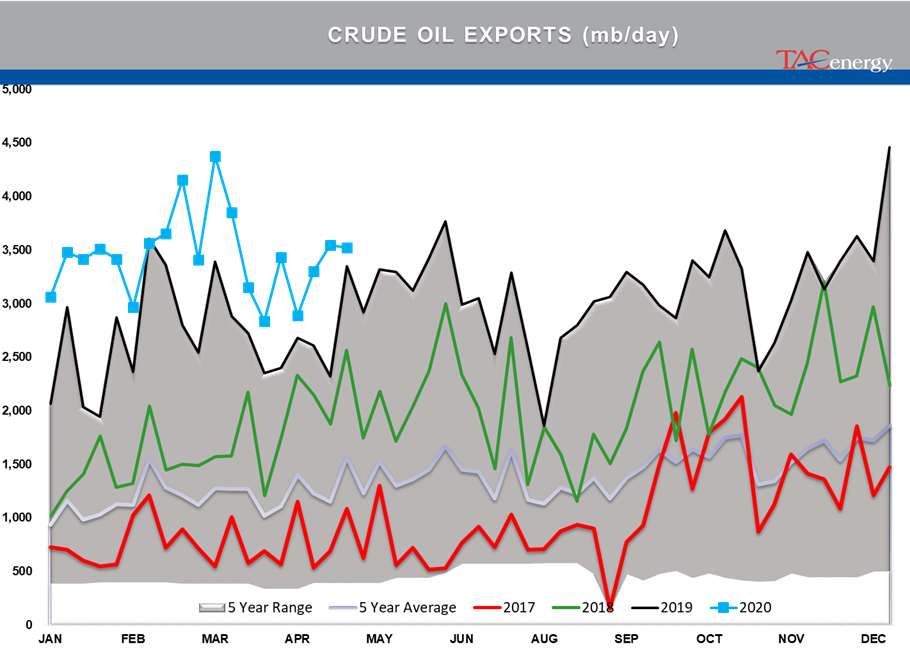

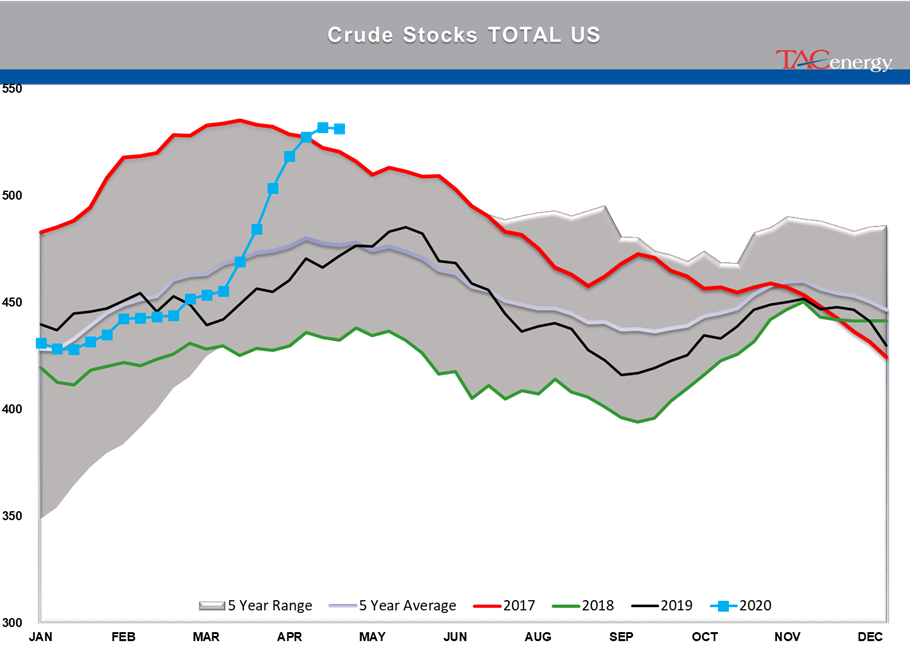

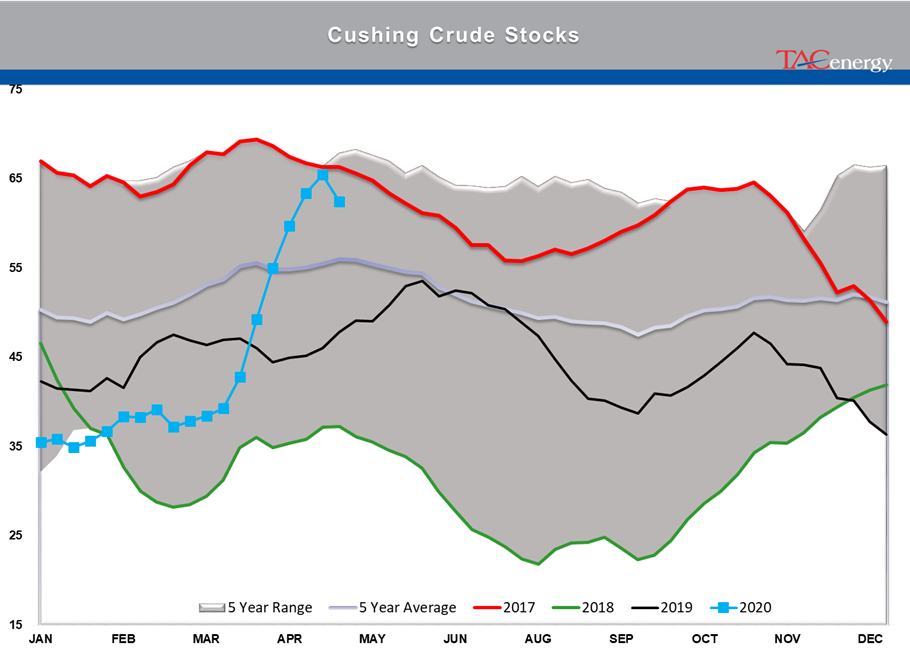

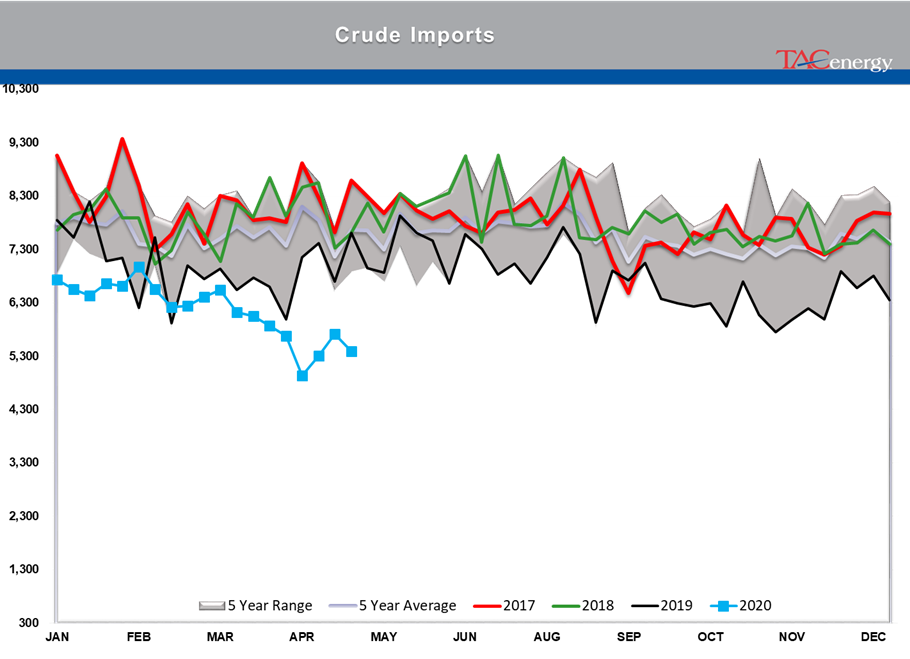

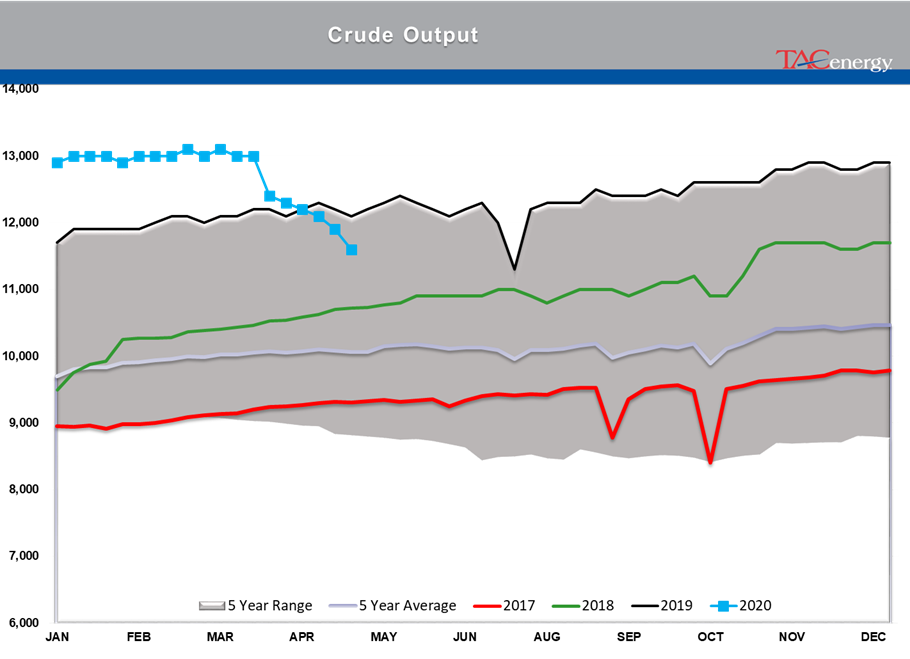

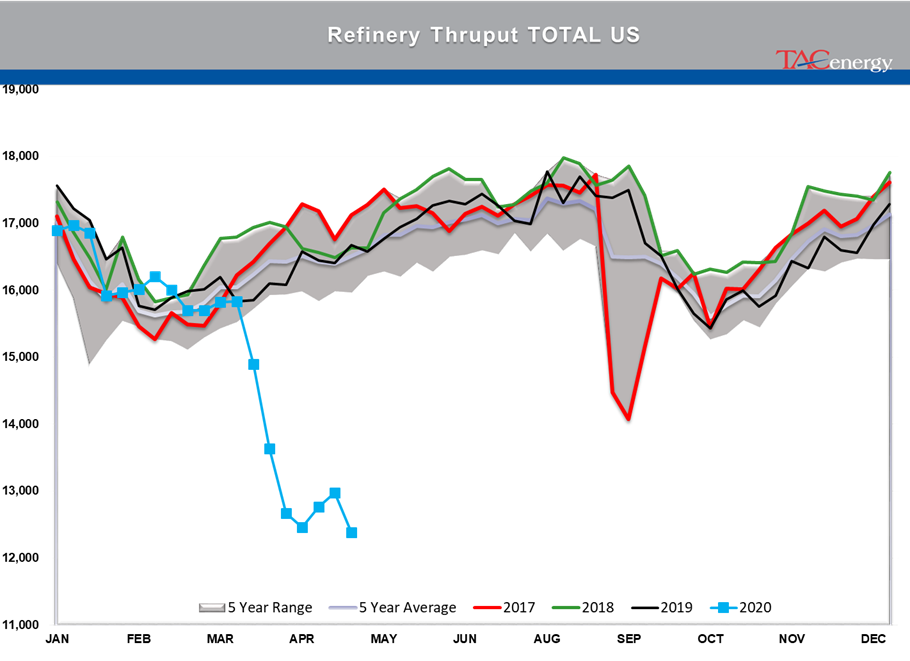

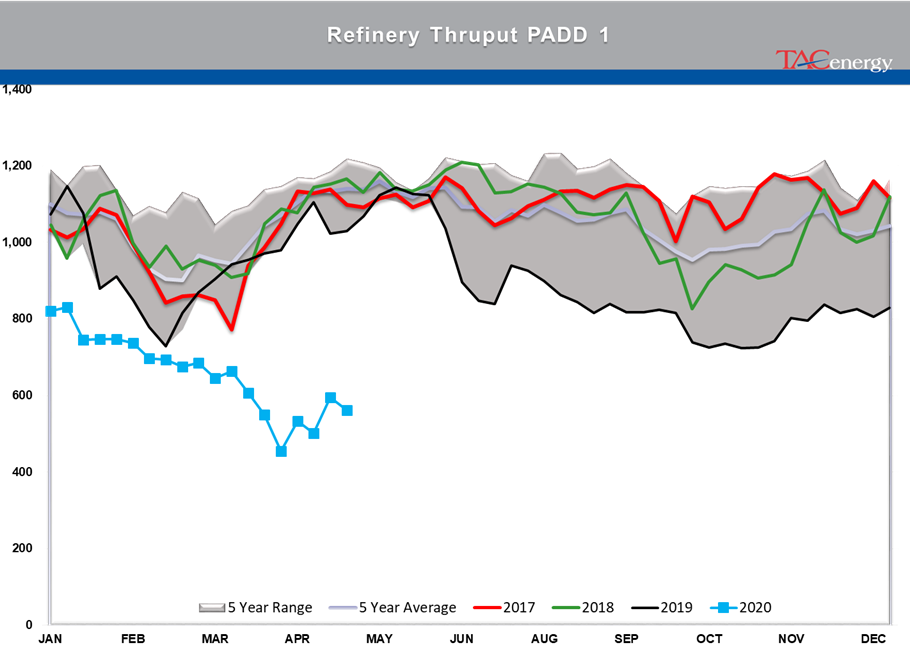

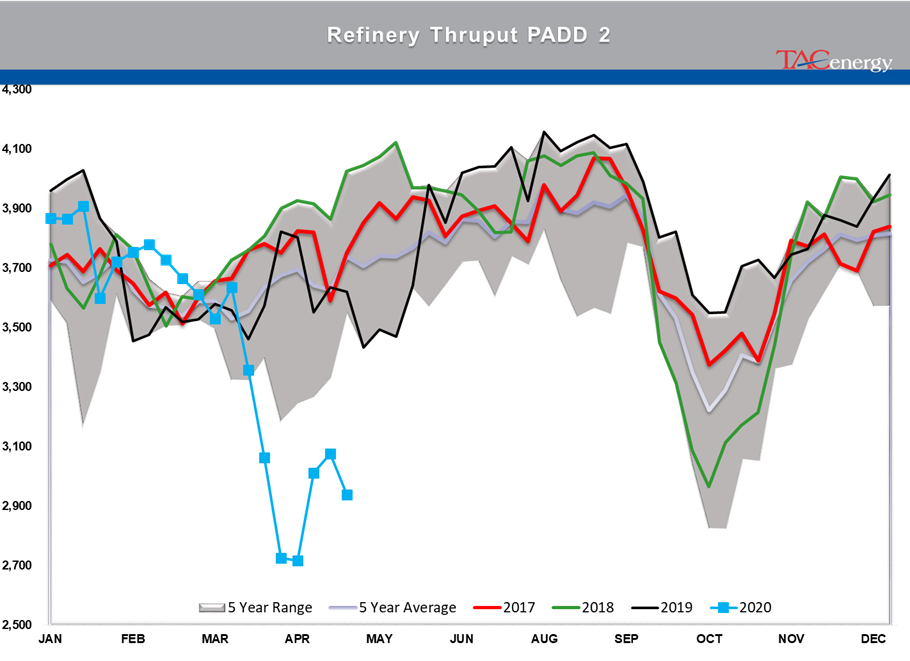

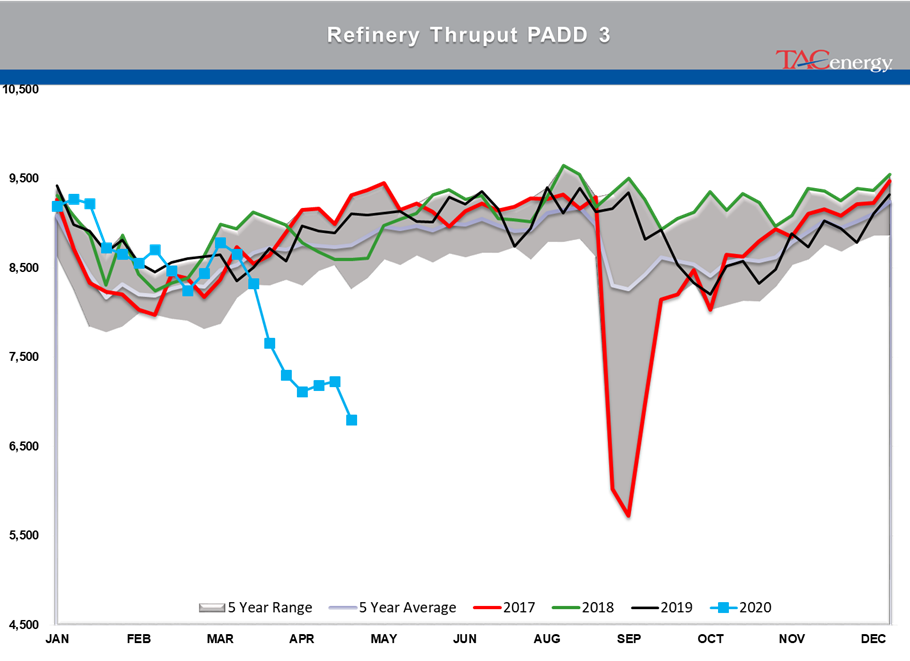

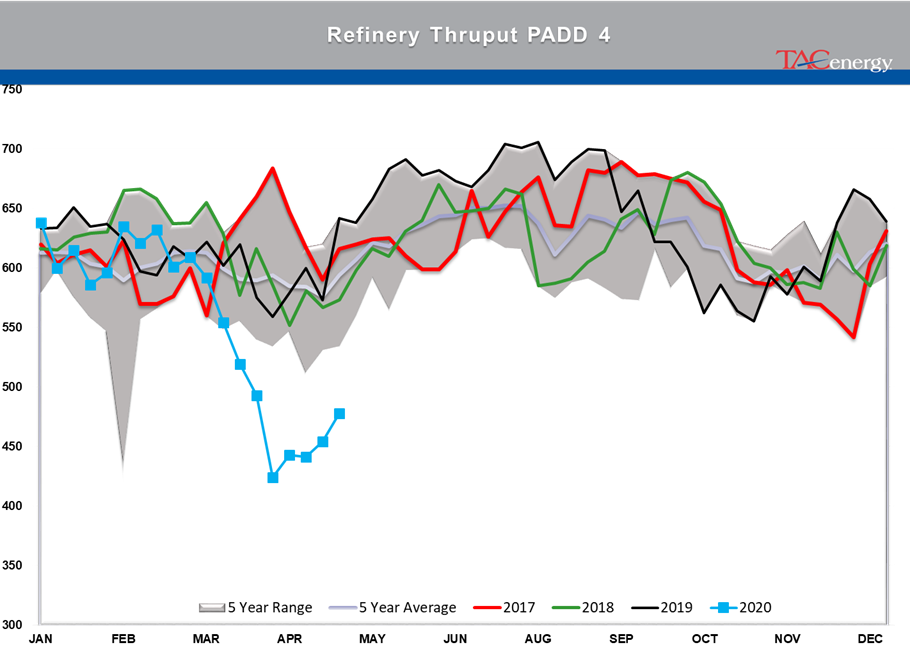

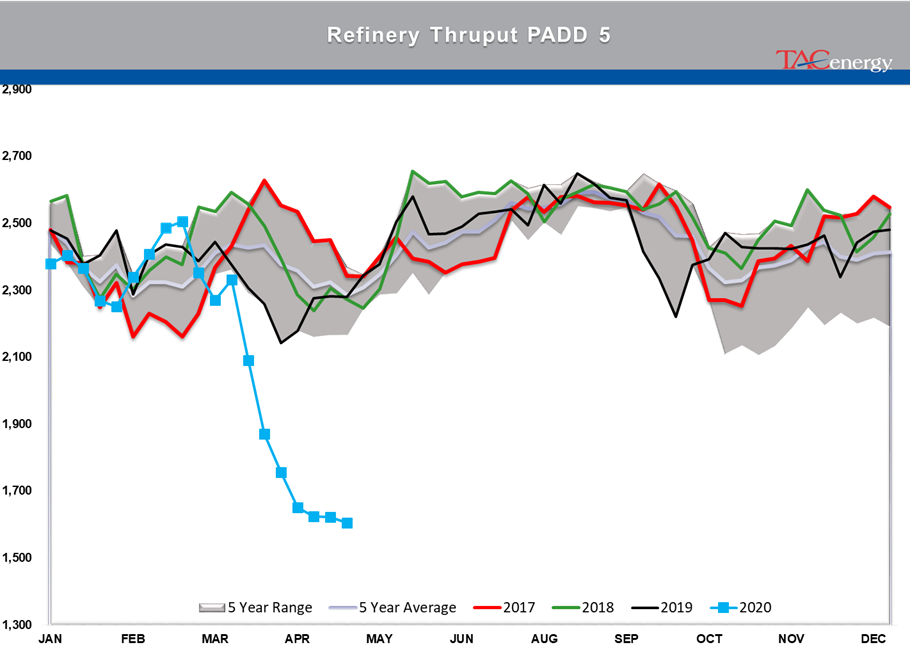

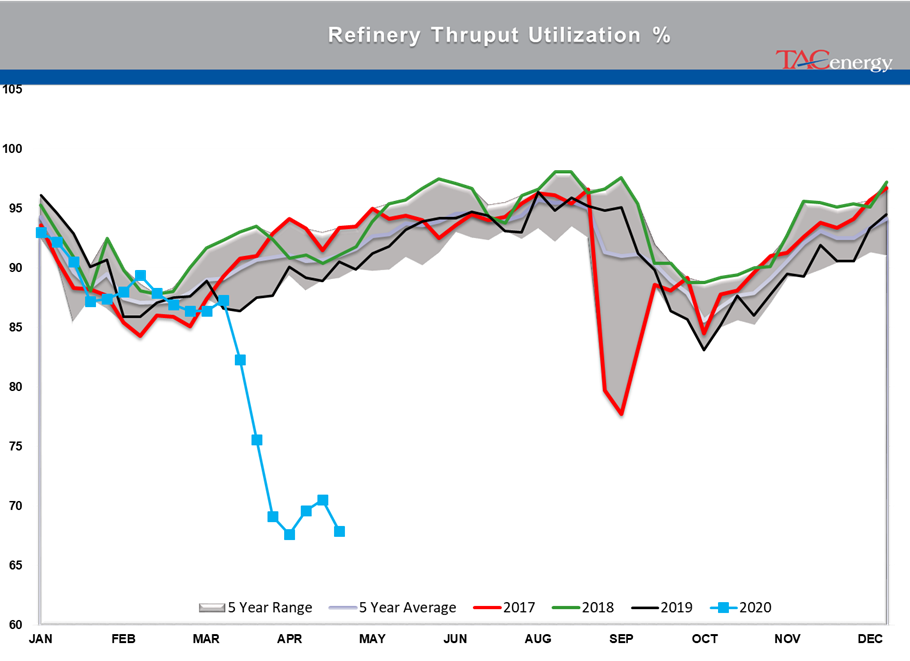

Yesterday’s DOE status report showed U.S. crude oil stocks declining for the first time in 16 weeks, as lower production and fewer imports were able to offset another drop in refinery runs, while export volumes of oil held relatively steady. Cushing, OK stocks dropped by more than one million barrels on the week, leaving inventories at the NYMEX delivery hub some seven million barrels below the record levels set in 2017, and suggesting the May contract plunge into negative territory last month was less about tankage, and more about amateur trading.

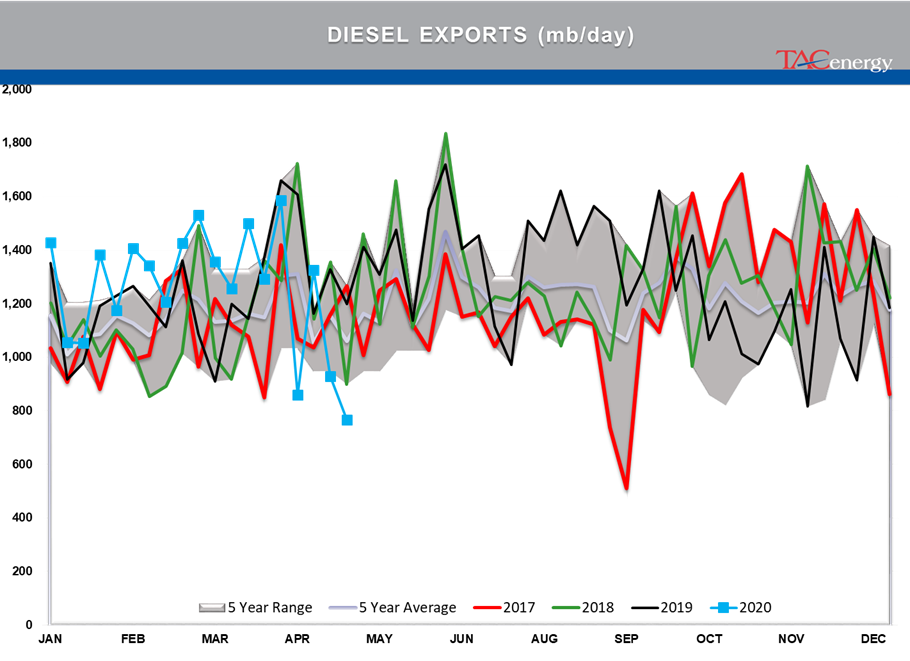

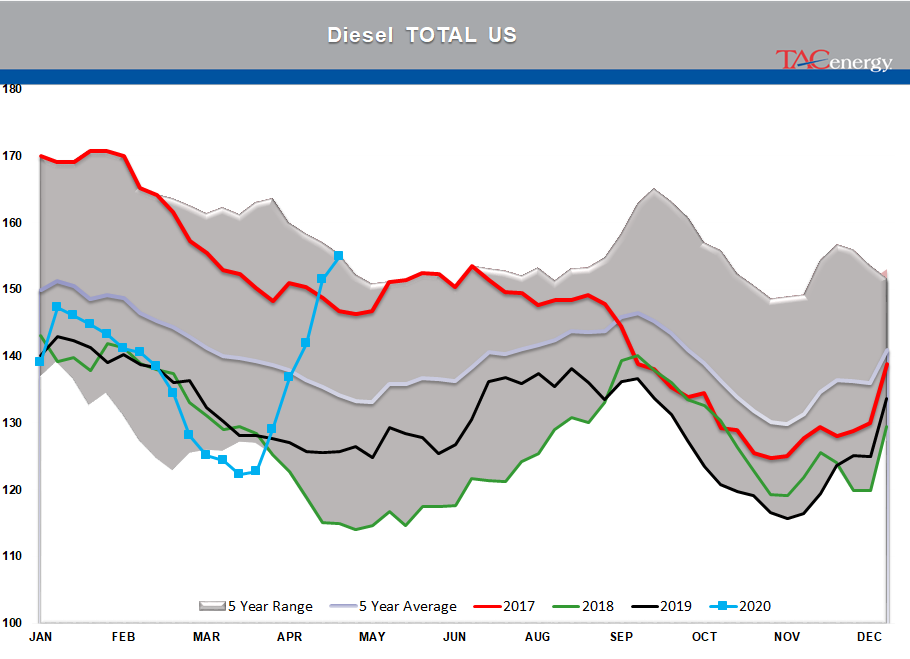

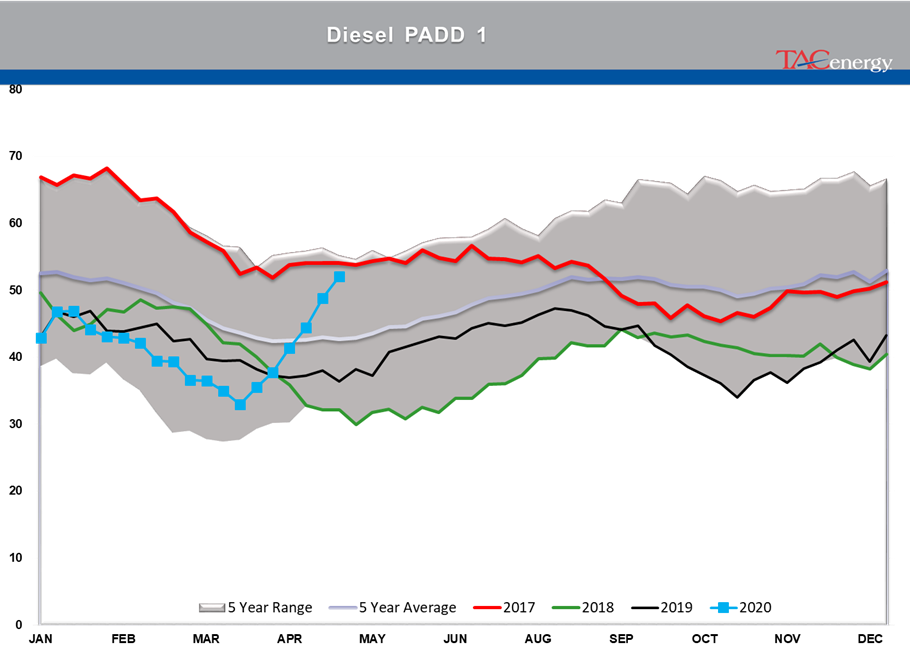

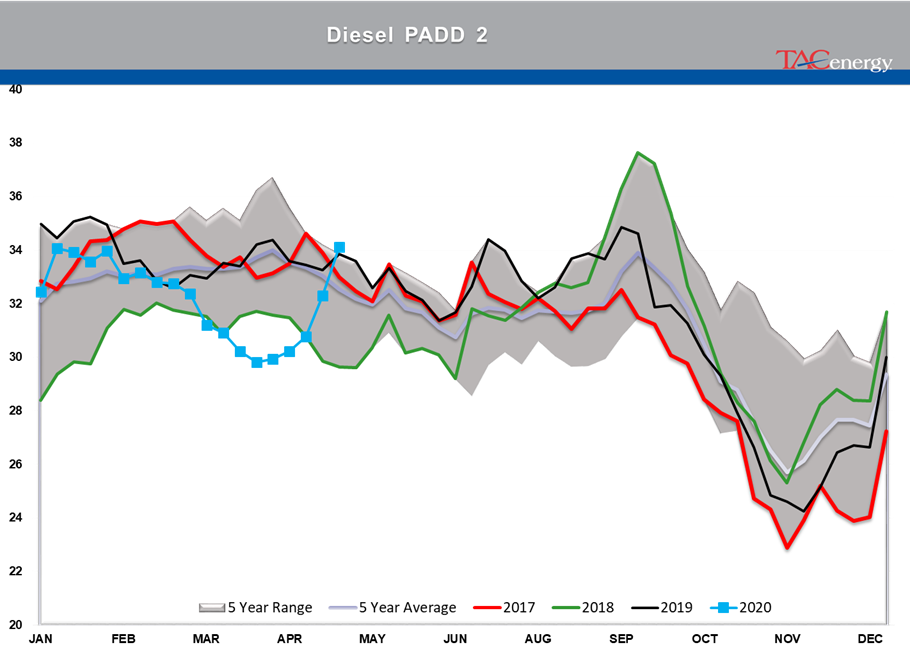

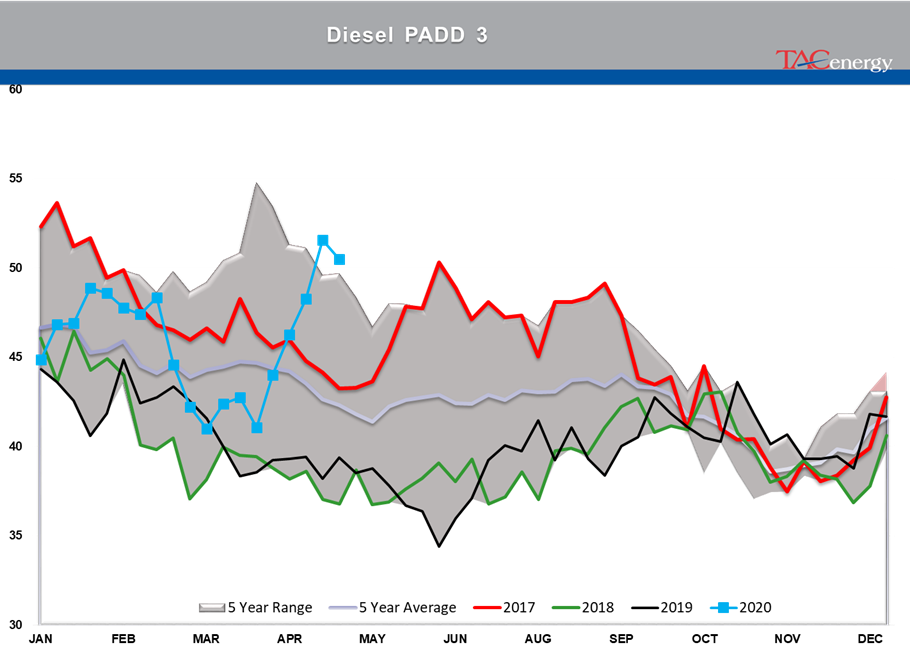

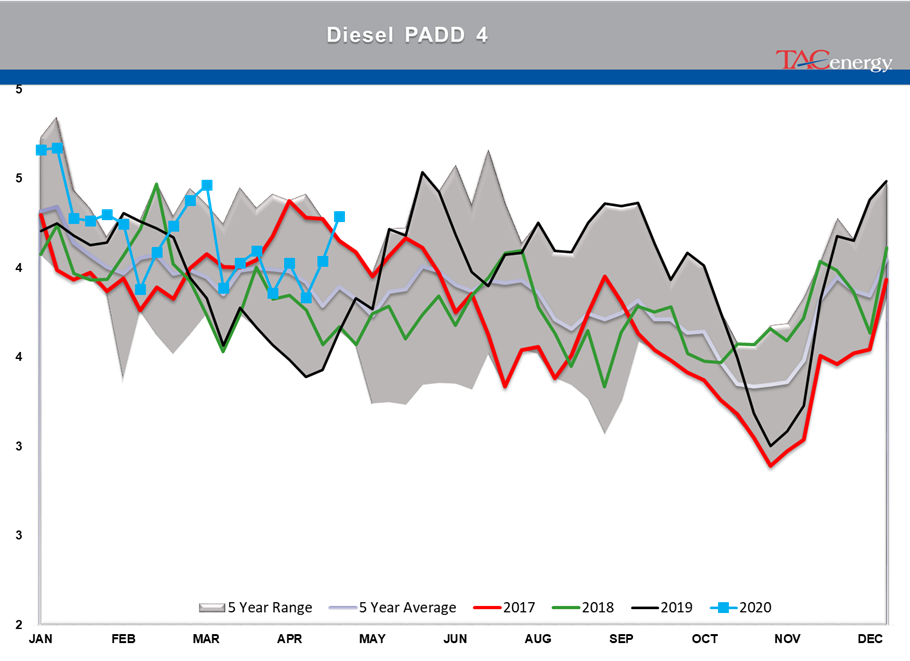

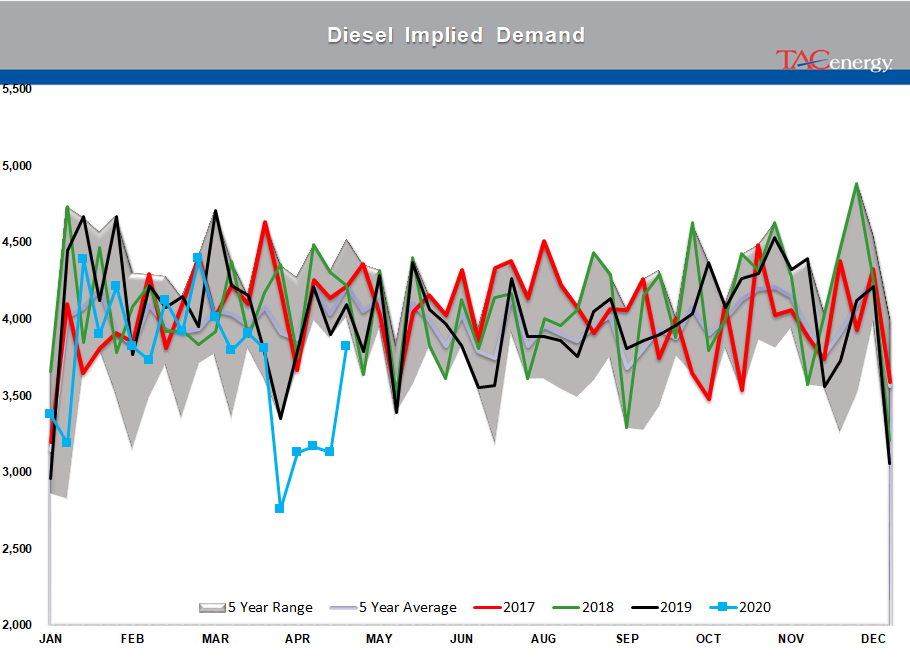

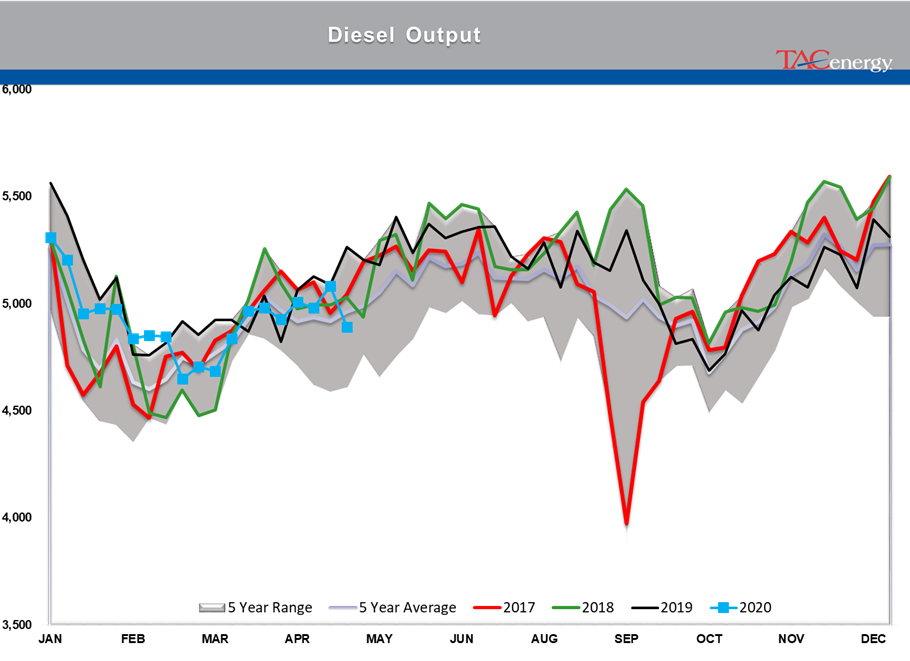

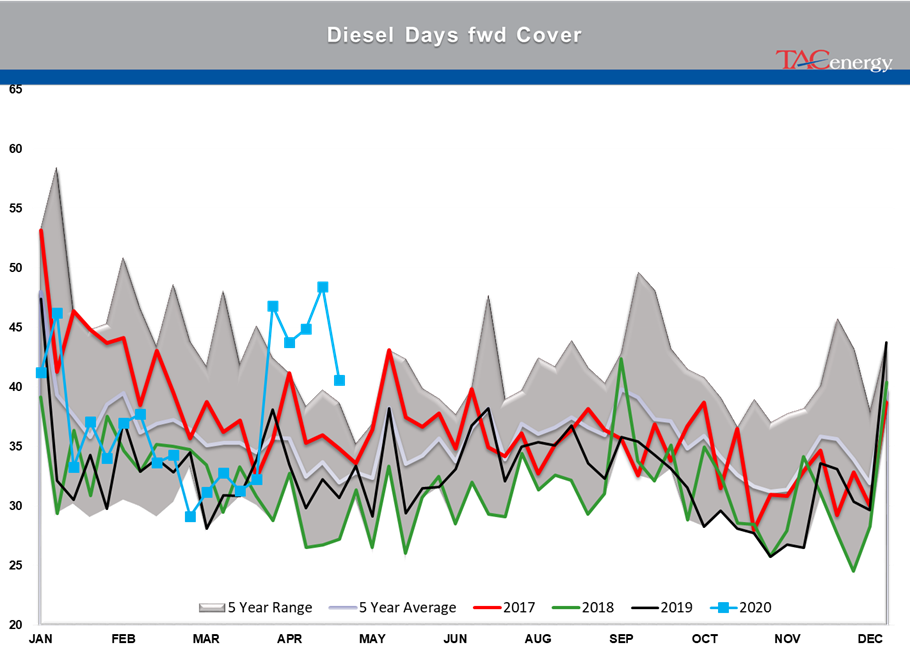

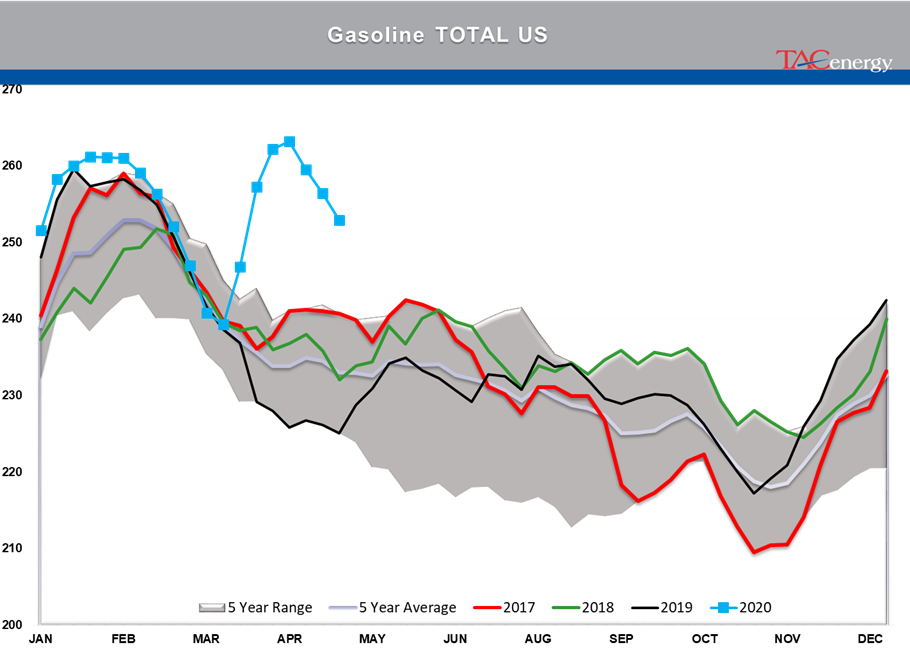

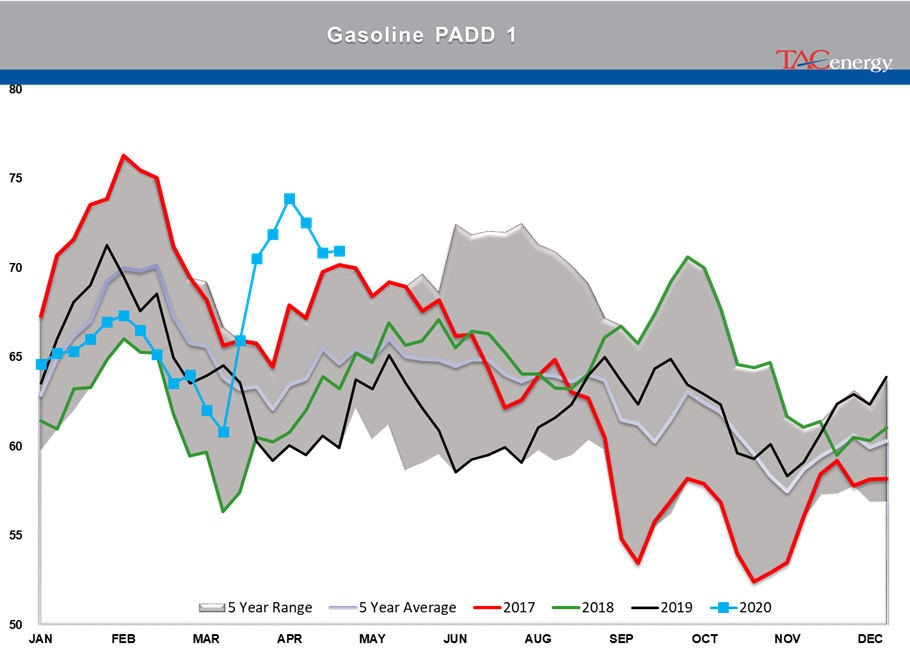

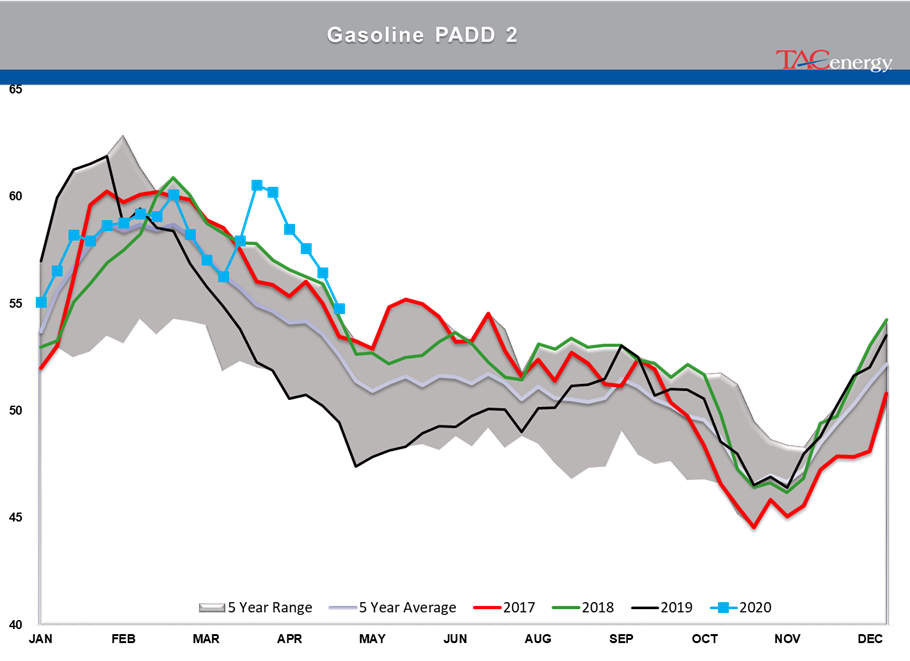

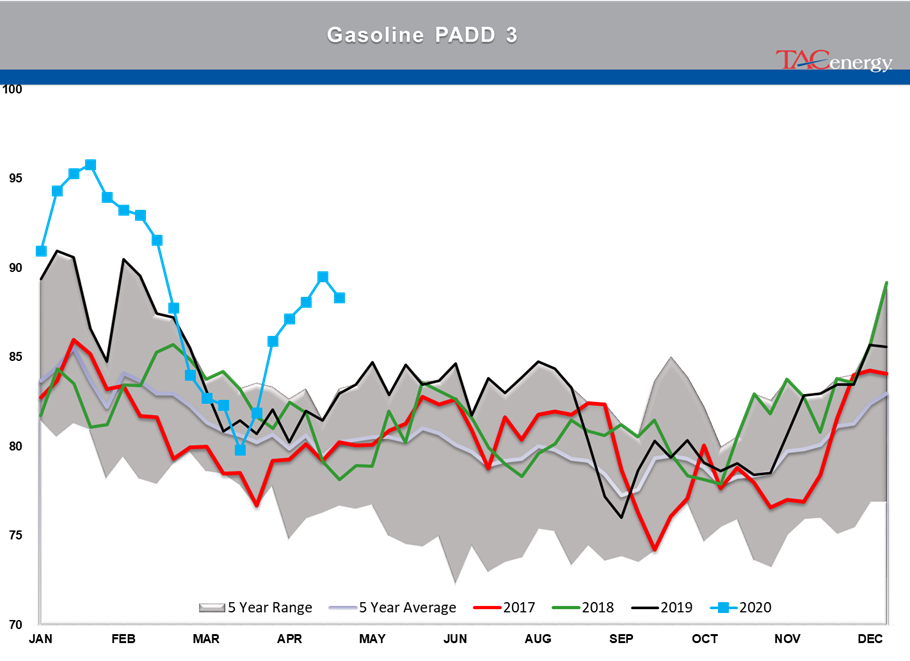

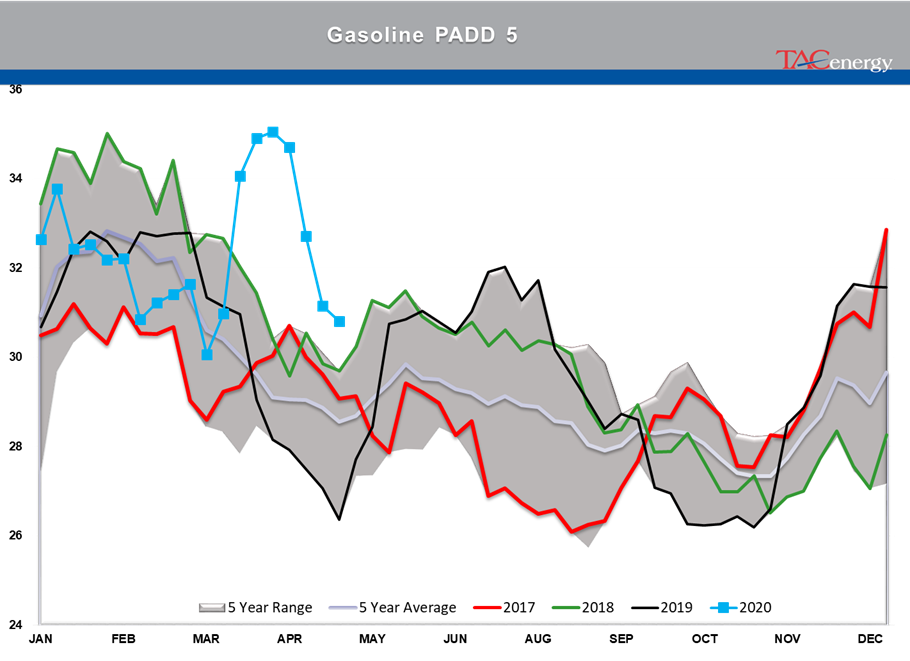

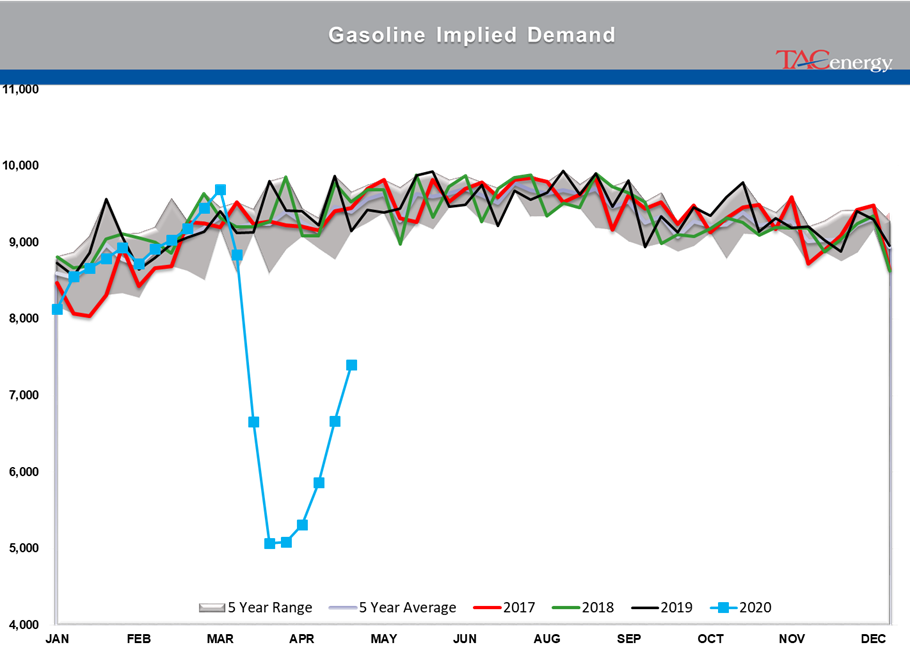

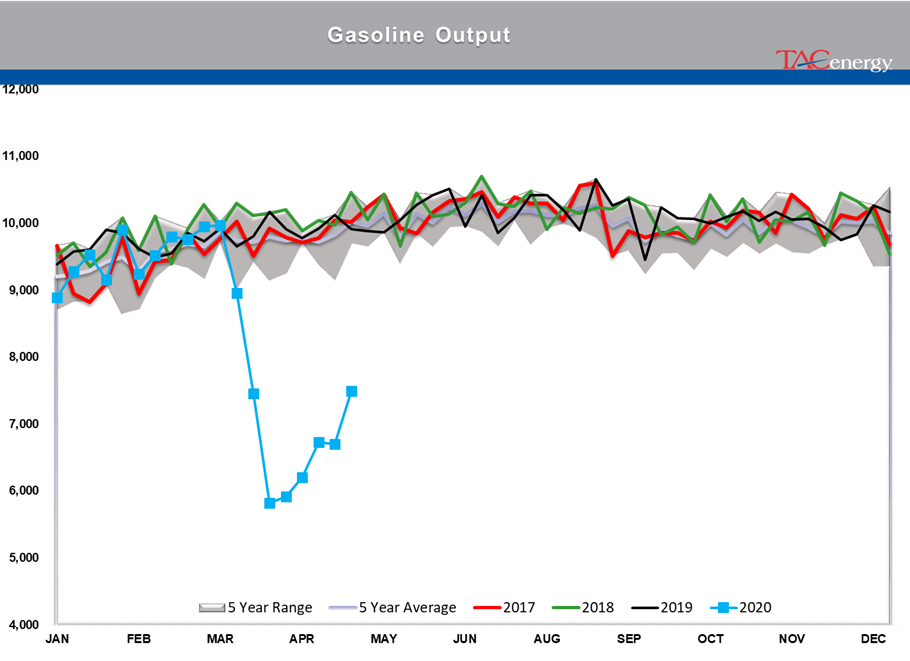

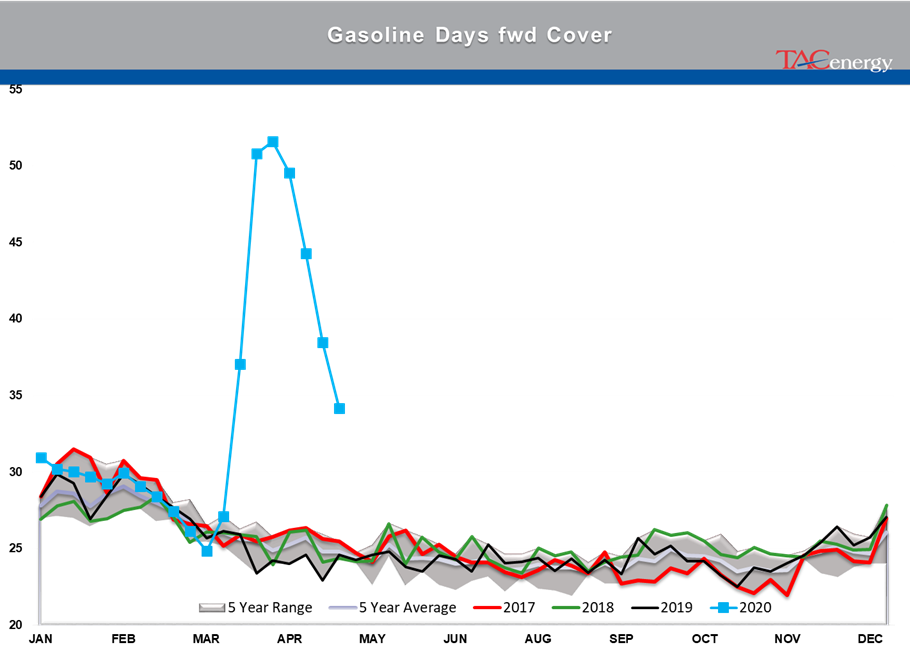

The DOE report also suggest the industry may have over-healed its gasoline containment issues from a month ago, and now left itself with diesel containment challenges. While several regional markets are now facing short term gasoline shortages due to demand picking back up more quickly than supply can keep up, diesel inventories have spiked from below their seasonal range five weeks ago, to above the top end of that range currently.

Right on cue, Colonial Pipeline filed for a temporary rule change with the FERC Wednesday, which would allow the pipeline operator to liquidate product that was shipped without a capable receipt destination at negative values if necessary, and charge the shipper back for any pipeline delays or shutdowns caused by “shipper misbehavior.” The filing cites merchant storage along its destinations filling to capacity and an uptick in product being shipped without a valid destination, forcing the company to auction off more abandoned product.

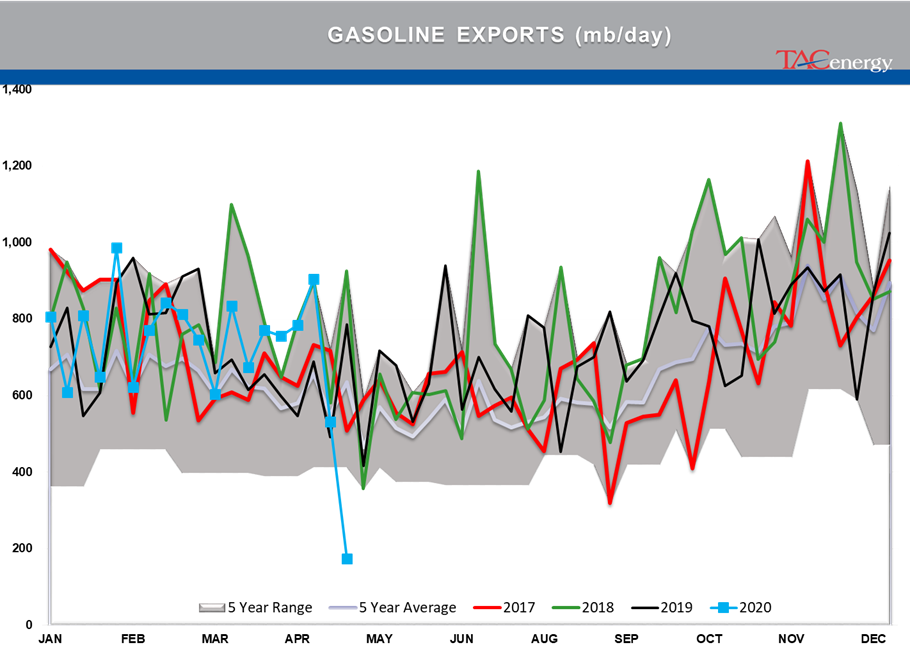

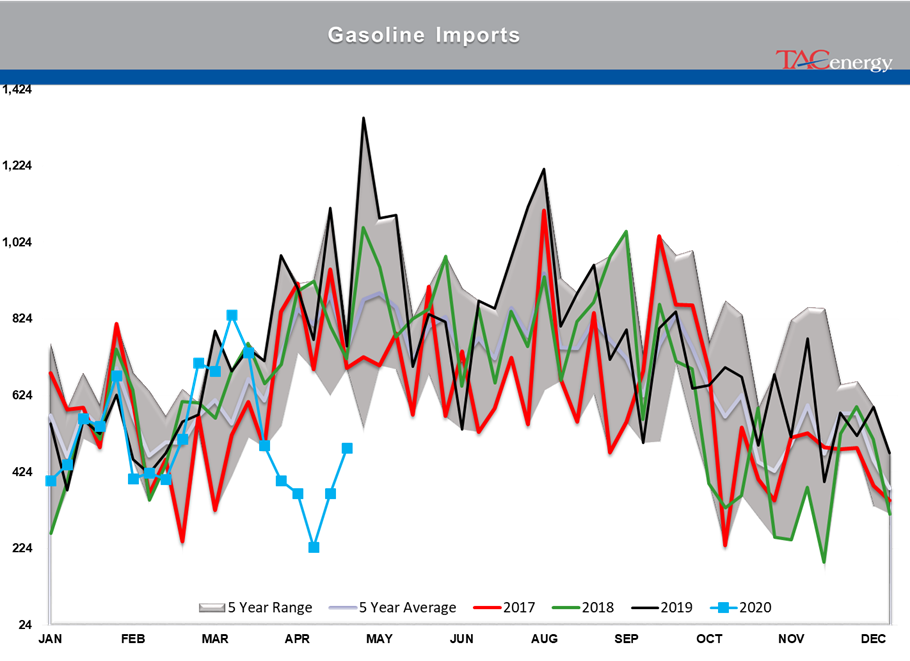

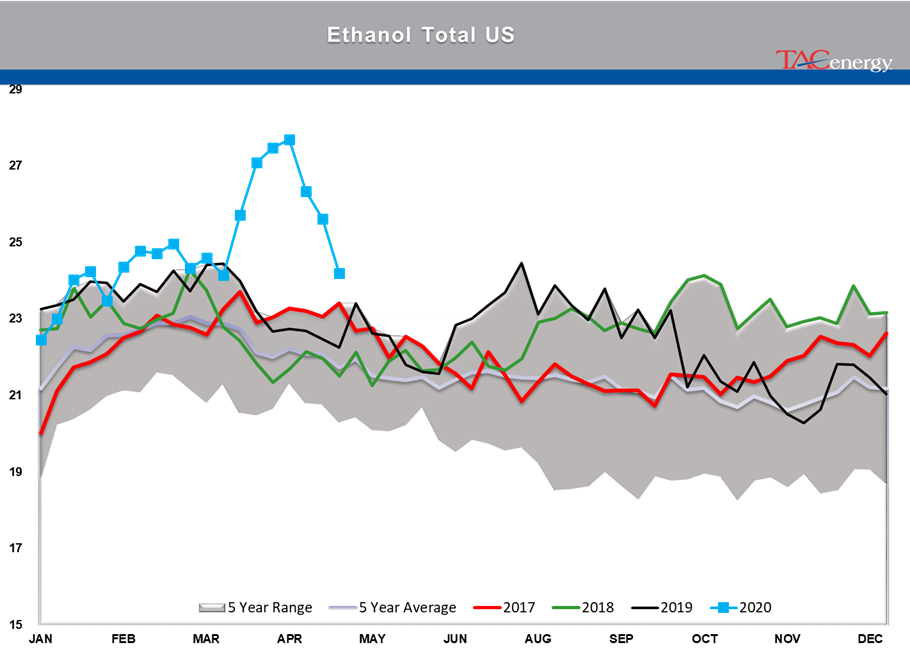

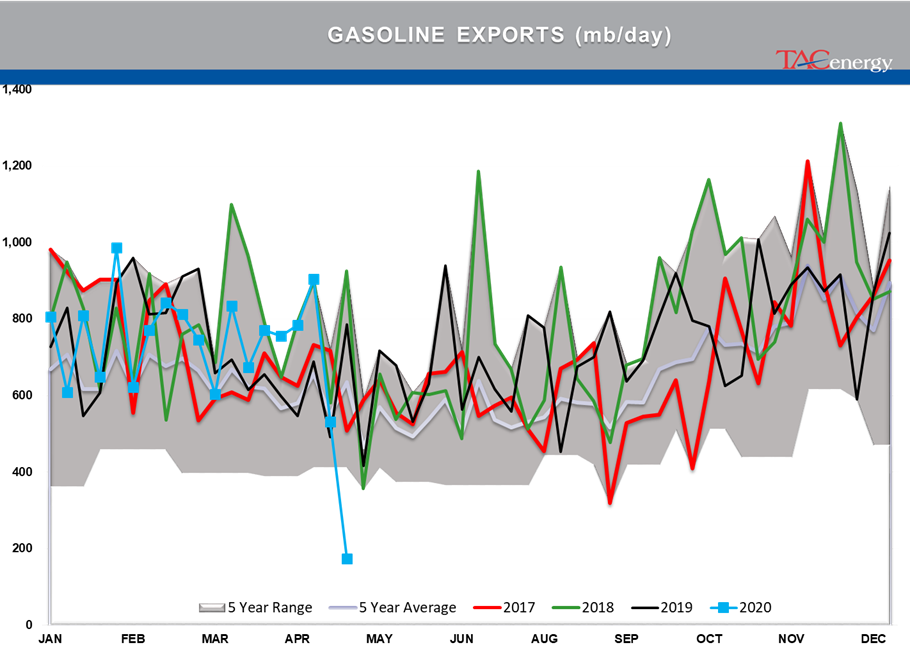

So why did gasoline prices drop seven cents on a day when inventories were reported to decline for a third week and U.S. demand ticked up by eleven percent? It’s hard to make a strong fundamental argument based on the headline data – although gasoline output was up more than demand on the week, and exports dropped sharply for a second week. With U.S. refiners becoming more dependent on exports in recent years to balance the fundamental equation, last week’s plunge to new five-year lows for gasoline exports could spell trouble longer term if it doesn’t reverse course soon. In addition to the export and production swings, there’s a technical argument for the heavy wave of selling once RBOB futures failed to break resistance and formed a short term rounding top on the chart. That technical weakness suggests that unless RBOB can get back above $.90 to end the week, there’s more selling likely in the back half of May.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

Energy Markets Are Pointing Modestly Higher To Start Friday’s Session

Energy markets are pointing modestly higher to start Friday’s session, in a meager attempt at a recovery rally at the end of what would be the worst week in over two months if prices settle near current values. The liquidation of speculative bets placed on higher energy prices ahead of the direct conflict between Israel and Iran continues to appear to be the driver of the weakness, and we’ll have to wait and see if this modest bounce is a sign that the liquidation is over, or just a pause before it picks up again. Most contracts remain in a precarious technical position with the potential for a slide towards $70 for WTI and $2.20 for both refined products if the buyers don’t get serious soon.

Stocks are pointing sharply higher after a slowdown in job growth reported in the April Non-Farm payroll report. The BLS reported an increase of 175,000 jobs for the month, down sharply from the 315,000 jobs added in March, and the February & March estimates were revised down a combined 22,000. Both the “official” (U-3) and “real” (U-6) unemployment rates ticked up by .1% to 3.9% and 7.4% respectively. The immediate positive reaction to negative news suggest that the bad news is good news low-interest-rate junkies believe this may help the FED’s dilemma of the US economy being too strong to cut rates. The big jump in equities has not seemed to spill over into energy contracts yet, as crude and refined product contracts changed very little following the report.

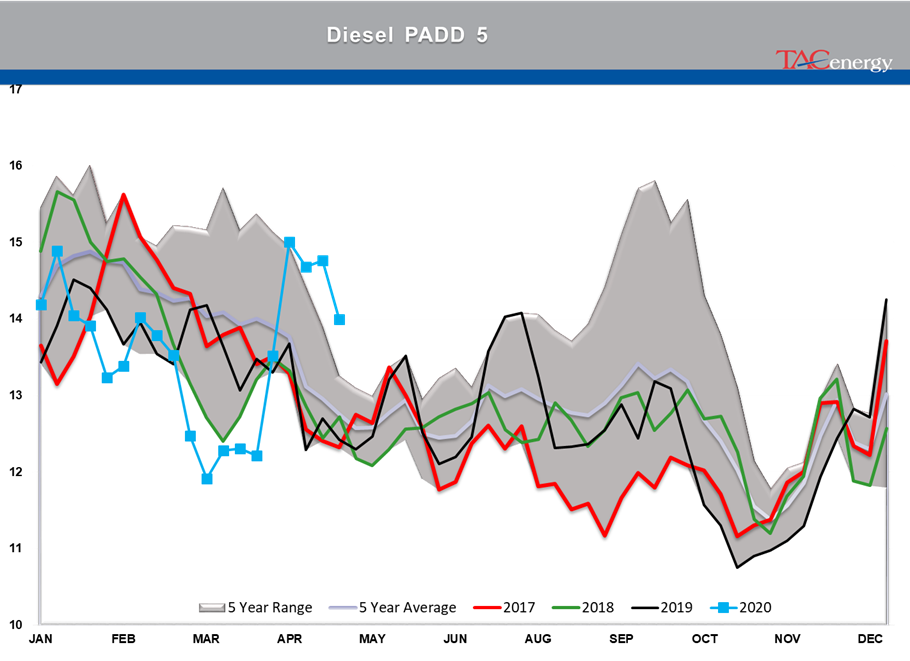

San Francisco diesel basis spiked 15 cents Thursday to reach the highest level of any market in the country so far this year at 35 cents over prompt futures. While there aren’t yet any refinery upsets reported to blame the spike on, PBF is undergoing planned maintenance at its Martinez facility, and of course P66 just finished converting its Rodeo plant to RD after Marathon converted its Martinez facility in the past couple of years, meaning there are at most only 2 out of the previous 5 refineries in the region operating near capacity these days. The question now is how quickly barrels can shift north from Southern California which continues to show signs of a supply glut with weak basis values and spot to rack spreads.

PBF continued the trend of Q1 refinery earnings that were sharply lower, but still healthy by longer-term historical standards. The company noted that its Saint Bernard (the parish, not the dog) Renewables facility co-processing at its Chalmette refinery had received provisional approval from CARB to lower its CI scores and help improve the amount of LCFS subsidies it can receive. That facility is operating at 18mb/day which is roughly 86% of its capacity.

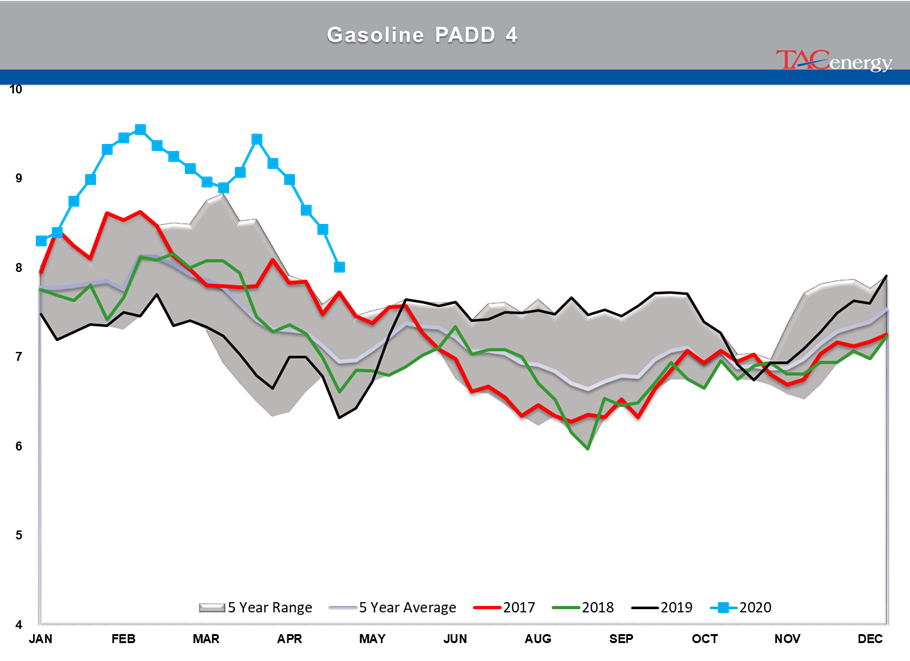

Cenovus highlighted the restart of its Toledo and Superior refineries in improved refinery run rates in Q1 2024 vs Q1 2023 and noted that it had ramped up production at units that were slowed down for economic reasons in December and January (you may remember this as the time when midcontinent basis values were trading 50 cents/gallon below futures). The company did note that the January deep freeze slowed operations at Superior, but did not mention any change in operating rates despite numerous upsets at its 50% owned Borger refinery.

Dress rehearsal for a busy hurricane season? So far there are no reports of refinery issues caused by the flooding in the Houston area this week. At this point, most of the flooding appears to be far to the north of the refining hubs on the Gulf Coast but with more storms in the forecast and 88 counties already declaring disaster status, this will be something to watch for the next few days.

Click here to download a PDF of today's TACenergy Market Talk.

Crude Oil Inventories Climbed Above Year-Ago Levels For The First Time In 2024

Sell by May then go away.

The old trading adage looked good for energy markets in 2024 as the new month started off with the biggest daily sell-off of the year so far. WTI and ULSD contracts are now in “rally or else” mode on the charts with sharply lower prices a strong possibility now that technical support layers have broken down. RBOB doesn’t look quite as bearish on the charts, but seasonal factors will now act as a headwind as we’re well into the spring peaking window for gasoline prices, and we’ve already seen a 27 cent drop from the highs. If RBOB can hold above $2.50 there’s a chance to avoid a larger selloff, but if not, a run towards $2.20 for both gasoline and diesel looks likely in the months ahead.

The selling picked up steam following the DOE’s weekly report Wednesday, even though the inventory changes were fairly small. Crude oil inventories continue their steady build and climbed above year-ago levels for the first time in 2024. Demand for refined products remains sluggish, even after accounting for the RD consumption that’s still not in the weekly reports, and most PADDs are following a typical seasonal inventory trend. The Gulf Coast saw a healthy build in diesel inventories last week as the export market slowed for a 3rd straight week. Refinery runs dipped modestly last week following a handful of upsets across the country, but overall rates remain near normal levels for this time of year.

The Transmountain pipeline expansion began operations yesterday, completing a 12-year saga that has the potential to materially change refining economics for plants in the US that relied heavily on discounted Canadian crude to turn profits over the past decade.

The P66 Borger refinery reported another operational upset Monday that lasted a full 24 hours impacting a sulfur recovery unit. Last week the company highlighted how the plant’s fire department helped the surrounding area when the largest wildfire in state history came within feet of the facility.

The EPA approved a new model to determine life cycle carbon intensity scores this week, which cracks open the door for things like ethanol to SAF, which were previously deemed to not reduce emissions enough to qualify for government subsidies. The new model would require improved farming techniques like no-till, cover crop planting and using higher efficiency nitrogen fertilizer to limit the damage done by farms that no longer rotate crops due to the ethanol mandates. Whether or not the theoretical ability to produce SAF comes to fruition in the coming years thanks to the increased tax credit potential will be a key pivot point for some markets that find themselves with too much RD today, but could see those supplies transition to aviation demand.

The FED continues to throw cold water on anyone hoping for a near term cut in interest rates. The FOMC held rates steady as expected Wednesday, but also highlighted the struggles with stubbornly high inflation. The CME’s Fedwatch tool gave 58% odds of at least one rate cut by September before the announcement, and those odds have slipped modestly to 54% this morning.