Fear Has Taken Hold Of Energy And Equity Markets

Fear has taken hold of energy and equity markets overnight as the Trade Truce between the US & China is threatened by the arrest of a Chinese CFO for violating US sanctions (allegedly) and the Saudi energy minister is suggesting that there may be no OPEC deal this week.

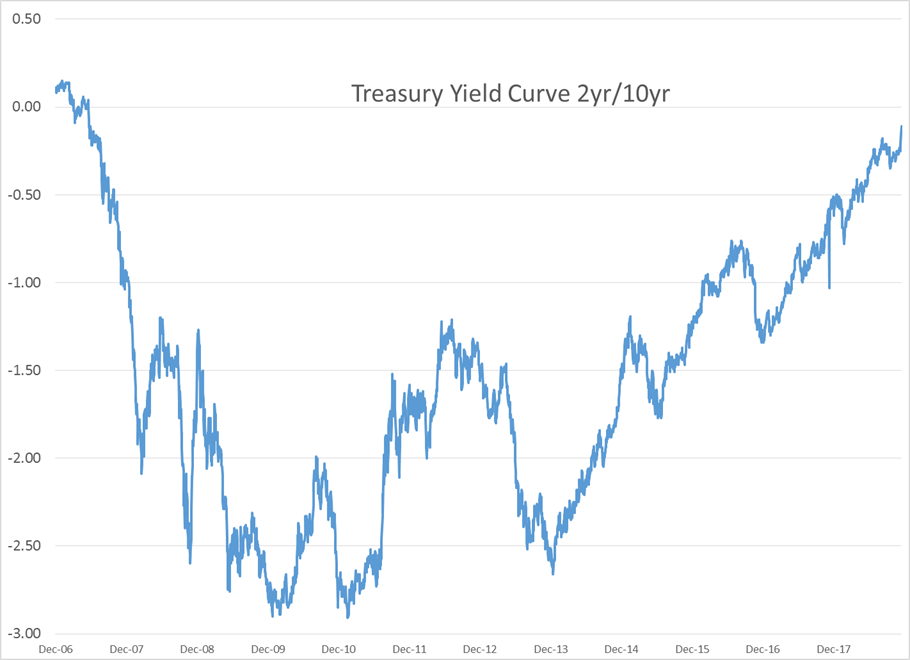

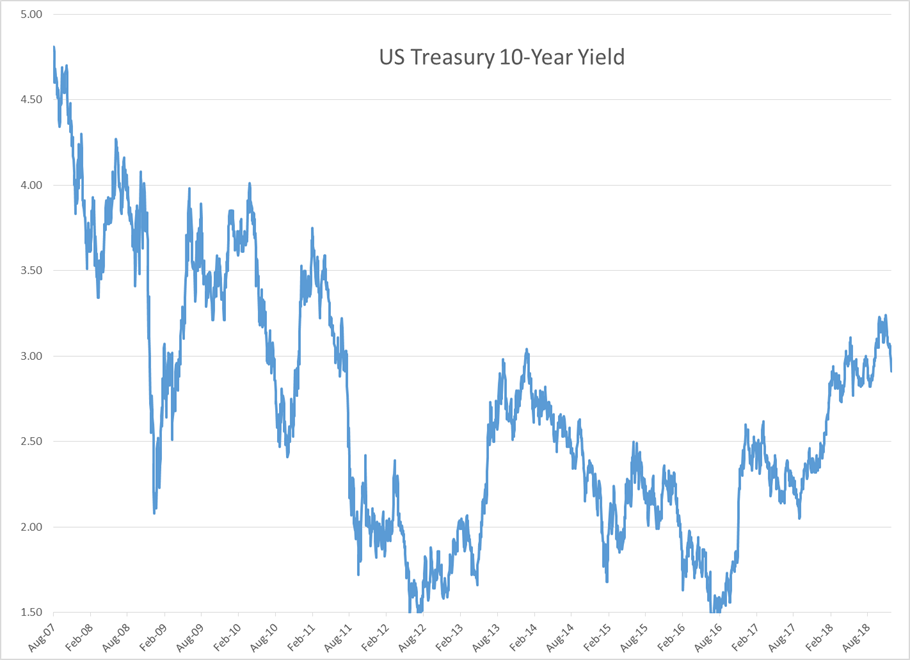

Also weighing on markets around the world is the yield curve on US treasuries has been tightening, which is an often cited early warning indicator of a pending economic slowdown. As the charts below show, the spread between 2 & 10 year treasury rates reached its smallest discounts in more than 11 years. If you don’t remember, ask a neighbor what the economy did after 2007 and that may help explain some of the fear trade we’re witnessing this morning.

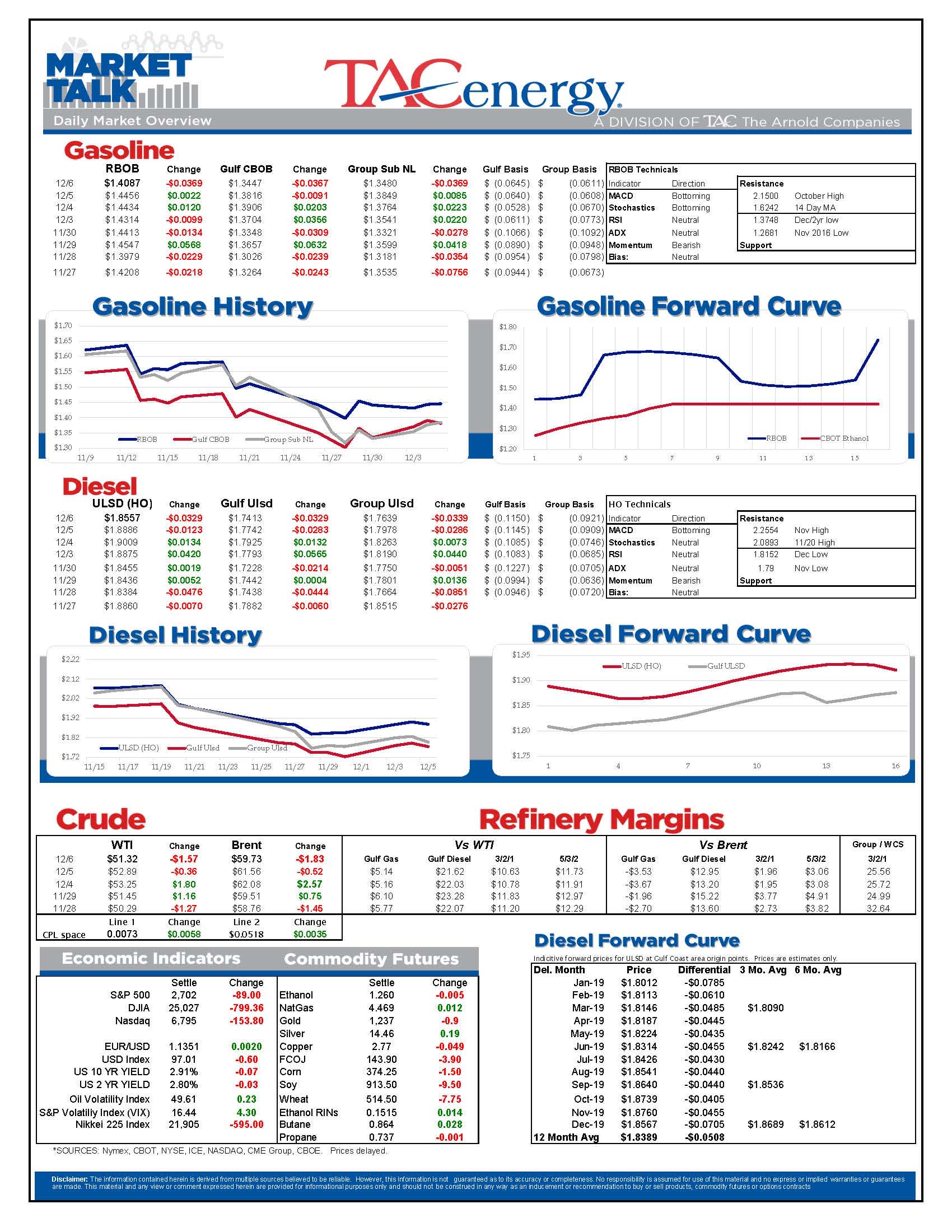

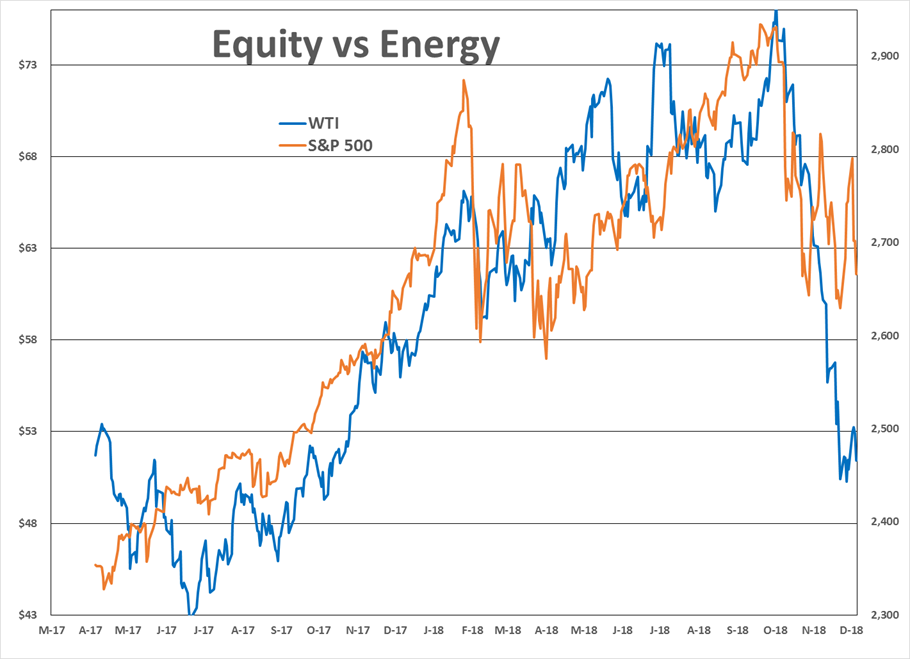

US equity futures are trading down around 1.5% so far today, while oil & product futures are down 2-3% at the moment, after being down nearly twice that amount around 4:30am. RBOB gasoline future briefly dipped to fresh 2-year lows during the overnight sell-off, while the rest of the energy complex is still holding above the lows set last week.

This week’s price action of 3 early buying sprees that fizzled into the close, followed by a 4th session that’s started with a heavy sell-off leaves the potential for a bearish continuation pattern on daily & weekly charts. If the bottom end of the past week’s range (set by November’s low trades) breaks down, there’s a strong case that the bear market will continue, and could have another 15-20% of downside based on the reverse flag formation on the charts. It’s too soon to say this formation is going to happen, as we’ll need to see WTI break (and hold) below $49 and Brent drop below $57, some $2.5/barrel lower than current levels before it’s confirmed.

Of course, even if OPEC doesn’t come to a resolution today, there’s still a chance that there could be an agreement announced tomorrow, when cartel members meet with Russia to discuss their extended output cut arrangement. If you’re wondering just how much influence has on OPEC, given that it’s not a member of the cartel, take a look at the birthday letter the OPEC secretary general sent to the Russian president 2 months ago.

The weekly status report from the Department of Energy’s EIA is due out at 11am Eastern.

Latest Posts

Energy Futures Are Drifting Quietly Higher This Morning

Refined Products Holding Close To Break Even While Oil Prices Are Losing Just Under 1%

Markets Rallying To End The Week, Diesel Prices Lead The Way For Energy

Energy Markets Rally Again Thursday After A Choppy Wednesday Session

Social Media

News & Views

View All

Energy Futures Are Drifting Quietly Higher This Morning

Energy futures are drifting quietly higher this morning as a new round of hostage negotiations between Israel and Hamas seem to show relative promise. It seems the market is focusing on the prospect of cooler heads prevailing, rather than the pervasive rocket/drone exchanges, the latest of which took place over Israel’s northern border.

A warmer-than-expected winter depressed diesel demand and, likewise, distillate refinery margins, which has dropped to its lowest level since the beginning of 2022. The ULSD forward curve has shifted into contango (carry) over the past month as traders seek to store their diesel inventories and hope for a pickup in demand, domestic or otherwise.

The DOE announced it had continued rebuilding it’s Strategic Petroleum Reserve this month, noting the addition of 2.3 million barrels of crude so far in April. Depending on what the private sector reported for last week, Wednesday’s DOE report may put current national crude oil inventories (include those of the SPR) above the year’s previous levels, something we haven’t seen since April of 2022, two months after Ukraine war began.

The latest in the Dangote Refinery Saga: Credit stall-out, rising oil prices, and currency exchange.

Click here to download a PDF of today's TACenergy Market Talk.

Refined Products Holding Close To Break Even While Oil Prices Are Losing Just Under 1%

Energy markets are vacillating this morning with refined products holding close to break even while oil prices are losing just under 1%.

Negotiators are meeting in Egypt this week to try and hammer out a truce in Gaza, even as Israeli airstrikes intensify. The Red Sea has continued to be active after a few weeks of relative calm, with multiple strikes reported over the weekend and another this morning.

Ukrainian drones targeted two more Russian oil refineries over the weekend, and at least one facility was reportedly taken offline as a result which means two things: Ukraine isn’t listening to US requests to stop targeting refineries, using nets to protect refineries isn’t working yet.

The CFTC’s weekly Commitments of Traders report gave a glimpse into the speculative liquidation (AKA clowns exiting the Volkswagen) that occurred in energy contracts after the direct conflict between Iran and Israel fizzled. Money managers saw heavy long liquidation, with both Brent and WTI dropping nearly 10% on the week. The only contract to see an increase in net length in last week’s report was ULSD, which had been the weak link in the complex for most of the year. ULSD did see a healthy amount of length liquidated, but that was offset by short covering as prices reached 5-month lows to create a very small net increase.

Baker Hughes reported a drop of 5 oil rigs and 1 natural gas rig drilling in the US last week, with Louisiana accounting for the majority of the decline. Pipeline capacity continues to be a limiting factor for many producers, and an RBN energy blog this morning suggests that things are about to get worse in the Permian when major pipeline maintenance occurs in June.

A fire was reported at CVR’s Wynnewood Oklahoma refinery over the weekend, although it’s unclear if the deadly storms that swept through the region played a role in that event.

Marathon’s Galveston Bay refinery reported an upset Friday that knocked a coking unit offline, but said operations were already resuming. That facility was the most-frequent TCEQ reporter last year but has been relatively quiet over the past couple of months.

Today’s interesting read courtesy of the Financial Times: How Europe solved its Russian gas crisis.

Click here to download a PDF of today's TACenergy Market Talk.

Markets Rallying To End The Week, Diesel Prices Lead The Way For Energy

Energy markets are rallying to end the week, with diesel prices leading the way up 2.5 cents in the early going. Equity markets are also rallying after a big Thursday selloff as strong tech earnings seem to be outweighing the FED’s favorite inflation gauge remaining stubbornly high.

RBOB gasoline futures are trading higher for a 4th straight day, but despite bouncing nearly 14 cents from Tuesday’s low, they still need to rally another nickel to break the downward sloping pattern forming on the weekly charts. Seasonal factors could go either way for gasoline for the next few weeks as we’re in the Spring peaking window, and while the high set April 12th would fit the annual pattern nicely, a May price peak is certainly not unusual, and if $2.85 is broken it seems like RBOB will run to $3 in a hurry.

Diesel prices have bounced 7 cents after touching a 5-month low on Monday but need to climb back above $2.60 to reduce the chance of a slide to $2.20 or lower should the chart support around $2.50 break down.

Back to the shadow war: After a relatively quiet few weeks in the Red Sea, Houthi attacks on ships have started again over the past few days, although so far, no major damage has been reported.

ExxonMobil reported another strong quarter in Q1 with more than $10 billion in free cash flow generated, even though earnings in its refining segment were down 67% from the first quarter of last year. The company noted the success of its Beaumont refinery expansion that came online last year and marked the only major refinery expansion in the US in over a decade. It's worth noting that within the refining segment, international earnings suffered more than domestic facilities did, with non-US refining earnings down 77% from a year ago as crack spreads came back to reality after the record-setting quarters in 2022 and 2023.

Chevron followed a similar pattern (as expected) in its Q1 report, noting strong operating cash flows of $6.8 billion in total, despite downstream earnings falling more than 56% for the quarter.

The company also highlighted its expanding marketing network along the US West and Gulf Coast markets encompassing more than 250 retail stations and highlighted its new solar-to-hydrogen project in California.

Phillips 66 continued the trend, reporting a “strong” quarter in which earnings were 63% lower than a year ago. The company highlighted the conversion of its Rodeo refinery which is now producing roughly 30mb/day of RD and is expected to ramp up to 50mb/day in the 2nd quarter. That facility had a capacity of more than 120mb/day prior to its conversion, and it used to produce gasoline along with its diesel. The company also noted its ongoing plans to sell assets that no longer fit its strategy, highlighting retail assets in Germany and Austria as being on the chopping block, while not mentioning any of its US refining assets that have long been rumored to be for sale.

Delek reported another upset at its Alon Big Spring refinery Thursday, which has become another one of the TCEQ’s frequent fliers after suffering damage from the cold snaps in both 2021 and earlier this year.

A harsh reality sinking in: Mexico’s President has made plenty of headlines with fictitious claims of energy sovereignty in the past few years, but not only is the country’s new Dos Bocas refinery still not producing finished products on any sort of meaningful scale, two of its other facilities have suffered fires recently forcing the country to import even more product from the US. This phenomenon continues to help US Gulf and West coast refiners who would be struggling (even more) to move their excess with sluggish domestic demand.

Click here to download a PDF of today's TACenergy Market Talk.