Gasoline Prices Don’t Look As Bullish On The Charts With Only 3 Trading Days Left, Hurricane Franklin Reached Category 4 Status

Refined product prices came back to earth Monday after the tank fire at the Garyville LA refinery that sent prices soaring on Friday was finally extinguished with reports suggesting that no damage was done to operating units at the refinery.

The 10-cent drop puts ULSD at risk of snapping its record-setting 9 consecutive weeks of gains, even though the trend line that’s seen prices rally nearly $1/gallon during that time is still intact at the moment. If we see a sustained move below $3.20 for ULSD, the charts suggest we could see another 10-20 cents of downside soon as a natural correction of this big rally, but if the $3.20 range support layers hold, the door is still open to rally north of $3.50 as we head into fall.

Gasoline prices meanwhile don’t look nearly as bullish on the charts, and there are only 3 trading days left before the last summer-spec futures contract of the year goes off the board and we start the winter gasoline season. Both the technical and seasonal factors suggest that outside of a major supply disruption, it’s more likely we’ll see RBOB trading at $2.40 soon than it is we’ll see a run at $3.

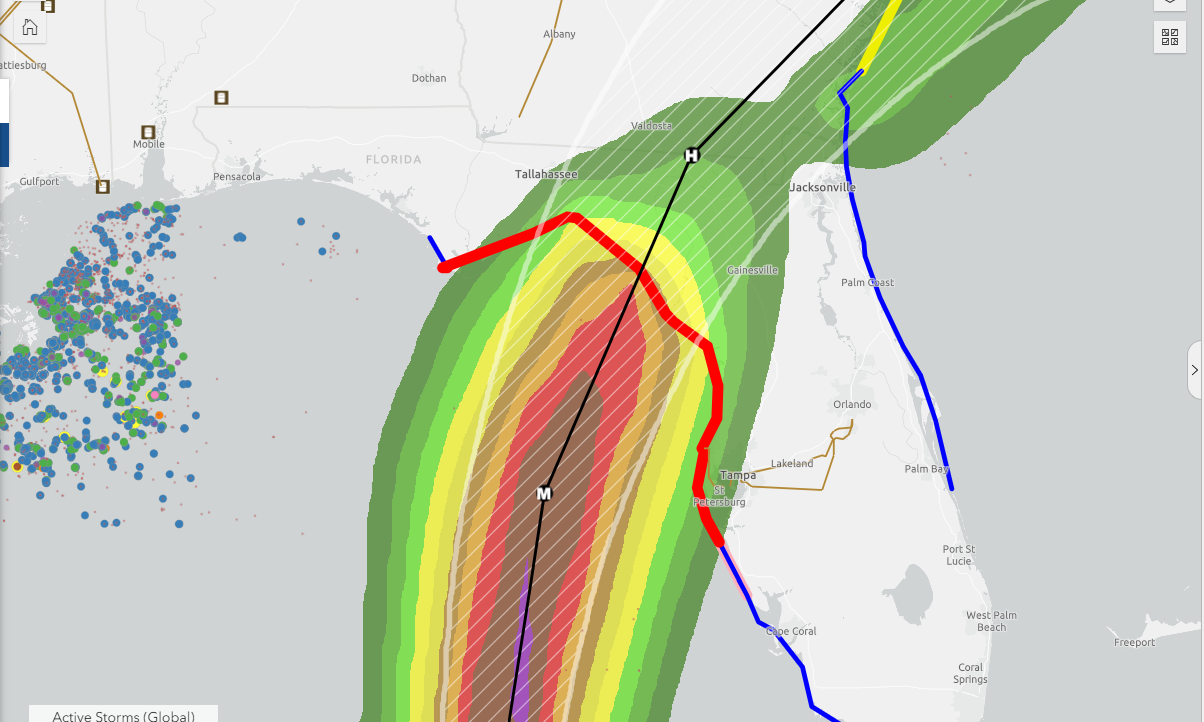

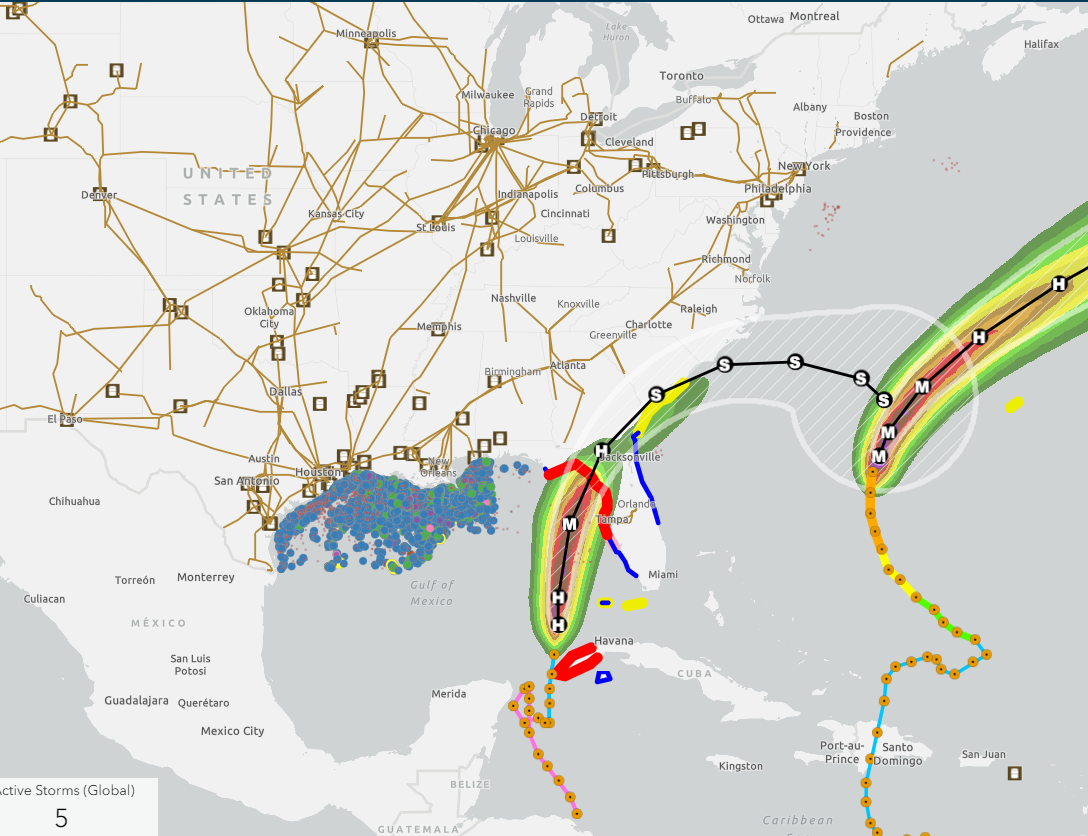

Idalia is currently a category 1 hurricane and is expected to reach category 3 status before making landfall in Florida’s big bend region overnight. Port Tampa Bay is still at risk of flooding from storm surge which is expected to be 4-7 feet in that area, but the latest path keeps the worst parts of the storm well away from major population centers and ports, which means the impacts on supply should be localized despite the dangerous nature of this storm. Numerous ports in Florida and further east in the Gulf Coast have begun to limit operations as the storm passes and terminals in the area are expected to close around noon today. Non-essential personnel are being moved off of oil platforms in the Gulf of Mexico, but the storm is far enough east that it shouldn’t do any damage to production or refining assets.

The other type of storm in Tampa that’s been causing all sorts of headaches for suppliers attempting to top off tanks ahead of Idalia may require an EPA waiver to allow the contaminated product to be re-loaded onto ships and sent back to a refinery rather than attempting to truck out millions of gallons of transmix, which could take months given the location and looming demand for trucks in the wake of the hurricane.

Hurricane Franklin has reached Category 4 status in a reminder of what record warm water temperatures can produce as it moves north roughly 500 miles east of Jacksonville FL this morning but is hooking east and will stay far off shore. The NHC is tracking 2 other systems in the Atlantic, both given 50% odds of being named, but both looking like they’ll also stay out to sea.

The EPA issued a waiver for El Paso’s boutique 7.0lb RVP gasoline Monday, citing unplanned outages at the Alon Big Spring and Marathon El Paso refineries that have caused fuel shortages in recent weeks. The waiver allows for 9lb RVP gasoline, or 10lb RVP if blended with ethanol, through the end of the summer-grade season ending September 16.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

Week 19 - US DOE Inventory Recap

Another Wave Of Selling Pushed Energy Futures To Fresh Multi-Month Lows On Tuesday

The search for a bottom continues after another wave of selling pushed energy futures to fresh multi-month lows on Tuesday. While most of the futures complex remains on the edge of a technical breakdown, we still haven’t seen the snowball effect of selling that signals the bulls (or more likely their trading algorithms) have finally thrown in the towel.

The most important technical test of the day comes from the RBOB futures contract that managed a modest bounce off of its 200-day moving average Tuesday, and could make a case for a recovery rally if it’s able to sustain a move higher from here. If that layer of support breaks however, there’s not much on the charts to prevent another 20 cents of losses.

We’re seeing a bit of the opposite reaction this morning to the May CPI report that came in just below expectations than we did yesterday when the PPI report showed inflation was still running hot. Both refined products added a penny in the first few minutes following the report, tagging along with a bounce in US equity futures. The annual inflation rate from the CPI came in at 3.4%, which is still well above the FED’s target of 2%, but the monthly rate of .3% was slightly lower than many estimates around .4%. Both the PPI and CPI reports showed the spring rally in fuel prices leading the tick up in inflation, which give us good reason to believe we’ll see lower numbers in June now that both gasoline and diesel futures have dropped 40 cents from their April highs.

ULSD futures hit their lowest level since July 5th of last year, which was just before the contract rallied more than $1/gallon in the next two months. Physical traders are also acting bearish on diesel contracts with more heavy selling in the LA and Group 3 markets which dropped to 14 cent discounts to futures Tuesday, but were left in the dust by Chicago values that collapsed to a 30 cent discount.

The latest crash in Chicago diesel basis combined with futures trading near a 10 month low pushed cash prices to the lowest level we’ve seen since December 2021, offering a seasonally unusual opportunity for those that are still waiting to lock in their fuel price for the next year.

The diesel overhang is also witnessed in the ongoing collapse in California LCFS credit values which reached an 8 year low Tuesday at $45/MT yesterday, down from $140/MT just over 2 years ago. The drop in LCFS values combined with last year’s collapse in RINs and the upcoming change to the blender’s tax credit has already caused the closure of a few biodiesel plants, a re-conversion of a refinery back to traditional fuels, and then Tuesday the world’s largest RD producer issued a profit warning due to a continued decrease in both diesel prices, and the subsidies for renewables. For those that lived through the early days of the ethanol industry that included multiple cycles of bankruptcies and frequent regulation changes wreaking havoc, this cycle on the diesel side of the barrel feels oddly similar.

The IEA continues to bang a bearish drum to try and counteract OPEC’s bullishness in their monthly reports, citing weak demand in Europe as a driver of OECD nations moving into fuel consumption contraction in the first quarter of 2024. The tax-payer funded agency also acknowledged the drop in refinery margins in April as the distillate glut continues across much of the world, while also noting that refinery run rates are set to increase further in the back half of the year. The report also noted that even if OPEC & Friends (now Rebranded as DoC) maintain their output cuts through 2025, growth in output from the US, Guyana, Canada and Brazil will be enough to keep world supply outpacing demand.

RIN prices got a quick bounce this week after a Federal Court denied a refinery suit against the EPA’s RFS rules for 2020-2022, but already gave back those gains yesterday, with D4 and D6 values holding around the $.45/RIN mark, down slightly from this time last year when they were worth about $1.50.

Click here to download a PDF of today's TACenergy Market Talk.

Energy Prices Are Trading At Multi-Month Lows

Energy prices are trading at multi-month lows and are on the verge of a technical breakdown this morning after Monday’s attempted rally fizzled, and concerns over high inflation and low demand both seem to be keeping buyers at bay.

The complex was trading modestly lower overnight, and then the slide picked up steam following the April Producer Price Index (PPI) report which showed stubbornly high inflation of .5% for the month (which would annualize to 6%) giving the FED another reason to hold off on cutting interest rates. The bright side to this report is that the main contributor to April’s higher inflation reading was higher energy prices, and with the sharp pullback we’ve seen over the past month that component of pricing pressure should come down in the May report.

OPEC continues to bang a bullish drum in its monthly oil market report, increasing its economic estimates for Q1 of this year, and holding its forecasted demand growth steady at 2.8% and 2.9% for 2024 and 2025 respectively. The report also noted big decreases in clean-product tanker rates with east of Suez prices down 10% and West of Suez rates down 20%, in a sign that the physical market is not stressed over the potential shipping disruptions around the Middle East. Refinery margins declined across all major global markets as an end to a busy spring maintenance season and new capacity increased output.

What’s up Doc? The cartel also made a tweak to its monthly report and will now be highlighting output and demand for the countries participating in the Declaration of Cooperation (DoC…aka OPEC & Friends) to demonstrate solidarity and unity, which may signal that some in OPEC are getting nervous that the members may become more uncooperative in the coming months. Total OPEC output dipped by 48mb/day during April with declines in Nigeria and Iraq offsetting increases in Iran and the Congo. Total DoC output declined by 246mb/day during the month with Russia’s output declining by 154mb/day and Kazakhstan’s output down by 50mb/day.

Space on Colonial’s main diesel line (Line 2) settled in positive territory for the first time this year, as the building contango for distillates helps to incentivize shippers. There also appears to be another buildup of un-wanted inventory of distillates in several regional markets with basis values in LA, Chicago and the Group 3 market all reaching multi-month lows this week.

Some of the weakness in diesel prices can be blamed on recent wet weather delaying planting in several states, and those delays are also helping corn and ethanol prices rebound to approach their highest levels of the year.

New tariffs on Chinese EV’s are making headlines this week, but it’s a potential tariff on Used Cooking Oil (UCO) from China that could have a larger impact near term on the fuel industry as US grain processor think it’s unfair that China dares recycle oil to the detriment of their food to fuel factories.

Speaking of EV’s, the EIA this morning wrote that the US share of electric and hybrid vehicle sales decreased on the first quarter of 2024 after more than 3 years of steady growth.

Click here to download a PDF of today's TACenergy Market Talk.