How Long Until Power Comes Back On?

How long until the power comes back on? That’s the big question being asked by millions of people across the U.S. and Mexico, and a huge proportion of the energy industry as the remnants of a brutal stretch of winter weather moves East, and the thawing out process begins. In addition to the direct impact, the trickle down effects of the collapse in oil, refined products, natural gas and ethylene production are being felt around the world.

The refining hubs along the Gulf Coast from Corpus Christi to New Orleans have temperatures above freezing this morning, and should stay that way for the next week, except for a few hours tonight. If that thaw allows most plants to resume operations by the weekend, the impact of this chaotic event should be short-lived. Of course, the warm up also means that more drivers are about to hit the road, while terminals and stations that have been closed for a few days may or may not be able to come back online with supply, power and/or intact pipes to meet demand.

If you remember the panic buying in the wake of Hurricane Harvey, it’s not hard to imagine that the next few days could create a demand spike as news of the refinery shutdowns hits the mainstream just in time for people to start leaving their homes again, and could create a preventable panic phenomenon which could create supply shortages all on its own.

The Houston ship channel was able to resume limited operations after the ice blocking shipping lanes started to break up, a most unusual occurrence that may have some Texans reluctant to use the phrase “When Hell Freezes over” ever again.

We did see some heavy selling for about an hour Wednesday morning after a WSJ report that said Saudi Arabia was going to increase its oil output now that prices had recovered. That wave of selling wiped out the early gains for crude and product futures, but was fairly short lived and the march higher picked up later in the morning.

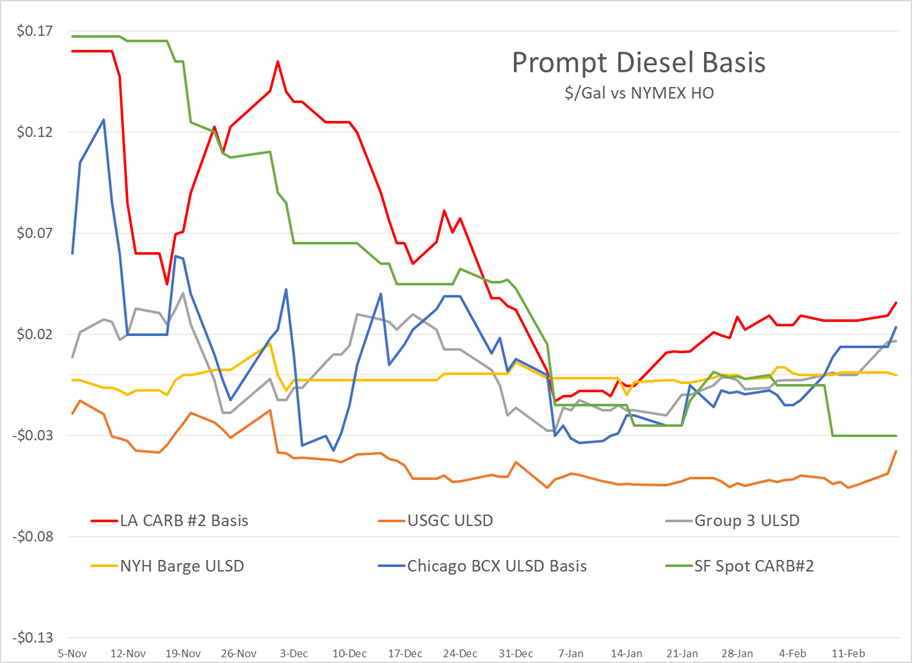

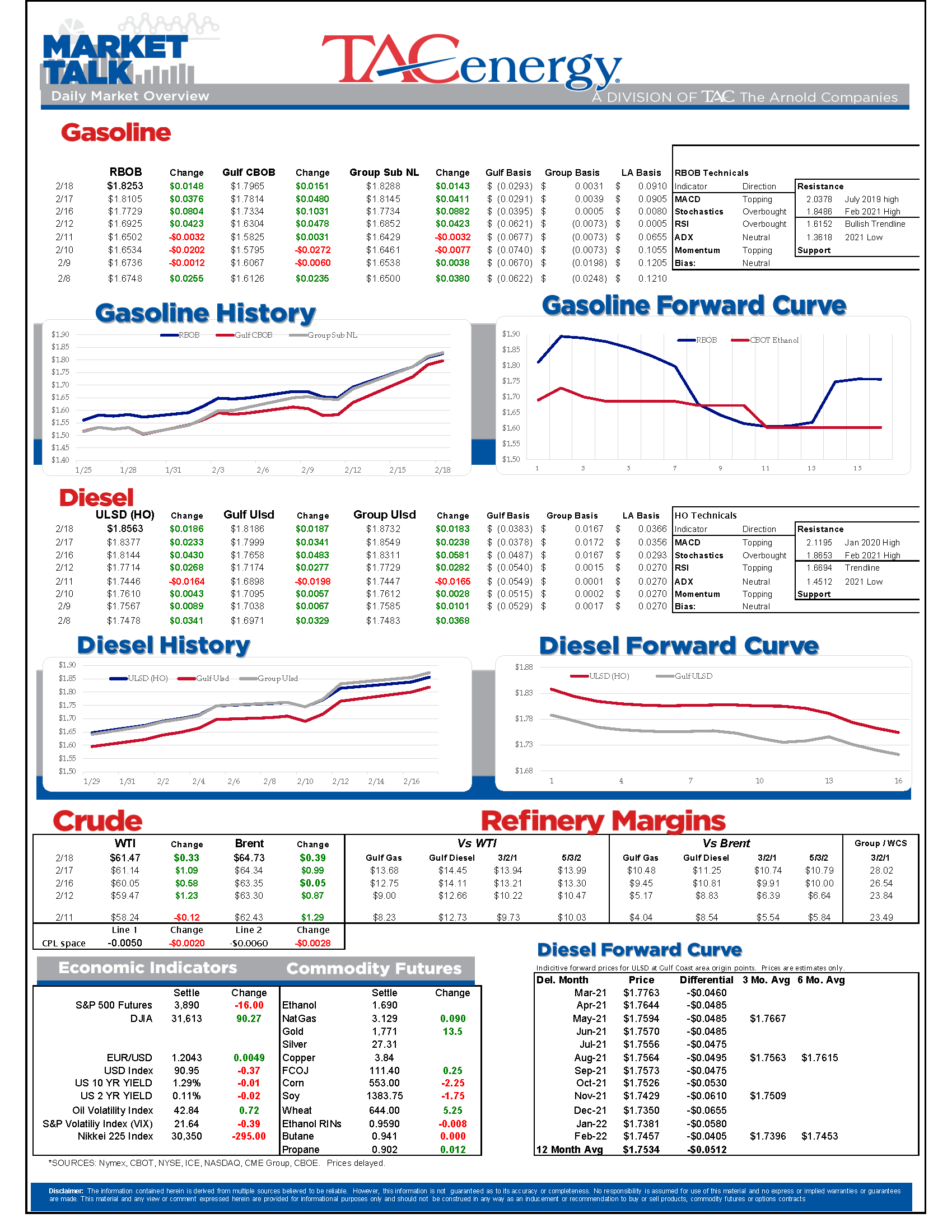

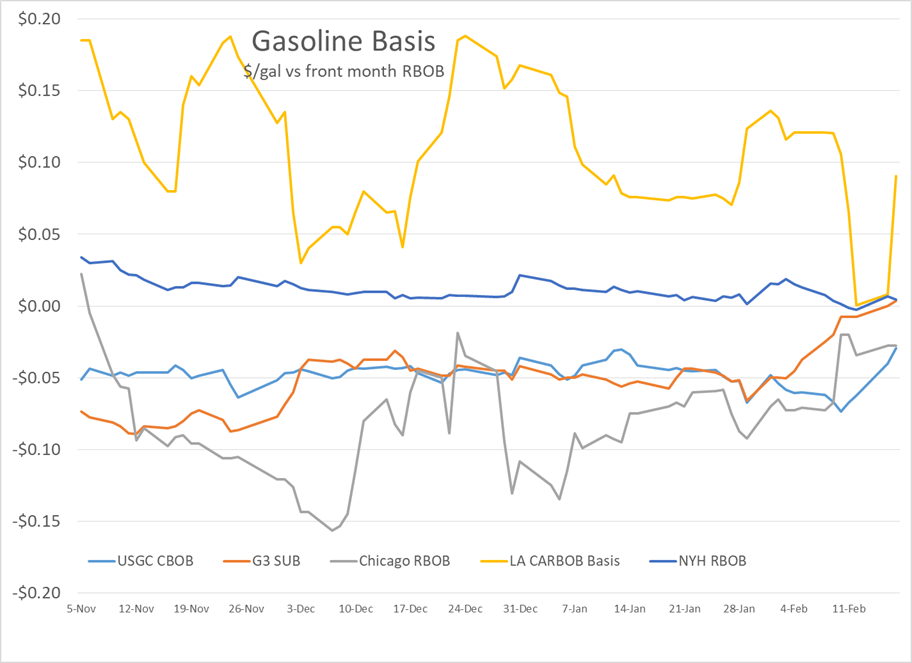

Basis markets continue to show strength for both gasoline and diesel grades across most U.S. spot markets, but those moves are still relatively minor compared to disruptions we’ve witnessed over the past two decades, a testament to the excess capacity in the U.S. and the softer-than-normal demand environment. In addition to stronger spot prices, numerous rack markets stretching from Arizona to Maryland have switched from seeing suppliers having to offer steep discounts to move product during the winter doldrums, to enforcing strict allocations as resupply options become questionable.

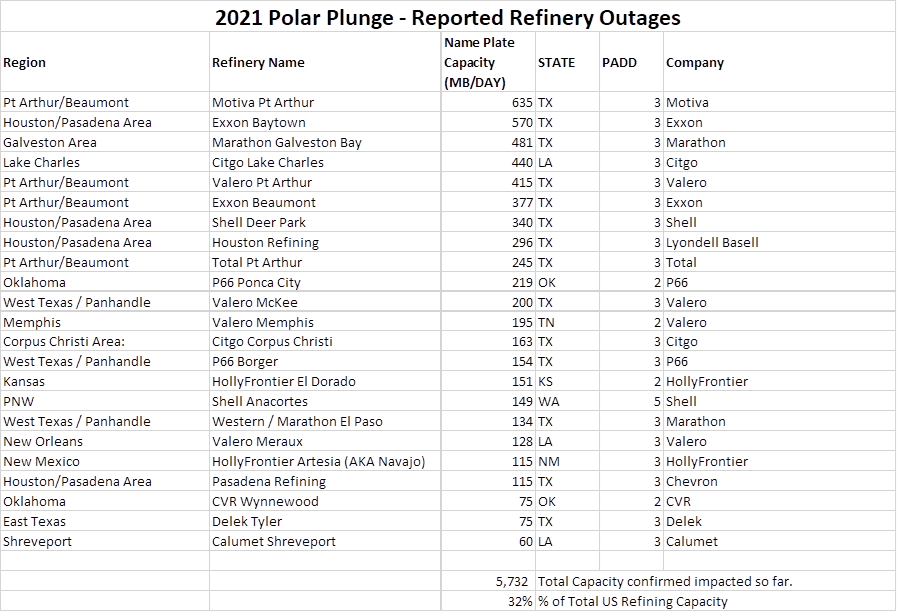

The API reported large draws in oil and diesel stocks last week, while gasoline stocks had another large build. The DOE’s weekly report is due out at 10 a.m. central today, and should give some glimpse into the impact on gasoline demand caused by the winter storms that battered the East Coast two weeks ago, that now appear quaint in comparison. Don’t expect the report to move the market much as last Friday’s data doesn’t mean much after almost 1/3 of the country’s refining capacity was forced to cut back this week.

In other non-frozen refinery news this week, Calumet laid out plans to convert part of its Great Falls Montana facility to Renewable Diesel production this week in an SEC filing, joining a long list of refiners looking to jump on the BTC/RIN/LCFS and new Canadian CFS programs that combined can offer more than $4.50/gallon in subsidies for RD production. The company also closed on the sale and leaseback of its Shreveport facility in an effort to save enough cash to survive the weak margin environment that was hammering refineries before the storms hit.

Great Falls Renewable Diesel Opportunity:

We believe Great Falls, which connects western agriculture with West Coast and Canadian clean product markets, presents one of the most compelling opportunities for Renewable Diesel production in North America. We estimate the oversized hydrocracker built in 2016 can be reconfigured to process 10-12,000 BPD renewable feedstock at the lowest capital cost per barrel of any announced industry project. Hydrocracker conversions are typically faster to market, cheaper, and less technically challenging. In addition, the planned configuration could retain 10-12,000 BPD low-cost Canadian crude processing, providing Montana customers with clean energy and our unique specialty asphalt. Future dual train operations are currently estimated to generate $220 to $260 million of Adjusted EBITDA assuming mid-cycle market prices and existing environmental market structure (BTC, RINs, LCFS).

Given strong investor interest in renewables, Calumet expects to utilize third party equity for this unique opportunity, without expending Calumet funds.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

Energy Futures Are Drifting Quietly Higher This Morning

Refined Products Holding Close To Break Even While Oil Prices Are Losing Just Under 1%

Markets Rallying To End The Week, Diesel Prices Lead The Way For Energy

Energy Markets Rally Again Thursday After A Choppy Wednesday Session

Social Media

News & Views

View All

Energy Futures Are Drifting Quietly Higher This Morning

Energy futures are drifting quietly higher this morning as a new round of hostage negotiations between Israel and Hamas seem to show relative promise. It seems the market is focusing on the prospect of cooler heads prevailing, rather than the pervasive rocket/drone exchanges, the latest of which took place over Israel’s northern border.

A warmer-than-expected winter depressed diesel demand and, likewise, distillate refinery margins, which has dropped to its lowest level since the beginning of 2022. The ULSD forward curve has shifted into contango (carry) over the past month as traders seek to store their diesel inventories and hope for a pickup in demand, domestic or otherwise.

The DOE announced it had continued rebuilding it’s Strategic Petroleum Reserve this month, noting the addition of 2.3 million barrels of crude so far in April. Depending on what the private sector reported for last week, Wednesday’s DOE report may put current national crude oil inventories (include those of the SPR) above the year’s previous levels, something we haven’t seen since April of 2022, two months after Ukraine war began.

The latest in the Dangote Refinery Saga: Credit stall-out, rising oil prices, and currency exchange.

Click here to download a PDF of today's TACenergy Market Talk.

Refined Products Holding Close To Break Even While Oil Prices Are Losing Just Under 1%

Energy markets are vacillating this morning with refined products holding close to break even while oil prices are losing just under 1%.

Negotiators are meeting in Egypt this week to try and hammer out a truce in Gaza, even as Israeli airstrikes intensify. The Red Sea has continued to be active after a few weeks of relative calm, with multiple strikes reported over the weekend and another this morning.

Ukrainian drones targeted two more Russian oil refineries over the weekend, and at least one facility was reportedly taken offline as a result which means two things: Ukraine isn’t listening to US requests to stop targeting refineries, using nets to protect refineries isn’t working yet.

The CFTC’s weekly Commitments of Traders report gave a glimpse into the speculative liquidation (AKA clowns exiting the Volkswagen) that occurred in energy contracts after the direct conflict between Iran and Israel fizzled. Money managers saw heavy long liquidation, with both Brent and WTI dropping nearly 10% on the week. The only contract to see an increase in net length in last week’s report was ULSD, which had been the weak link in the complex for most of the year. ULSD did see a healthy amount of length liquidated, but that was offset by short covering as prices reached 5-month lows to create a very small net increase.

Baker Hughes reported a drop of 5 oil rigs and 1 natural gas rig drilling in the US last week, with Louisiana accounting for the majority of the decline. Pipeline capacity continues to be a limiting factor for many producers, and an RBN energy blog this morning suggests that things are about to get worse in the Permian when major pipeline maintenance occurs in June.

A fire was reported at CVR’s Wynnewood Oklahoma refinery over the weekend, although it’s unclear if the deadly storms that swept through the region played a role in that event.

Marathon’s Galveston Bay refinery reported an upset Friday that knocked a coking unit offline, but said operations were already resuming. That facility was the most-frequent TCEQ reporter last year but has been relatively quiet over the past couple of months.

Today’s interesting read courtesy of the Financial Times: How Europe solved its Russian gas crisis.

Click here to download a PDF of today's TACenergy Market Talk.

Markets Rallying To End The Week, Diesel Prices Lead The Way For Energy

Energy markets are rallying to end the week, with diesel prices leading the way up 2.5 cents in the early going. Equity markets are also rallying after a big Thursday selloff as strong tech earnings seem to be outweighing the FED’s favorite inflation gauge remaining stubbornly high.

RBOB gasoline futures are trading higher for a 4th straight day, but despite bouncing nearly 14 cents from Tuesday’s low, they still need to rally another nickel to break the downward sloping pattern forming on the weekly charts. Seasonal factors could go either way for gasoline for the next few weeks as we’re in the Spring peaking window, and while the high set April 12th would fit the annual pattern nicely, a May price peak is certainly not unusual, and if $2.85 is broken it seems like RBOB will run to $3 in a hurry.

Diesel prices have bounced 7 cents after touching a 5-month low on Monday but need to climb back above $2.60 to reduce the chance of a slide to $2.20 or lower should the chart support around $2.50 break down.

Back to the shadow war: After a relatively quiet few weeks in the Red Sea, Houthi attacks on ships have started again over the past few days, although so far, no major damage has been reported.

ExxonMobil reported another strong quarter in Q1 with more than $10 billion in free cash flow generated, even though earnings in its refining segment were down 67% from the first quarter of last year. The company noted the success of its Beaumont refinery expansion that came online last year and marked the only major refinery expansion in the US in over a decade. It's worth noting that within the refining segment, international earnings suffered more than domestic facilities did, with non-US refining earnings down 77% from a year ago as crack spreads came back to reality after the record-setting quarters in 2022 and 2023.

Chevron followed a similar pattern (as expected) in its Q1 report, noting strong operating cash flows of $6.8 billion in total, despite downstream earnings falling more than 56% for the quarter.

The company also highlighted its expanding marketing network along the US West and Gulf Coast markets encompassing more than 250 retail stations and highlighted its new solar-to-hydrogen project in California.

Phillips 66 continued the trend, reporting a “strong” quarter in which earnings were 63% lower than a year ago. The company highlighted the conversion of its Rodeo refinery which is now producing roughly 30mb/day of RD and is expected to ramp up to 50mb/day in the 2nd quarter. That facility had a capacity of more than 120mb/day prior to its conversion, and it used to produce gasoline along with its diesel. The company also noted its ongoing plans to sell assets that no longer fit its strategy, highlighting retail assets in Germany and Austria as being on the chopping block, while not mentioning any of its US refining assets that have long been rumored to be for sale.

Delek reported another upset at its Alon Big Spring refinery Thursday, which has become another one of the TCEQ’s frequent fliers after suffering damage from the cold snaps in both 2021 and earlier this year.

A harsh reality sinking in: Mexico’s President has made plenty of headlines with fictitious claims of energy sovereignty in the past few years, but not only is the country’s new Dos Bocas refinery still not producing finished products on any sort of meaningful scale, two of its other facilities have suffered fires recently forcing the country to import even more product from the US. This phenomenon continues to help US Gulf and West coast refiners who would be struggling (even more) to move their excess with sluggish domestic demand.

Click here to download a PDF of today's TACenergy Market Talk.