Markets Around The World Are Seeing Big Swings Over The Past 24 Hours As The Unknowns Of Monetary Policy

Markets around the world are seeing big swings over the past 24 hours as the unknowns of monetary policy, war strategy and storm paths all converge. It’s not unusual for the day after an FOMC announcement to see big price swings, and today in particular is set up for big moves after the FED made it clear it prefers a recession to inflation, and numerous other banks followed suit.

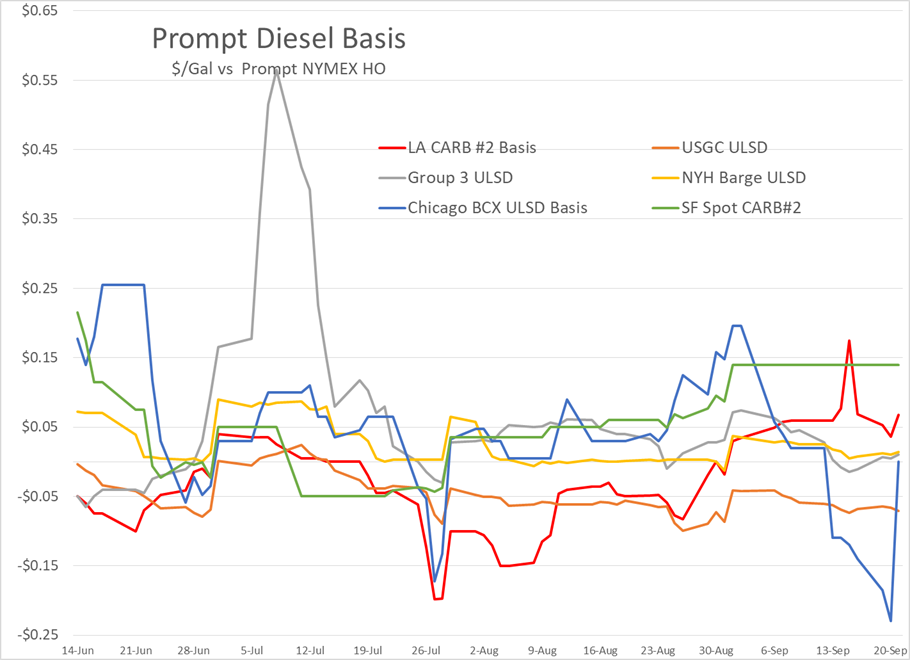

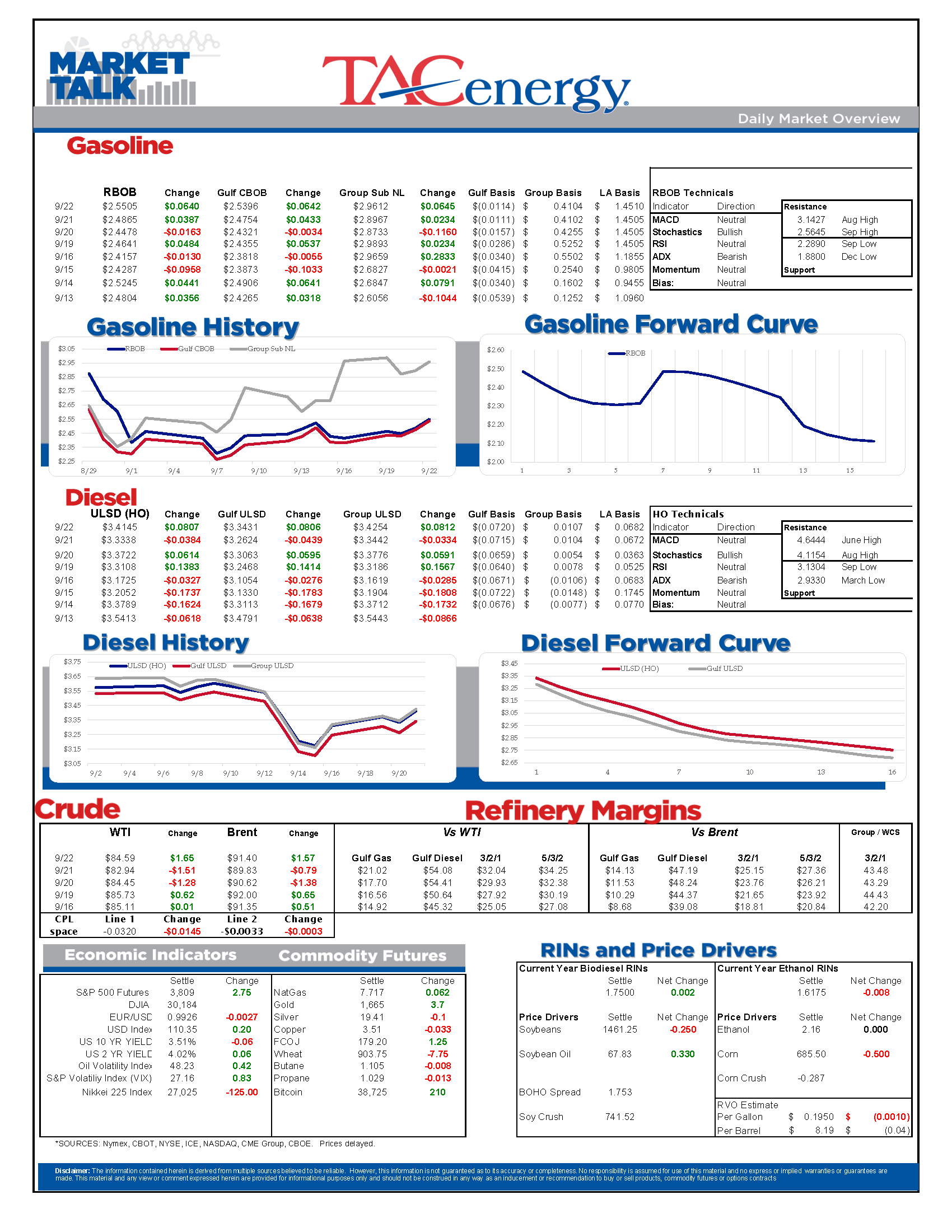

ULSD has been the most volatile contract in the energy complex this week, with multiple 10 cents swings in various directions as demand fears and supply fears manage to both grip parts of the global distillate market simultaneously. Adding to the uncertainty this week, Exxon’s refinery in France is facing a strike as employees see more leverage than ever given the weakened state of Europe’s energy supplies.

2 brothers were killed in the fire at the Husky refinery in Ohio, adding a tragic turn to the supply shortages in the area, which have sent Chicago basis values soaring. That plant is completely offline, and may stay so for weeks as the investigation continues, further complicating resupply efforts. The Explorer pipeline froze nominations shortly following that fire as shippers raced to find replacement options from other regions, quickly maxing out the pipe’s capacity. See the PADD 2 inventory charts below for perspective on how unusually low supplies in the Midwest are as a rash of refinery issues, and lack of shipments from the Gulf Coast – who is busy supplying the rest of the Western hemisphere – draw down stocks. PADD 2 refinery runs did see a 2nd straight large increase, largely due to the BP Whiting plant coming back online after a fire a few weeks ago.

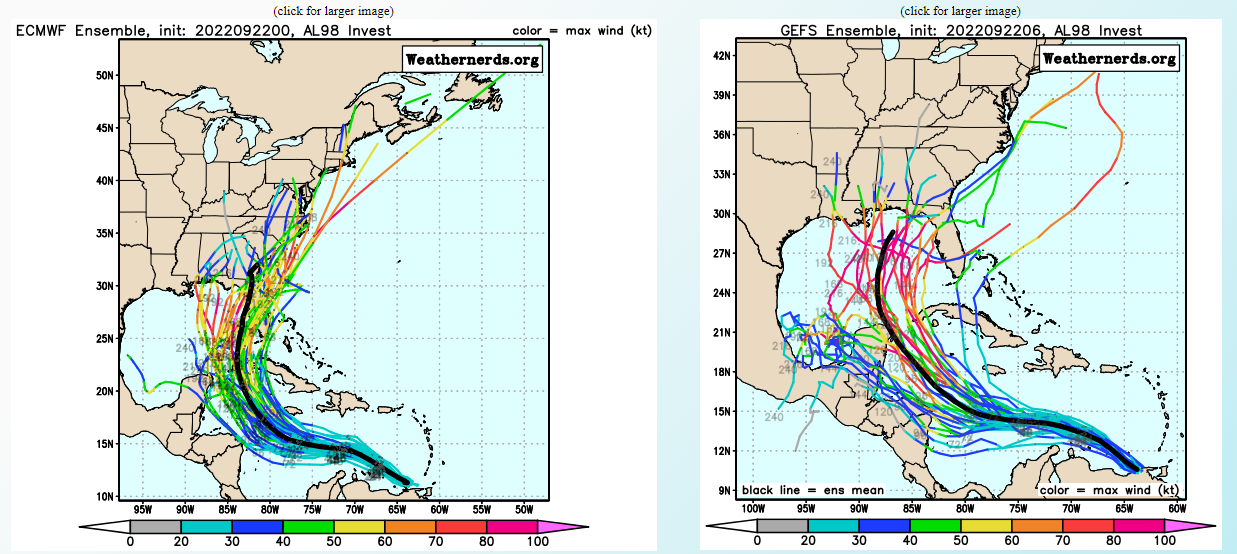

The storm currently known as 98L continues to move towards the Caribbean with 90% odds of development in the next 5 days. Florida looks like it is still has the highest odds of getting hit by this storm (soon to be named Hermine) although the GEFS model has shifted it further West in the past 24 hours which puts Alabama, Mississippi and Louisiana all in the range of potential landing zones. While the odds may still be low, Louisiana has been a hurricane magnet the past two seasons, so those refineries and off-shore facilities will not breathe easy until this system is long gone. Hurricane Fiona meanwhile continues to churn north after battering several islands as a category 3 or 4 storm, and now sets its sites on Atlantic Canada. The Irving refinery in St. John looks like it will avoid a hit from this storm, while the long-idled and struggling to convert to RD production refinery in Come-By-Chance could still take a hit from this system.

Refinery production increased again last week, holding near the top end of the seasonal range as plants defer maintenance to try and continue maximizing output during these times of tight supply (and high margins). Compare this year’s refinery runs to 2021 and 2020 which both saw big storm-induced declines, and you’ll get a feeling for why the industry is still holding its breath to make it another month without a direct hit on refinery row.

One item to keep an eye on (if you didn’t have enough already): US ethanol production dropped to its lowest level since the great freeze of 2021 wreaked havoc on fuel producers of all varieties, which pushed ethanol inventories to their lowest levels of the year. Ethanol prices have been pulling back since the railroads narrowly dodged a major strike, so this drop in production could be a short term anomaly tied to maintenance or timing the corn crop, but if not, it could further complicate the refined fuel supply network since gasoline is no good in most cases without 190 proof grain alcohol to go with it.

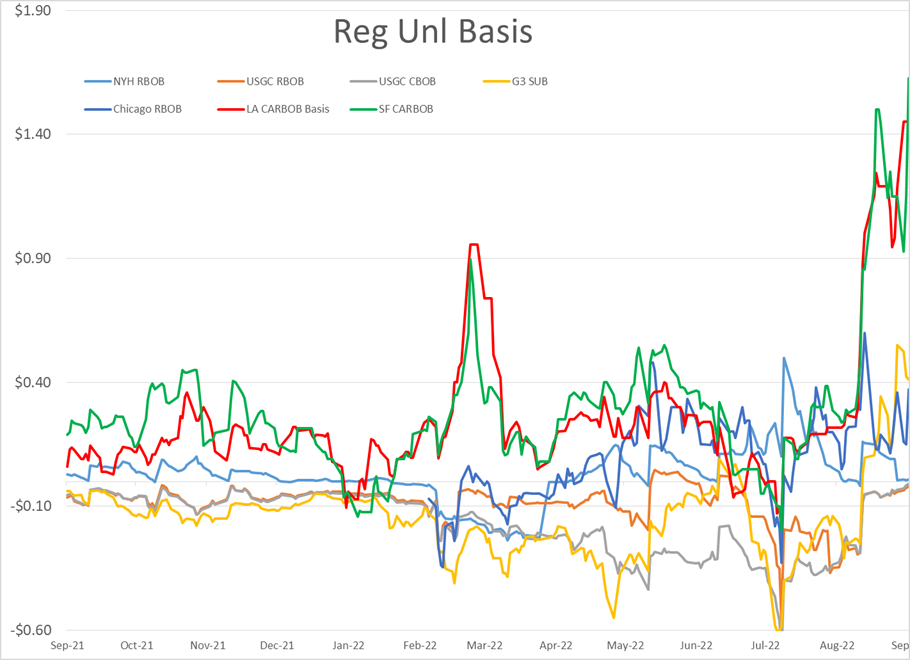

West Coast (PADD 5) gasoline stocks look like they turned the corner on the charts with a small increase last week, but that did little to stop the squeeze on prompt supplies as San Francisco values shot up to a $1.70/gallon premium to futures and PNW values traded north of $1.40, which puts current values back close to $4/gallon.

Latest Posts

Week 17 - US DOE Inventory Recap

The Energy Complex Is Trading Modestly Lower So Far This Morning With WTI Crude Oil Futures Leading The Way

Energy Futures Are Drifting Quietly Higher This Morning

Refined Products Holding Close To Break Even While Oil Prices Are Losing Just Under 1%

Social Media

News & Views

View All

Week 17 - US DOE Inventory Recap

The Energy Complex Is Trading Modestly Lower So Far This Morning With WTI Crude Oil Futures Leading The Way

The energy complex is trading modestly lower so far this morning with WTI crude oil futures leading the way, exchanging hands $1.50 per barrel lower (-1.9%) than Tuesday’s settlement price. Gasoline and diesel futures are following suit, dropping .0390 and .0280 per gallon, respectively.

A surprise crude oil build (one that doesn’t include any changes to the SPR) as reported by the American Petroleum Institute late Tuesday is taking credit for the bearish trading seen this morning. The Institute estimated an increase in crude inventories of ~5 million barrels and drop in both refined product stocks of 1.5-2.2 million barrels for the week ending April 26. The Department of Energy’s official report is due out at it’s regular time (9:30 CDT) this morning.

The Senate Budget Committee is scheduled to hold a hearing at 9:00 AM EST this morning regarding a years-long probe into climate change messaging from big oil companies. Following a 3-year investigation, Senate and House Democrats released their final report yesterday alleging major oil companies have internally recognized the impacts of fossil fuels on the climate since as far back as the 1960s, while privately lobbying against climate legislation and publicly presenting a narrative that undermines a connection between the two. Whether this will have a tangible effect on policy or is just the latest announcement in an election-yeardeluge is yet to be seen.

Speaking of deluge, another drone attack was launched against Russian infrastructure earlier this morning, causing an explosion and subsequent fire at Rosneft’s Ryazan refinery. While likely a response to the five killed from Russian missile strikes in Odesa and Kharkiv, Kyiv has yet to officially claim responsibility for the attack that successfully struck state infrastructure just 130 miles from Moscow.

The crude oil bears are on a tear this past week, blowing past WTI’s 5 and 10 day moving averages on Monday and opening below it’s 50-day MA this morning. The $80 level is likely a key resistance level, below which the path is open for the American oil benchmark to drop to the $75 level in short order.

Click here to download a PDF of today's TACenergy Market Talk.

Energy Futures Are Drifting Quietly Higher This Morning

Energy futures are drifting quietly higher this morning as a new round of hostage negotiations between Israel and Hamas seem to show relative promise. It seems the market is focusing on the prospect of cooler heads prevailing, rather than the pervasive rocket/drone exchanges, the latest of which took place over Israel’s northern border.

A warmer-than-expected winter depressed diesel demand and, likewise, distillate refinery margins, which has dropped to its lowest level since the beginning of 2022. The ULSD forward curve has shifted into contango (carry) over the past month as traders seek to store their diesel inventories and hope for a pickup in demand, domestic or otherwise.

The DOE announced it had continued rebuilding it’s Strategic Petroleum Reserve this month, noting the addition of 2.3 million barrels of crude so far in April. Depending on what the private sector reported for last week, Wednesday’s DOE report may put current national crude oil inventories (include those of the SPR) above the year’s previous levels, something we haven’t seen since April of 2022, two months after Ukraine war began.

The latest in the Dangote Refinery Saga: Credit stall-out, rising oil prices, and currency exchange.

Click here to download a PDF of today's TACenergy Market Talk.