Markets Celebrate China's COVID Case-Count Collapse

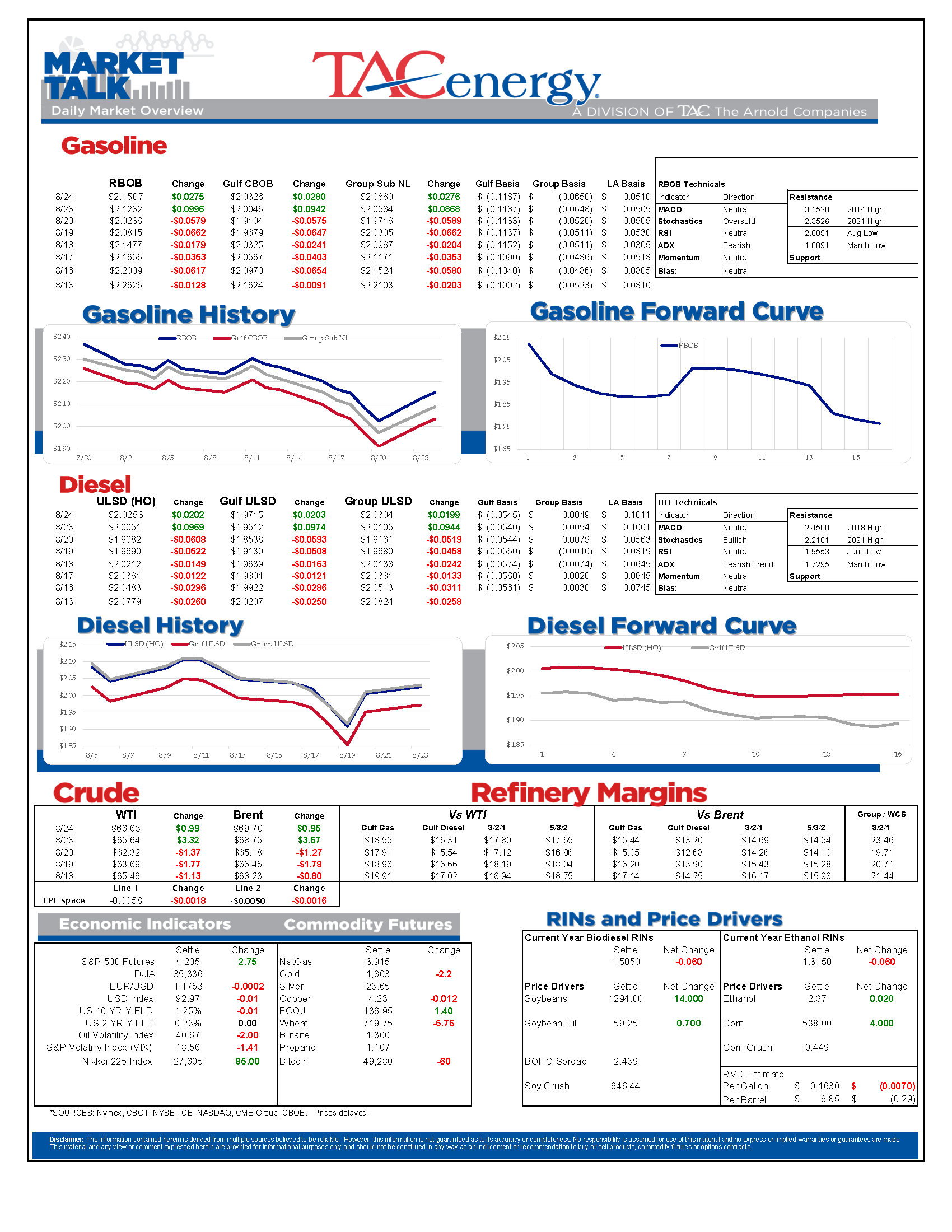

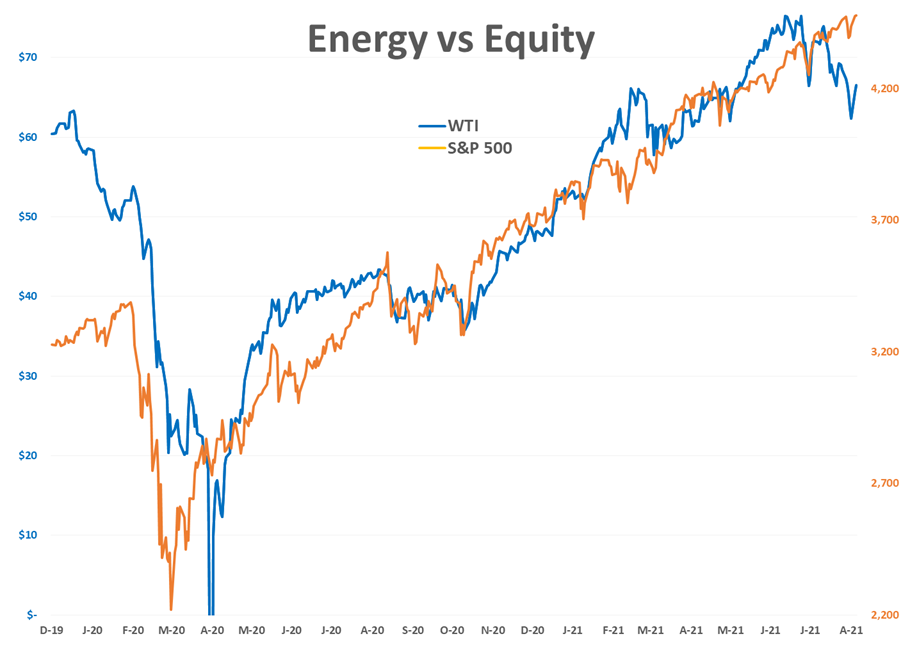

Energy futures have taken back half of the losses they suffered during their 7 day selloff. Equity and commodity markets all seemed to be celebrating China’s COVID case count collapse Monday, and the US dollar was moving lower ahead of the FED’s virtual summit that may or may not signal the end to the latest round of money printing.

Adding to the bullish fervor Monday were a slew of refinery and oil production mishaps, all unrelated to the Hurricane that took much of the focus over the previous few days.

Two of the largest refineries in the country, both on the TX Gulf Coast, had units knocked offline over the past few days, with power loss at least partially to blame for the unexpected shutdowns. Speaking of power loss, LA Spot markets saw big spikes in both gasoline and diesel basis values Monday after a local refinery was reportedly forced to shut again due to lack of power.

At least 5 people have died and 2 are still missing after a fire on an offshore oil platform in the Bay of Campeche. Efforts to stop that fire, which include shutting off natural gas supplies to surrounding wells, have cut oil output by nearly 450,000 barrels/day, and could be a contributor to the big rally in oil prices this week. Initial reports suggest the fire was caused by a lightning strike, just a day after Hurricane Grace passed through the area last week.

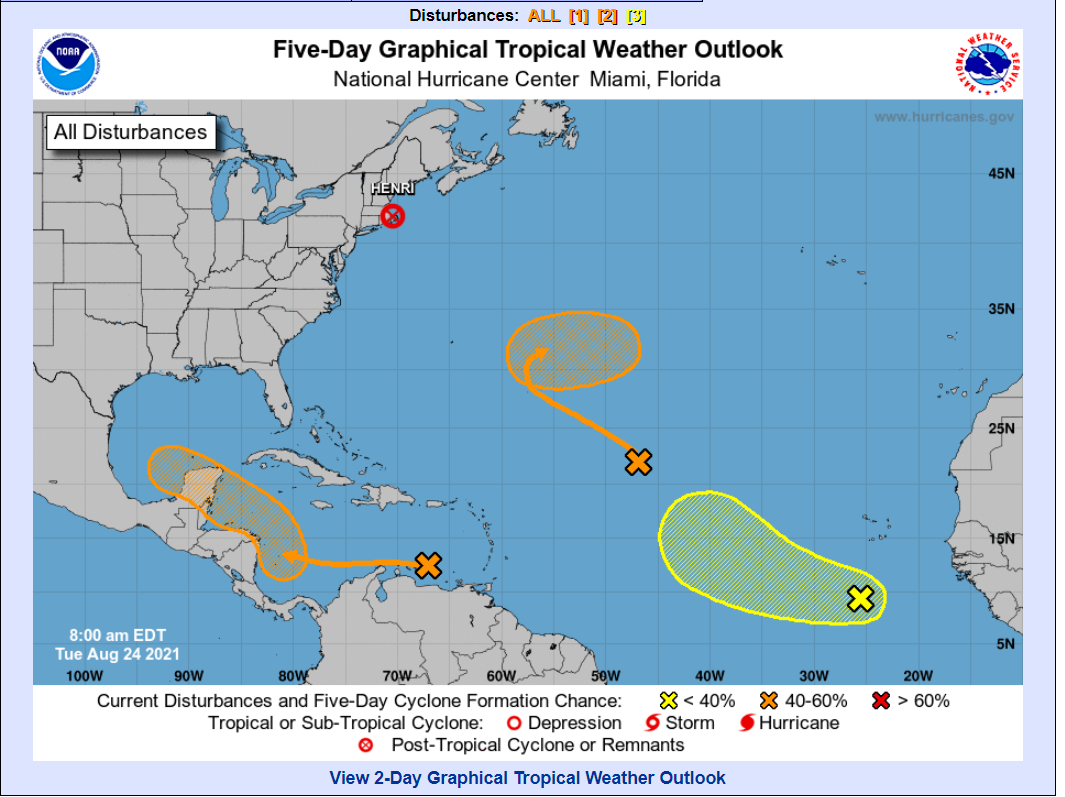

It looks like the NHC knew what it was talking about when it predicted an above average year for storm activity. As Henri moves back offshore, 3 more potential storms are being tracked this morning, and the 2 given low odds of development yesterday are now given a 60% chance of being named this week. None of the 3 potential storms looks particularly ominous for refining country, but as we just saw with Henri, the early model runs can be way off, so we’ll need to keep watching their progress. The system furthest to the east looks like it will develop in the Caribbean in a similar spot where we saw 2 storms that ended up hitting Louisiana last year.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

Week 17 - US DOE Inventory Recap

The Energy Complex Is Trading Modestly Lower So Far This Morning With WTI Crude Oil Futures Leading The Way

Energy Futures Are Drifting Quietly Higher This Morning

Refined Products Holding Close To Break Even While Oil Prices Are Losing Just Under 1%

Social Media

News & Views

View All

Week 17 - US DOE Inventory Recap

The Energy Complex Is Trading Modestly Lower So Far This Morning With WTI Crude Oil Futures Leading The Way

The energy complex is trading modestly lower so far this morning with WTI crude oil futures leading the way, exchanging hands $1.50 per barrel lower (-1.9%) than Tuesday’s settlement price. Gasoline and diesel futures are following suit, dropping .0390 and .0280 per gallon, respectively.

A surprise crude oil build (one that doesn’t include any changes to the SPR) as reported by the American Petroleum Institute late Tuesday is taking credit for the bearish trading seen this morning. The Institute estimated an increase in crude inventories of ~5 million barrels and drop in both refined product stocks of 1.5-2.2 million barrels for the week ending April 26. The Department of Energy’s official report is due out at it’s regular time (9:30 CDT) this morning.

The Senate Budget Committee is scheduled to hold a hearing at 9:00 AM EST this morning regarding a years-long probe into climate change messaging from big oil companies. Following a 3-year investigation, Senate and House Democrats released their final report yesterday alleging major oil companies have internally recognized the impacts of fossil fuels on the climate since as far back as the 1960s, while privately lobbying against climate legislation and publicly presenting a narrative that undermines a connection between the two. Whether this will have a tangible effect on policy or is just the latest announcement in an election-yeardeluge is yet to be seen.

Speaking of deluge, another drone attack was launched against Russian infrastructure earlier this morning, causing an explosion and subsequent fire at Rosneft’s Ryazan refinery. While likely a response to the five killed from Russian missile strikes in Odesa and Kharkiv, Kyiv has yet to officially claim responsibility for the attack that successfully struck state infrastructure just 130 miles from Moscow.

The crude oil bears are on a tear this past week, blowing past WTI’s 5 and 10 day moving averages on Monday and opening below it’s 50-day MA this morning. The $80 level is likely a key resistance level, below which the path is open for the American oil benchmark to drop to the $75 level in short order.

Click here to download a PDF of today's TACenergy Market Talk.

Energy Futures Are Drifting Quietly Higher This Morning

Energy futures are drifting quietly higher this morning as a new round of hostage negotiations between Israel and Hamas seem to show relative promise. It seems the market is focusing on the prospect of cooler heads prevailing, rather than the pervasive rocket/drone exchanges, the latest of which took place over Israel’s northern border.

A warmer-than-expected winter depressed diesel demand and, likewise, distillate refinery margins, which has dropped to its lowest level since the beginning of 2022. The ULSD forward curve has shifted into contango (carry) over the past month as traders seek to store their diesel inventories and hope for a pickup in demand, domestic or otherwise.

The DOE announced it had continued rebuilding it’s Strategic Petroleum Reserve this month, noting the addition of 2.3 million barrels of crude so far in April. Depending on what the private sector reported for last week, Wednesday’s DOE report may put current national crude oil inventories (include those of the SPR) above the year’s previous levels, something we haven’t seen since April of 2022, two months after Ukraine war began.

The latest in the Dangote Refinery Saga: Credit stall-out, rising oil prices, and currency exchange.

Click here to download a PDF of today's TACenergy Market Talk.