Markets Cheer News Of New U.S. Treasury Secretary

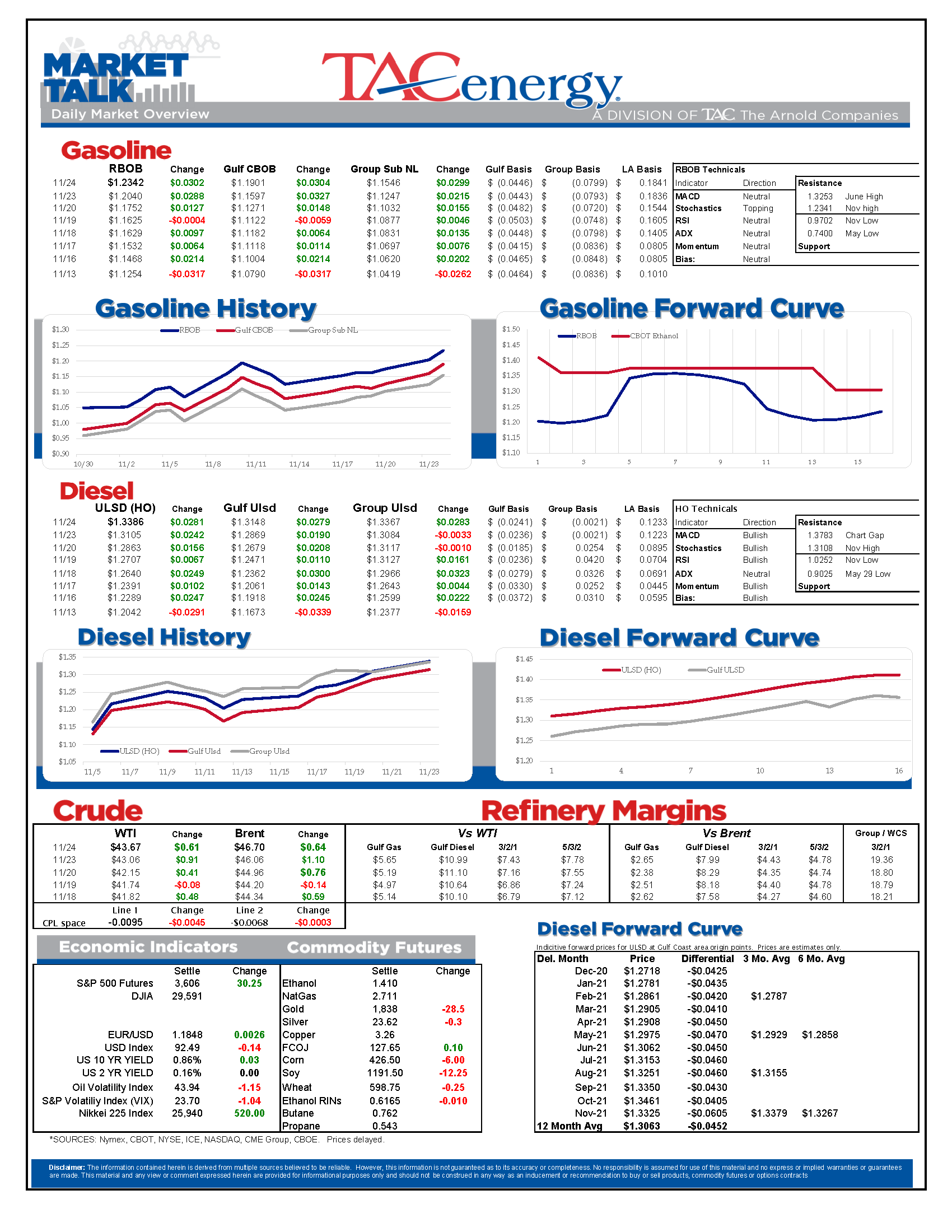

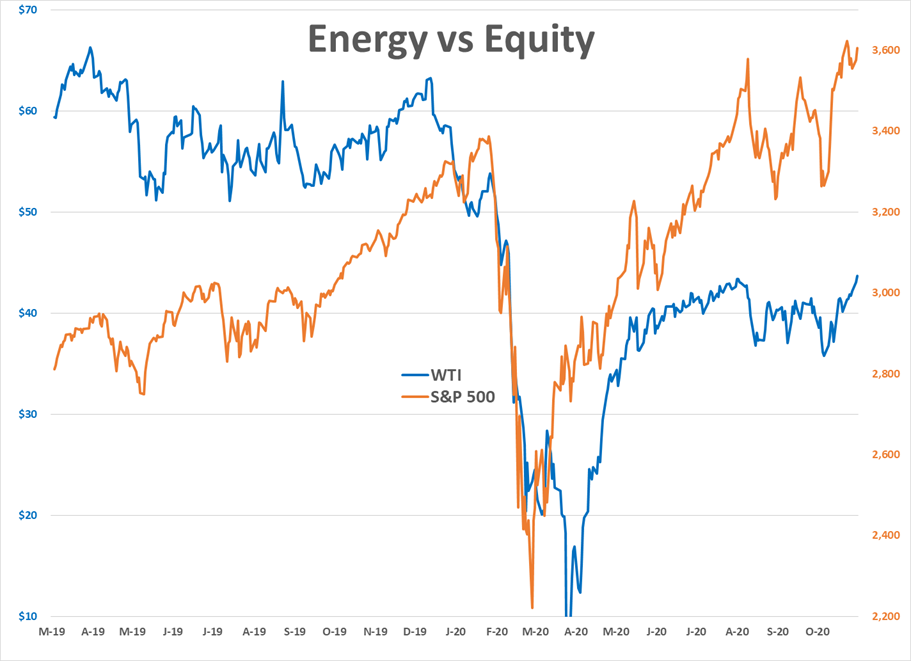

Energy markets are on the cusp of a technical breakout to the upside with diesel prices hitting eight month highs, while crude and gasoline prices follow close behind.

Markets around the world seem to be cheering the news that Janet Yellen – the relatively market-friendly former FED Chair – is being tapped as the new U.S. Treasury Secretary. That move is seen by many as a sign that the new administration will be more focused on economic recovery than reform. In addition, reports that the Presidential transition is moving forward seems to be easing concerns over a protracted legal battle.

ULSD is trading higher for a seventh consecutive day, reaching a new eight month high and moving half way into the chart gap left behind during the March price collapse. WTI came within three cents of hitting an eight month high of its own overnight, setting up a critical test of the sideways trading pattern that’s contained the price action for June. There’s an interesting potential move on the WTI monthly chart, as the short lived selloff Sunday, November 1 and subsequent rally could make an outside up monthly bar that breaks both the low and the high ends of that sideways range. If prices can settle the month by breaking through the top end (near $44) there’s a strong case to be made that we’re soon going to see $50 crude.

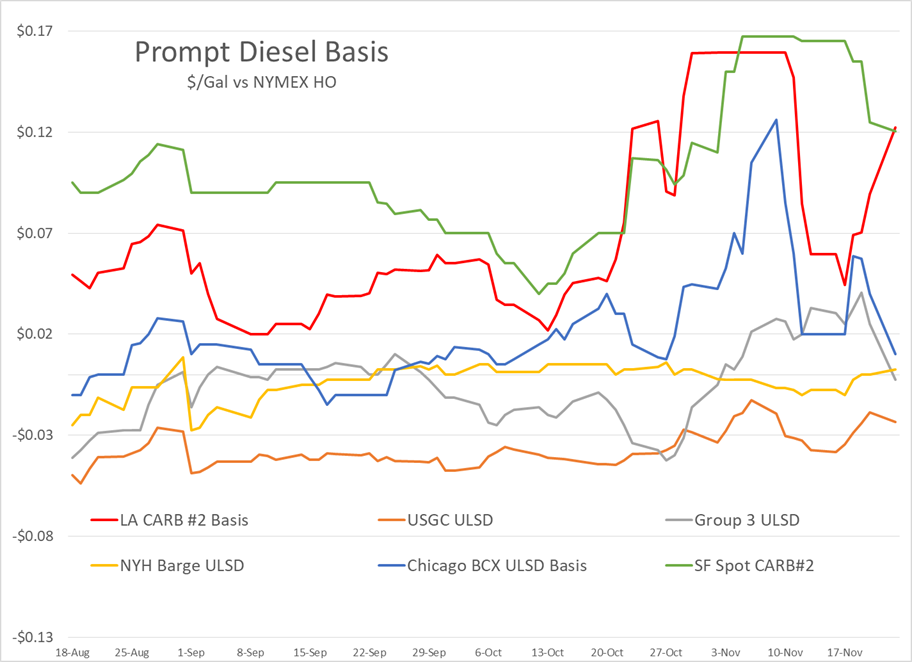

Diverging diesel markets: Midwestern diesel spreads are collapsing this week after hitting their highest premiums in years as the annual post-harvest demand slump seems to be in full force across the region. Gulf coast values saw modest weakness in sympathy as the window to profitably ship barrels north has closed. West Coast values meanwhile are trading at double digit premiums to futures, with LA spots rebounding sharply from a mid-November slump, in what seems to be a reaction to a handful of unplanned refinery issues in the area.

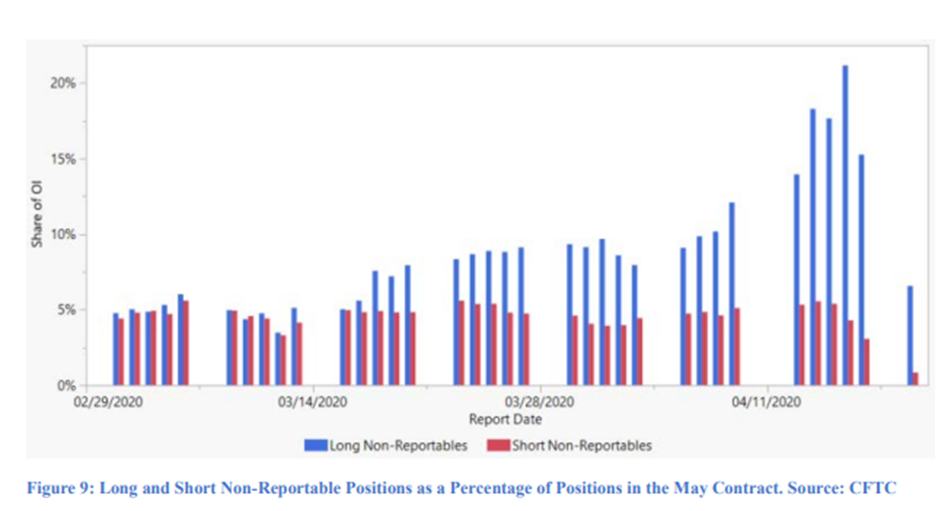

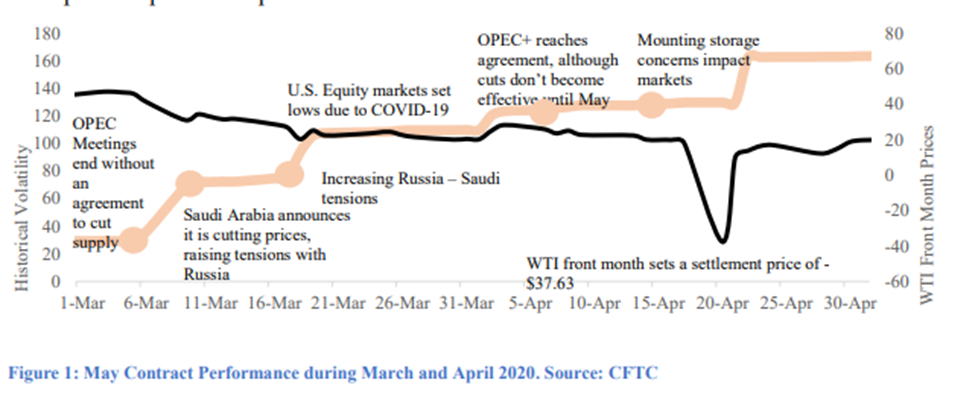

The CFTC published a report on WTI’s plunge to negative values on April 20th. The report cites numerous fundamental and technical factors, and stops short of placing blame, and in many ways suggests the market performed as intended. The results are disappointing many who were looking for a smoking gun, and those that have a hard time understanding how complex commodity futures trading can be. One interesting point brought up in the report is the relatively high open interest in WTI in April, and the amount of positions held by “non-reportable” trading groups, meaning those with small enough positions they aren’t required to report to the CFTC. Those findings are consistent with earlier reports that suggested retail investors – many in China - were left holding the bag when they started trading in WTI without understanding how the contract really works.

NYMEX contracts will trade every day this week, although there will be no settlements published Thursday due to the Thanksgiving holiday in the U.S. Spot markets will not be assessed Thursday or Friday, so most rack prices will carry from Wednesday night through the weekend, even though futures will continue trading.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

Energy Markets Rally Again Thursday After A Choppy Wednesday Session

Week 16 - US DOE Inventory Recap

Energy Markets Trading Quietly In The Red As Ethanol Prices Rally To Five-Month High

The Struggle For Renewable Producers Continues As A Rapid Influx Of Supply And Crashing Credit Prices Make Biodiesel

Social Media

News & Views

View All

Energy Markets Rally Again Thursday After A Choppy Wednesday Session

Energy markets are trying to rally again Thursday after a choppy Wednesday session. RBOB gasoline futures are leading the push higher, on pace for a 3rd consecutive day of gains after finding a temporary floor Tuesday and have added 12 cents from those lows.

Equity markets are pointing sharply lower after a weak Q1 GDP estimate which seems to have contributed to a pullback in product prices over the past few minutes, but don’t be surprised if the “bad news is good news” low interest rate junkies start jumping in later on.

The DOE’s weekly report showed sluggish demand for gasoline and diesel, but inventory levels in most markets continue to follow their typical seasonal trends. Refinery runs held fairly steady last week with crude inputs down slightly but total gross throughputs up slightly as most facilities are now back online from a busy spring maintenance season and geared up for peak demand this summer.

Propane and propylene exports spiked to a record high north of 2.3 million barrels/day last week, which demonstrates both the US’s growing influence on global product markets, and the steady shift towards “other” products besides traditional gasoline and diesel in the level of importance for refiners.

The EIA acknowledged this morning that its weak diesel consumption estimates reflected the switch to Renewable Diesel on the West Coast, although they did not provide any timeline for when that data will be included in the weekly survey. The agency acknowledged that more than 4% of the total US consumption is now a combination of RD and Biodiesel, and that number is expected to continue to grow this year. This morning’s note also suggested that weak manufacturing activity was to blame for the sluggish diesel demand across the US, while other reports suggest the freight recession continued through Q1 of this year, which is also contributing to the big shift from tight diesel markets to oversupplied in several regions.

Valero kicked off the Q1 earnings releases for refiners with solid net income of $1.2 billion that’s a far cry from the spectacular earnings north of $3 billion in the first quarter of 2023. The refining sector made $1.7 billion, down from $4.1 billion last year. That is a pattern that should be expected from other refiners as well as the industry returns to a more normal market after 2 unbelievable years. You wouldn’t guess it by looking at stock prices for refiners though, as they continue to trade near record highs despite the more modest earnings.

Another pattern we’re likely to see continue with other refiners is that Renewable earnings were down, despite a big increase in production as lower subsidies like RINs and LCFS credit values sting producers that rely on those to compete with traditional products. Valero’s SAF conversion project at its Diamond Green joint venture is progressing ahead of schedule and will give the company optionality to flip between RD and SAF depending on how the economics of those two products shakes out this year. Valero also shows part of why refiners continue to disappear in California, with operating expenses for its West Coast segment nearly 2X that of the other regions it operates in.

Week 16 - US DOE Inventory Recap

Energy Markets Trading Quietly In The Red As Ethanol Prices Rally To Five-Month High

Energy markets are trading quietly in the red to start Wednesday’s session after a healthy bounce Tuesday afternoon suggested the Israel-Iran-linked liquidation had finally run its course.

There are reports of more Ukrainian strikes on Russian energy assets overnight, but the sources are sketchy so far, and the market doesn’t seem to be reacting as if this is legitimate news.

Ethanol prices have rallied to a 5-month high this week as corn and other grain prices have rallied after the latest crop progress update highlighted risks to farmers this year, lower grain export expectations from Ukraine, and the approval of E15 blends this summer despite the fact it pollutes more. The rally in grain and renewables prices has also helped RIN values find a bid after it looked like they were about to test their 4-year lows last week.

The API reported small changes in refined product inventories last week, with gasoline stocks down about 600,000, while distillates were up 724,000. Crude oil inventories increased by 3.2 million barrels according to the industry-group estimates. The DOE’s weekly report is due out at its normal time this morning.

Total reported another upset at its Port Arthur refinery that’s been a frequent flier on the TCEQ alerts since the January deep freeze knocked it offline and damaged multiple operating units. This latest upset seems minor as the un-named unit impacted was returned to normal operations in under an hour. Gulf Coast basis markets have shrugged off most reports of refinery upsets this year as the region remains well supplied, and it’s unlikely we’ll see any impact from this news.

California conversely reacted in a big way to reports of an upset at Chevron’s El Segundo refinery outside of LA, with CARBOB basis values jumping by more than a dime. Energy News Today continued to show its value by reporting the upset before the flaring notice was even reported to area regulators, proving once again it’s ahead of the curve on refinery-related events. Another industry news outlet meanwhile struggled just to remember where the country’s largest diesel seller is located.

Click here to download a PDF of today's TACenergy Market Talk