More Choppy Action For Energy Contracts To Start The Last Day Of January, Which Will Be Highlighted By The Weekly Inventory Report

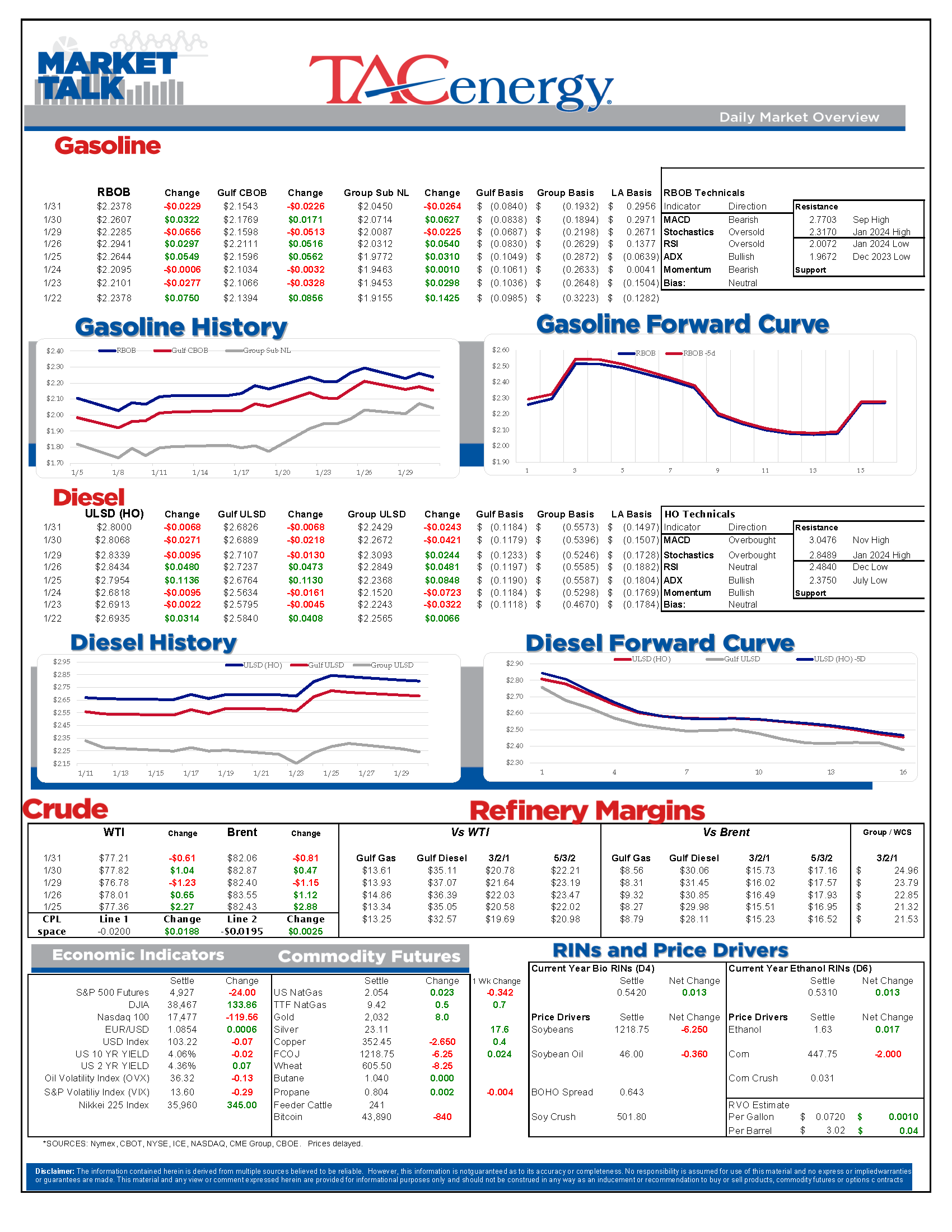

More choppy action for energy contracts to start the last day of January, which will be highlighted by the weekly inventory report, and a decision from the FED. Tuesday saw early morning selling largely erased in afternoon trading, with ULSD futures the only contract to end the day in the red. This morning ULSD futures are the only ones trading green, while RBOB and WTI see modest losses in the early going. Tuesday’s bounce keeps the bulls in control for now despite this week’s pullback in prices, with a strong spring rally still looking possible despite the weakness in many cash markets to start the year.

A glimmer of hope for peace? In addition to ongoing ceasefire talks in Gaza, one of Iran’s puppet armies announced it was backing down from attacks on US troops, as they try to avoid meeting the US Air Force the hard way following the deadly attacks on a base in Jordan.

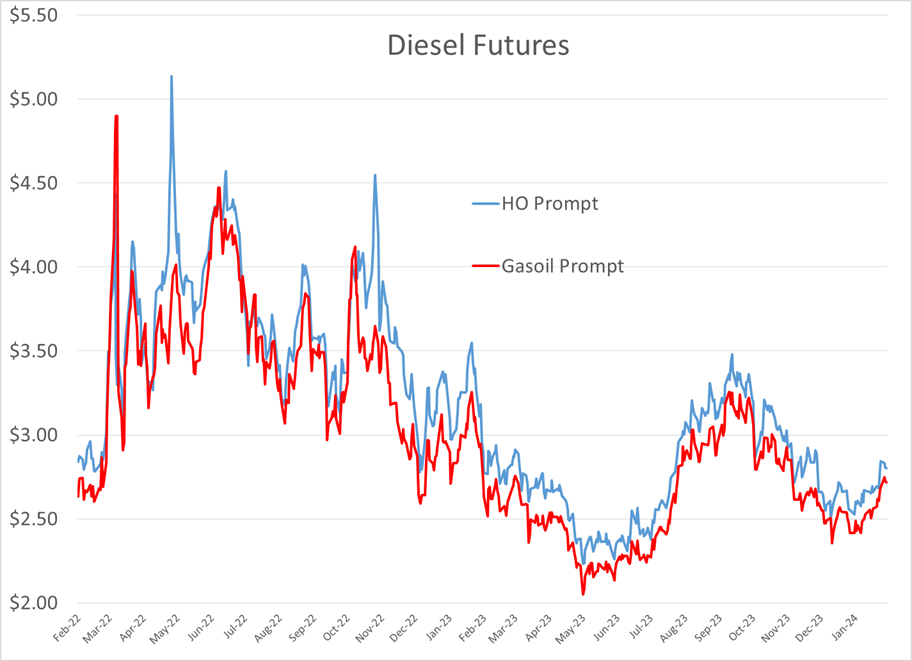

European Gasoil futures which are closely tight to ULSD (HO) futures in the US are trading lower for a 3rd straight day as traders seem to be betting that the supply disruptions caused by the re-routing of ships around the violence won’t become major.

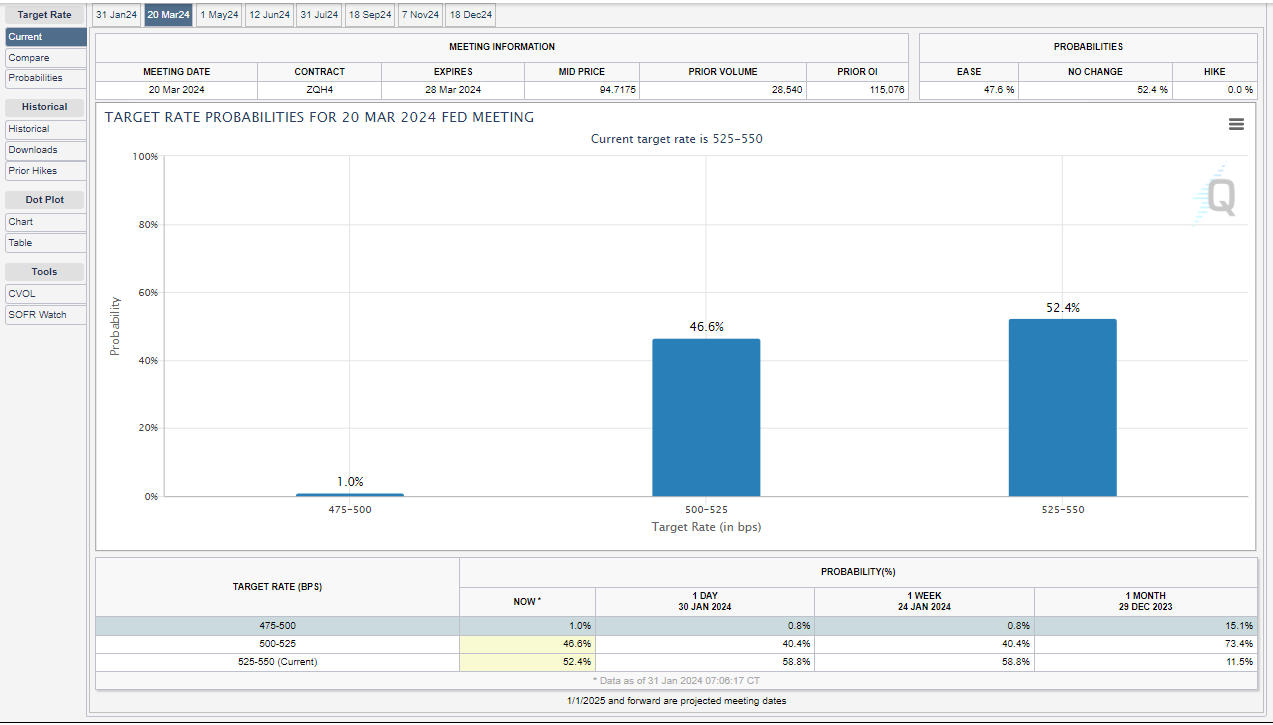

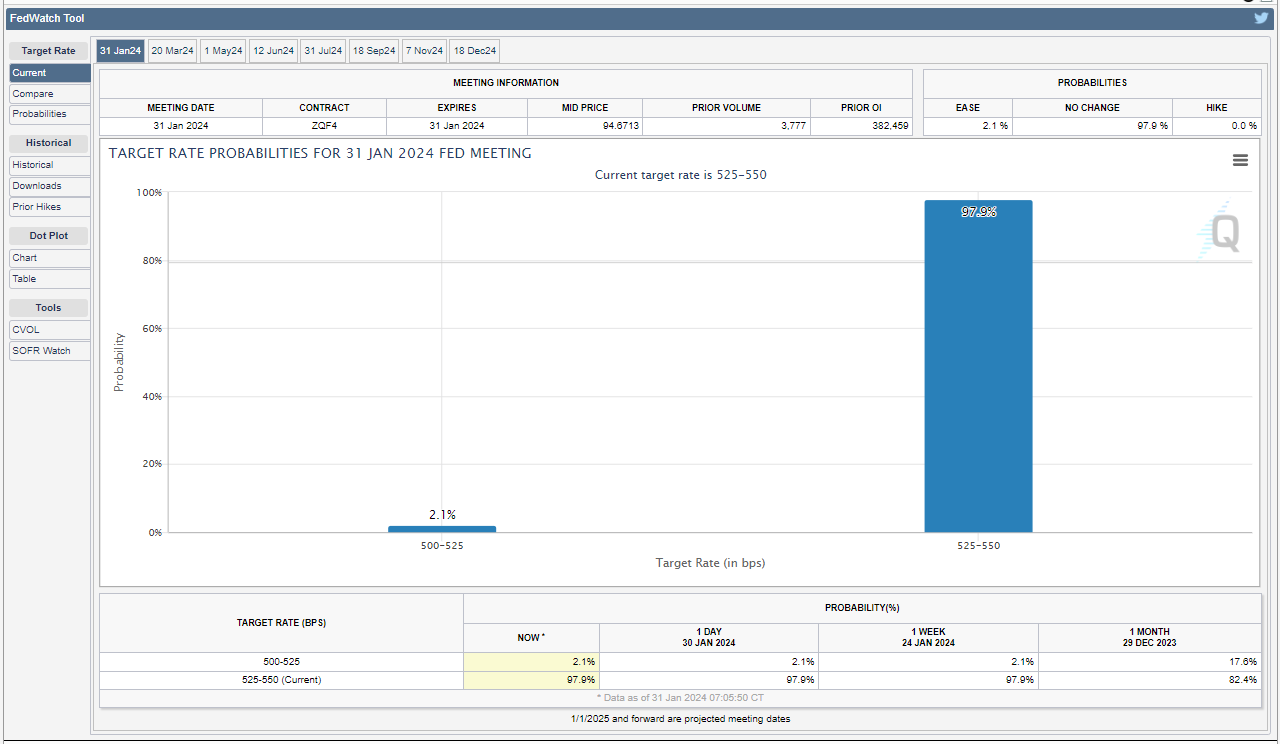

The FOMC will announce the latest in monetary policy at 1pm central today. Pretty much nobody believes the FED will be changing rates today, with the CME’s Fedwatch tool showing just 2% probability of a 25-point rate reduction today. The big question for today’s whether or not the FED will signal plans to start lowering rates in March, with nearly half of the Fed Fund futures bets expecting the start of the easing then, down from 73% odds of a March cut bet a month ago.

The API estimated crude oil and diesel stocks both declined by more than 2 million barrels last week, while gasoline stocks had a small build of around 600,000 barrels. The DOE’s weekly report will be out at its normal time this morning, and we’ll get to see how quickly refiners are coming back online after the cold snap. Don’t expect a complete bounce back in run rates this week however as there is plenty of scheduled maintenance occurring, as most refiners have been noting a busy turnaround schedule for Q1 in their earnings releases this week.

Marathon noted two noteworthy projects in its Q4 earnings release Tuesday. The Galveston Bay facility, who earned frequent flier miles with the TCEQ in 2023 with nearly weekly upset reports, is going to install a new 90,000 distillate hydro-treater, with an expected completion in 2025. Their LA-area refinery meanwhile will be undergoing a modernization plan to improve its energy efficiency and reduce NOx emissions to meet California’s ever-changing regulations. The company did not specifically note anything about its renewable operations in the earnings release but did note in the analyst call that its converted facility in Martinez is running at less than half of its nameplate capacity after last year’s fire. For those who have been experiencing how suddenly long California is on RD this winter, just imagine if that plant was producing another 25MBD.

Phillips 66 continued the trend of good, not great, earnings in its Q4 report this morning, earning more than $800 million in its refining sector the past 3 months, down from $1.7 billion in Q3. Unlike most of the others however, P66 continues to highlight its cost reduction strategies rather than its plans to grow, saying it achieved $1.2 billion in sustainable savings in 2023 which is AKA laying people off. The company’s conversion project in Rodeo CA is still scheduled to come online in the first quarter, although it remains unclear how long it will take between starting operations and reaching the new nameplate capacity of 50MBD of renewables output. The company continues to highlight plans to sell off roughly $3 billion in unnamed assets that don’t fit its long-term strategy.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

Week 18 - US DOE Inventory Recap

Crude Oil, Gasoline, And Diesel Benchmarks Are All Trading >1% Lower To Start The Day

Energy prices are sinking again this morning, albeit with a little more conviction than yesterday’s lackadaisical wilting. Crude oil, gasoline, and diesel benchmarks are all trading >1% lower to start the day with headlines pointing to an across-the-board build in national inventories as the source for this morning’s bearish sentiment. The Department of Energy’s official report is due out at its regular time this morning (9:30am CDT).

WTI has broken below its 100-day moving average this morning as it fleshed out the downward trend that began early last month. While crossing this technical threshold may not be significant in and of itself (it happened multiple times back in February), the fact that it coincides with the weekly and monthly charts also breaking below a handful of their respective moving averages paints a pretty bearish picture in the short term. The door is open for prices to drop down to $75 per barrel in the next couple weeks.

Shortly after the EIA’s weekly data showed U.S. commercial crude inventories surpassing 2023 levels for the first time this year, their monthly short-term energy outlook is forecasting a fall back to the bottom end of the 5-year range by August due to increasing refinery runs over the period. However, afterward the administration expects a rise in inventories into 2025, citing continued production increases and loosening global markets hindering the incentive to send those excess barrels overseas. The agency also cut back their average gas and diesel price forecasts for the first time since February with the biggest reductions in the second and third quarter of this year.

The STEO also featured their famed price prediction for WTI, stating with 95% confidence that the price for crude oil will be between $40 and $140 through 2026.

Need a general indication of the global crude oil supply? Most headlines seem to be covering a shortage of a different type of oil, one that we haven’t turned into fuel (yet).

Click here to download a PDF of today's TACenergy Market Talk.

The Perceived Cooling Of Regional Tensions In The Middle East Area Attributing To The Quiet Start To Today’s Trading Session

The energy complex is drifting lower this morning with RBOB futures outpacing its counterparts, trading -.9% lower so far to start the day. The oils (WTI, Brent, heating) are down only .2%-.3% so far this morning.

The perceived cooling of regional tensions in the Middle East area attributing to the quiet start to today’s trading session, despite Israel’s seizure of an important border crossing. A ceasefire/hostage-release agreement was proposed Monday, and accepted by Hamas, but rejected by Israel as they seemingly pushed ahead with their Rafah offensive.

U.S. oil and natural gas production both hit record highs in 2023 and continue to rise in 2024, with oil output currently standing at 13.12 million barrels per day and January 2024 natural gas production slightly exceeding the previous year. With WTI currently changing hands at higher than year-ago levels, this increased production trend is expected to continue despite a decrease in rigs drilling for these resources.

Less than a week after the Senate Budget Committee’s hearing centered on the credibility of big oil’s climate preservation efforts, a major oil company was reported to have sold millions of carbon capture credits, without capturing any carbon. Fraud surrounding government subsidies to push climate-conscious fuel initiatives is nothing new, on a small scale, but it will be interesting to see how much (if any) of the book is thrown at a major refiner.

Today’s interesting read: sourcing hydrogen for refining.

Click here to download a PDF of today's TACenergy Market Talk.