Petroleum Prices Move Higher Following Inventory Declines

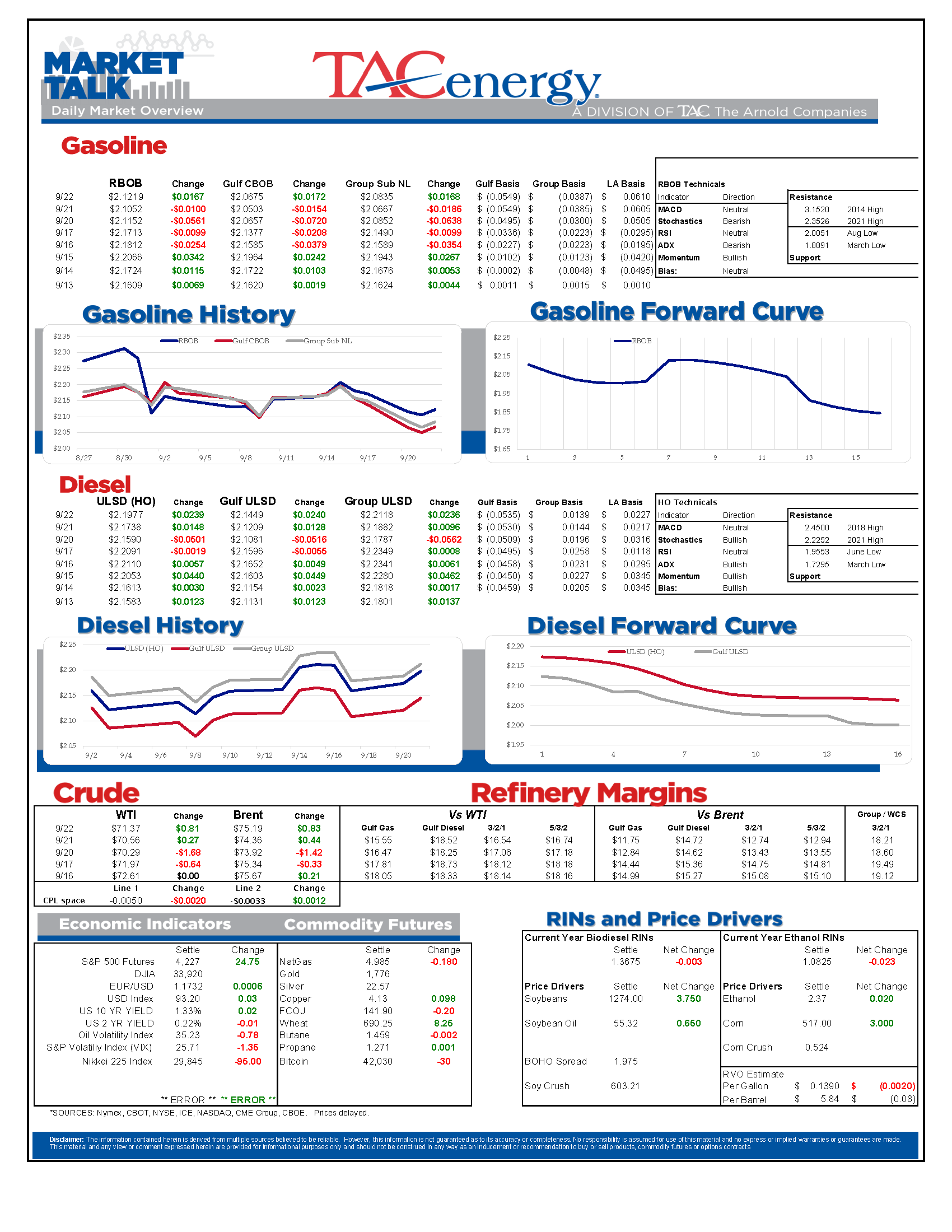

Petroleum prices are on the move higher again following more inventory declines. Diesel prices continue to hover near 3 year highs as we approach peak demand season for distillates, while gasoline prices are lagging behind as the fall RVP transition is almost behind us and the driving season comes to an end.

The API reported a large draw of 6.1 million barrels for crude oil inventories last week, while distillates declined by 2.7 million barrels and gasoline decreased by 432,000 barrels. The DOE’s version of the inventory report is due out at its normal time this morning, and the lingering impacts from Hurricane Ida are still expected to play a big role in those numbers.

Shell announced that damage from Ida will take until early 2022 to fix, and damage to both offshore wells and pipelines is likely to keep more than 200,000 barrels/day of oil production offline through the end of the year. Put it another way, the damage to Shell’s facilities will reduce oil inventories by 1.5 million barrels every week for the next 3.5 months unless an alternate source can replace those barrels.

Meanwhile, the company’s Norco refinery is still closed due to storm damage and it’s unclear how long those repairs may take. It’s a similar story for the P66 refinery in Belle Chasse LA, that is up for sale, and may need more than 6 months to make repairs after the facility flooded.

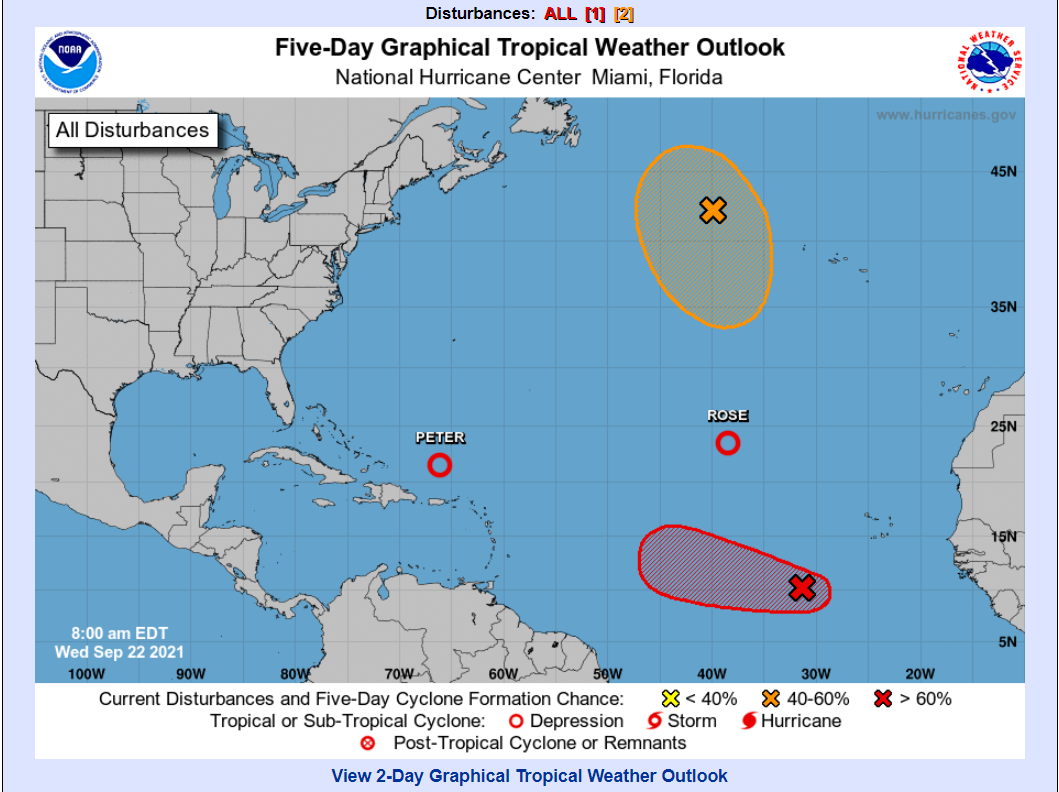

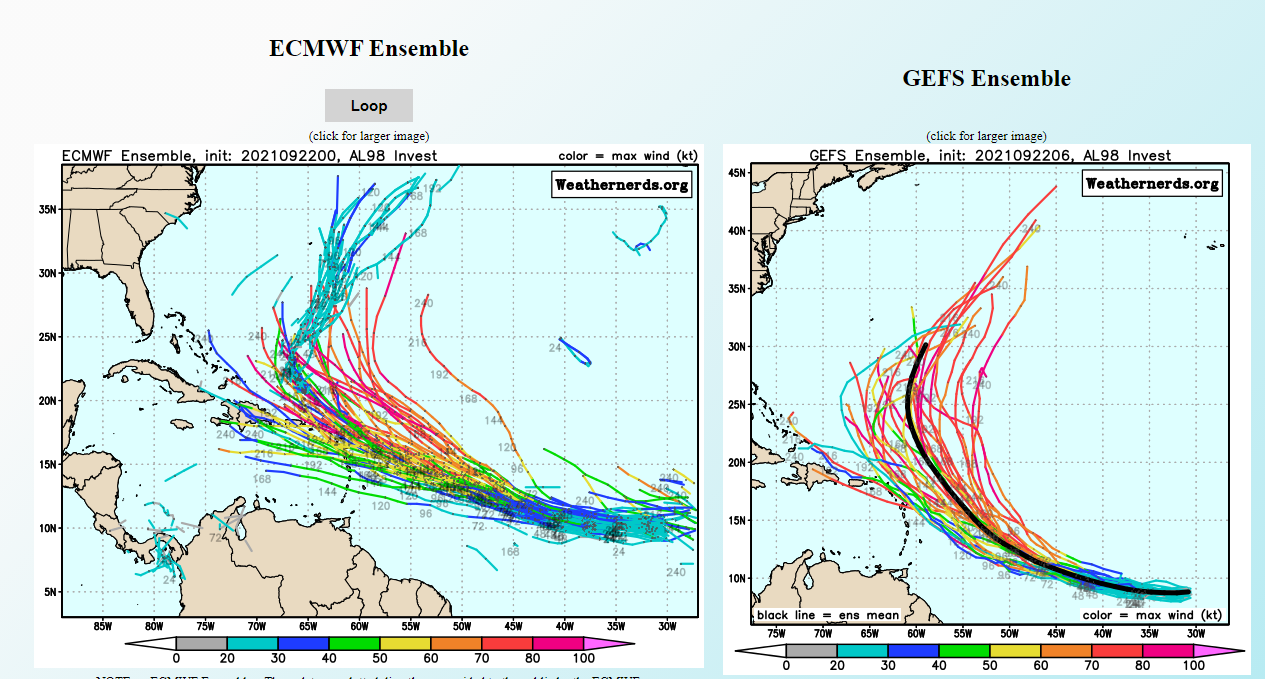

Those racing to restore operations after Ida can breathe a little easier this morning as Peter & Rose appear to be non-issues, while the storm that will probably be named Sam later this week has a good chance of following those two storms out towards the open sea and not threatening the US coast line. There are still low odds that storm could get into the Gulf of Mexico so we’ll need to keep an eye on it for a while longer.

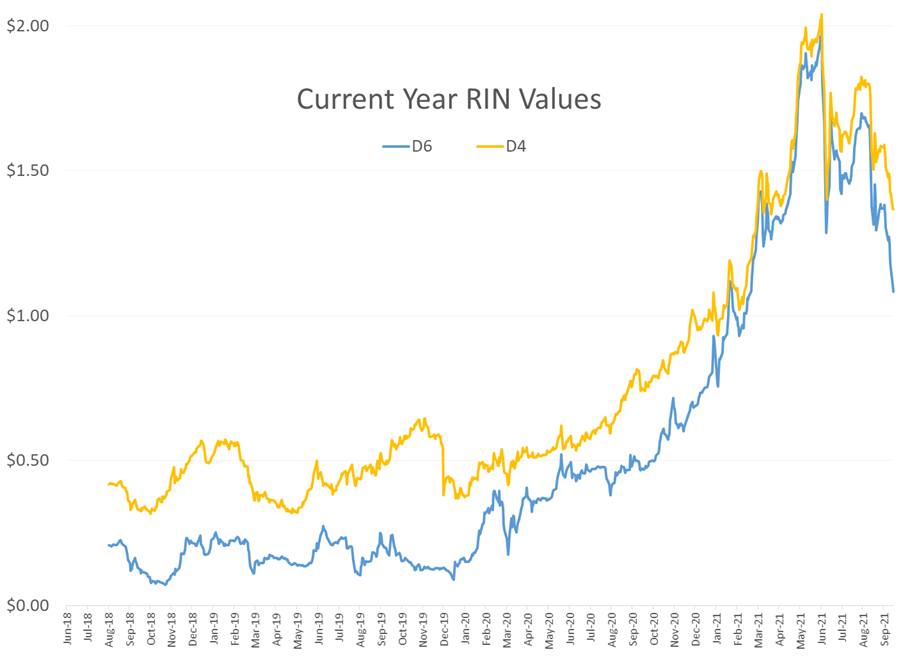

RIN prices continued their downward slide Tuesday, with both D4 and D6 values reaching fresh 7 month lows. Still no word on when the EPA will actually announce the blending targets for 2021 (which were due almost a year ago) or for 2022. The EPA did announce Friday that it would be auditing RIN transactions to make sure that fraudulent RINs weren’t still making it through their system.

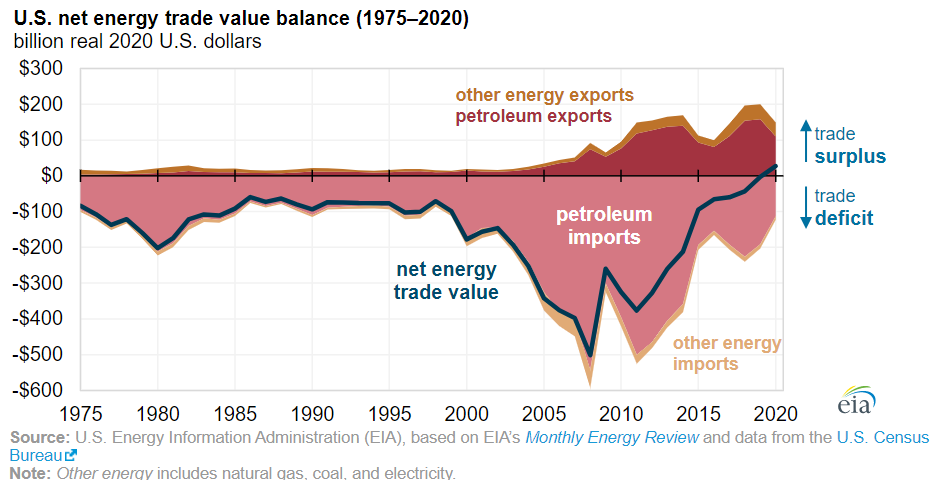

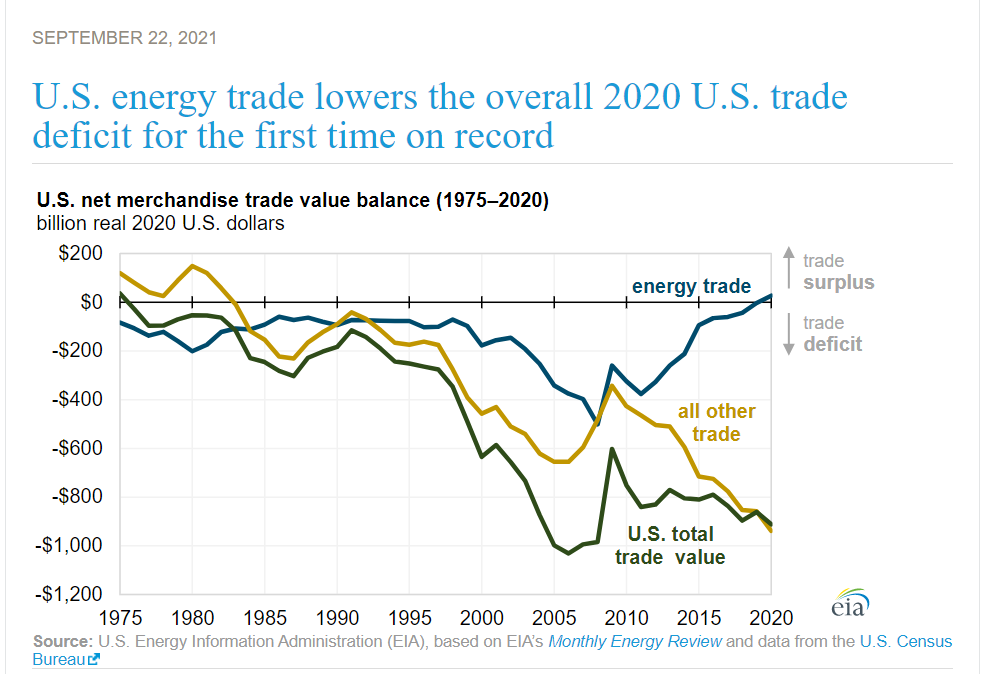

The EIA this morning reported that energy exports reduced the US trade deficit for the first time ever in 2020, proving once again the expanding role of Gulf Coast refiners in supplying the world’s demand for both fuel, plastics, and other petroleum-based products.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

Energy Markets Are Pointing Modestly Higher To Start Friday’s Session

Energy markets are pointing modestly higher to start Friday’s session, in a meager attempt at a recovery rally at the end of what would be the worst week in over two months if prices settle near current values. The liquidation of speculative bets placed on higher energy prices ahead of the direct conflict between Israel and Iran continues to appear to be the driver of the weakness, and we’ll have to wait and see if this modest bounce is a sign that the liquidation is over, or just a pause before it picks up again. Most contracts remain in a precarious technical position with the potential for a slide towards $70 for WTI and $2.20 for both refined products if the buyers don’t get serious soon.

Stocks are pointing sharply higher after a slowdown in job growth reported in the April Non-Farm payroll report. The BLS reported an increase of 175,000 jobs for the month, down sharply from the 315,000 jobs added in March, and the February & March estimates were revised down a combined 22,000. Both the “official” (U-3) and “real” (U-6) unemployment rates ticked up by .1% to 3.9% and 7.4% respectively. The immediate positive reaction to negative news suggest that the bad news is good news low-interest-rate junkies believe this may help the FED’s dilemma of the US economy being too strong to cut rates. The big jump in equities has not seemed to spill over into energy contracts yet, as crude and refined product contracts changed very little following the report.

San Francisco diesel basis spiked 15 cents Thursday to reach the highest level of any market in the country so far this year at 35 cents over prompt futures. While there aren’t yet any refinery upsets reported to blame the spike on, PBF is undergoing planned maintenance at its Martinez facility, and of course P66 just finished converting its Rodeo plant to RD after Marathon converted its Martinez facility in the past couple of years, meaning there are at most only 2 out of the previous 5 refineries in the region operating near capacity these days. The question now is how quickly barrels can shift north from Southern California which continues to show signs of a supply glut with weak basis values and spot to rack spreads.

PBF continued the trend of Q1 refinery earnings that were sharply lower, but still healthy by longer-term historical standards. The company noted that its Saint Bernard (the parish, not the dog) Renewables facility co-processing at its Chalmette refinery had received provisional approval from CARB to lower its CI scores and help improve the amount of LCFS subsidies it can receive. That facility is operating at 18mb/day which is roughly 86% of its capacity.

Cenovus highlighted the restart of its Toledo and Superior refineries in improved refinery run rates in Q1 2024 vs Q1 2023 and noted that it had ramped up production at units that were slowed down for economic reasons in December and January (you may remember this as the time when midcontinent basis values were trading 50 cents/gallon below futures). The company did note that the January deep freeze slowed operations at Superior, but did not mention any change in operating rates despite numerous upsets at its 50% owned Borger refinery.

Dress rehearsal for a busy hurricane season? So far there are no reports of refinery issues caused by the flooding in the Houston area this week. At this point, most of the flooding appears to be far to the north of the refining hubs on the Gulf Coast but with more storms in the forecast and 88 counties already declaring disaster status, this will be something to watch for the next few days.

Click here to download a PDF of today's TACenergy Market Talk.

Crude Oil Inventories Climbed Above Year-Ago Levels For The First Time In 2024

Sell by May then go away.

The old trading adage looked good for energy markets in 2024 as the new month started off with the biggest daily sell-off of the year so far. WTI and ULSD contracts are now in “rally or else” mode on the charts with sharply lower prices a strong possibility now that technical support layers have broken down. RBOB doesn’t look quite as bearish on the charts, but seasonal factors will now act as a headwind as we’re well into the spring peaking window for gasoline prices, and we’ve already seen a 27 cent drop from the highs. If RBOB can hold above $2.50 there’s a chance to avoid a larger selloff, but if not, a run towards $2.20 for both gasoline and diesel looks likely in the months ahead.

The selling picked up steam following the DOE’s weekly report Wednesday, even though the inventory changes were fairly small. Crude oil inventories continue their steady build and climbed above year-ago levels for the first time in 2024. Demand for refined products remains sluggish, even after accounting for the RD consumption that’s still not in the weekly reports, and most PADDs are following a typical seasonal inventory trend. The Gulf Coast saw a healthy build in diesel inventories last week as the export market slowed for a 3rd straight week. Refinery runs dipped modestly last week following a handful of upsets across the country, but overall rates remain near normal levels for this time of year.

The Transmountain pipeline expansion began operations yesterday, completing a 12-year saga that has the potential to materially change refining economics for plants in the US that relied heavily on discounted Canadian crude to turn profits over the past decade.

The P66 Borger refinery reported another operational upset Monday that lasted a full 24 hours impacting a sulfur recovery unit. Last week the company highlighted how the plant’s fire department helped the surrounding area when the largest wildfire in state history came within feet of the facility.

The EPA approved a new model to determine life cycle carbon intensity scores this week, which cracks open the door for things like ethanol to SAF, which were previously deemed to not reduce emissions enough to qualify for government subsidies. The new model would require improved farming techniques like no-till, cover crop planting and using higher efficiency nitrogen fertilizer to limit the damage done by farms that no longer rotate crops due to the ethanol mandates. Whether or not the theoretical ability to produce SAF comes to fruition in the coming years thanks to the increased tax credit potential will be a key pivot point for some markets that find themselves with too much RD today, but could see those supplies transition to aviation demand.

The FED continues to throw cold water on anyone hoping for a near term cut in interest rates. The FOMC held rates steady as expected Wednesday, but also highlighted the struggles with stubbornly high inflation. The CME’s Fedwatch tool gave 58% odds of at least one rate cut by September before the announcement, and those odds have slipped modestly to 54% this morning.