Rising Fuel Stockpiles Outweighing Rising Stock Markets

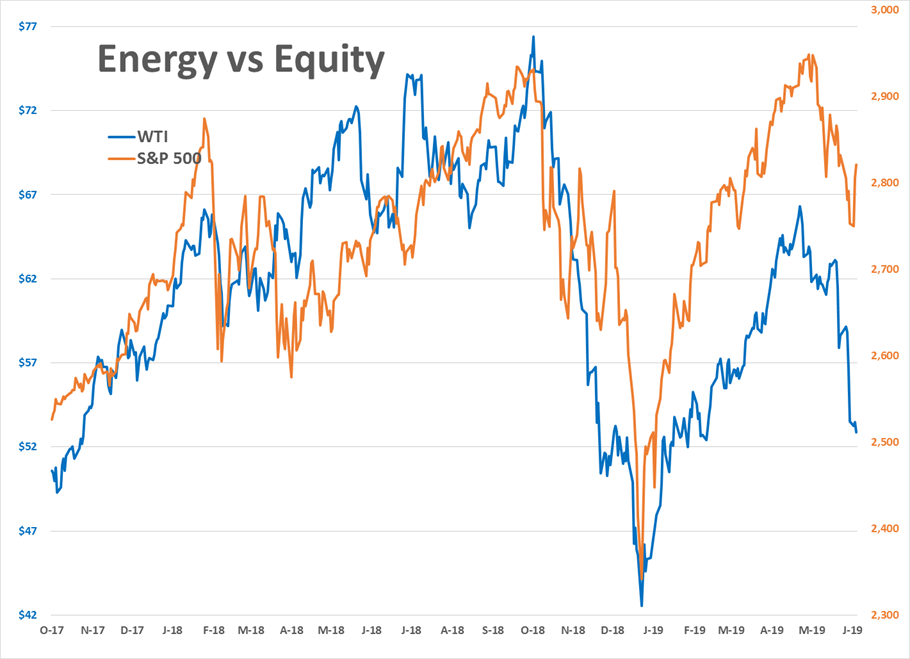

Rising fuel stockpiles are outweighing rising stock markets as RBOB gasoline futures trade lower for a 6th straight session and the rest of the energy complex continues to hover near multi-month lows.

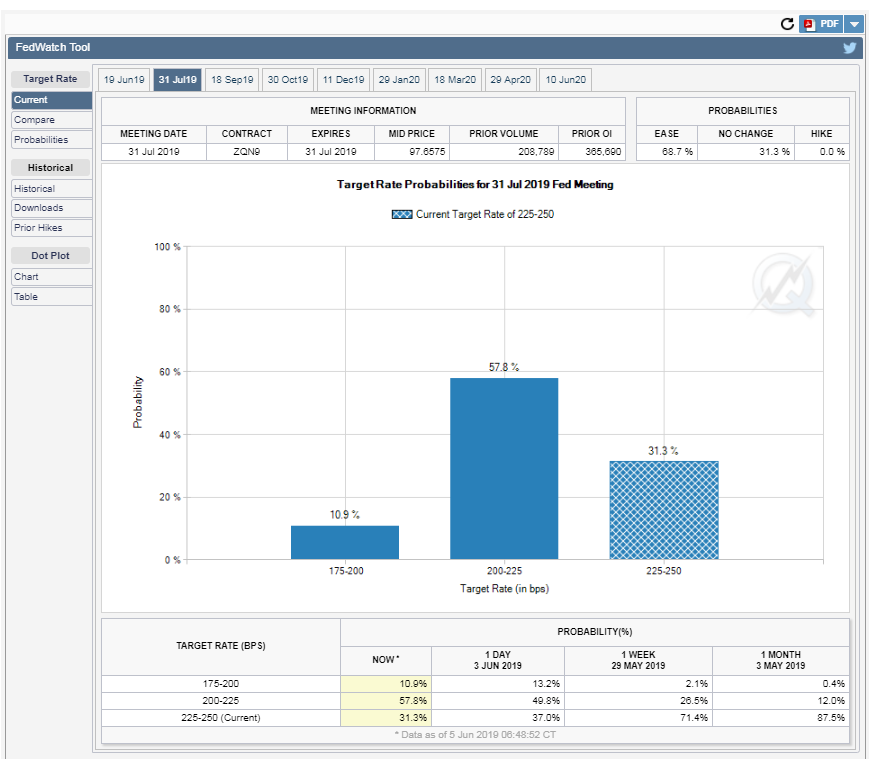

US equities had a huge rally Tuesday, which seemed to help energy prices pull back from the multi-month lows, after the FED Chairman Jerome Powell suggested that an interest rate cut may be coming to help offset potential impacts of the trade wars. The CME’s fedwatch tool is showing a nearly 70% probability that the FED will cut rates by at least 25 points by the end of July following those statements, up from less than a 30% probability just a week ago. With expectations changing that rapidly, it seems like the market may be setting itself up for disappointment if that rate cut doesn’t come soon.

Unfortunately for the beleaguered bulls in energy contracts, the equity-induced bounce didn’t hold up after the API was said to report across-the-board builds in inventory last week. Diesel stocks were estimated to have the largest increase of 6.3 million barrels, while crude stocks were up 3.6 million and gasoline supplies increased by 2.7 million barrels. The DOE/EIA’s weekly report is due out at its normal time of 9:30 central.

The storms moving across the Gulf of Mexico are not expected to develop into a tropical system, but they are expected to bring flooding rains to refinery country. The majority of gulf coast refineries, and more than 1/3 of the country’s total, and are covered by the flood alerts through the end of the week. While major refinery damage from a disorganized system like this seems unlikely, it is certainly possible that it could further disrupt pipeline and/or marine vessel traffic and perhaps back up barrels destined for export, leading to more inventory builds in next week’s reports.

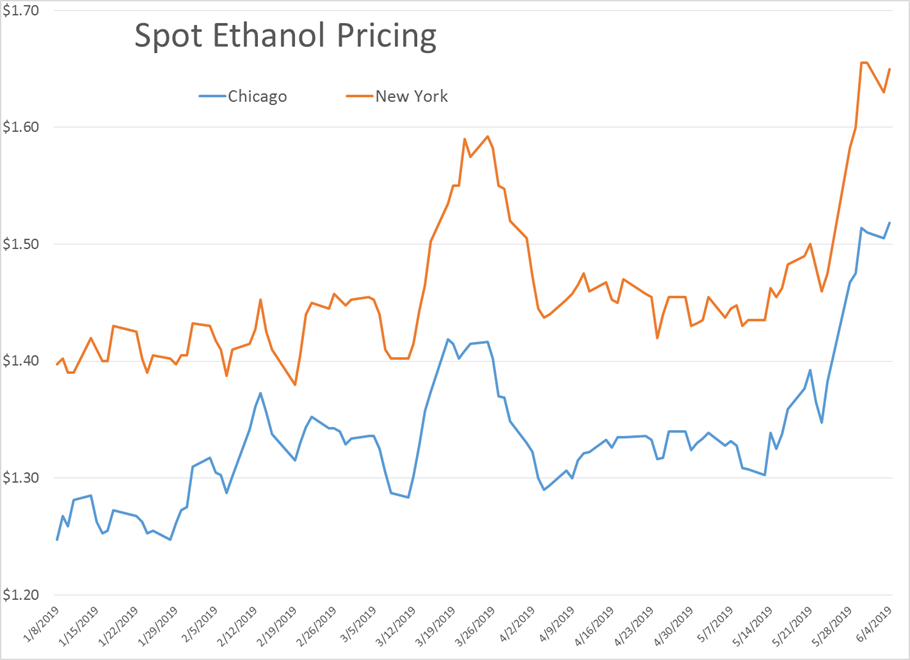

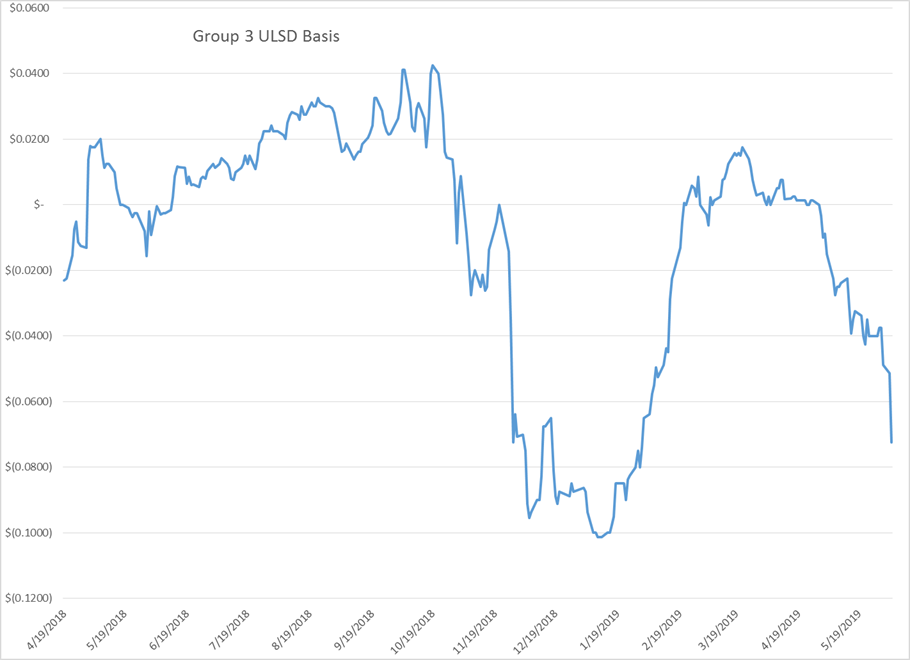

The additional rains are even less welcome in the Midwest, as it looks like a record amount of farm land will go unplanted this year. The charts below show how that continues to put a bid under ethanol prices, while diesel differentials in the region are collapsing.

A Wall Street journal survey of 10 investment banks suggests the latest price plunge hasn’t changed their outlooks for oil prices in the back half of the year, with most still targeting Brent around $70. The bulls will find solace in their predictions that fundamental supply tightness will eventually outweigh trade fears in sending prices higher, while the bears will find solace that these predictions come from the same institutions that made up credit default swaps on mortgage backed securities.

Latest Posts

Crude Oil Inventories Climbed Above Year-Ago Levels For The First Time In 2024

Week 17 - US DOE Inventory Recap

The Energy Complex Is Trading Modestly Lower So Far This Morning With WTI Crude Oil Futures Leading The Way

Energy Futures Are Drifting Quietly Higher This Morning

Social Media

News & Views

View All

Crude Oil Inventories Climbed Above Year-Ago Levels For The First Time In 2024

Sell by May then go away.

The old trading adage looked good for energy markets in 2024 as the new month started off with the biggest daily sell-off of the year so far. WTI and ULSD contracts are now in “rally or else” mode on the charts with sharply lower prices a strong possibility now that technical support layers have broken down. RBOB doesn’t look quite as bearish on the charts, but seasonal factors will now act as a headwind as we’re well into the spring peaking window for gasoline prices, and we’ve already seen a 27 cent drop from the highs. If RBOB can hold above $2.50 there’s a chance to avoid a larger selloff, but if not, a run towards $2.20 for both gasoline and diesel looks likely in the months ahead.

The selling picked up steam following the DOE’s weekly report Wednesday, even though the inventory changes were fairly small. Crude oil inventories continue their steady build and climbed above year-ago levels for the first time in 2024. Demand for refined products remains sluggish, even after accounting for the RD consumption that’s still not in the weekly reports, and most PADDs are following a typical seasonal inventory trend. The Gulf Coast saw a healthy build in diesel inventories last week as the export market slowed for a 3rd straight week. Refinery runs dipped modestly last week following a handful of upsets across the country, but overall rates remain near normal levels for this time of year.

The Transmountain pipeline expansion began operations yesterday, completing a 12-year saga that has the potential to materially change refining economics for plants in the US that relied heavily on discounted Canadian crude to turn profits over the past decade.

The P66 Borger refinery reported another operational upset Monday that lasted a full 24 hours impacting a sulfur recovery unit. Last week the company highlighted how the plant’s fire department helped the surrounding area when the largest wildfire in state history came within feet of the facility.

The EPA approved a new model to determine life cycle carbon intensity scores this week, which cracks open the door for things like ethanol to SAF, which were previously deemed to not reduce emissions enough to qualify for government subsidies. The new model would require improved farming techniques like no-till, cover crop planting and using higher efficiency nitrogen fertilizer to limit the damage done by farms that no longer rotate crops due to the ethanol mandates. Whether or not the theoretical ability to produce SAF comes to fruition in the coming years thanks to the increased tax credit potential will be a key pivot point for some markets that find themselves with too much RD today, but could see those supplies transition to aviation demand.

The FED continues to throw cold water on anyone hoping for a near term cut in interest rates. The FOMC held rates steady as expected Wednesday, but also highlighted the struggles with stubbornly high inflation. The CME’s Fedwatch tool gave 58% odds of at least one rate cut by September before the announcement, and those odds have slipped modestly to 54% this morning.

Week 17 - US DOE Inventory Recap

The Energy Complex Is Trading Modestly Lower So Far This Morning With WTI Crude Oil Futures Leading The Way

The energy complex is trading modestly lower so far this morning with WTI crude oil futures leading the way, exchanging hands $1.50 per barrel lower (-1.9%) than Tuesday’s settlement price. Gasoline and diesel futures are following suit, dropping .0390 and .0280 per gallon, respectively.

A surprise crude oil build (one that doesn’t include any changes to the SPR) as reported by the American Petroleum Institute late Tuesday is taking credit for the bearish trading seen this morning. The Institute estimated an increase in crude inventories of ~5 million barrels and drop in both refined product stocks of 1.5-2.2 million barrels for the week ending April 26. The Department of Energy’s official report is due out at it’s regular time (9:30 CDT) this morning.

The Senate Budget Committee is scheduled to hold a hearing at 9:00 AM EST this morning regarding a years-long probe into climate change messaging from big oil companies. Following a 3-year investigation, Senate and House Democrats released their final report yesterday alleging major oil companies have internally recognized the impacts of fossil fuels on the climate since as far back as the 1960s, while privately lobbying against climate legislation and publicly presenting a narrative that undermines a connection between the two. Whether this will have a tangible effect on policy or is just the latest announcement in an election-yeardeluge is yet to be seen.

Speaking of deluge, another drone attack was launched against Russian infrastructure earlier this morning, causing an explosion and subsequent fire at Rosneft’s Ryazan refinery. While likely a response to the five killed from Russian missile strikes in Odesa and Kharkiv, Kyiv has yet to officially claim responsibility for the attack that successfully struck state infrastructure just 130 miles from Moscow.

The crude oil bears are on a tear this past week, blowing past WTI’s 5 and 10 day moving averages on Monday and opening below it’s 50-day MA this morning. The $80 level is likely a key resistance level, below which the path is open for the American oil benchmark to drop to the $75 level in short order.

Click here to download a PDF of today's TACenergy Market Talk.