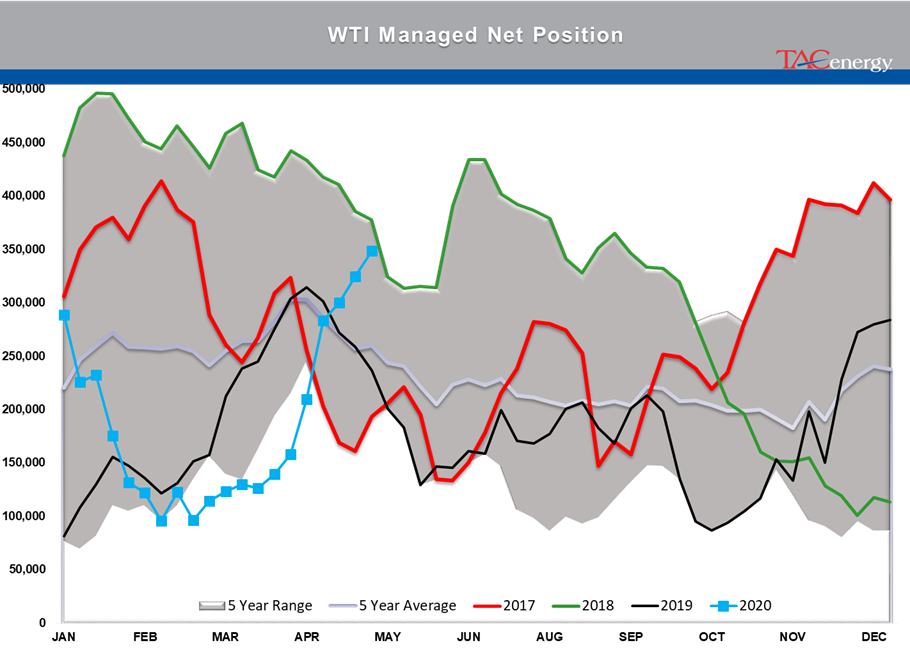

Signs Of Economic Recovery Continue To Appear

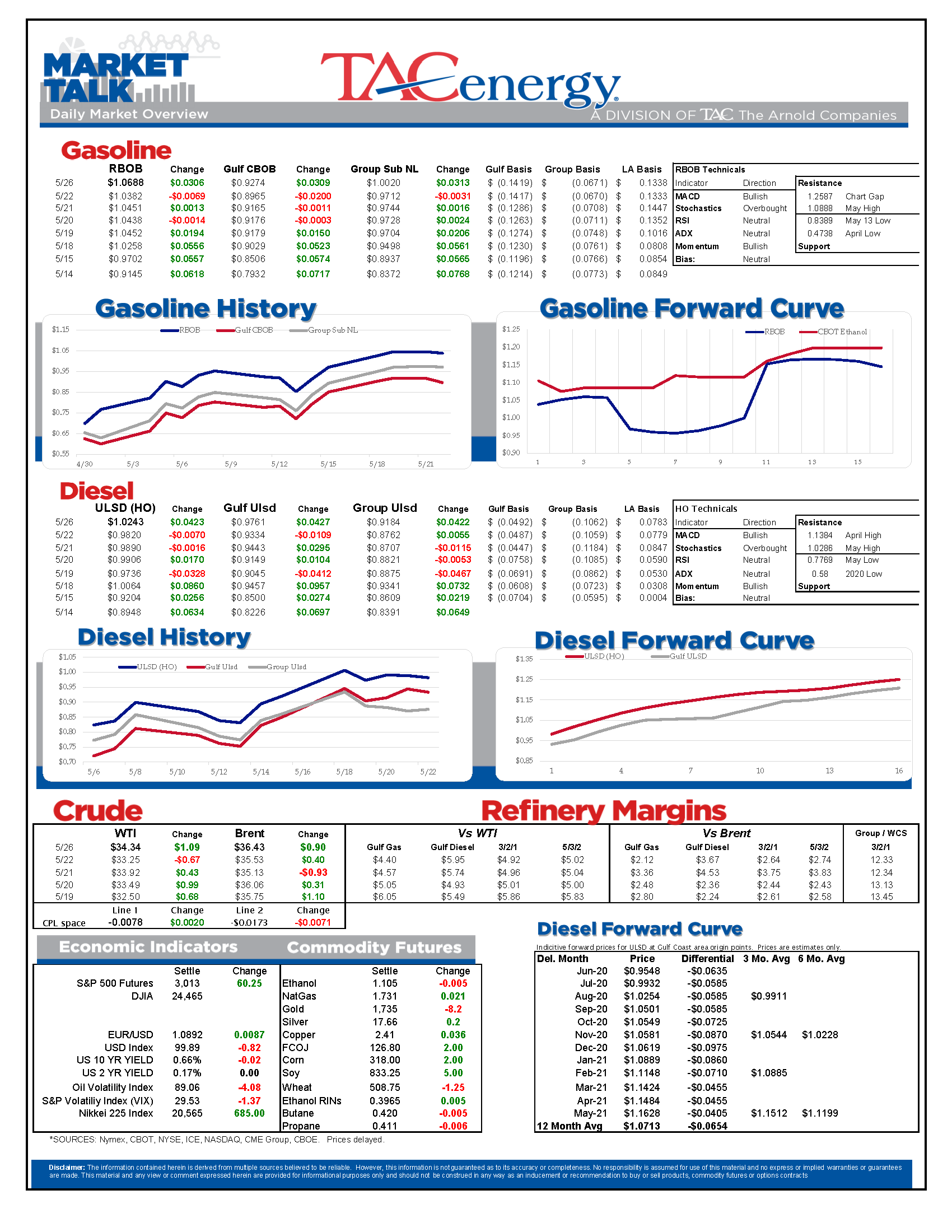

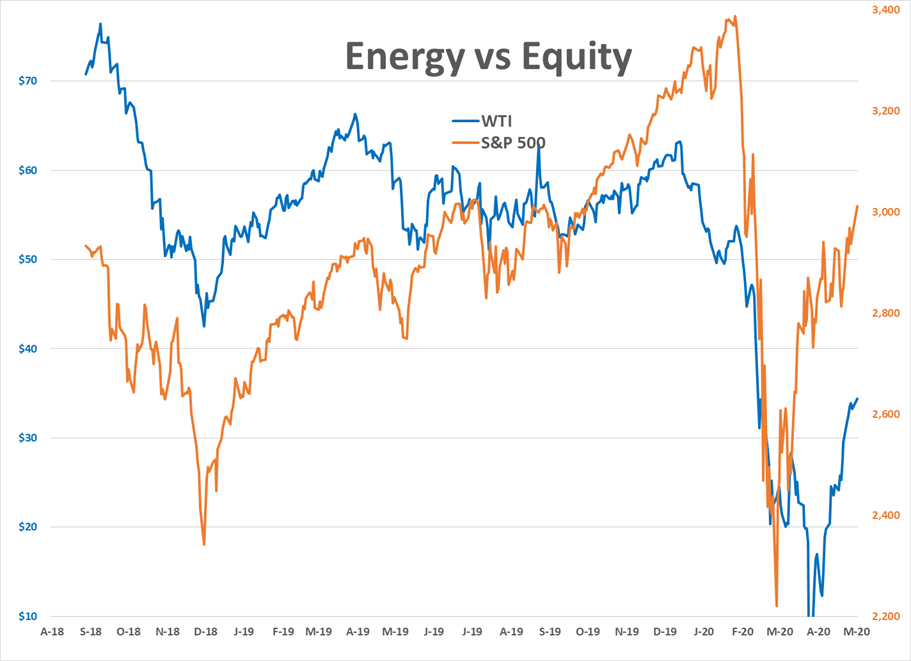

Energy and equity markets are rallying again this morning as signs of hope for economic recovery continue to appear. Specific to energy, comments from the IEA Director and Russian oil minister over the past few days seem to be encouraging buyers that the supply and demand equation is balancing.

From a technical perspective, the buying after Friday’s selloff helped heal some of the overbought condition on the charts, but we will need to see prices break through last week’s highs to say that the upward trend is fully back online.

Baker Hughes reported another 21 oil rigs were taken offline last week, marking a 65 percent drop in active oil rigs since March 6. The combined oil and gas rig count also fell by 21 rigs, which sets a new all-time low.

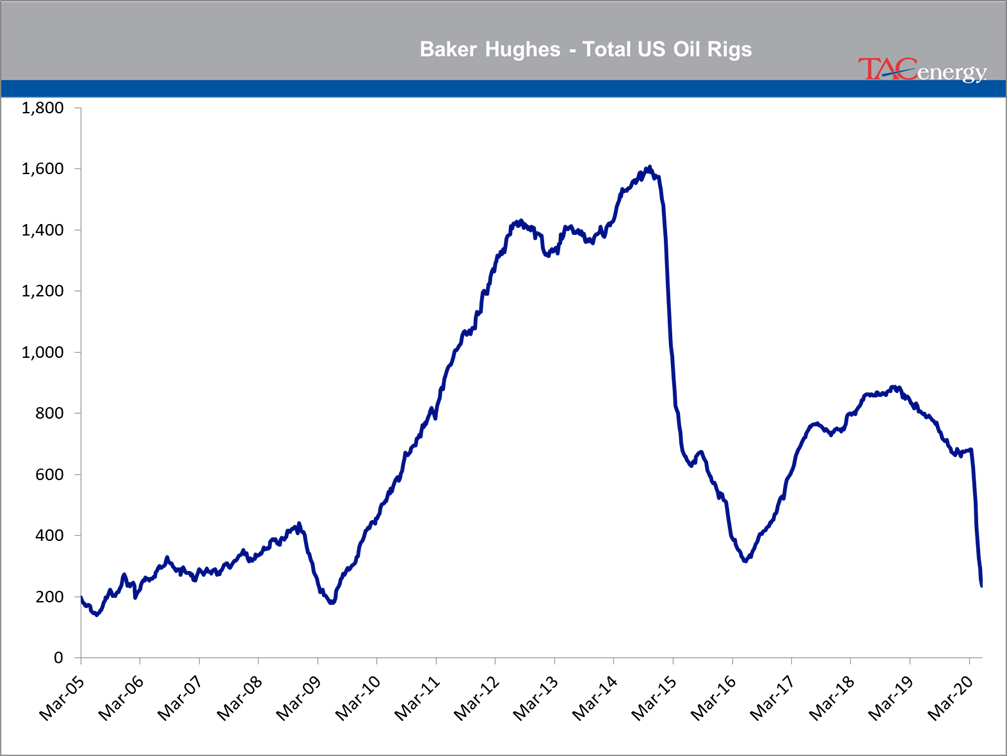

Money managers seem to be encouraged by the drop in U.S. drilling activity, adding to their net length in WTI for a seventh straight week, and approaching the top end of the five-year seasonal range for bets on higher prices. The net length increases have been primarily driven by new long positions rather than short covering, suggesting that the big funds are betting on a price rally in the back half of the year.

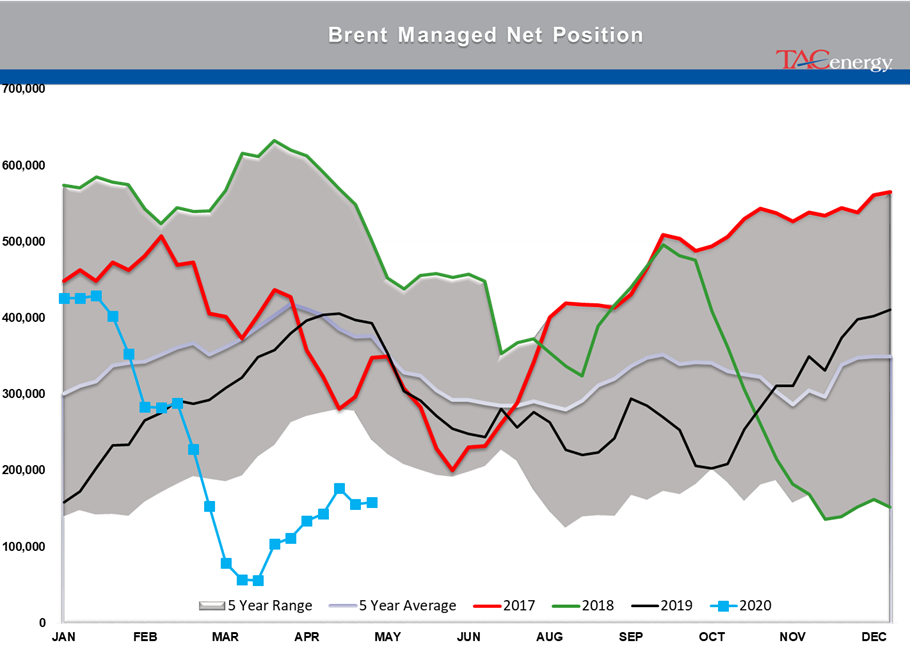

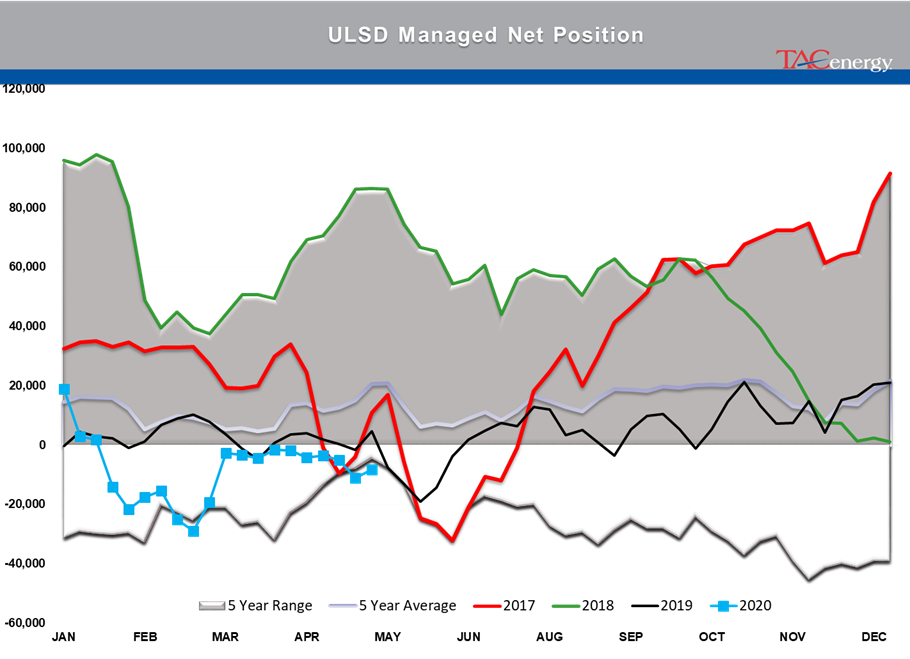

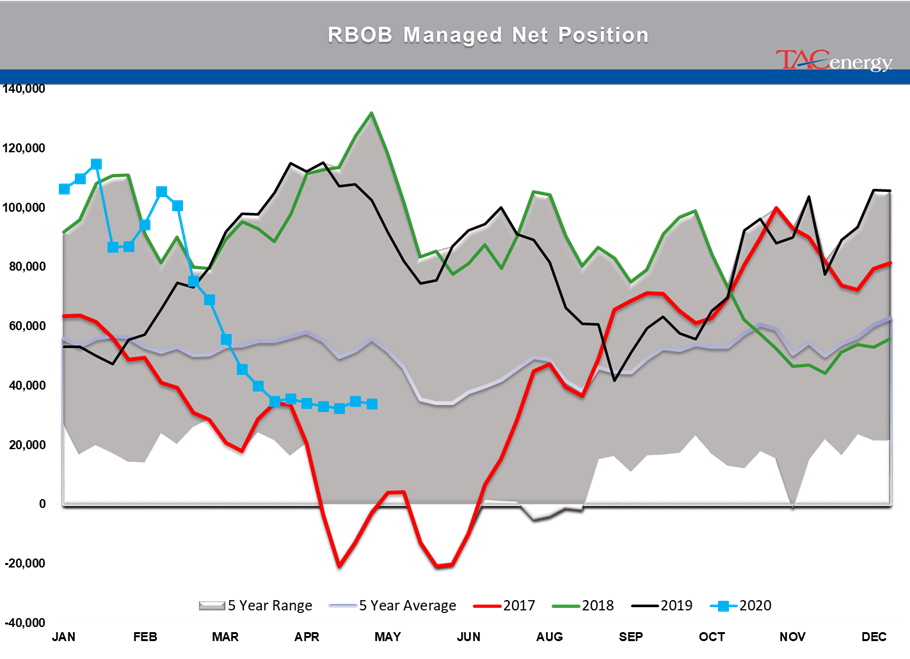

The managed money category of trader is much less optimistic for Brent and refined products than they are for WTI, with only minimal changes last week and net positions well below historical averages. That lack of buying suggests the enthusiasm for WTI has more to do with the U.S. oil industry’s ability to rapidly change course, than it does with expectations that global demand is rapidly healing.

The Dallas FED published a new study on the impacts of social distancing and economic activity, noting that while states are reopening, the pace of recovery for businesses is lower and may stay that way for a while.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

Week 17 - US DOE Inventory Recap

The Energy Complex Is Trading Modestly Lower So Far This Morning With WTI Crude Oil Futures Leading The Way

Energy Futures Are Drifting Quietly Higher This Morning

Refined Products Holding Close To Break Even While Oil Prices Are Losing Just Under 1%

Social Media

News & Views

View All

Week 17 - US DOE Inventory Recap

The Energy Complex Is Trading Modestly Lower So Far This Morning With WTI Crude Oil Futures Leading The Way

The energy complex is trading modestly lower so far this morning with WTI crude oil futures leading the way, exchanging hands $1.50 per barrel lower (-1.9%) than Tuesday’s settlement price. Gasoline and diesel futures are following suit, dropping .0390 and .0280 per gallon, respectively.

A surprise crude oil build (one that doesn’t include any changes to the SPR) as reported by the American Petroleum Institute late Tuesday is taking credit for the bearish trading seen this morning. The Institute estimated an increase in crude inventories of ~5 million barrels and drop in both refined product stocks of 1.5-2.2 million barrels for the week ending April 26. The Department of Energy’s official report is due out at it’s regular time (9:30 CDT) this morning.

The Senate Budget Committee is scheduled to hold a hearing at 9:00 AM EST this morning regarding a years-long probe into climate change messaging from big oil companies. Following a 3-year investigation, Senate and House Democrats released their final report yesterday alleging major oil companies have internally recognized the impacts of fossil fuels on the climate since as far back as the 1960s, while privately lobbying against climate legislation and publicly presenting a narrative that undermines a connection between the two. Whether this will have a tangible effect on policy or is just the latest announcement in an election-yeardeluge is yet to be seen.

Speaking of deluge, another drone attack was launched against Russian infrastructure earlier this morning, causing an explosion and subsequent fire at Rosneft’s Ryazan refinery. While likely a response to the five killed from Russian missile strikes in Odesa and Kharkiv, Kyiv has yet to officially claim responsibility for the attack that successfully struck state infrastructure just 130 miles from Moscow.

The crude oil bears are on a tear this past week, blowing past WTI’s 5 and 10 day moving averages on Monday and opening below it’s 50-day MA this morning. The $80 level is likely a key resistance level, below which the path is open for the American oil benchmark to drop to the $75 level in short order.

Click here to download a PDF of today's TACenergy Market Talk.

Energy Futures Are Drifting Quietly Higher This Morning

Energy futures are drifting quietly higher this morning as a new round of hostage negotiations between Israel and Hamas seem to show relative promise. It seems the market is focusing on the prospect of cooler heads prevailing, rather than the pervasive rocket/drone exchanges, the latest of which took place over Israel’s northern border.

A warmer-than-expected winter depressed diesel demand and, likewise, distillate refinery margins, which has dropped to its lowest level since the beginning of 2022. The ULSD forward curve has shifted into contango (carry) over the past month as traders seek to store their diesel inventories and hope for a pickup in demand, domestic or otherwise.

The DOE announced it had continued rebuilding it’s Strategic Petroleum Reserve this month, noting the addition of 2.3 million barrels of crude so far in April. Depending on what the private sector reported for last week, Wednesday’s DOE report may put current national crude oil inventories (include those of the SPR) above the year’s previous levels, something we haven’t seen since April of 2022, two months after Ukraine war began.

The latest in the Dangote Refinery Saga: Credit stall-out, rising oil prices, and currency exchange.

Click here to download a PDF of today's TACenergy Market Talk.