Stand-Off In Congress Sparks Flight To Safety

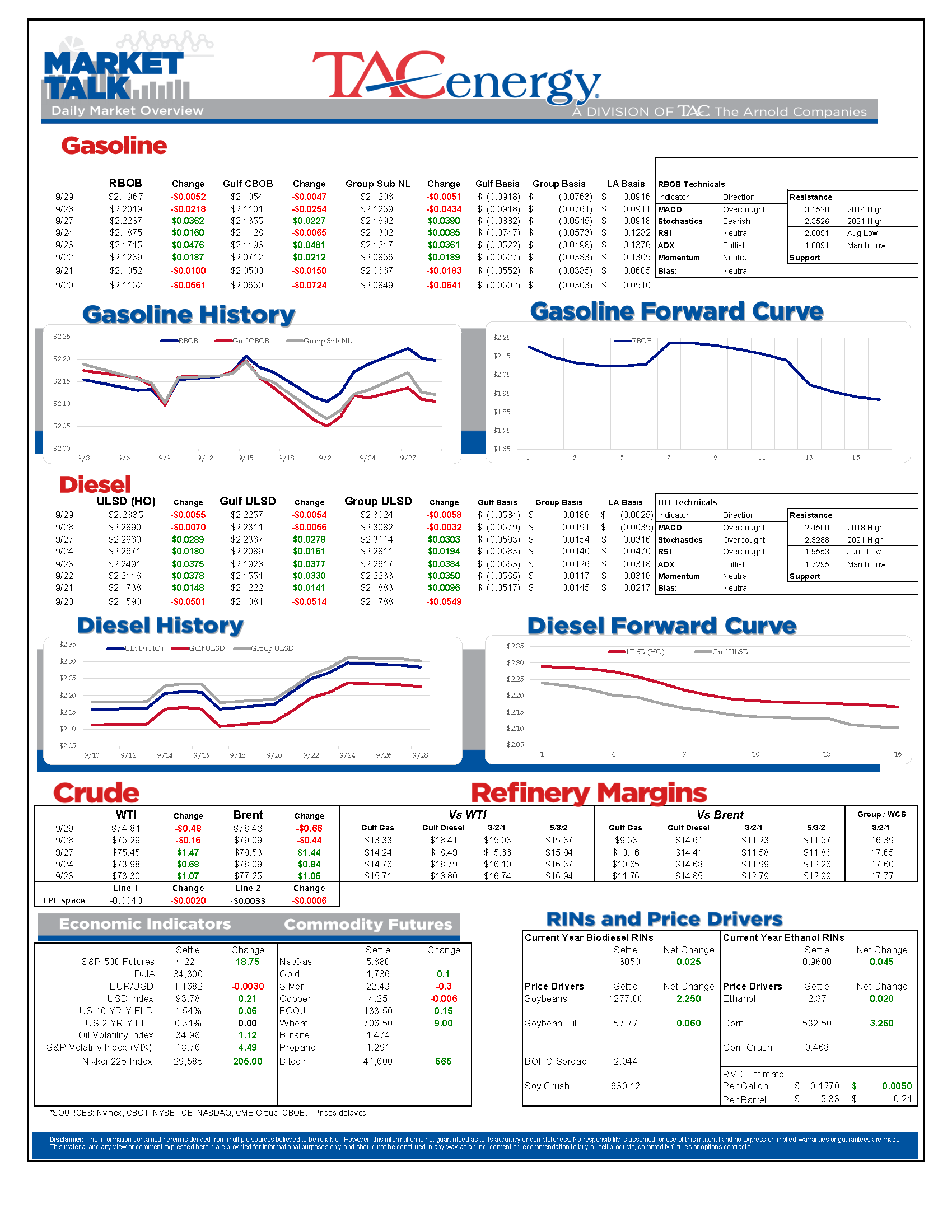

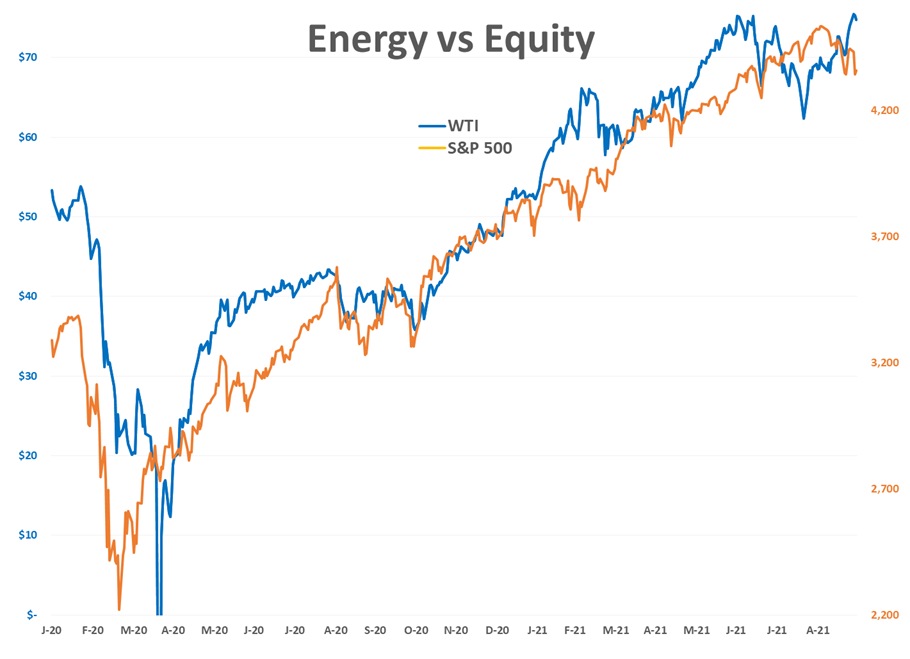

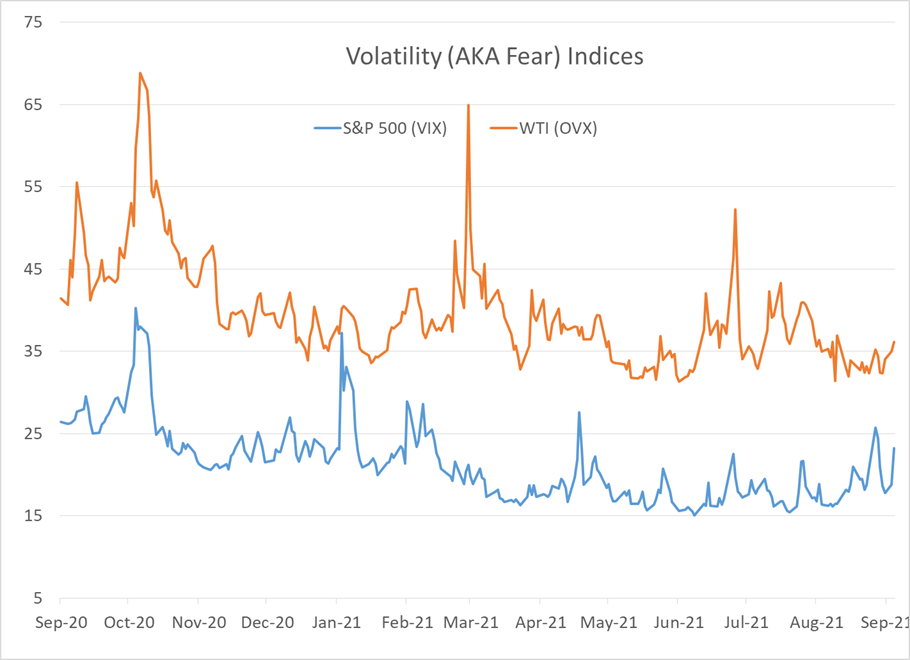

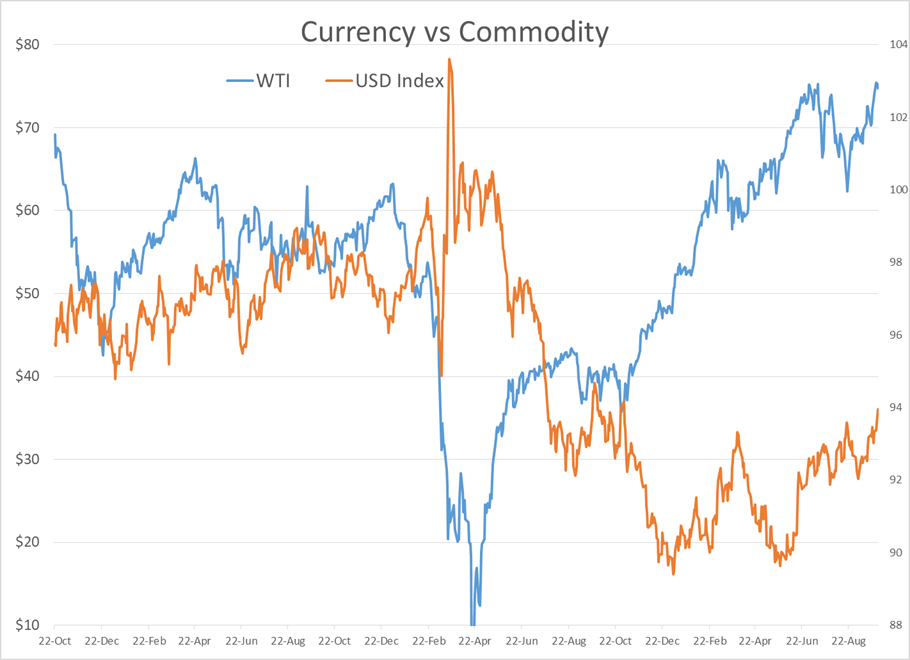

Energy futures pulled back from multi-year highs Tuesday as the latest stand-off in congress sparked a bit of a flight to safety with equity and commodity markets moving lower, while the US dollar rallied to its highest level in almost a year. The selling in energy contracts seems to be tempered by the ongoing surge in natural gas prices around the world, that is showing few signs of abating anytime soon, which will make various petroleum products more attractive as supplemental fuels.

RIN Values saw their first day of solid buying in weeks Tuesday, as political pressure on behalf of ethanol interests was heating up. There’s still no official word on whether or not the “leaked” RVO numbers last week were real or not, and the congressional staring match over budgets suggests we may not get an answer until that latest dumpster fire negotiation is put to rest.

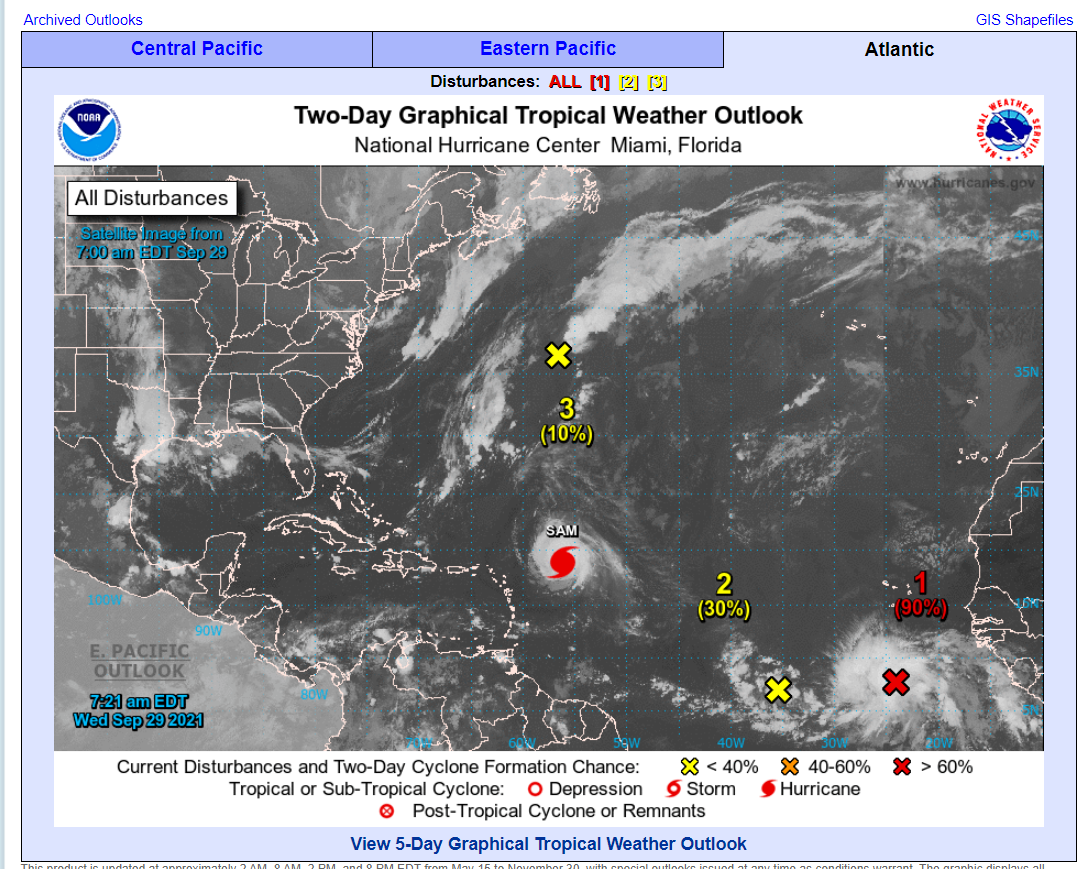

Tropical Storm Teresa is expected to be named later today, and the models should start giving us a better feel by the end of the week whether or not it will pose a threat to the US. The other storm system that was given 80% odds of developing just to the west of Teresa, is now given only 30% odds. Sam meanwhile continues to be a gentle giant major hurricane that is politely staying out to sea.

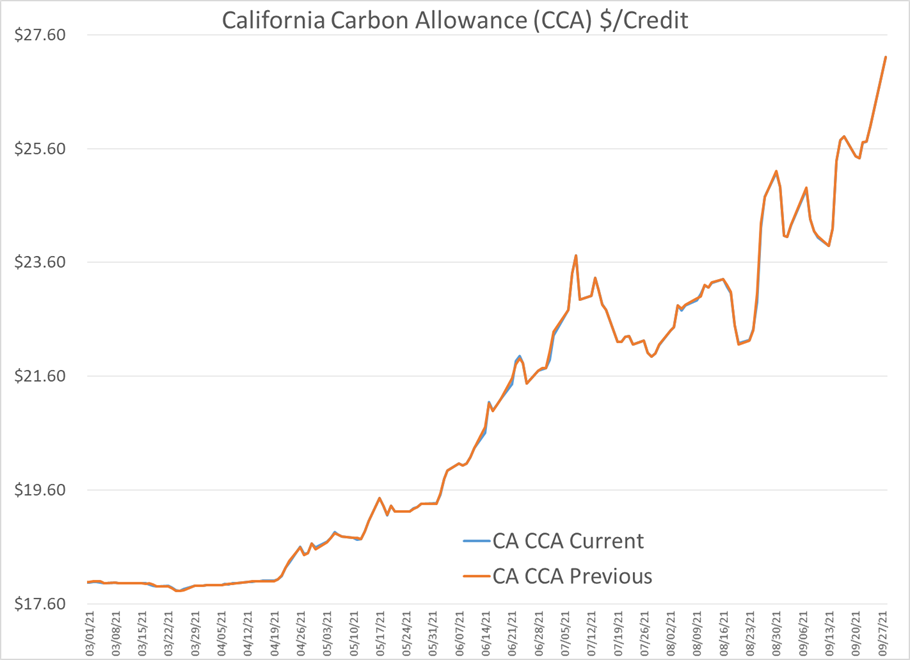

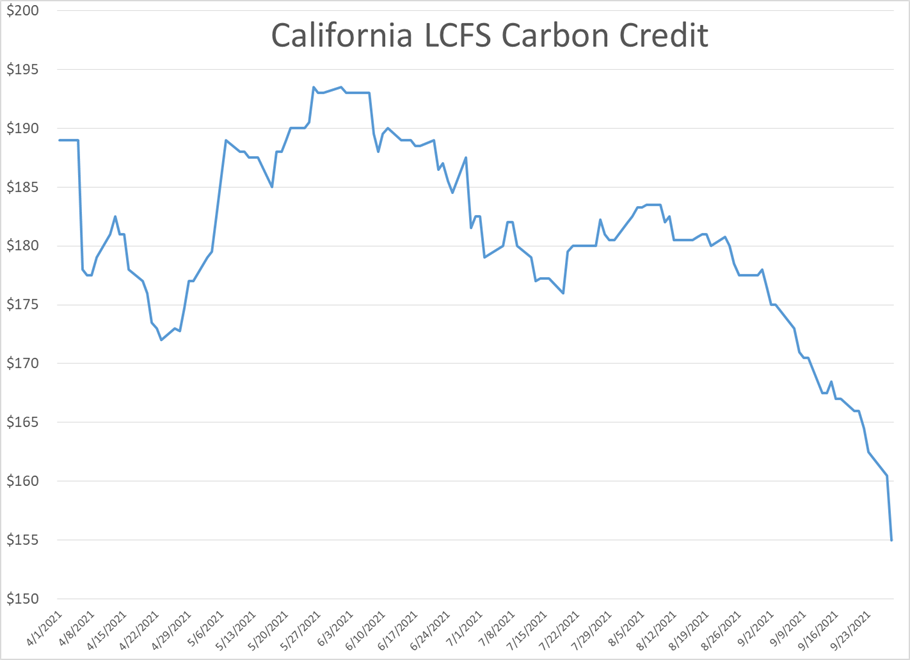

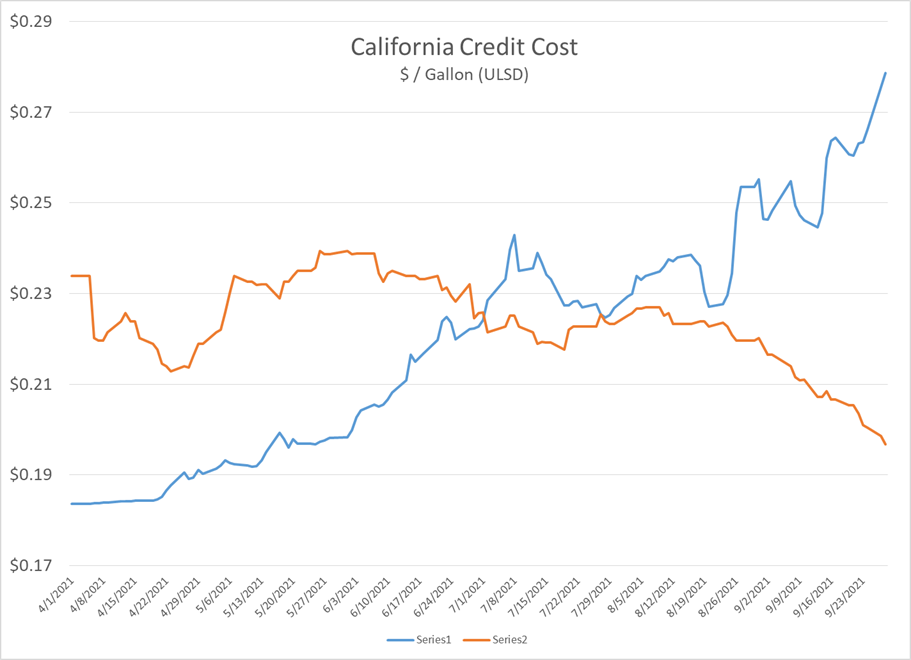

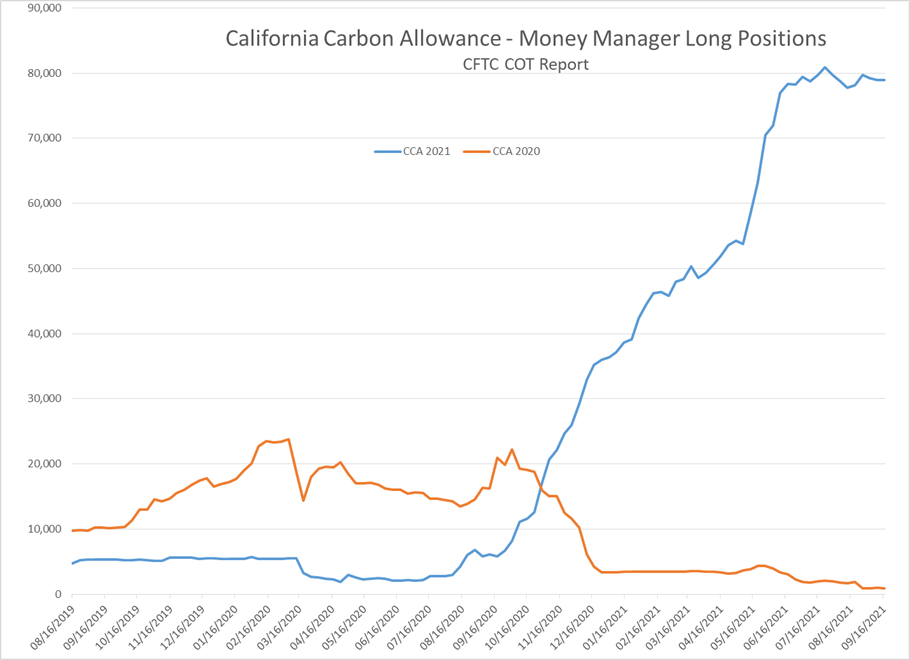

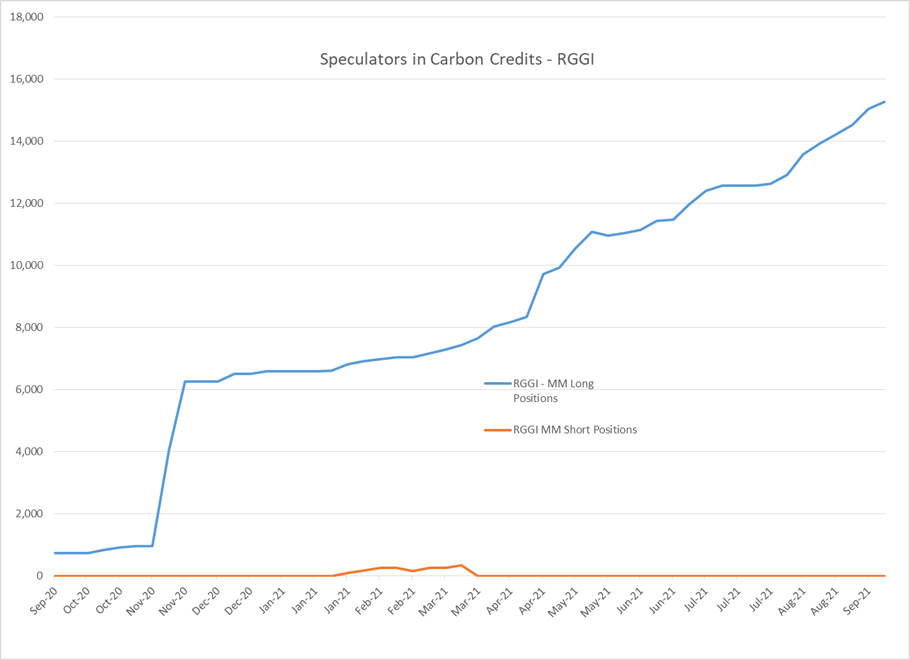

A tale of two carbon credits: California Carbon Allowances (CCA) values have continued their seemingly relentless march higher, reaching new record highs on a weekly basis ever since April. A huge influx in net long holdings by money managers (AKA hedge funds) coincided with this steady push higher as it seems the banksters see an easy opportunity to profit from green ambitions, particularly when most of the world is still trying to figure out how their business can participate in the net-zero movement. California’s LCFS credits meanwhile have dropped sharply to a multi-year low, partially offsetting the increased cost of CCAs to consumers.

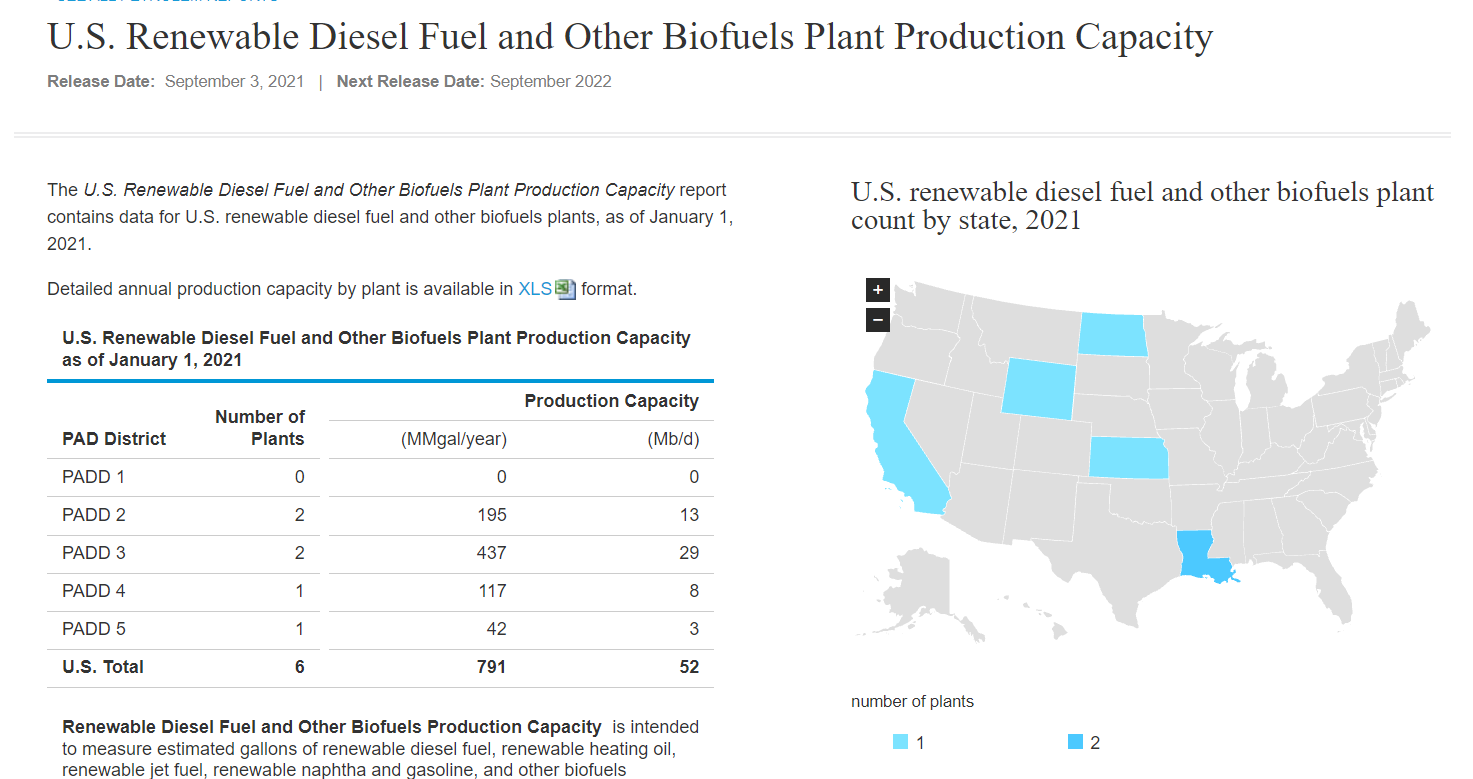

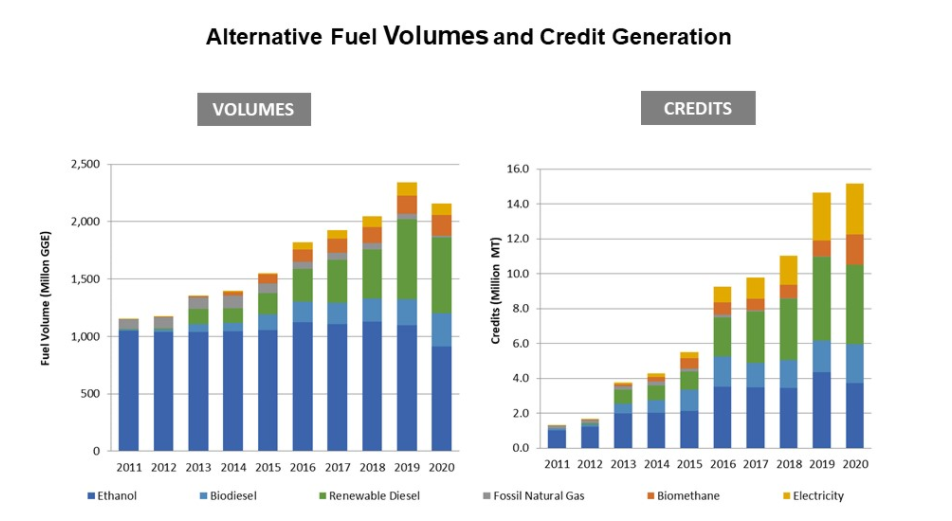

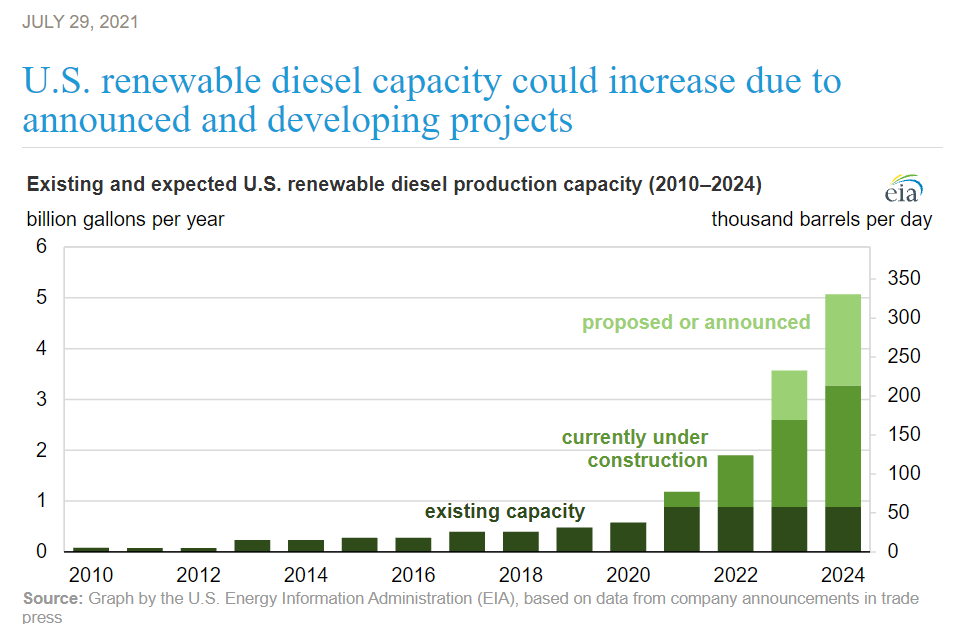

What’s the difference? LCFS credits can be generated by various renewable fuel & electricity producers that can prove their product beats the carbon intensity target values set by the California Air Resource board (CARB). CCA credits meanwhile are created out of thin air by CARB. So, as production for renewables (Renewable diesel in particular, along with biomethane, SAF, renewable electricity etc) surges, so does the production of LCFS credits, while the CCA pool stays relatively stagnant.

In addition to the big uptick in renewable diesel production, biodiesel that used to be sold in other parts of the US has been pushed west to pick up the additional LCFS tax credit in California that was adding roughly $1.50/gallon (depending on the Carbon intensity value of the fuel) but now is “only” adding around $1.20/gallon after the drop in credit values. Keep in mind that’s in addition to the $1/gallon blenders tax credit, and roughly $2+/gallon in RIN credits for each gallon sold, and suddenly it makes sense why a fuel that costs around $6/gallon to produce can compete with diesel that’s going for around $2.25.

Why does this matter if you’re not living in California? Odds are your state (or country) are considering their own carbon-reduction program for fuels, and if they are, odds are even better they’re considering adopting something like one of the 2 California programs. Oregon’s CFP program follows the LCFS model almost exactly, while the new proposal for New England (TCI) seems to take after the CCA model.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

Energy Futures Are Caught Up In Headline Tug-O-War This Morning

Energy futures are caught up in headline tug-o-war this morning with Canadian oil production concerns and a positive US GDP report trying to push prices higher while sinking Chinese demand worries and Gaza ceasefire hopes are applying downward pressure. The latter two seem to be favored more so far this morning with WTI and Brent crude oil futures down ~45 cents per barrel, while gasoline and diesel prices are down about half a cent and two cents, respectively.

No news is good news? Chicago gasoline prices dropped nearly 30 cents yesterday, despite there not being any update on Exxon’s Joliet refinery after further damage was discovered Wednesday. Its tough to say if traders have realized the supply situation isn’t as bad as originally thought or if this historically volatile market is just being itself (aka ‘Chicago being Chicago’).

The rain isn’t letting up along the Texas Gulf Coast today and is forecasted to carry on through the weekend. While much of the greater Houston area is under flood watch, only two refineries are within the (more serious) flood warning area: Marathon’s Galveston Bay and Valero’s Texas City refineries. However, notification that more work is needed at Phillip’s 66 Borger refinery (up in the panhandle) is the only filing we’ve seen come through the TECQ, so far.

Premiums over the tariff on Colonial’s Line 1 (aka linespace value) returned to zero yesterday, and actually traded in the negatives, after its extended run of positive values atypical of this time of year. Line 1’s counterpart, Line 2, which carries distillates from Houston to Greensboro NC, has traded at a discount so far this year, due to the healthy, if not over-, supply of diesel along the eastern seaboard.

Click here to download a PDF of today's TACenergy Market Talk.

WTI And Brent Crude Oil Futures Are Trading ~$1.50 Per Barrel Lower In Pre-Market Trading

The across-the-board drawdown in national energy stockpiles, as reported by the Department of Energy yesterday, stoked bullish sentiment Wednesday and prompt month gasoline, diesel, and crude oil futures published gains on the day. Those gains are being given back this morning.

The surprise rate cut by the People’s Bank of China is being blamed for the selling we are seeing in energy markets this morning. While the interest rate drop in both short- and medium-term loans won’t likely affect energy prices outright, the concern lies in the overall economic health of the world’s second largest economy and crude oil consumer. Prompt month WTI and Brent crude oil futures are trading ~$1.50 per barrel lower in pre-market trading, gasoline and diesel are following suit, shaving off .0400-.0450 per gallon.

Chicagoland RBOB has maintained its 60-cent premium over New York prices through this morning and shows no sign of coming down any time soon. Quite the opposite in fact: the storm damage, which knocked Exxon Mobil’s Joliet refinery offline on 7/15, seems to be more extensive than initially thought, potentially extending the repair time and pushing back the expected return date.

There are three main refineries that feed the Chicago market, the impact from one of them shutting down abruptly can be seen in the charts derived from aforementioned data published by the DOE. Refinery throughput in PADD 2 dropped 183,000 barrels per day, driving gasoline stockpiles in the area down to a new 5-year seasonal low.

While it seems all is quiet on the Atlantic front (for now), America’s Refineryland is forecasted to receive non-stop rain and thunderstorms for the next four days. While it may not be as dramatic as a hurricane, flooding and power outages can shut down refineries, and cities for that matter, all the same, as we learned from Beryl.