The Latest Warmer-Than-Expected Winter Has Driven Natural Gas Prices To The Lowest Level Seen Since The NG Futures

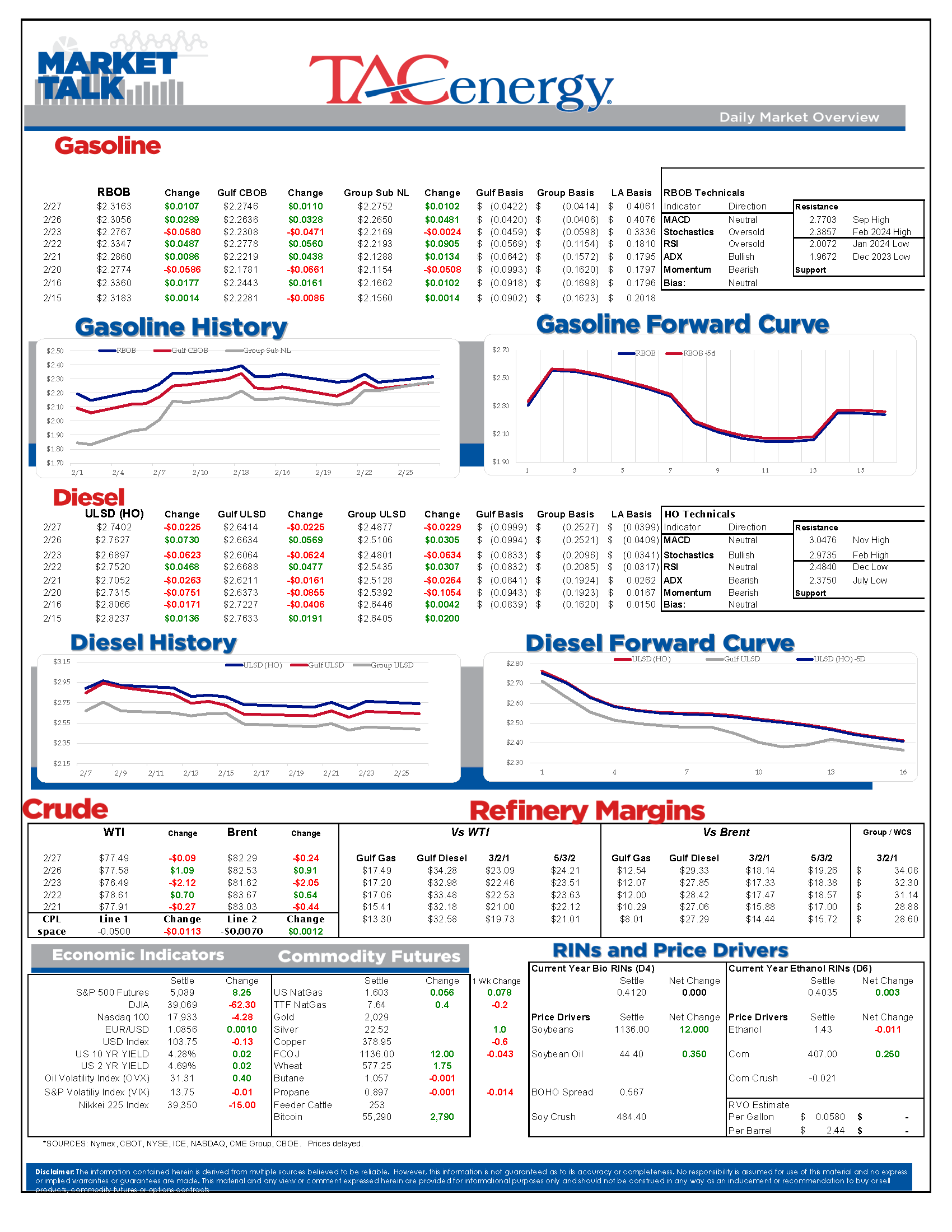

It’s a mixed bag for energy futures so far this morning with RBOB and prompt month WTI trading slightly higher while HO and Brent futures drift lower. A potential ceasefire in Gaza, continued shipping strife in the Red Sea, and attempts to avoid a partial government shutdown are what the markets are watching this morning. Material developments on any of those three fronts might be enough for prices to decide what they want to do today.

The Kremlin has announced a ban on gasoline exports that will last for six months, earlier this morning, in order to combat domestic fuel shortages and high pump prices. The announcement comes on the heels of repeated Ukrainian drone attacks on Russian refineries, the resulting downtime from which cut throughput rates by an estimated 380,000 barrels per day.

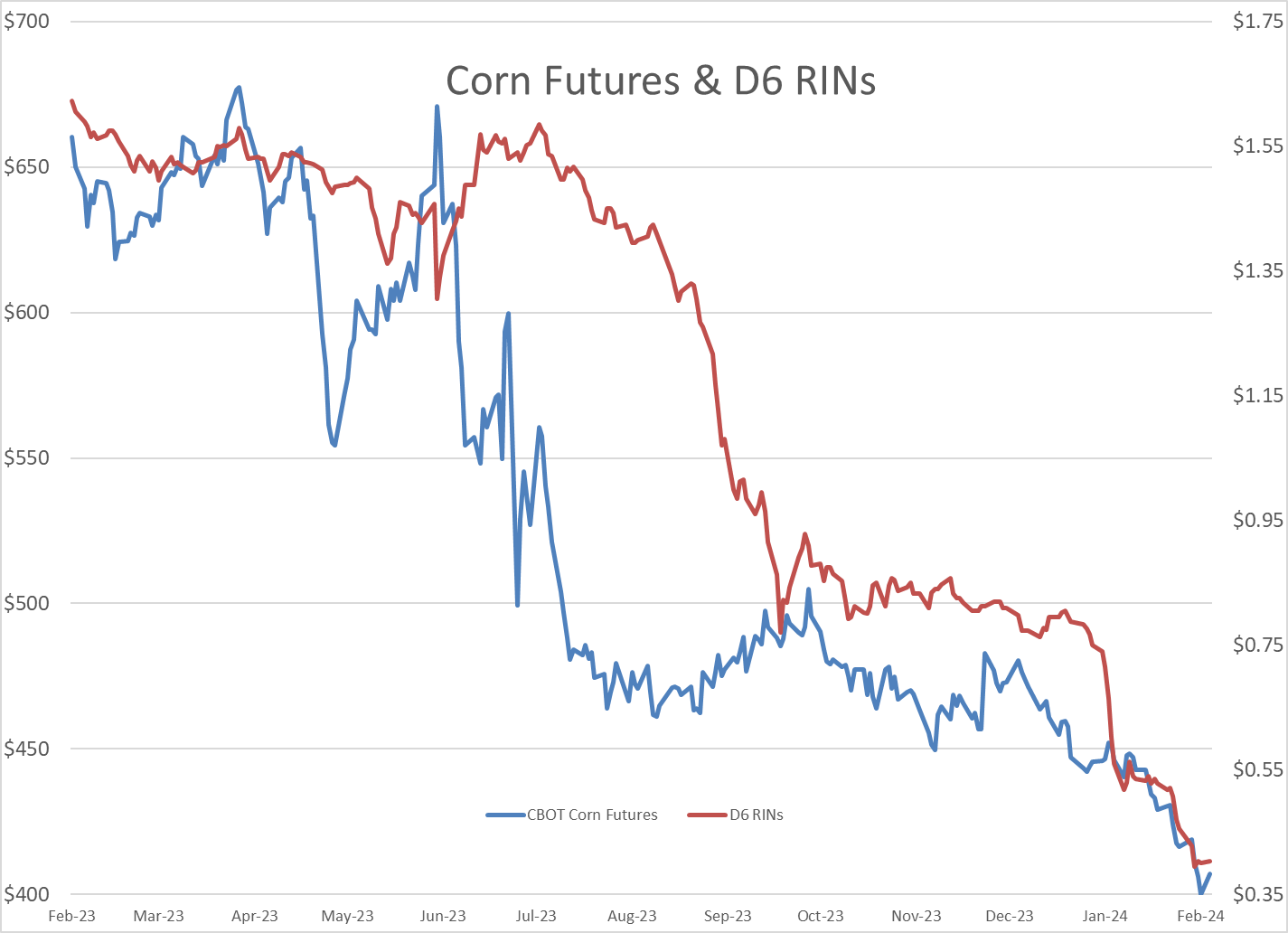

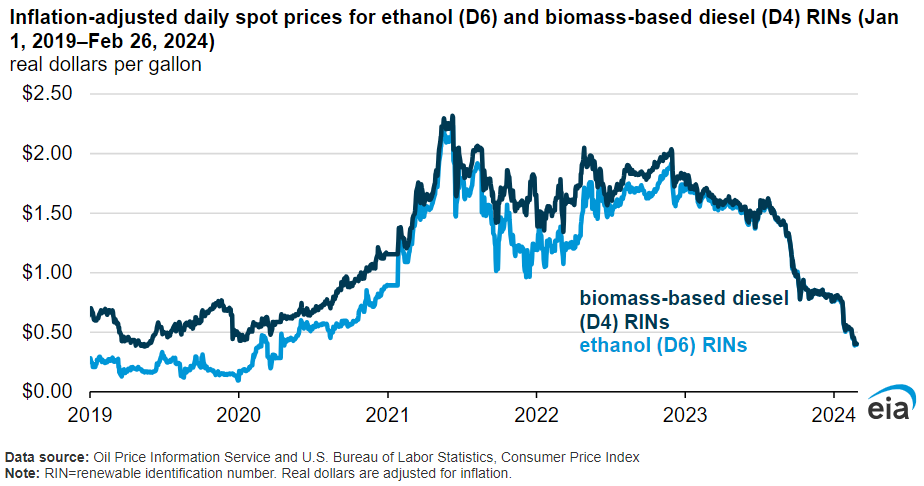

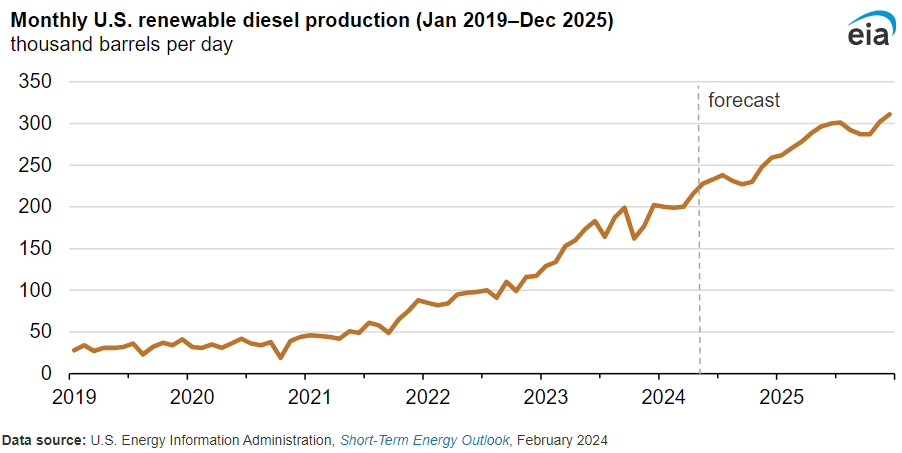

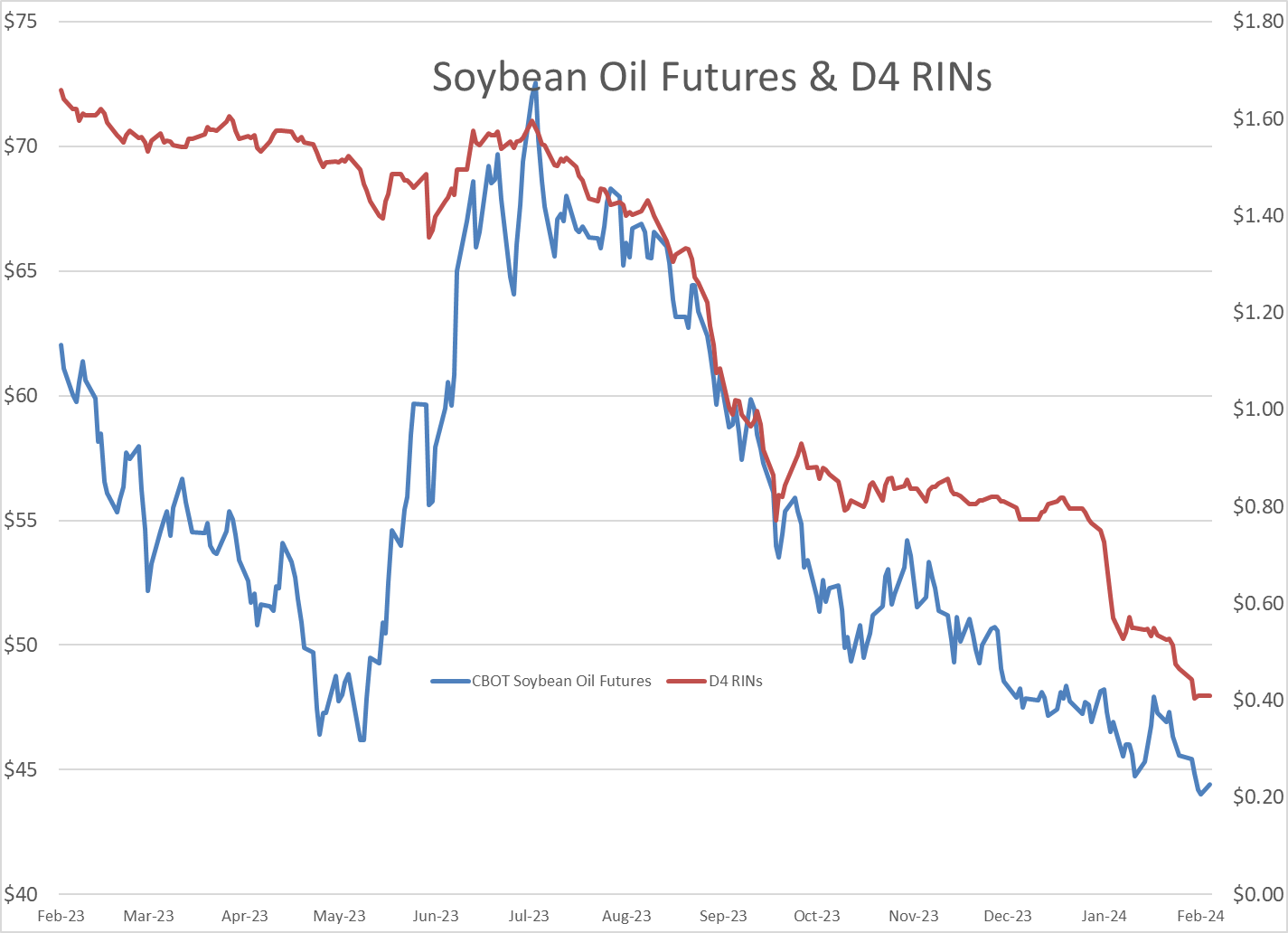

The EIA published a comprehensive article this morning detailing all-things-RINs and why they’ve cratered since the beginning of the year. While the administration breaks down the effects of feedstock prices and projects a consistent increased in renewable diesel production, there are no quips about what, if any, changes might be coming for the Renewable Fuel Standard.

The latest warmer-than-expected winter has driven natural gas prices to the lowest level seen since the NG futures contract began trading back in 1990. The increased oil production, of which natural gas is a byproduct, has flooded the market, often resulting in voluntary disposal of excess through the process called flaring. This is great news for consumers, bad news for producers who are forced to cut production, which succeeded in buoying prices, albeit temporarily.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

Week 18 - US DOE Inventory Recap

Crude Oil, Gasoline, And Diesel Benchmarks Are All Trading >1% Lower To Start The Day

Energy prices are sinking again this morning, albeit with a little more conviction than yesterday’s lackadaisical wilting. Crude oil, gasoline, and diesel benchmarks are all trading >1% lower to start the day with headlines pointing to an across-the-board build in national inventories as the source for this morning’s bearish sentiment. The Department of Energy’s official report is due out at its regular time this morning (9:30am CDT).

WTI has broken below its 100-day moving average this morning as it fleshed out the downward trend that began early last month. While crossing this technical threshold may not be significant in and of itself (it happened multiple times back in February), the fact that it coincides with the weekly and monthly charts also breaking below a handful of their respective moving averages paints a pretty bearish picture in the short term. The door is open for prices to drop down to $75 per barrel in the next couple weeks.

Shortly after the EIA’s weekly data showed U.S. commercial crude inventories surpassing 2023 levels for the first time this year, their monthly short-term energy outlook is forecasting a fall back to the bottom end of the 5-year range by August due to increasing refinery runs over the period. However, afterward the administration expects a rise in inventories into 2025, citing continued production increases and loosening global markets hindering the incentive to send those excess barrels overseas. The agency also cut back their average gas and diesel price forecasts for the first time since February with the biggest reductions in the second and third quarter of this year.

The STEO also featured their famed price prediction for WTI, stating with 95% confidence that the price for crude oil will be between $40 and $140 through 2026.

Need a general indication of the global crude oil supply? Most headlines seem to be covering a shortage of a different type of oil, one that we haven’t turned into fuel (yet).

Click here to download a PDF of today's TACenergy Market Talk.

The Perceived Cooling Of Regional Tensions In The Middle East Area Attributing To The Quiet Start To Today’s Trading Session

The energy complex is drifting lower this morning with RBOB futures outpacing its counterparts, trading -.9% lower so far to start the day. The oils (WTI, Brent, heating) are down only .2%-.3% so far this morning.

The perceived cooling of regional tensions in the Middle East area attributing to the quiet start to today’s trading session, despite Israel’s seizure of an important border crossing. A ceasefire/hostage-release agreement was proposed Monday, and accepted by Hamas, but rejected by Israel as they seemingly pushed ahead with their Rafah offensive.

U.S. oil and natural gas production both hit record highs in 2023 and continue to rise in 2024, with oil output currently standing at 13.12 million barrels per day and January 2024 natural gas production slightly exceeding the previous year. With WTI currently changing hands at higher than year-ago levels, this increased production trend is expected to continue despite a decrease in rigs drilling for these resources.

Less than a week after the Senate Budget Committee’s hearing centered on the credibility of big oil’s climate preservation efforts, a major oil company was reported to have sold millions of carbon capture credits, without capturing any carbon. Fraud surrounding government subsidies to push climate-conscious fuel initiatives is nothing new, on a small scale, but it will be interesting to see how much (if any) of the book is thrown at a major refiner.

Today’s interesting read: sourcing hydrogen for refining.

Click here to download a PDF of today's TACenergy Market Talk.