Tough Start To August Trading Turned Ugly

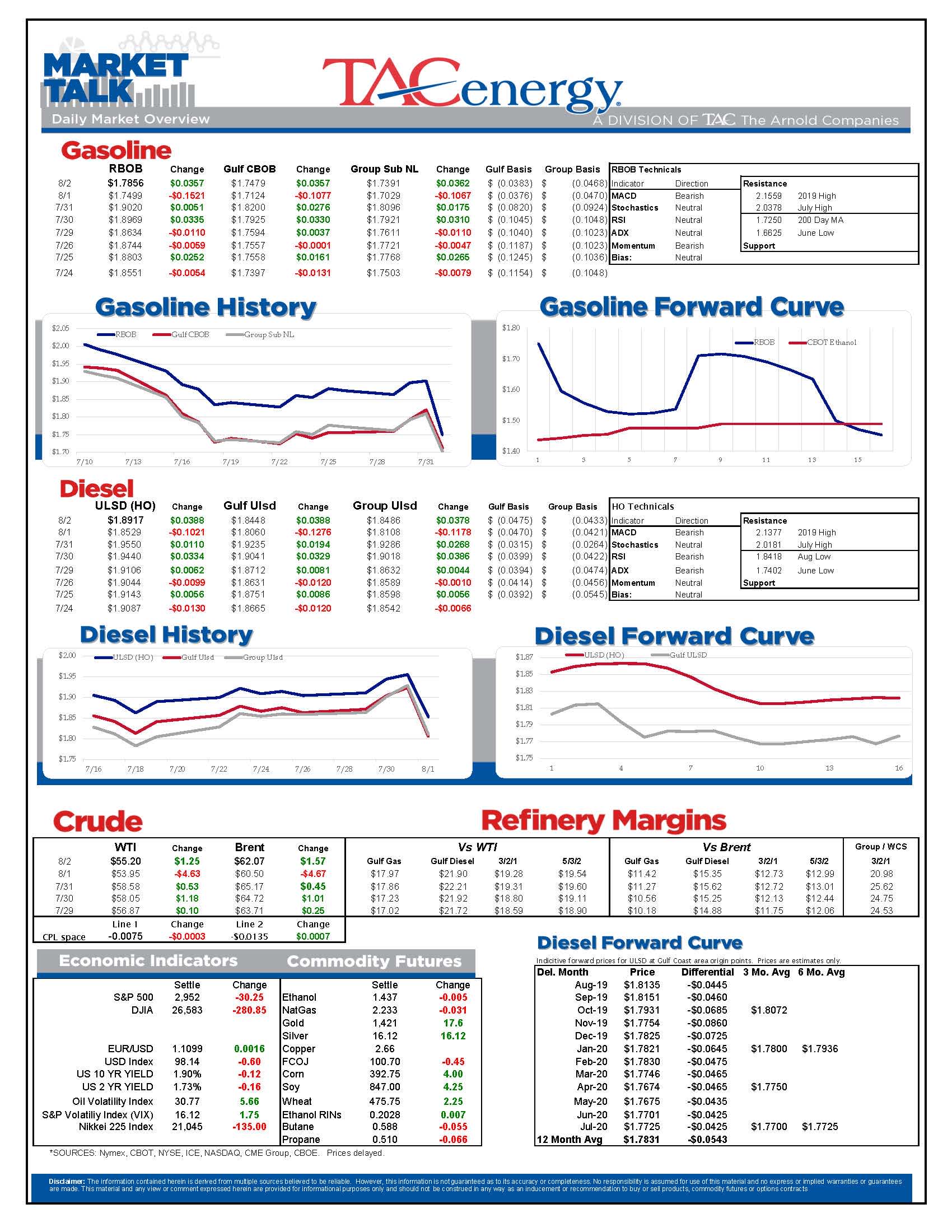

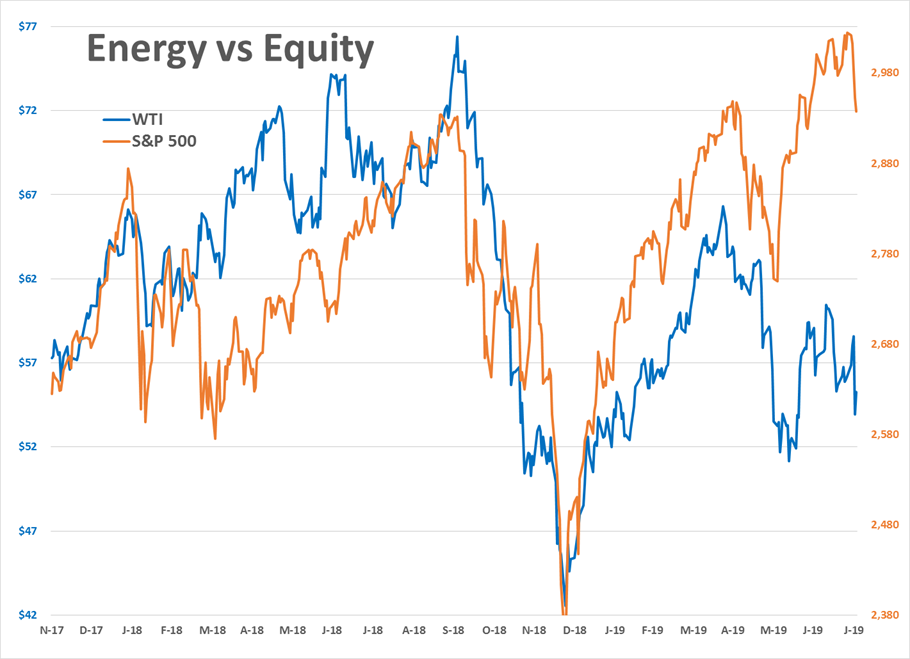

A tough start to August trading turned downright ugly for energy markets Thursday, with refined products wiping out two weeks of gains in what was the biggest day of selling in more than a year. The big news of the day was when President trump announced a new round of tariffs on Chinese goods, that moved the trade war from the back burner to the front as China has already warned of retaliatory moves.

Before the tweet stock markets had been rallying, taking back most of the post-FOMC losses, but quickly joined energy prices in a heavy wave of selling, highlighted by a 600 point intraday drop in the DJIA. In other words, equity and energy traders seem to have voted quite strongly that the only thing Trump’s trade twitter tirades are good for is alliteration.

The good news for those wanting higher energy prices is that a recovery bounce is underway, taking back about 1/3 of Thursday’s losses. There’s an interesting pivot point on the chart right around current levels that acted as resistance during June’s rally, and as support during July’s early selloff, and seems like a natural landing spot for prices to consolidate while they wait for the next shots to be fired in the trade or tanker wars.

The longer term charts meanwhile are showing triangle formations in most of the petroleum futures contracts that suggest there’s going to be a much larger price move coming this fall once one of those converging trend lines breaks, although which direction that breakout will take is unclear although product charts seem to be giving slight favor to lower prices, while crude charts are mixed.

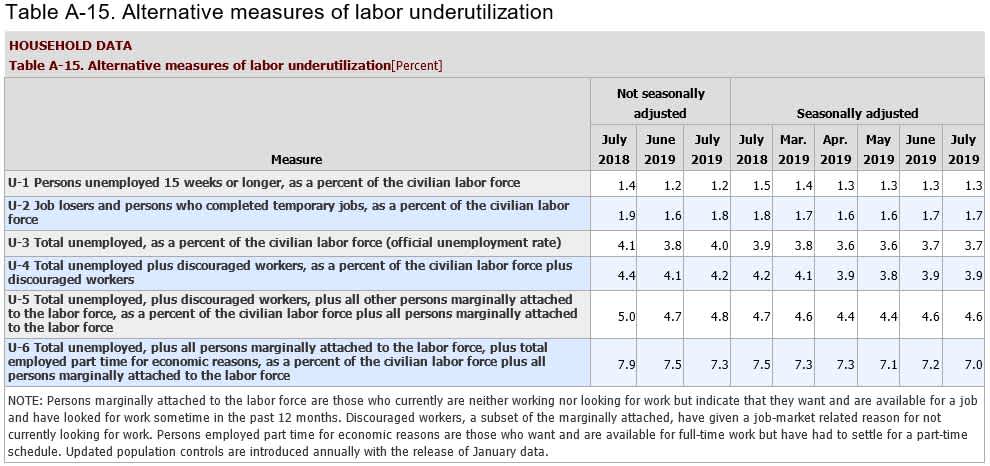

The July non-farm payroll report showed 164,000 jobs added during July, with the official unemployment rate holding steady at 3.7 percent, while the unofficial “U-6” rate dropped to 7%. This report was about average for 2019, and the market reaction has been muted so far. Equities dipped briefly after the report which pulled energy prices back from their highs of the day, but both asset classes have since stabilized.

Latest Posts

Markets Rallying To End The Week, Diesel Prices Lead The Way For Energy

Energy Markets Rally Again Thursday After A Choppy Wednesday Session

Week 16 - US DOE Inventory Recap

Energy Markets Trading Quietly In The Red As Ethanol Prices Rally To Five-Month High

Social Media

News & Views

View All

Markets Rallying To End The Week, Diesel Prices Lead The Way For Energy

Energy markets are rallying to end the week, with diesel prices leading the way up 2.5 cents in the early going. Equity markets are also rallying after a big Thursday selloff as strong tech earnings seem to be outweighing the FED’s favorite inflation gauge remaining stubbornly high.

RBOB gasoline futures are trading higher for a 4th straight day, but despite bouncing nearly 14 cents from Tuesday’s low, they still need to rally another nickel to break the downward sloping pattern forming on the weekly charts. Seasonal factors could go either way for gasoline for the next few weeks as we’re in the Spring peaking window, and while the high set April 12th would fit the annual pattern nicely, a May price peak is certainly not unusual, and if $2.85 is broken it seems like RBOB will run to $3 in a hurry.

Diesel prices have bounced 7 cents after touching a 5-month low on Monday but need to climb back above $2.60 to reduce the chance of a slide to $2.20 or lower should the chart support around $2.50 break down.

Back to the shadow war: After a relatively quiet few weeks in the Red Sea, Houthi attacks on ships have started again over the past few days, although so far, no major damage has been reported.

ExxonMobil reported another strong quarter in Q1 with more than $10 billion in free cash flow generated, even though earnings in its refining segment were down 67% from the first quarter of last year. The company noted the success of its Beaumont refinery expansion that came online last year and marked the only major refinery expansion in the US in over a decade. It's worth noting that within the refining segment, international earnings suffered more than domestic facilities did, with non-US refining earnings down 77% from a year ago as crack spreads came back to reality after the record-setting quarters in 2022 and 2023.

Chevron followed a similar pattern (as expected) in its Q1 report, noting strong operating cash flows of $6.8 billion in total, despite downstream earnings falling more than 56% for the quarter.

The company also highlighted its expanding marketing network along the US West and Gulf Coast markets encompassing more than 250 retail stations and highlighted its new solar-to-hydrogen project in California.

Phillips 66 continued the trend, reporting a “strong” quarter in which earnings were 63% lower than a year ago. The company highlighted the conversion of its Rodeo refinery which is now producing roughly 30mb/day of RD and is expected to ramp up to 50mb/day in the 2nd quarter. That facility had a capacity of more than 120mb/day prior to its conversion, and it used to produce gasoline along with its diesel. The company also noted its ongoing plans to sell assets that no longer fit its strategy, highlighting retail assets in Germany and Austria as being on the chopping block, while not mentioning any of its US refining assets that have long been rumored to be for sale.

Delek reported another upset at its Alon Big Spring refinery Thursday, which has become another one of the TCEQ’s frequent fliers after suffering damage from the cold snaps in both 2021 and earlier this year.

A harsh reality sinking in: Mexico’s President has made plenty of headlines with fictitious claims of energy sovereignty in the past few years, but not only is the country’s new Dos Bocas refinery still not producing finished products on any sort of meaningful scale, two of its other facilities have suffered fires recently forcing the country to import even more product from the US. This phenomenon continues to help US Gulf and West coast refiners who would be struggling (even more) to move their excess with sluggish domestic demand.

Click here to download a PDF of today's TACenergy Market Talk.

Energy Markets Rally Again Thursday After A Choppy Wednesday Session

Energy markets are trying to rally again Thursday after a choppy Wednesday session. RBOB gasoline futures are leading the push higher, on pace for a 3rd consecutive day of gains after finding a temporary floor Tuesday and have added 12 cents from those lows.

Equity markets are pointing sharply lower after a weak Q1 GDP estimate which seems to have contributed to a pullback in product prices over the past few minutes, but don’t be surprised if the “bad news is good news” low interest rate junkies start jumping in later on.

The DOE’s weekly report showed sluggish demand for gasoline and diesel, but inventory levels in most markets continue to follow their typical seasonal trends. Refinery runs held fairly steady last week with crude inputs down slightly but total gross throughputs up slightly as most facilities are now back online from a busy spring maintenance season and geared up for peak demand this summer.

Propane and propylene exports spiked to a record high north of 2.3 million barrels/day last week, which demonstrates both the US’s growing influence on global product markets, and the steady shift towards “other” products besides traditional gasoline and diesel in the level of importance for refiners.

The EIA acknowledged this morning that its weak diesel consumption estimates reflected the switch to Renewable Diesel on the West Coast, although they did not provide any timeline for when that data will be included in the weekly survey. The agency acknowledged that more than 4% of the total US consumption is now a combination of RD and Biodiesel, and that number is expected to continue to grow this year. This morning’s note also suggested that weak manufacturing activity was to blame for the sluggish diesel demand across the US, while other reports suggest the freight recession continued through Q1 of this year, which is also contributing to the big shift from tight diesel markets to oversupplied in several regions.

Valero kicked off the Q1 earnings releases for refiners with solid net income of $1.2 billion that’s a far cry from the spectacular earnings north of $3 billion in the first quarter of 2023. The refining sector made $1.7 billion, down from $4.1 billion last year. That is a pattern that should be expected from other refiners as well as the industry returns to a more normal market after 2 unbelievable years. You wouldn’t guess it by looking at stock prices for refiners though, as they continue to trade near record highs despite the more modest earnings.

Another pattern we’re likely to see continue with other refiners is that Renewable earnings were down, despite a big increase in production as lower subsidies like RINs and LCFS credit values sting producers that rely on those to compete with traditional products. Valero’s SAF conversion project at its Diamond Green joint venture is progressing ahead of schedule and will give the company optionality to flip between RD and SAF depending on how the economics of those two products shakes out this year. Valero also shows part of why refiners continue to disappear in California, with operating expenses for its West Coast segment nearly 2X that of the other regions it operates in.