ULSD Prices Drop Despite Looming Russian Supply Ban

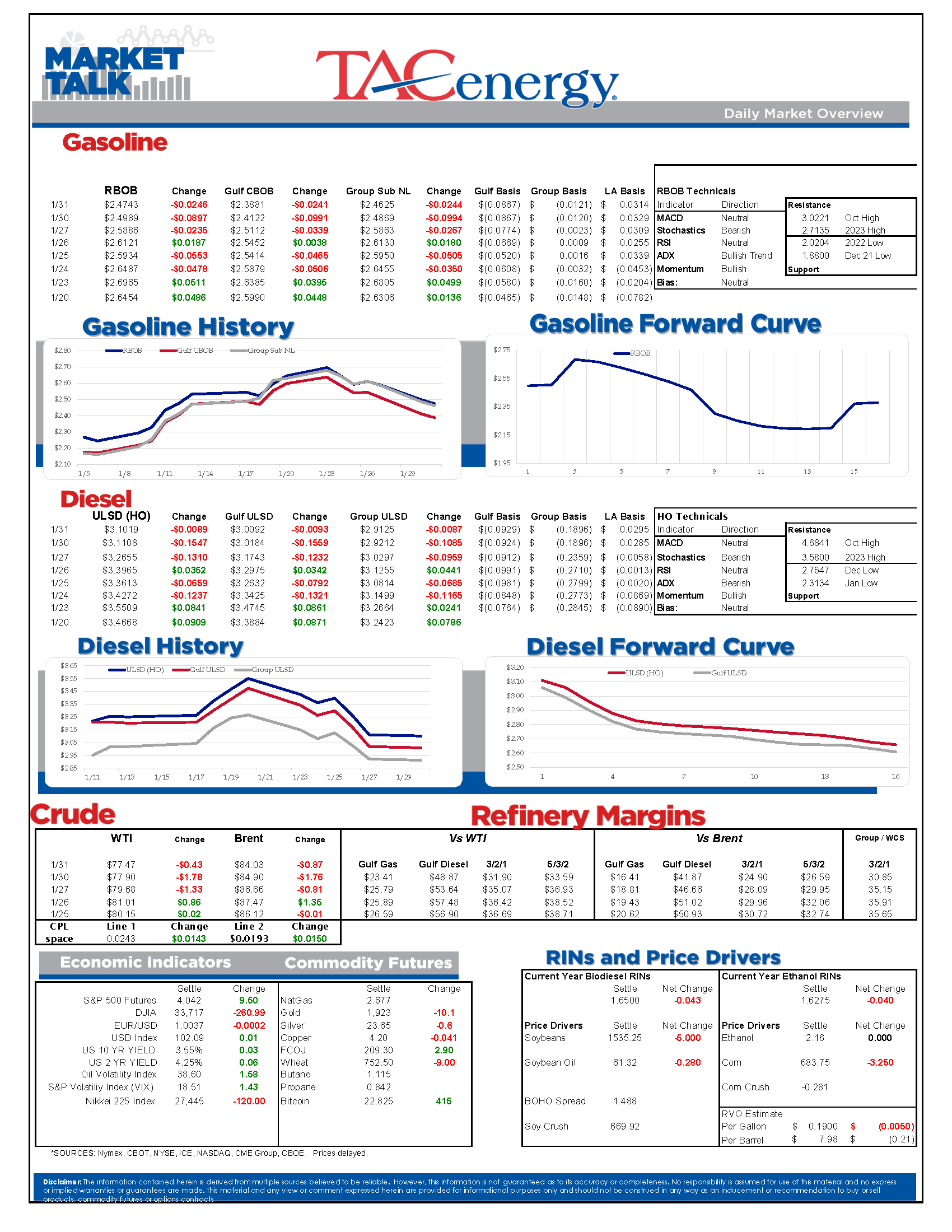

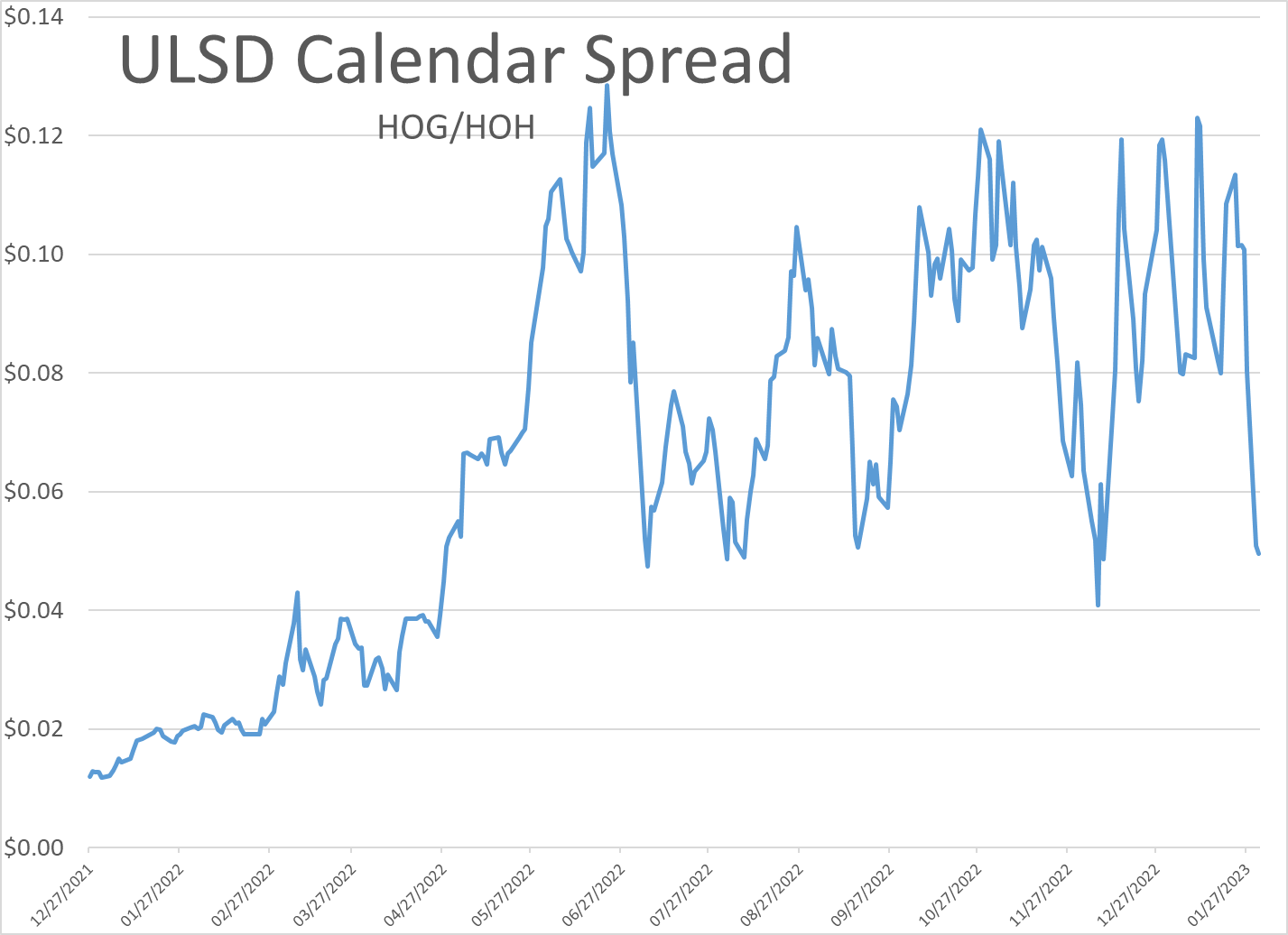

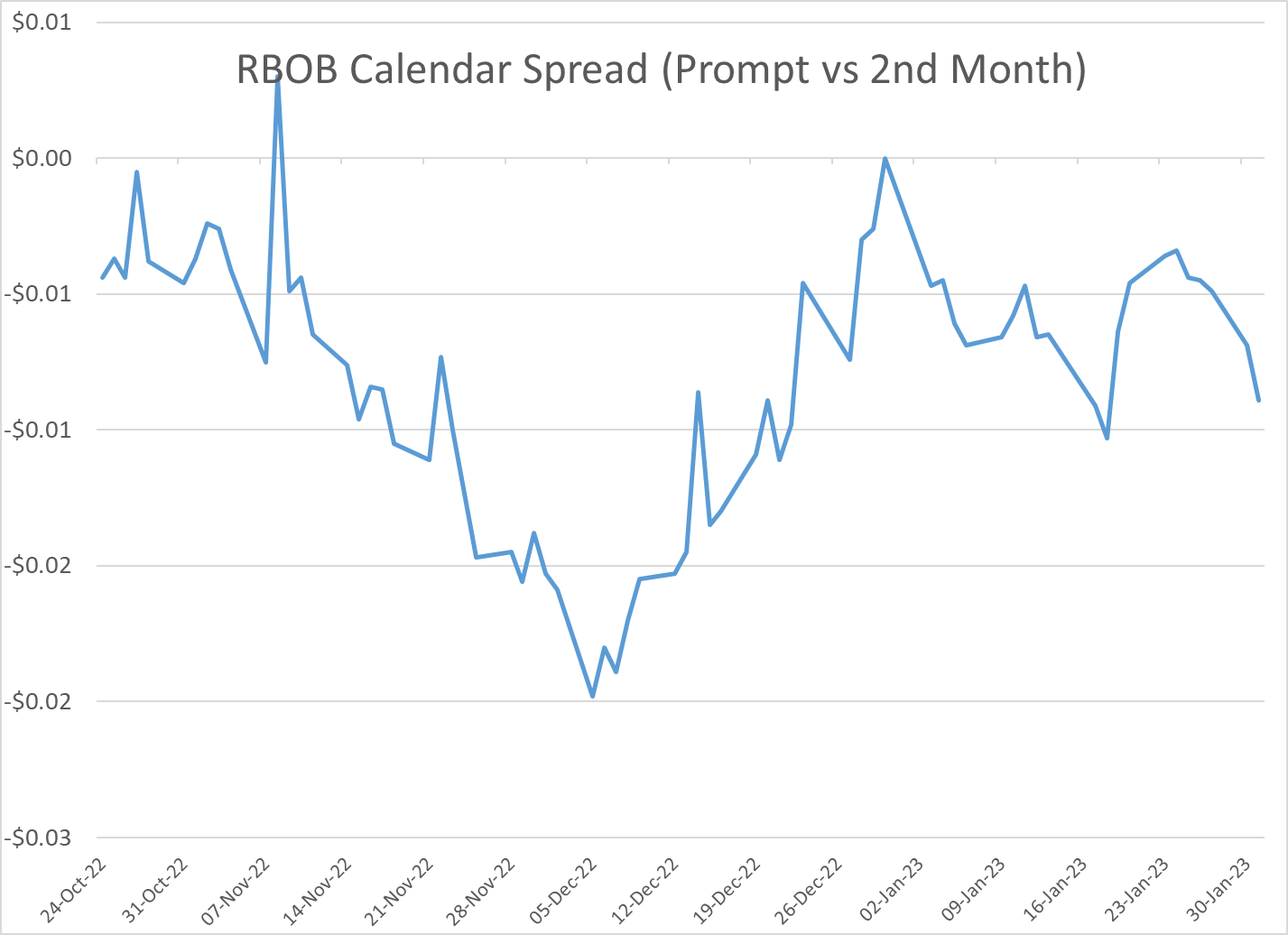

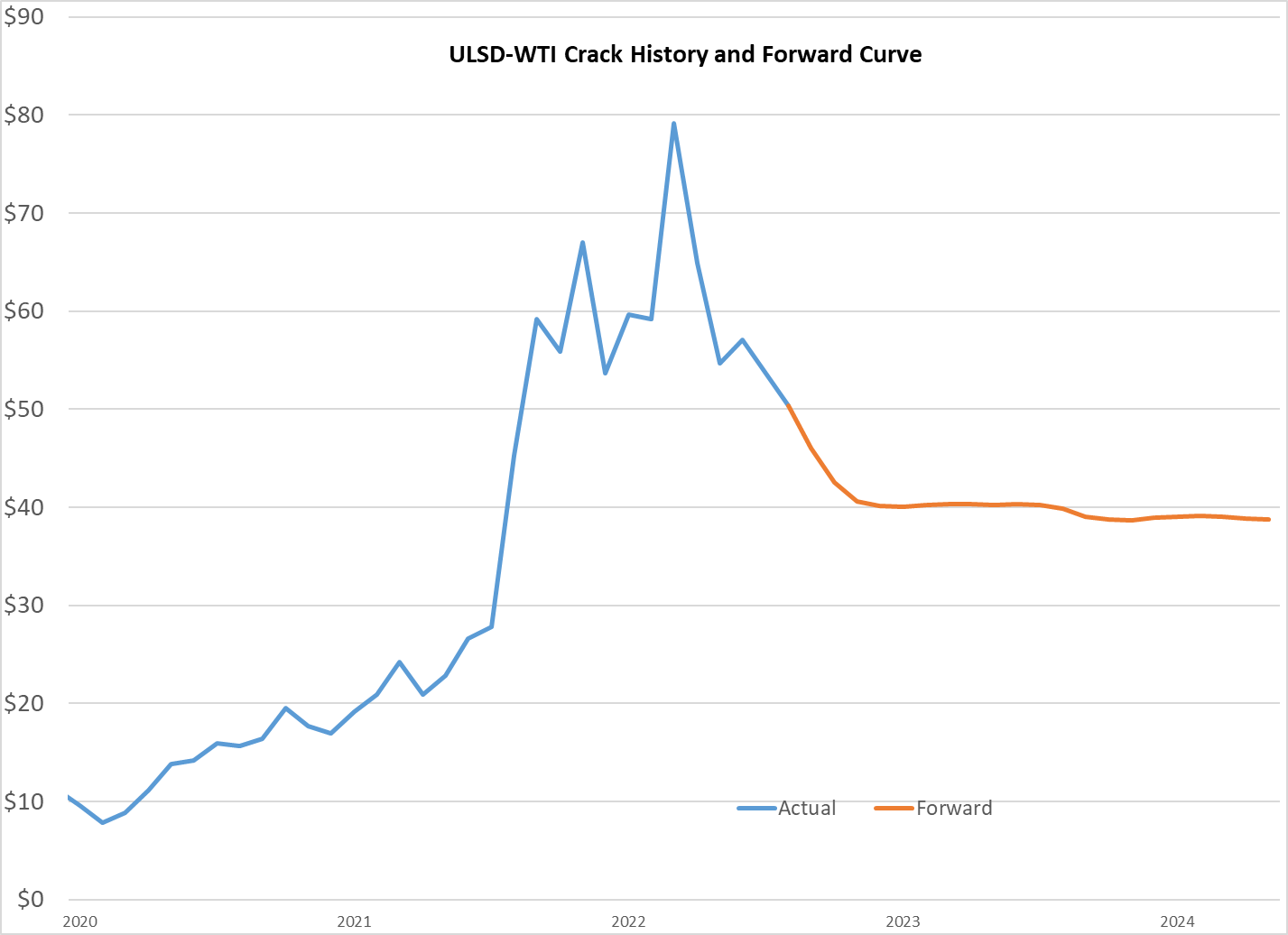

ULSD continues to lead the energy complex lower as January winds to a close, dropping from a high of $3.58 one week ago to a low of $3.0570 this morning. Crude oil and gasoline prices have also come under heavy pressure, but have lagged far behind the moves in ULSD, which has pushed prompt diesel crack spreads by down by $12/barrel in just a week.

Why exactly diesel prices got so weak so fast is a bit of a mystery given that inventories remain well below their seasonal ranges, refineries across the country are running below normal levels due to a rash of unplanned issues, and the embargo on Russian diesel shipments starts this weekend.

The warmer than expected winter has certainly eased concerns of more severe shortages of natural gas and heating oil across Europe and the US North East, but European natural gas prices have been rebounding as temperatures are expected to drop again next week, and French workers are attempting to block more fuel deliveries today as part of the ongoing strikes against state pension reform.

Recession expectations could be a factor in this pullback, as they were during the last 2022 selloff as earnings season is showing that US consumers are slowing down purchases, while the FED is poised for another rate hike tomorrow.

Liquidations by the hedge funds that added new bets on higher prices last week, just in time for this pullback could also be at play, although we won’t get to see that data again until Friday.

The drop could be a sign of the classic “buy the rumor, sell the news” trading phenomenon with the upcoming Russian embargo, particularly given that exports have surged in recent weeks as buyers race to beat the deadline.

There’s also a real possibility that there simply is not a fundamental reason at all for this price pullback, and it has more to do with the big speculative funds that can be the fair weather fans of commodity markets, or the trading algorithms that account for most daily volume being programmed to sell after an 82 cent rally from a low of $2.76 in early December to $3.58 last week.

Whatever the cause, ULSD is now breaking its weekly trendline that propelled prices higher for 7 weeks, and sets up a test of the January lows at $2.92 if they can’t manage a bounce in the next day or two. Then again, if they do bounce, this 50 cent pullback in 5 trading days may be seen as nothing more than the latest big swing in an extraordinarily volatile market and a good buying opportunity for anyone that has a fuel budget.

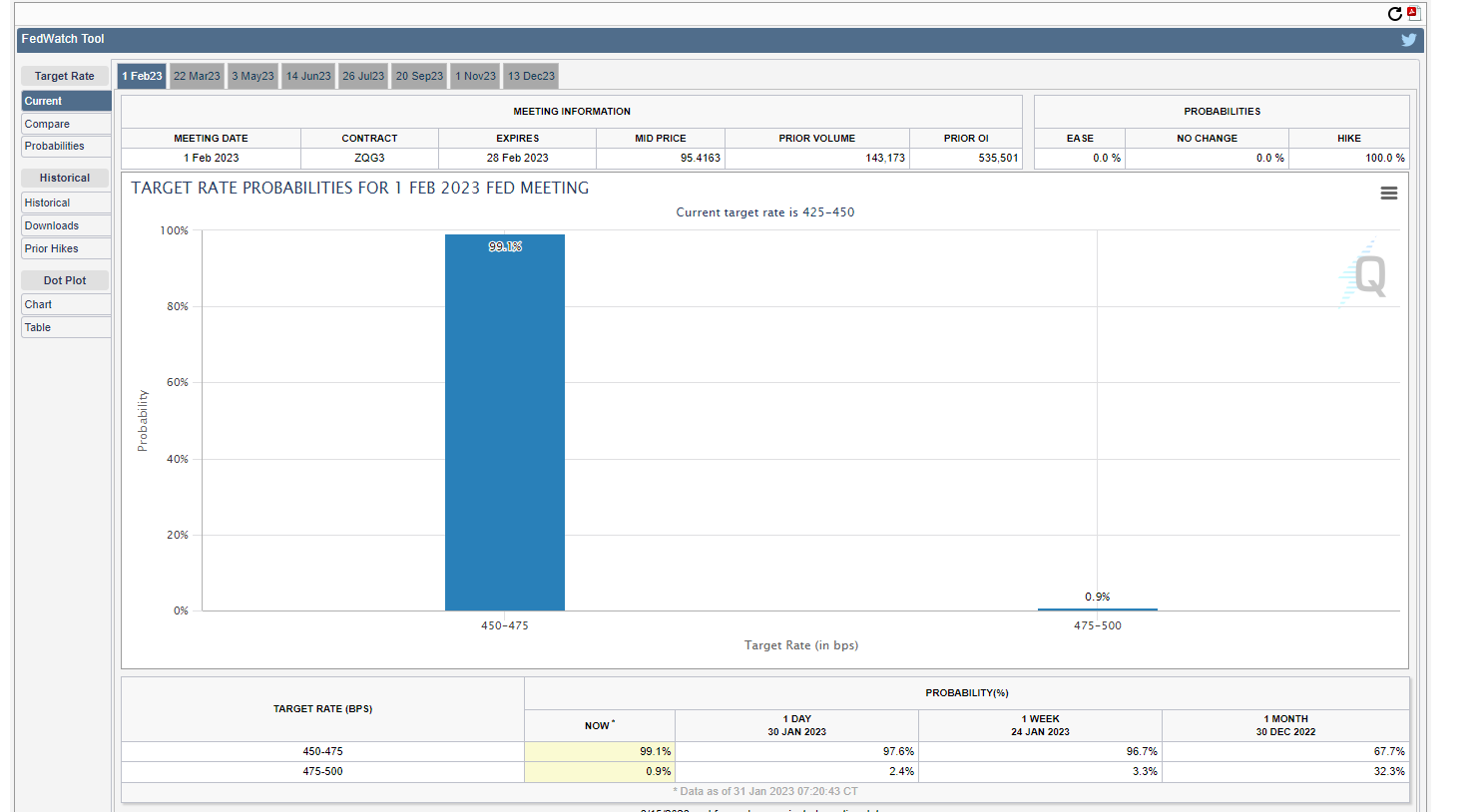

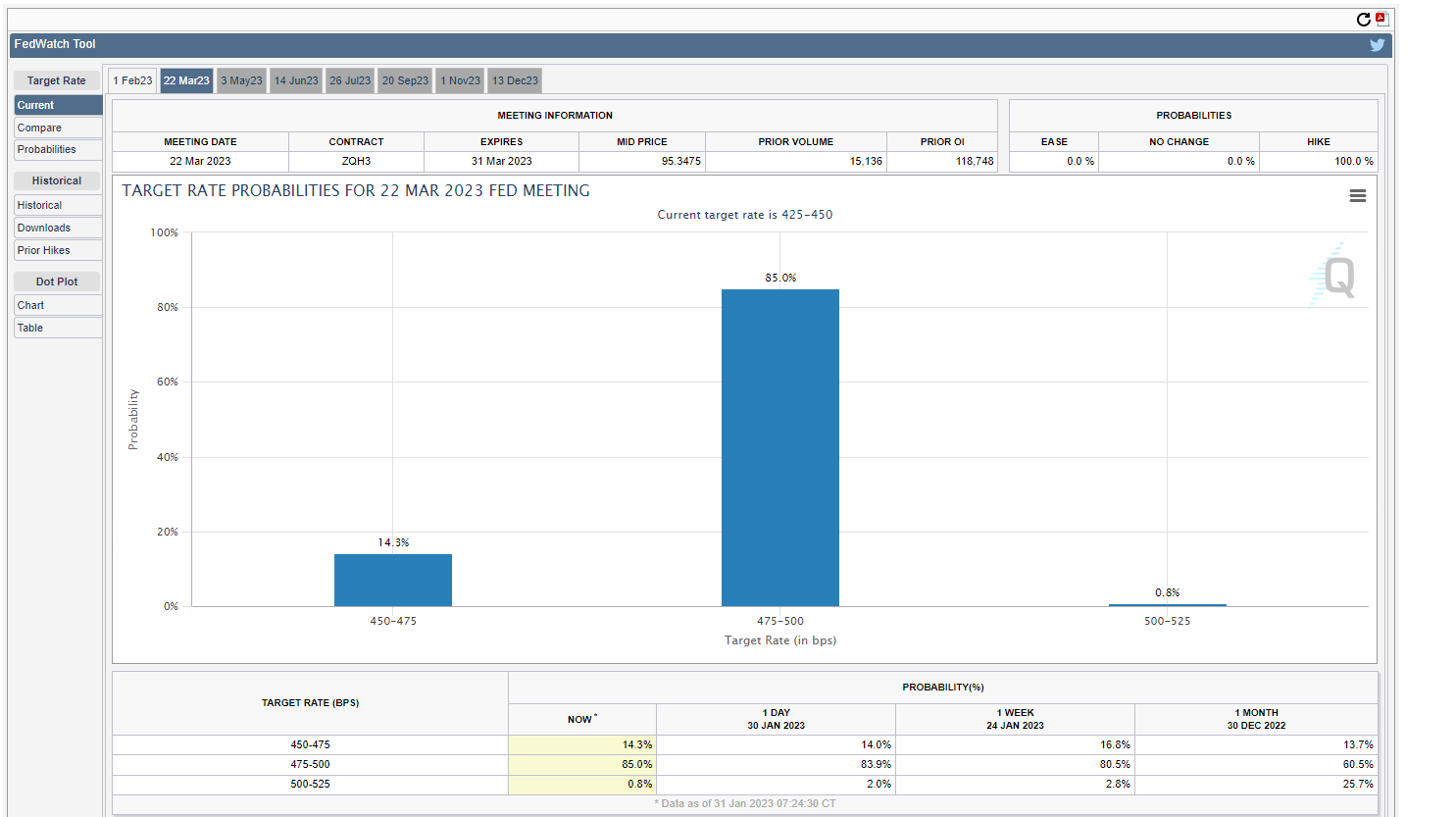

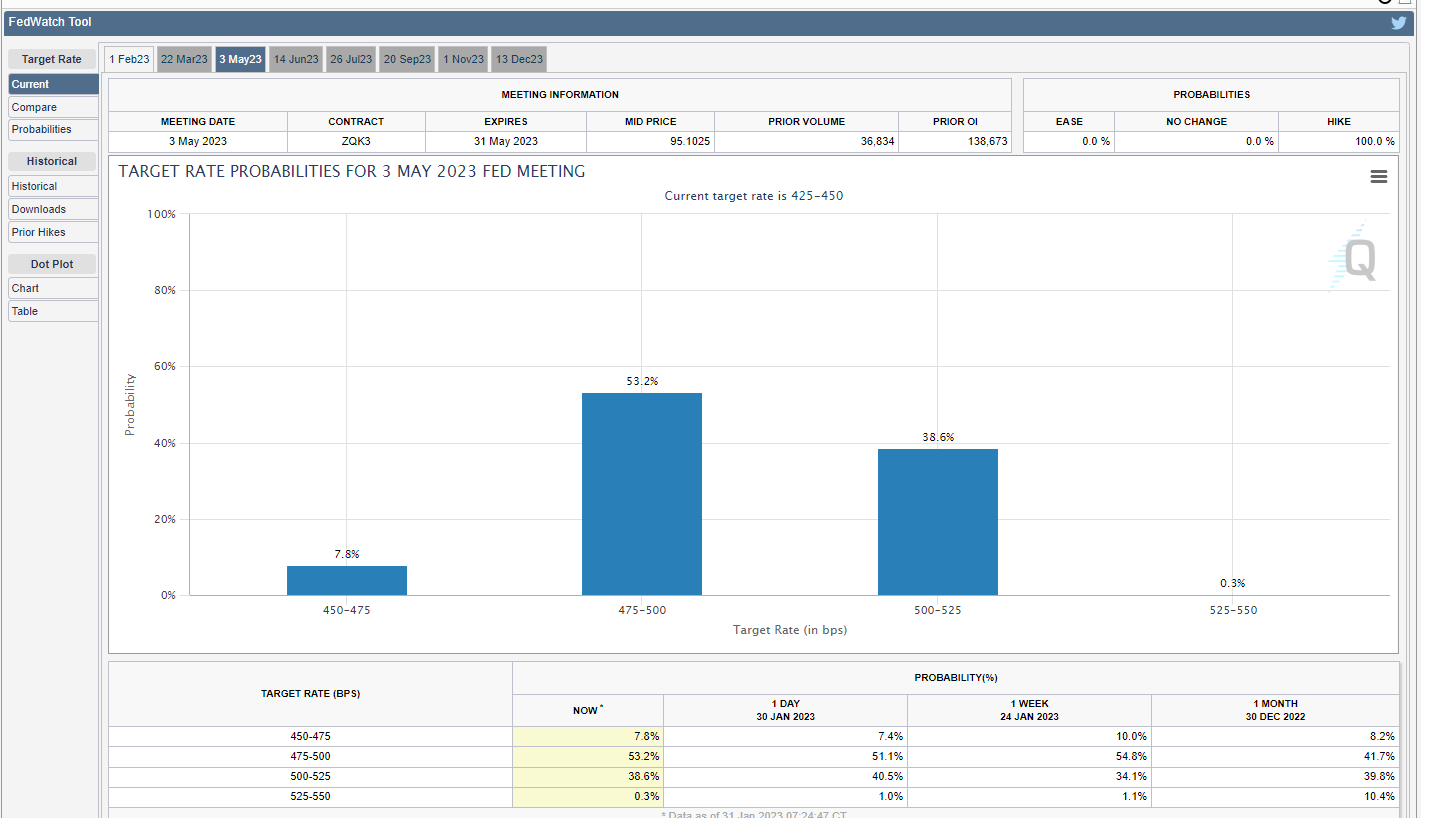

Pretty much everyone expects the FED to raise rates by 25 basis points tomorrow, with the CME’s fedwatch tool showing a 99% probability of that outcome, and 85% that they’ll raise another 25 points in March. The big question is whether or not the FED will be done raising rates after that, with traders fairly evenly split in their bets on the rates beyond the next two months.

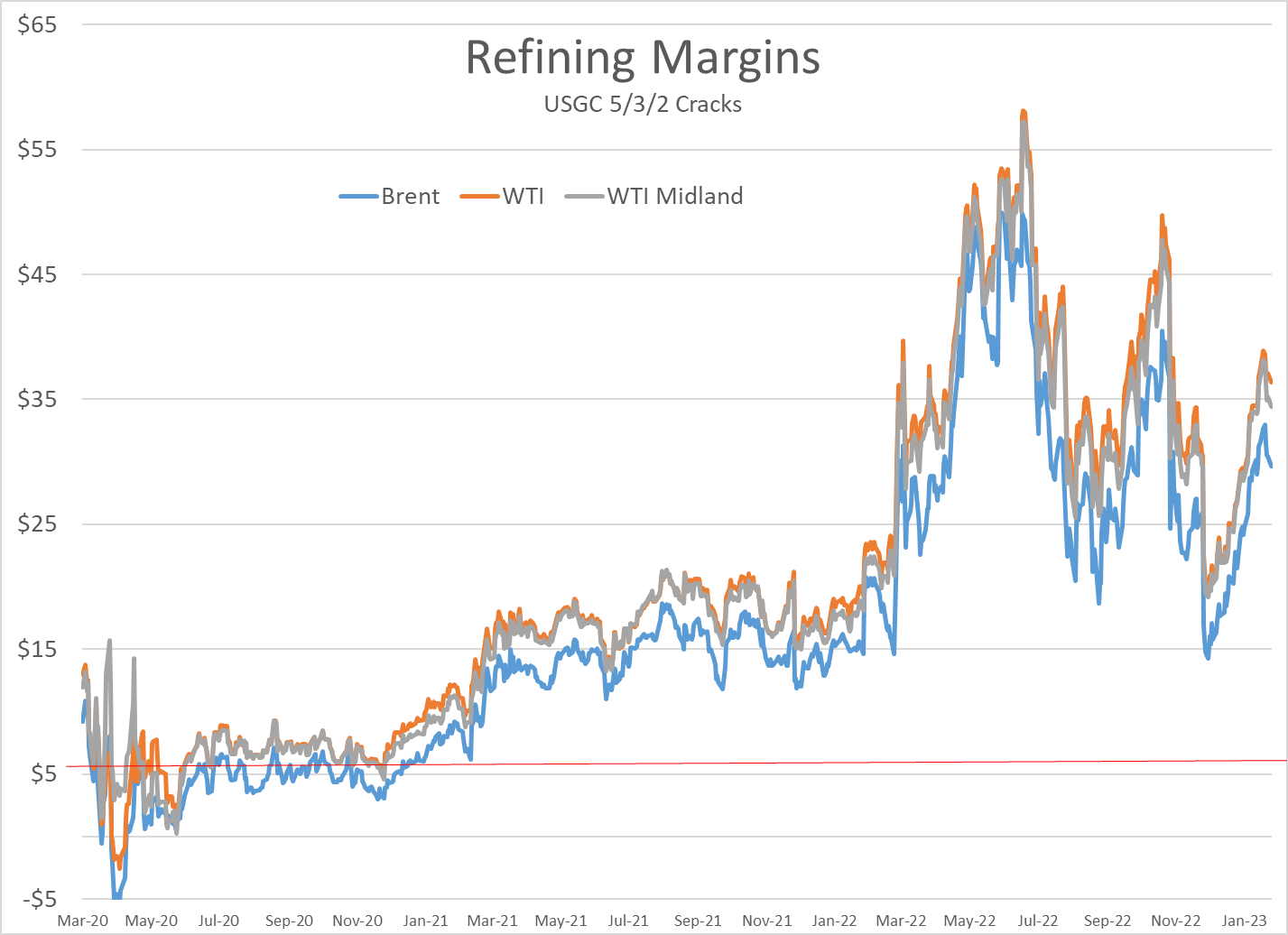

Exxon, Marathon and P66 all reported earnings for Q4 today, and surprised no-one with their strong results, even though refining margins pulled back from the record levels set earlier in the year.

Click here to download a PDF of today's TACenergy Market Talk.

Latest Posts

Energy Markets Rally Again Thursday After A Choppy Wednesday Session

Week 16 - US DOE Inventory Recap

Energy Markets Trading Quietly In The Red As Ethanol Prices Rally To Five-Month High

The Struggle For Renewable Producers Continues As A Rapid Influx Of Supply And Crashing Credit Prices Make Biodiesel

Social Media

News & Views

View All

Energy Markets Rally Again Thursday After A Choppy Wednesday Session

Energy markets are trying to rally again Thursday after a choppy Wednesday session. RBOB gasoline futures are leading the push higher, on pace for a 3rd consecutive day of gains after finding a temporary floor Tuesday and have added 12 cents from those lows.

Equity markets are pointing sharply lower after a weak Q1 GDP estimate which seems to have contributed to a pullback in product prices over the past few minutes, but don’t be surprised if the “bad news is good news” low interest rate junkies start jumping in later on.

The DOE’s weekly report showed sluggish demand for gasoline and diesel, but inventory levels in most markets continue to follow their typical seasonal trends. Refinery runs held fairly steady last week with crude inputs down slightly but total gross throughputs up slightly as most facilities are now back online from a busy spring maintenance season and geared up for peak demand this summer.

Propane and propylene exports spiked to a record high north of 2.3 million barrels/day last week, which demonstrates both the US’s growing influence on global product markets, and the steady shift towards “other” products besides traditional gasoline and diesel in the level of importance for refiners.

The EIA acknowledged this morning that its weak diesel consumption estimates reflected the switch to Renewable Diesel on the West Coast, although they did not provide any timeline for when that data will be included in the weekly survey. The agency acknowledged that more than 4% of the total US consumption is now a combination of RD and Biodiesel, and that number is expected to continue to grow this year. This morning’s note also suggested that weak manufacturing activity was to blame for the sluggish diesel demand across the US, while other reports suggest the freight recession continued through Q1 of this year, which is also contributing to the big shift from tight diesel markets to oversupplied in several regions.

Valero kicked off the Q1 earnings releases for refiners with solid net income of $1.2 billion that’s a far cry from the spectacular earnings north of $3 billion in the first quarter of 2023. The refining sector made $1.7 billion, down from $4.1 billion last year. That is a pattern that should be expected from other refiners as well as the industry returns to a more normal market after 2 unbelievable years. You wouldn’t guess it by looking at stock prices for refiners though, as they continue to trade near record highs despite the more modest earnings.

Another pattern we’re likely to see continue with other refiners is that Renewable earnings were down, despite a big increase in production as lower subsidies like RINs and LCFS credit values sting producers that rely on those to compete with traditional products. Valero’s SAF conversion project at its Diamond Green joint venture is progressing ahead of schedule and will give the company optionality to flip between RD and SAF depending on how the economics of those two products shakes out this year. Valero also shows part of why refiners continue to disappear in California, with operating expenses for its West Coast segment nearly 2X that of the other regions it operates in.

Week 16 - US DOE Inventory Recap

Energy Markets Trading Quietly In The Red As Ethanol Prices Rally To Five-Month High

Energy markets are trading quietly in the red to start Wednesday’s session after a healthy bounce Tuesday afternoon suggested the Israel-Iran-linked liquidation had finally run its course.

There are reports of more Ukrainian strikes on Russian energy assets overnight, but the sources are sketchy so far, and the market doesn’t seem to be reacting as if this is legitimate news.

Ethanol prices have rallied to a 5-month high this week as corn and other grain prices have rallied after the latest crop progress update highlighted risks to farmers this year, lower grain export expectations from Ukraine, and the approval of E15 blends this summer despite the fact it pollutes more. The rally in grain and renewables prices has also helped RIN values find a bid after it looked like they were about to test their 4-year lows last week.

The API reported small changes in refined product inventories last week, with gasoline stocks down about 600,000, while distillates were up 724,000. Crude oil inventories increased by 3.2 million barrels according to the industry-group estimates. The DOE’s weekly report is due out at its normal time this morning.

Total reported another upset at its Port Arthur refinery that’s been a frequent flier on the TCEQ alerts since the January deep freeze knocked it offline and damaged multiple operating units. This latest upset seems minor as the un-named unit impacted was returned to normal operations in under an hour. Gulf Coast basis markets have shrugged off most reports of refinery upsets this year as the region remains well supplied, and it’s unlikely we’ll see any impact from this news.

California conversely reacted in a big way to reports of an upset at Chevron’s El Segundo refinery outside of LA, with CARBOB basis values jumping by more than a dime. Energy News Today continued to show its value by reporting the upset before the flaring notice was even reported to area regulators, proving once again it’s ahead of the curve on refinery-related events. Another industry news outlet meanwhile struggled just to remember where the country’s largest diesel seller is located.

Click here to download a PDF of today's TACenergy Market Talk