Witnessing A Technical Breakout In Energy Prices

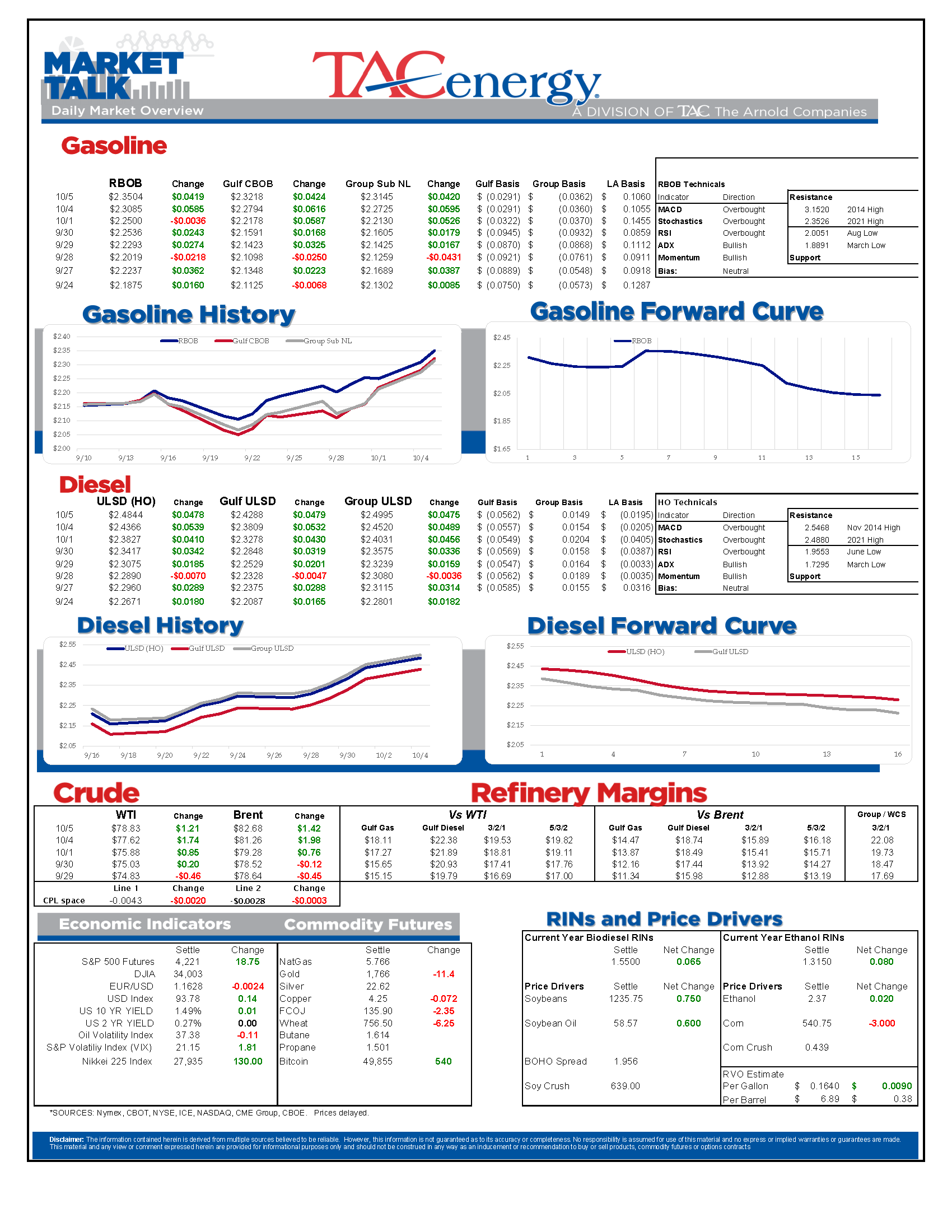

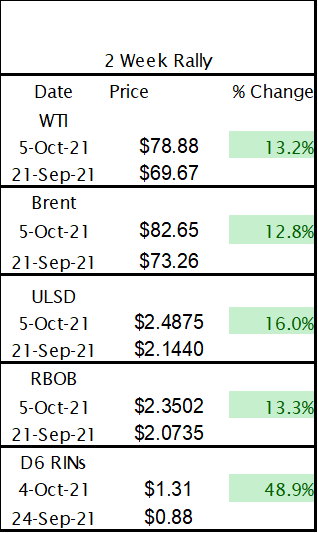

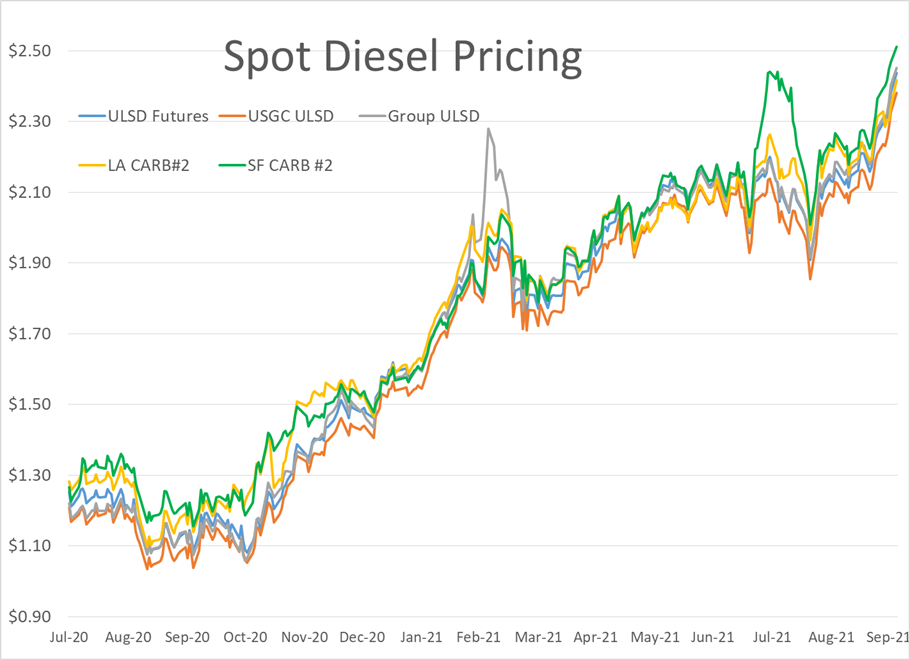

We’re witnessing a technical breakout in energy prices as oil and diesel contracts have surged to 7 year highs after chart resistance at the 2018 highs failed to contain the rally. OPEC & Friends decision to stick with their existing plans for oil output sent prices soaring Monday morning, and that momentum has carried through the overnight session. With OPEC members not willing to formally commit to new production increases (don’t forget they are already planning to increase output by 400,000 barrels/day each month) it seems there will not be a short-term answer to the supply crunch for energy supplies being felt around the world these days, which gives the bulls a strong argument to keep pushing prices higher.

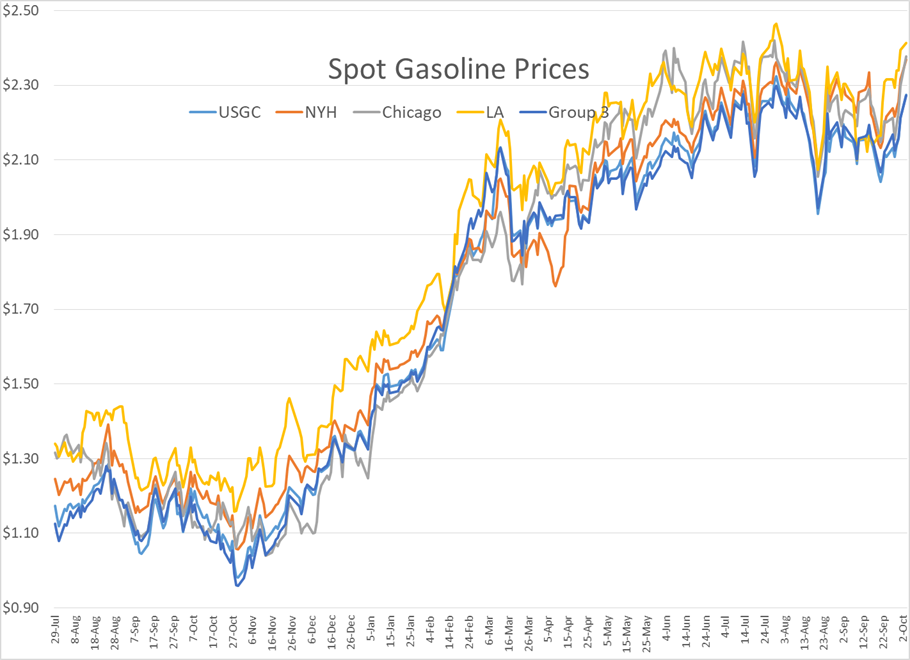

While gasoline prices haven’t yet joined diesel and crude at 7 year highs, the fact that we’re seeing winter-grade gasoline specs rival the highs from summer-grade prices earlier in the year, after the US driving season has been put in the rearview mirror is no less impressive.

A pair of pipeline leaks last weekend are creating plenty of trouble for their local communities, but so far appear to be having limited impact on prices.

The well-publicized oil spill caused by a pipeline leak near Los Angeles is creating plenty of ecological damage, even though the size of the spill (roughly 3,000 barrels) is fairly small in comparison to evens like the Deepwater Horizon spill that was estimated near 60,000mb PER DAY for several weeks) or the Exxon Valdez spill which was more than 260,000 barrels. While the damage to beaches and wildlife is tragic, and may take months to recover, the relative small size may explain the lack of market reaction so far. Adding insult to injury? Some reports suggest that a ship’s anchor may have caused the pipeline to rupture (although the cause is still being investigated) which gives an unfortunate new perspective to the ship backlog at the port of Long Beach.

Meanwhile, a not-so-well-publicized leak in Alabama shut down the pipeline formerly known as Plantation last week, causing some suppliers to restrict product allocations at terminals across the South East. The lack of publicity for this event suggests that Kinder Morgan’s strategy of changing the pipeline’s name to something generic like the Products (SE) Pipeline, is a stroke of brilliance, and/or that the industry has become numb to supply disruptions after going through so many over the past year. Gulf Coast basis values barely flinched following the news, and premiums for line space on the competing Colonial line remained in negative territory. Reports suggest the pipeline expects to resume operations tomorrow (10/6).

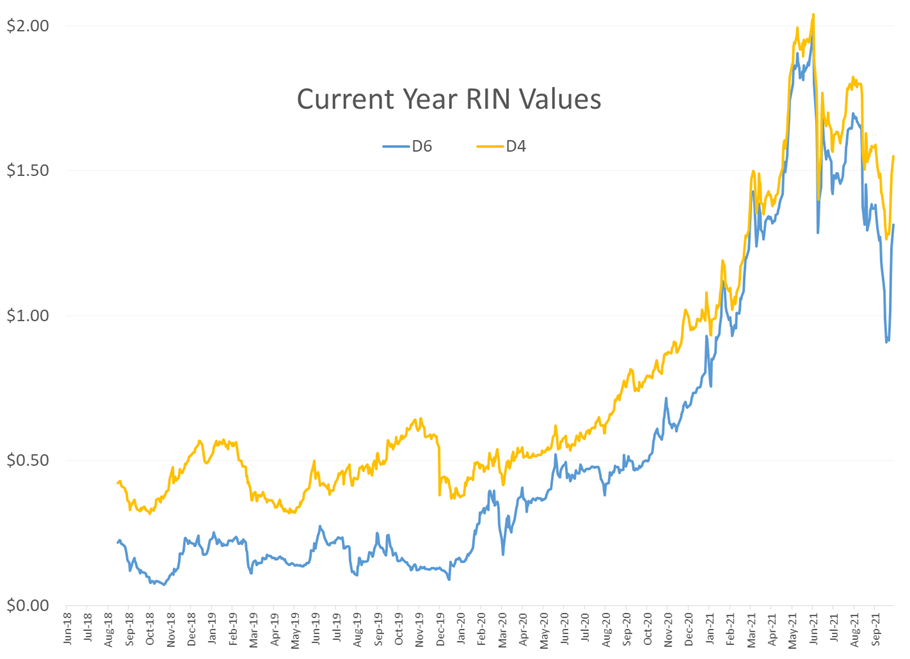

RINs had a 5th straight session of strong buying interest, with D6 values moving north of $1.30/RIN for the first time in nearly a month, and rallying 45 cents since bottoming out last week. The strength in RINs seems to be helping keep refined products outpace the rally in crude oil as crack spreads will adjust to offset the impact of the RVO for refiners. The industry continues to wait for official word on the long overdue blending obligations from the EPA, and with congress gridlocked on debt, infrastructure and tax bills, it’s hard to know if we’ll see the actual numbers anytime soon.

Meanwhile, BP became the latest refiner to announce plans to expand its Renewable Diesel production, with an investment at its Ferndale WA plant that would allow co-production of RD along with traditional refined products. That means that BP, Chevron and Exxon are all working towards avenues of co-producing renewables at existing refineries, while Marathon, P66 and Holly are going the route of converting existing refineries to produce RD. The outcome of these new investments may define the refinery landscape in the coming decade, as co-production could allow some refiners to stay afloat – and continue producing other products – vs a conversion that all but ends most other output.

Click here to download a PDF of today's TACenergy Market Talk.

News & Views

View All

Crude Oil, Gasoline, And Diesel Benchmarks Are All Trading >1% Lower To Start The Day

Energy prices are sinking again this morning, albeit with a little more conviction than yesterday’s lackadaisical wilting. Crude oil, gasoline, and diesel benchmarks are all trading >1% lower to start the day with headlines pointing to an across-the-board build in national inventories as the source for this morning’s bearish sentiment. The Department of Energy’s official report is due out at its regular time this morning (9:30am CDT).

WTI has broken below its 100-day moving average this morning as it fleshed out the downward trend that began early last month. While crossing this technical threshold may not be significant in and of itself (it happened multiple times back in February), the fact that it coincides with the weekly and monthly charts also breaking below a handful of their respective moving averages paints a pretty bearish picture in the short term. The door is open for prices to drop down to $75 per barrel in the next couple weeks.

Shortly after the EIA’s weekly data showed U.S. commercial crude inventories surpassing 2023 levels for the first time this year, their monthly short-term energy outlook is forecasting a fall back to the bottom end of the 5-year range by August due to increasing refinery runs over the period. However, afterward the administration expects a rise in inventories into 2025, citing continued production increases and loosening global markets hindering the incentive to send those excess barrels overseas. The agency also cut back their average gas and diesel price forecasts for the first time since February with the biggest reductions in the second and third quarter of this year.

The STEO also featured their famed price prediction for WTI, stating with 95% confidence that the price for crude oil will be between $40 and $140 through 2026.

Need a general indication of the global crude oil supply? Most headlines seem to be covering a shortage of a different type of oil, one that we haven’t turned into fuel (yet).

Click here to download a PDF of today's TACenergy Market Talk.

The Perceived Cooling Of Regional Tensions In The Middle East Area Attributing To The Quiet Start To Today’s Trading Session

The energy complex is drifting lower this morning with RBOB futures outpacing its counterparts, trading -.9% lower so far to start the day. The oils (WTI, Brent, heating) are down only .2%-.3% so far this morning.

The perceived cooling of regional tensions in the Middle East area attributing to the quiet start to today’s trading session, despite Israel’s seizure of an important border crossing. A ceasefire/hostage-release agreement was proposed Monday, and accepted by Hamas, but rejected by Israel as they seemingly pushed ahead with their Rafah offensive.

U.S. oil and natural gas production both hit record highs in 2023 and continue to rise in 2024, with oil output currently standing at 13.12 million barrels per day and January 2024 natural gas production slightly exceeding the previous year. With WTI currently changing hands at higher than year-ago levels, this increased production trend is expected to continue despite a decrease in rigs drilling for these resources.

Less than a week after the Senate Budget Committee’s hearing centered on the credibility of big oil’s climate preservation efforts, a major oil company was reported to have sold millions of carbon capture credits, without capturing any carbon. Fraud surrounding government subsidies to push climate-conscious fuel initiatives is nothing new, on a small scale, but it will be interesting to see how much (if any) of the book is thrown at a major refiner.

Today’s interesting read: sourcing hydrogen for refining.

Click here to download a PDF of today's TACenergy Market Talk.

Energy Contracts Are Trying To Find A Floor After Taking Their Largest Weekly Losses Of The Year So Far Last Week

Energy contracts are trying to find a floor after taking their largest weekly losses of the year so far last week.

There’s not much in the way of news yet this morning, so the modest buying is largely being blamed on reports that Saudi Arabia raised its prices for Asian and Mediterranean buyers in June, signaling that demand is strong enough in those markets to shoulder the increase.

RBOB gasoline futures have already dropped 28 cents from the high set April 12th, leading the argument that prices have peaked for the season. The 200-day moving average comes in just under $2.50/gallon this week, some 6.5 cents below current values, and helps set a pivotal chart support layer. If prices break there, there’s a strong case that we’ll see another 20-30 cents of downside, similar to what we saw this time last year.

Money managers continued to reduce their net length in NYMEX contracts last week, as WTI, RBOB and ULSD saw a net decrease of more than 17,000 contracts of speculative length. The hedge fund liquidation seems to have run its course for this latest news cycle however, as new short positions accounted for the majority of the decrease, and WTI and Brent both saw new length added by the big speculators. Money managers are now net-short on ULSD, which could be another reason to think the bottom is near if you subscribe to the theory that the bandwagon-jumping hedge funds usually are wrong.

Baker Hughes reported a decline of 7 oil rigs and 3 natural gas rigs last week, bringing the combined total rig count to its lowest level in more than 2 years. Perhaps most noteworthy in this week’s report was that Alaska saw 5 of its 14 active rigs taken offline in just 1 week. It’s not yet clear if this may have anything to do with the startup of the transmountain pipeline which will have Western Canadian crude now competing more directly with Alaskan grades.

Click here to download a PDF of today's TACenergy Market Talk.